Why Stretched Stock Market Valuations Shouldn't Deter Investors: A BofA Viewpoint

Table of Contents

The Limitations of Traditional Valuation Metrics

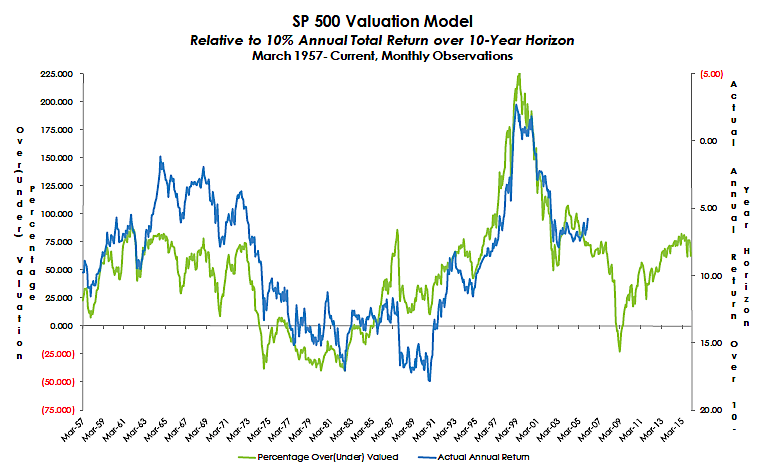

Traditional stock market valuation metrics, such as the Price-to-Earnings (P/E) ratio, often serve as primary indicators of market health. However, applying these metrics rigidly in the current environment can be misleading. Several factors complicate a straightforward interpretation of these seemingly high valuations.

-

Impact of Low Interest Rates: Historically low interest rates significantly impact valuations. Lower borrowing costs allow companies to justify higher valuations, as the discounted value of future earnings is increased. This makes comparing current P/E ratios to historical averages inaccurate without accounting for this crucial difference. BofA's research highlights this discrepancy, showing how adjusted valuations, accounting for low interest rates, paint a less alarming picture.

-

Technological Innovation and Disruption: Rapid technological advancements reshape industries and drive future earnings growth. This dynamic, often difficult to quantify, is not fully captured by traditional valuation metrics. Companies leading in innovation may command premium valuations, reflecting their substantial growth potential.

-

Unprecedented Monetary Policy: The current economic landscape differs significantly from historical periods used for valuation comparisons. The unprecedented scale of quantitative easing (QE) and other unconventional monetary policies has profoundly influenced asset prices, rendering historical averages less relevant for evaluating present-day valuations. BofA's analysts have extensively studied the impact of these policies on market valuations.

-

BofA's Specific Research: BofA Global Research consistently emphasizes the need to move beyond simplistic valuation metrics. Their analyses incorporate various factors, including long-term growth projections and the impact of monetary policy, providing a more holistic picture of market valuations.

The Importance of Considering Long-Term Growth Potential

Focusing solely on overall market valuations risks overlooking crucial individual company and sector growth prospects. A more productive approach is to analyze the long-term potential of specific investments.

-

High-Growth Sectors: Sectors like technology and renewable energy are expected to experience significant growth in the coming years. Investing in companies within these sectors can offset concerns about overall market valuations, offering substantial long-term returns. BofA's sector-specific analysis identifies promising areas within these high-growth sectors.

-

Growth at a Reasonable Price (GARP) Investing: GARP investing focuses on identifying companies with strong future growth prospects that are not yet fully reflected in their current valuations. This approach balances growth potential with a more cautious assessment of current valuations, mitigating some of the risk associated with investing in high-growth, high-valuation companies. BofA's research frequently features GARP strategies as a suitable approach in the current market environment.

-

BofA's Company-Specific Analyses: BofA provides detailed analyses on numerous companies, offering insights into their individual growth potential and how this aligns with their current market valuations. This granular approach helps investors make informed decisions, even within a market characterized by seemingly stretched stock market valuations.

The Role of Monetary Policy and Interest Rates

Monetary policy plays a critical role in shaping stock market valuations. Current and anticipated monetary policy actions significantly influence investor sentiment and asset prices.

-

Low Interest Rates and Valuations: As mentioned earlier, low interest rates are a key factor supporting higher valuations. They reduce the opportunity cost of investing in stocks, making them more attractive compared to fixed-income investments.

-

BofA's Interest Rate Outlook: BofA provides regular updates on its interest rate forecasts, which are crucial for assessing the potential impact on stock valuations. Understanding the anticipated direction of interest rates helps investors adapt their investment strategies accordingly.

-

Quantitative Easing (QE) and Other Tools: The influence of quantitative easing and other monetary policy tools on asset prices is undeniable. BofA's analysis incorporates these factors when evaluating the overall market outlook and the implications for stretched stock market valuations.

Managing Risk in a High-Valuation Environment

While the arguments presented above suggest a cautiously optimistic outlook, it's crucial to acknowledge the inherent risks associated with investing in a potentially overvalued market.

-

Risk Mitigation Strategies: Investors can employ several strategies to mitigate risk, including diversification across asset classes, value investing, and focusing on companies with strong balance sheets. This diversified approach lessens the impact of potential market corrections.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon is crucial. Short-term market fluctuations should not dictate long-term investment decisions. BofA consistently advises investors to adopt a long-term perspective.

-

BofA's Risk Management Advice: BofA provides comprehensive risk management advice, helping investors navigate the complexities of the current market. Their insights cover various aspects of risk assessment and mitigation, crucial for investors concerned about stretched stock market valuations.

Conclusion

While stretched stock market valuations are a legitimate concern, a comprehensive analysis, informed by BofA's research, reveals a more nuanced picture. By considering long-term growth prospects, the role of monetary policy, and adopting robust risk management strategies, investors can navigate this environment effectively. Understanding the nuances of "stretched stock market valuations" is key to making informed decisions. To gain a deeper understanding of BofA's insights and develop a well-informed investment strategy, consult their research and resources [link to relevant BofA resources here]. Don't let concerns about stretched stock market valuations deter you from exploring the opportunities available – take a thoughtful, informed approach.

Featured Posts

-

La Carte Blanche De Marc Fiorentino Analyse Et Decryptage

Apr 23, 2025

La Carte Blanche De Marc Fiorentino Analyse Et Decryptage

Apr 23, 2025 -

Tina Knowles And Breast Cancer A Missed Mammograms Impact

Apr 23, 2025

Tina Knowles And Breast Cancer A Missed Mammograms Impact

Apr 23, 2025 -

Challenges Facing Foreign Automakers In China Lessons From Bmw And Porsche

Apr 23, 2025

Challenges Facing Foreign Automakers In China Lessons From Bmw And Porsche

Apr 23, 2025 -

Erase Yourself From The Internet A Practical Approach

Apr 23, 2025

Erase Yourself From The Internet A Practical Approach

Apr 23, 2025 -

Cory Provus Reflects On The Legacy Of Bob Uecker

Apr 23, 2025

Cory Provus Reflects On The Legacy Of Bob Uecker

Apr 23, 2025

Latest Posts

-

Unlocking The Nyt Strands Crossword April 6 2025

May 10, 2025

Unlocking The Nyt Strands Crossword April 6 2025

May 10, 2025 -

Wednesday March 12 Nyt Strands Solutions Game 374

May 10, 2025

Wednesday March 12 Nyt Strands Solutions Game 374

May 10, 2025 -

Nyt Crossword Strands April 6th 2025 Hints And Answers

May 10, 2025

Nyt Crossword Strands April 6th 2025 Hints And Answers

May 10, 2025 -

Nyt Strands Game 374 Hints And Solutions For Wednesday March 12

May 10, 2025

Nyt Strands Game 374 Hints And Solutions For Wednesday March 12

May 10, 2025 -

Nyt Strands Puzzle Solutions Saturday February 15th Game 349

May 10, 2025

Nyt Strands Puzzle Solutions Saturday February 15th Game 349

May 10, 2025