Why Did Uber Stock Jump Over 10% In April?

Table of Contents

Strong Q1 2024 Earnings Report and Revenue Growth

Uber's impressive stock jump in April 2024 was largely fueled by its exceptionally strong Q1 2024 earnings report. The company significantly surpassed Wall Street's expectations, demonstrating robust growth across its key segments, namely ride-hailing and food delivery services. This positive performance instilled confidence in investors and triggered a surge in the stock price.

Exceeding Analyst Expectations

Uber's Q1 2024 earnings report shattered analyst predictions. The company exceeded expectations across various key metrics:

- Earnings Per Share (EPS): Uber reported an EPS significantly higher than the consensus estimate, indicating increased profitability.

- Revenue Growth: Revenue growth percentage far outpaced projections, showcasing strong demand for both ride-hailing and delivery services.

- Positive EBITDA: The positive EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) signaled a significant improvement in operational efficiency and profitability.

These numbers represent a significant improvement compared to previous quarters and outperformed industry averages, indicating a strong competitive advantage for Uber. Factors contributing to this success include increased ridership driven by a recovering economy and successful marketing campaigns boosting food delivery orders.

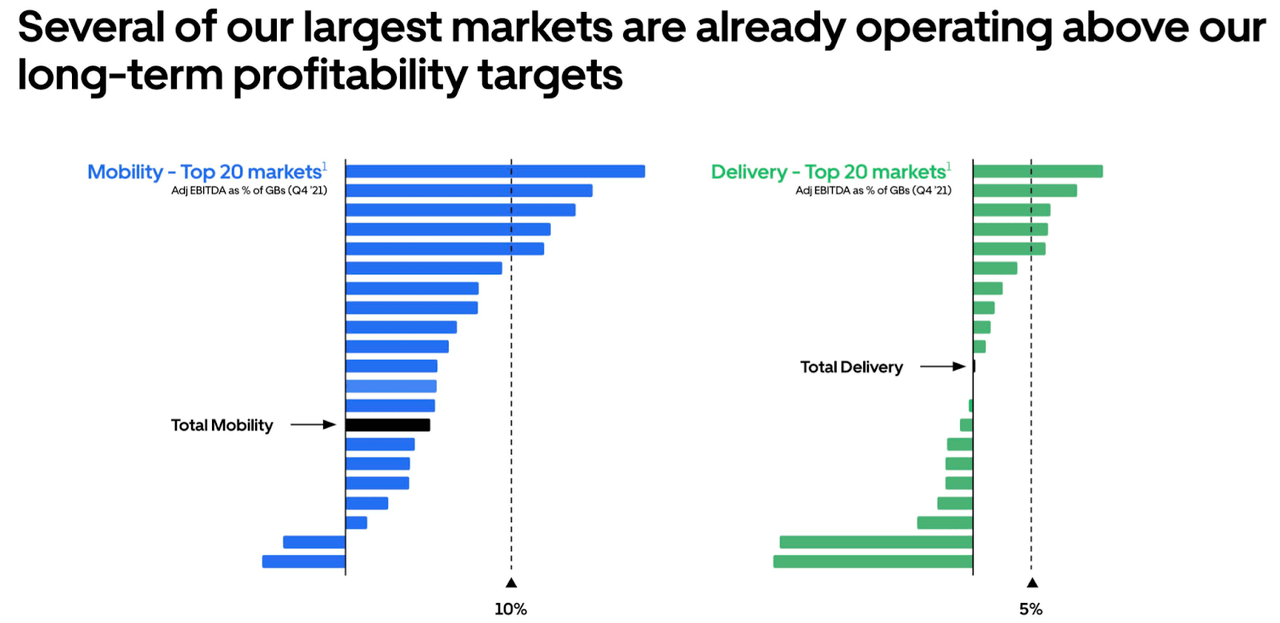

Growth in Rides and Delivery Services

The Q1 2024 report highlighted remarkable growth in both Uber's core businesses:

- Ride-Hailing Services: Experienced double-digit percentage growth year-over-year, particularly in key urban markets across North America and Europe.

- Food Delivery Services (Uber Eats): Showed continued strong growth, driven by increased consumer demand and effective marketing strategies targeting specific demographics.

Specific regions such as major metropolitan areas in the US and certain European capitals displayed exceptionally strong growth. This success can be partially attributed to post-pandemic recovery, increased consumer spending, and the effective implementation of new marketing and loyalty programs.

Positive Market Sentiment and Investor Confidence

Beyond the strong Q1 earnings, a positive market sentiment significantly contributed to the Uber stock jump. Investors reacted favorably to evidence of improved profitability and innovative strategies.

Improved Profitability and Efficiency

Uber demonstrated a significant improvement in its operational efficiency and cost management:

- Optimized Driver Network: Improved algorithms and driver management strategies led to a more efficient allocation of resources, resulting in cost savings.

- Dynamic Pricing Optimization: Refinements to the dynamic pricing model maximized revenue while maintaining customer satisfaction.

- Reduced Operational Costs: The company implemented various cost-cutting measures without compromising service quality.

These improvements directly impacted profitability, contributing to a more positive investor outlook.

Technological Advancements and Innovation

Uber's continued investment in technology and innovation further boosted investor confidence:

- Improved App Features: New features within the Uber app enhanced user experience and customer loyalty.

- Expansion of Electric Vehicle Options: The company’s efforts to increase its fleet of electric vehicles appealed to environmentally conscious consumers and investors.

- Strategic Partnerships with Autonomous Vehicle Companies: Collaboration with companies developing autonomous vehicle technology signaled future growth potential and a technological edge.

These technological advancements demonstrate Uber’s commitment to innovation and adaptation, strengthening its long-term competitive position and investor confidence.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions played a vital role in the positive market perception of Uber and its subsequent stock price increase.

New Partnerships and Collaborations

Several strategic partnerships contributed to the positive momentum:

- Logistics Partnerships: Collaborations with logistics companies expanded Uber's delivery network and service offerings.

- Ride-Sharing Partnerships: Partnerships with other transportation providers broadened access to users and markets.

- Marketing Collaborations: Joint marketing efforts with other brands increased brand visibility and customer acquisition.

These partnerships provided new revenue streams and expanded Uber's market reach, strengthening its overall business position.

Successful Acquisitions or Investments

While no major acquisitions were announced immediately preceding the stock jump, previous strategic investments laid the groundwork for the positive market sentiment:

- Investments in Delivery Infrastructure: Previous investments in delivery infrastructure enhanced efficiency and capacity, directly contributing to the strong performance of Uber Eats.

- Strategic Minority Investments: Investments in complementary businesses strengthened the Uber ecosystem and broadened its offerings.

These previous strategic moves were instrumental in supporting Uber's overall growth.

Macroeconomic Factors and Industry Trends

Positive macroeconomic trends and favorable industry conditions also contributed to Uber's stock performance.

Overall Economic Recovery

The recovering global economy provided a tailwind for Uber's business:

- Increased Consumer Spending: Higher disposable incomes translated into increased demand for ride-hailing and food delivery services.

- Return to Offices and Pre-Pandemic Activities: The return to pre-pandemic levels of commuting and social activity significantly boosted ride-hailing demand.

A healthier economy generally translates to better performance for businesses like Uber that rely on consumer spending.

Industry-Specific Trends

Industry-specific trends also benefited Uber:

- Increased Market Share: Uber's strategic moves and strong performance led to increased market share within the ride-sharing and food delivery sectors.

- Growing Demand for On-Demand Services: The consistent rise in demand for on-demand services further strengthened Uber’s position in the market.

These factors demonstrated the strength of the ride-sharing industry and the company's successful navigation of its competitive landscape.

Conclusion

Uber's over 10% stock jump in April 2024 was a result of a confluence of factors, including strong Q1 earnings that beat expectations, positive market sentiment driven by improved profitability and innovation, strategic partnerships, and favorable macroeconomic conditions. These combined elements contributed to increased investor confidence and a significant rise in Uber's stock price.

Call to Action: Understanding the factors driving Uber's stock performance is crucial for investors seeking to navigate the complexities of the ride-sharing market. Stay informed about future Uber stock movements by regularly reviewing financial reports and market analyses. Continue to research the Uber stock jump and related keywords for the latest updates.

Featured Posts

-

Should I Refinance My Federal Student Loans A Step By Step Analysis

May 17, 2025

Should I Refinance My Federal Student Loans A Step By Step Analysis

May 17, 2025 -

Koriun Inversiones Desentranando Su Fraudulento Esquema Ponzi

May 17, 2025

Koriun Inversiones Desentranando Su Fraudulento Esquema Ponzi

May 17, 2025 -

Moto News Gncc Mx Sx Flat Track Enduro Race Reports And More

May 17, 2025

Moto News Gncc Mx Sx Flat Track Enduro Race Reports And More

May 17, 2025 -

2024 25 High School Confidential A Week 26 Update

May 17, 2025

2024 25 High School Confidential A Week 26 Update

May 17, 2025 -

Ichiro Suzukis Enduring Legacy His Influence On Baseball Two Decades Later

May 17, 2025

Ichiro Suzukis Enduring Legacy His Influence On Baseball Two Decades Later

May 17, 2025

Latest Posts

-

Rune Dominira Protiv Povredenog Alkarasa U Finalu Barselone

May 17, 2025

Rune Dominira Protiv Povredenog Alkarasa U Finalu Barselone

May 17, 2025 -

Rune Bolji Od Povredenog Alkarasa U Finalu Barselone

May 17, 2025

Rune Bolji Od Povredenog Alkarasa U Finalu Barselone

May 17, 2025 -

Exploring The Trump Family Tree The Arrival Of Alexander Boulos

May 17, 2025

Exploring The Trump Family Tree The Arrival Of Alexander Boulos

May 17, 2025 -

Donald Trumps Family Tree Grows Tiffanys Son Alexander Joins The Lineage

May 17, 2025

Donald Trumps Family Tree Grows Tiffanys Son Alexander Joins The Lineage

May 17, 2025 -

A New Addition To The Trump Family Alexander Arrives Examining The Family Tree

May 17, 2025

A New Addition To The Trump Family Alexander Arrives Examining The Family Tree

May 17, 2025