Women & Finance: 3 Costly Errors To Prevent

Table of Contents

Underestimating the Power of Retirement Planning

Many women postpone retirement planning, often due to career breaks, family responsibilities, or feeling overwhelmed. However, delaying retirement savings can have significant long-term consequences, impacting your ability to maintain your desired lifestyle in retirement. This section explores how to proactively address retirement planning and avoid this costly mistake.

Delaying Retirement Savings

-

Starting early, even with small contributions, significantly benefits from compound interest. Compound interest is the magic of earning interest on your interest, allowing your savings to grow exponentially over time. A small contribution made early will grow much larger than a large contribution made later. For example, investing $100 per month starting at age 25 will yield significantly more than investing $200 per month starting at age 45, even though the total invested amount is less.

-

Explore employer-sponsored retirement plans like 401(k)s or 403(b)s and maximize employer matching contributions. Many employers offer matching contributions to your retirement plan, essentially giving you free money. Don't miss out on this opportunity to boost your savings!

-

Consider Roth IRAs for tax-advantaged growth. Roth IRAs offer tax-advantaged growth, meaning you pay taxes on your contributions now but withdraw your earnings tax-free in retirement. This can be a powerful tool for long-term wealth building.

Detailed explanation: The impact of compounding interest is undeniable. The earlier you start saving, the more time your money has to grow, leading to a significantly larger nest egg by retirement. To illustrate, consider using online compound interest calculators readily available via a quick Google search for "compound interest calculator". These tools allow you to input various contribution amounts and timelines to see the power of compounding in action. For further information on retirement planning, consult resources from the and the .

Ignoring or Underutilizing Financial Education Resources

A surprising number of women lack confidence in managing their finances, leading to poor decision-making. This lack of financial literacy can result in missed opportunities and costly mistakes. Empowering yourself with knowledge is a crucial step towards securing your financial future.

Lack of Financial Literacy

-

Seek out free or low-cost financial literacy programs offered by community organizations or online. Many organizations offer workshops, seminars, and online resources to help women improve their financial knowledge.

-

Read books, articles, and blogs on personal finance topics relevant to women. There is a wealth of information available online and in print to help you learn about budgeting, investing, and debt management.

-

Attend workshops and seminars on investing, budgeting, and debt management. Hands-on learning can be incredibly valuable, providing practical strategies and tools you can use immediately.

Detailed explanation: Understanding investment strategies, such as diversification and asset allocation, is crucial for building long-term wealth. Mastering budgeting techniques, like the 50/30/20 rule, can help you control your spending and save more. Effective debt management strategies, including paying off high-interest debts first, can save you significant money on interest payments over time. Many reputable financial education websites, such as and , offer valuable resources.

Failing to Negotiate Salaries and Benefits

Women often earn less than their male counterparts for the same work, impacting long-term financial security. This gender pay gap significantly affects retirement savings and overall financial well-being. Negotiating your salary and benefits is a critical skill for financial success.

The Gender Pay Gap

-

Research salary ranges for your position and experience level before negotiating. Websites like Glassdoor and Salary.com can provide valuable insights into industry standards.

-

Practice your negotiation skills and be confident in advocating for your worth. Prepare your arguments and rehearse your responses to potential objections.

-

Don't undervalue your skills and experience – remember your contributions are valuable. Know your worth and articulate your achievements confidently.

-

Negotiate not just salary but also benefits like health insurance, retirement contributions, and paid time off. Benefits are a significant part of your compensation package.

Detailed explanation: The gender pay gap is a persistent issue, but women can actively work to close the gap by negotiating their salaries effectively. Researching salary ranges empowers you to approach negotiations from a position of strength. Practicing your negotiation skills will increase your confidence and improve your outcomes. Remember that negotiating isn't about demanding more; it's about demonstrating the value you bring to the organization. For further resources on salary negotiation and gender pay equity, explore resources from organizations like the .

Conclusion

Taking control of your Women & Finance is empowering and essential for building a secure future. By avoiding these three common financial pitfalls – delaying retirement planning, neglecting financial education, and failing to negotiate effectively – you can significantly improve your financial well-being. Remember, proactive planning and continuous learning are key to achieving your financial goals. Start planning your Women & Finance strategy today! Take the first step towards securing your financial future – start researching and implementing these strategies for a more financially secure tomorrow.

Featured Posts

-

Wildlife Rescue A New Film On Helping Pronghorn After A Devastating Winter

May 22, 2025

Wildlife Rescue A New Film On Helping Pronghorn After A Devastating Winter

May 22, 2025 -

Long Term Impact Of Ohio Derailment Toxic Chemicals In Buildings For Months

May 22, 2025

Long Term Impact Of Ohio Derailment Toxic Chemicals In Buildings For Months

May 22, 2025 -

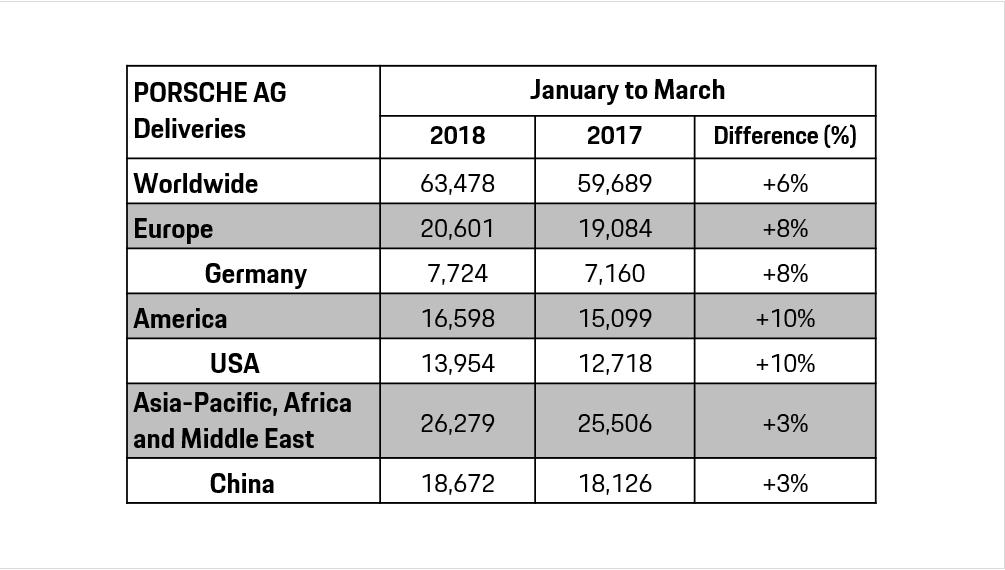

The China Market And Its Implications For Bmw Porsche And Competitors

May 22, 2025

The China Market And Its Implications For Bmw Porsche And Competitors

May 22, 2025 -

I Pretended To Be A Missing Girl A Viral Reddit Story

May 22, 2025

I Pretended To Be A Missing Girl A Viral Reddit Story

May 22, 2025 -

Core Weave Initial Public Offering 40 Listing Price Announced

May 22, 2025

Core Weave Initial Public Offering 40 Listing Price Announced

May 22, 2025

Latest Posts

-

Tractor Trailer Carrying Produce Overturns On I 83

May 22, 2025

Tractor Trailer Carrying Produce Overturns On I 83

May 22, 2025 -

Route 283 Fed Ex Truck Fire Lancaster County Incident

May 22, 2025

Route 283 Fed Ex Truck Fire Lancaster County Incident

May 22, 2025 -

Used Car Lot Fire Emergency Crews On Scene

May 22, 2025

Used Car Lot Fire Emergency Crews On Scene

May 22, 2025 -

Firefighters Respond To Major Car Dealership Fire

May 22, 2025

Firefighters Respond To Major Car Dealership Fire

May 22, 2025 -

Susquehanna Valley Storm Damage Resources For Homeowners And Businesses

May 22, 2025

Susquehanna Valley Storm Damage Resources For Homeowners And Businesses

May 22, 2025