Where Will Apple Stock (AAPL) Go Next? Key Price Level Analysis

Table of Contents

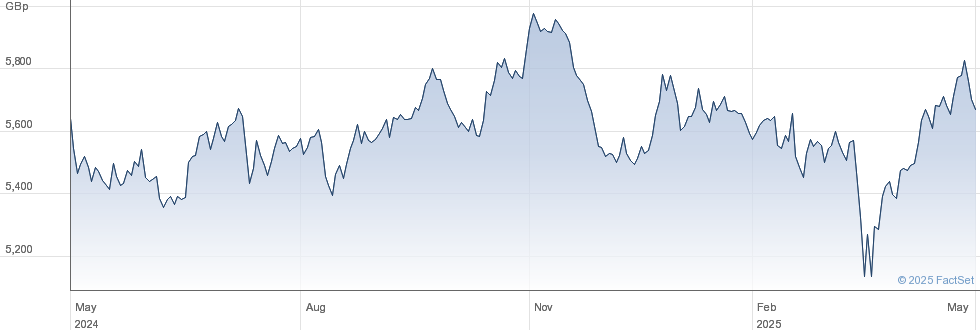

Analyzing Current Apple Stock Price (AAPL)

As of [Insert Current Date], Apple stock (AAPL) is trading at [Insert Current Price]. Recent market trends, influenced by [mention recent market events, e.g., interest rate hikes, inflation concerns], have impacted AAPL's price. The recent earnings report showed [brief summary of earnings report – positive or negative and its impact on the stock price]. Furthermore, the upcoming launch of [mention upcoming Apple product releases, e.g., the iPhone 15] is anticipated to significantly influence investor sentiment.

- Current AAPL Price and Recent Performance: [Detail recent price movement – percentage change over a specific period, e.g., the last week, month, or quarter].

- Key Support and Resistance Levels: Initial support seems to be around [price level], while resistance is currently at [price level]. Breaks above/below these levels could indicate stronger trends.

- Trading Volume Analysis: High trading volume during recent price movements suggests [interpret the volume – strong investor interest or possibly profit-taking].

- Indicators of Bullish or Bearish Sentiment: Technical indicators like the RSI [Relative Strength Index] and MACD [Moving Average Convergence Divergence] currently suggest [bullish or bearish] sentiment, though these should be interpreted in conjunction with other factors.

Key Support and Resistance Levels for AAPL

In technical analysis, support levels represent prices where buying pressure is expected to outweigh selling pressure, preventing further price declines. Conversely, resistance levels are prices where selling pressure is expected to outweigh buying pressure, hindering upward price movements.

Historically, AAPL has found support around [price levels] and resistance around [price levels]. These levels acted as significant pivots in the past, and a breach of these could signal a significant shift in the price trend.

- Historical Support and Resistance Levels: A detailed chart illustrating these historical levels would provide valuable context.

- Chart Patterns Suggesting Future Support/Resistance: [Mention any identifiable chart patterns, e.g., head and shoulders, double top/bottom, which could indicate future support or resistance levels].

- Fibonacci Retracement Levels: Applying Fibonacci retracement to recent price swings could identify potential support/resistance at [percentage levels, e.g., 38.2%, 50%, 61.8%].

- Moving Averages (e.g., 50-day, 200-day): The 50-day moving average is currently at [price], and the 200-day moving average is at [price]. A cross above or below these averages can often signal a change in trend.

Factors Influencing Future Apple Stock (AAPL) Price

Numerous factors beyond technical analysis influence AAPL's future price movement.

- Impact of Economic Conditions on AAPL: Global macroeconomic factors like interest rate changes and inflation significantly impact consumer spending and investor confidence, directly affecting AAPL's performance.

- Analysis of Apple's Financial Statements (Revenue, Earnings, etc.): Apple's financial health, including revenue growth, profit margins, and debt levels, is a crucial determinant of its stock price.

- Potential Impact of New Product Launches (e.g., iPhone, Apple Watch): Successful new product launches can boost sales and investor optimism, driving up the AAPL price. Conversely, underperforming products can negatively impact the stock.

- Competitive Landscape and Market Share: Competition from companies like Samsung and Google in the smartphone and other technology markets influences Apple's market share and overall profitability.

Predicting Apple Stock (AAPL) Price Movement

Based on our analysis of support/resistance levels and the influencing factors discussed above, we can cautiously suggest potential price movements. However, it’s crucial to remember that stock market predictions are inherently uncertain.

- Potential Price Targets Based on Technical Analysis: Considering the support and resistance levels, short-term price targets could range between [price range].

- Short-Term Price Prediction (e.g., next few months): A cautiously optimistic outlook suggests that AAPL might see [price movement] in the next few months, contingent on positive market sentiment and the successful launch of new products.

- Long-Term Price Prediction (e.g., next year or beyond): Over the long term, Apple's strong fundamentals and innovative capabilities suggest a potential for [price movement], but this is subject to various economic and competitive factors.

- Disclaimer about the Inherent Risks in Stock Market Investments: Investing in the stock market always carries risk, and past performance is not indicative of future results.

Conclusion: Where Will Apple Stock (AAPL) Go Next? A Final Outlook

Our key price level analysis suggests a potential for [summarize predicted price movement – upward or downward trend and range] for Apple stock (AAPL). However, this outlook considers both technical analysis and fundamental factors, emphasizing the importance of a holistic approach. Remember that predicting stock prices with complete accuracy is impossible. Before investing in Apple stock (AAPL), conduct thorough research, consider your risk tolerance, and consult with a qualified financial advisor. The future prospects for Apple stock (AAPL) remain tied to its ability to innovate, maintain market share, and navigate the complex global economic landscape. Conduct your own due diligence to formulate your own Apple stock forecast and AAPL price target for informed investing in AAPL.

Featured Posts

-

La Fire Victims Exploitation And The Struggle For Affordable Housing

May 24, 2025

La Fire Victims Exploitation And The Struggle For Affordable Housing

May 24, 2025 -

Ai Stuwt Relx Resultaten Ondanks Zwakke Economie Voorspellingen Voor 2025

May 24, 2025

Ai Stuwt Relx Resultaten Ondanks Zwakke Economie Voorspellingen Voor 2025

May 24, 2025 -

Italian Citizenship The Revised Law On Great Grandparent Claims

May 24, 2025

Italian Citizenship The Revised Law On Great Grandparent Claims

May 24, 2025 -

Porsche Macan Buyers Guide Find The Right Macan For You

May 24, 2025

Porsche Macan Buyers Guide Find The Right Macan For You

May 24, 2025 -

Understanding The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Understanding The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Latest Posts

-

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025 -

Efficient Podcast Production Ais Role In Processing Repetitive Scatological Documents

May 24, 2025

Efficient Podcast Production Ais Role In Processing Repetitive Scatological Documents

May 24, 2025 -

Italian Citizenship Law Reform Implications For Great Grandchildren

May 24, 2025

Italian Citizenship Law Reform Implications For Great Grandchildren

May 24, 2025 -

Ai Powered Podcast Creation Analyzing Repetitive Scatological Data

May 24, 2025

Ai Powered Podcast Creation Analyzing Repetitive Scatological Data

May 24, 2025