X's Debt Sale: A Detailed Look At The Company's Financial Shift

Table of Contents

Shockwaves rippled through the financial markets recently with the announcement of X Corp.'s significant debt sale. For those unfamiliar, X Corp. is a leading [brief description of X Corp.'s industry and business, e.g., technology firm specializing in AI-powered solutions]. This article aims to provide a comprehensive analysis of this debt sale, examining its specifics, the underlying reasons, its impact on various stakeholders, and its potential long-term consequences for X Corp.'s financial health and future trajectory. We'll explore key aspects of this corporate finance maneuver, using terms like "debt restructuring," "financial strategy," and "X's financial performance" to provide a complete picture.

Main Points:

H2: The Details of X's Debt Sale:

H3: Type of Debt Sold:

X Corp. announced the sale of [specify type of debt, e.g., $500 million in high-yield bonds]. These bonds, issued in [year], carried a coupon rate of [interest rate]% and matured in [year]. The specifics of the debt instruments involved are crucial to understanding the transaction’s impact. The sale encompassed not only the bonds but also included [mention any other types of debt, e.g., a portion of their term loans].

H3: The Buyer(s) and Their Motivation:

The debt was primarily acquired by [name of buyer(s), e.g., a consortium of distressed debt investors including Apex Capital and Redwood Investments]. These investors likely saw an opportunity to acquire the debt at a discounted price, anticipating potential upside through [mention the buyer's likely strategy, e.g., restructuring efforts or eventual recovery of X Corp.'s financial performance]. Their motivation likely stems from a belief in X Corp.'s long-term potential despite its current financial challenges.

H3: The Sale Price and Valuation:

The sale price of the debt was reported to be [amount], representing a [percentage]% discount to the face value. This discount reflects the perceived risk associated with the debt, influenced by factors such as X Corp.'s current credit rating, prevailing market conditions, and the overall outlook for the [industry] sector. This debt valuation plays a significant role in assessing the overall success of the sale.

- Bullet Points:

- Total debt sold: [amount]

- Sale price: [amount]

- Discount to face value: [percentage]%

- Transaction closing date: [date]

H2: The Reasons Behind X's Debt Sale:

H3: Addressing High Debt Levels:

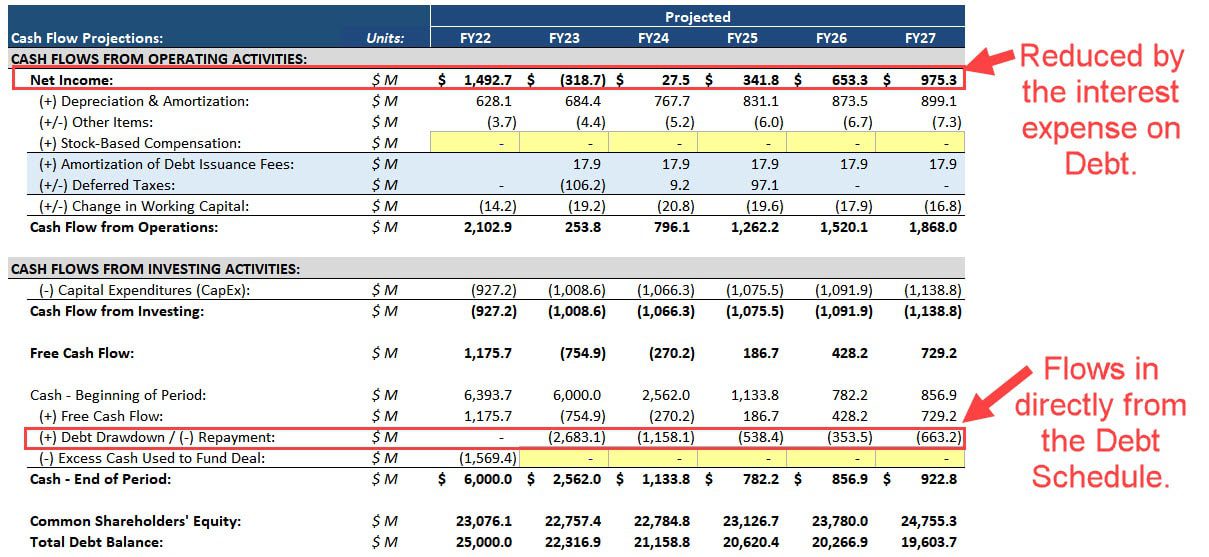

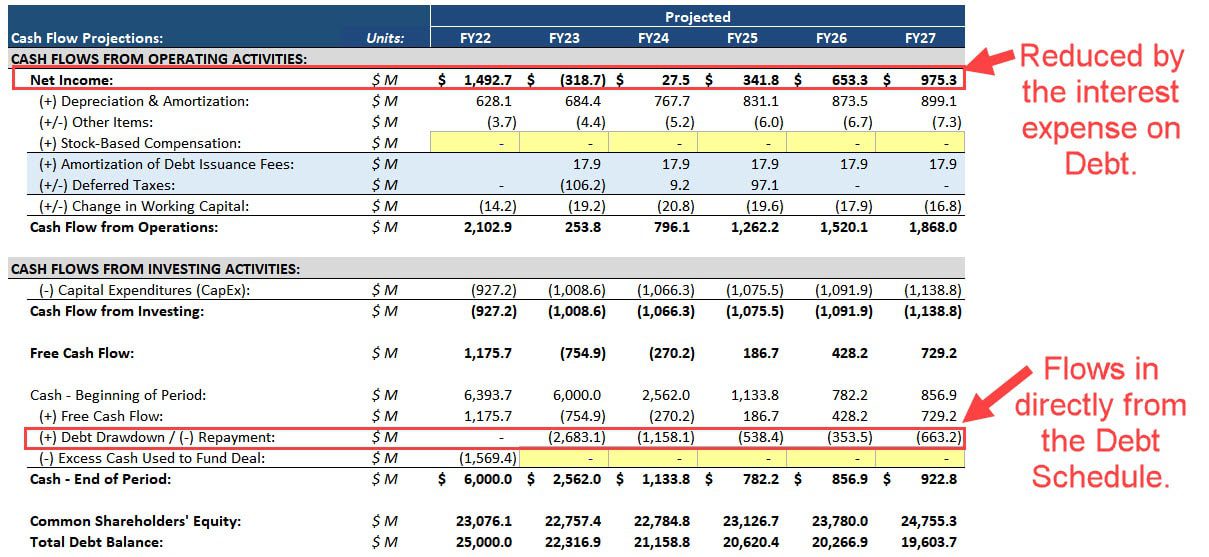

X Corp. had been carrying a substantial debt burden, primarily accumulated through [reasons for high debt levels, e.g., aggressive expansion strategy, previous acquisitions, and challenging market conditions]. This high leverage ratio had become unsustainable, leading to increased interest payments and limiting the company's financial flexibility. The debt sale was a critical step in addressing this pressing issue.

H3: Improving the Company's Financial Health:

By reducing its overall debt load, X Corp. significantly improves its balance sheet. This leads to lower interest expense, freeing up cash flow for other crucial areas like research and development, marketing, or debt reduction. A lower debt burden also enhances the company's credit rating, making future borrowing easier and cheaper.

H3: Strategic Initiatives and Future Investments:

The improved financial position resulting from the debt sale allows X Corp. to pursue strategic initiatives, such as investing in [mention potential investments, e.g., new product development, expansion into new markets, or potential acquisitions]. This newfound financial flexibility is critical for navigating a competitive landscape and achieving long-term growth.

- Bullet Points:

- Pre-sale debt-to-equity ratio: [ratio]

- Post-sale debt-to-equity ratio (projected): [ratio]

- Expected reduction in annual interest expense: [amount]

H2: The Impact of X's Debt Sale on Stakeholders:

H3: Shareholders:

The debt sale could have a mixed impact on shareholders. In the short-term, the stock price might initially decline due to the perceived risk associated with the debt sale. However, the long-term effect could be positive, as improved financial health and future growth prospects boost shareholder value.

H3: Bondholders:

The remaining bondholders will see a change in the capital structure of the company. This may have a positive or negative effect depending on the terms of the remaining bonds.

H3: Creditors:

Creditors involved in the debt sale will receive payment, reducing their exposure to X Corp. This can positively improve their overall financial portfolio.

H3: Employees:

The debt sale's impact on employees is largely indirect. The improved financial health might lead to increased job security and potential for future growth, but this depends on the company's successful execution of its strategic initiatives.

- Bullet Points:

- Stock price change since announcement: [percentage change]

- Analyst ratings following the announcement: [summary of ratings changes]

Conclusion: Analyzing the Long-Term Effects of X's Debt Sale

X Corp.'s debt sale represents a significant financial shift, aimed at addressing high debt levels, improving financial health, and enabling future growth. While short-term impacts might include stock price fluctuations, the long-term implications could be highly positive for the company. The improved balance sheet, reduced interest expense, and increased financial flexibility all contribute to a more promising outlook. However, the success of this strategy hinges on X Corp.'s ability to effectively execute its strategic initiatives and capitalize on the new opportunities. The careful management of the remaining debt is also crucial for long-term stability. Understanding such financial shifts is vital for investors and stakeholders alike. Stay tuned for further updates on X's financial restructuring and debt management strategy.

Featured Posts

-

Nationwide Sanctuary City List Trumps Executive Order

Apr 29, 2025

Nationwide Sanctuary City List Trumps Executive Order

Apr 29, 2025 -

Zuckerbergs New Chapter Navigating The Trump Presidency

Apr 29, 2025

Zuckerbergs New Chapter Navigating The Trump Presidency

Apr 29, 2025 -

Capital Summertime Ball 2025 The Ultimate Ticket Buying Guide

Apr 29, 2025

Capital Summertime Ball 2025 The Ultimate Ticket Buying Guide

Apr 29, 2025 -

Trumps Tariffs Exclusive Strategic Guidance From Goldman Sachs

Apr 29, 2025

Trumps Tariffs Exclusive Strategic Guidance From Goldman Sachs

Apr 29, 2025 -

Coping With Adhd Naturally A Guide To Holistic Management Strategies

Apr 29, 2025

Coping With Adhd Naturally A Guide To Holistic Management Strategies

Apr 29, 2025

Latest Posts

-

Experiential Learning Observing Life Cycles On A Campus Farm

May 13, 2025

Experiential Learning Observing Life Cycles On A Campus Farm

May 13, 2025 -

Addressing Kelly Ripas Absence Mark Consuelos Live Show Experience

May 13, 2025

Addressing Kelly Ripas Absence Mark Consuelos Live Show Experience

May 13, 2025 -

Life Cycle Education The Role Of Campus Farm Animals In Student Learning

May 13, 2025

Life Cycle Education The Role Of Campus Farm Animals In Student Learning

May 13, 2025 -

Deja Kelly Undrafted Rookies Game Winning Shot Highlights Aces Preseason

May 13, 2025

Deja Kelly Undrafted Rookies Game Winning Shot Highlights Aces Preseason

May 13, 2025 -

Kelly Ripas Unforeseen Absence How It Affected Mark Consuelos On Live

May 13, 2025

Kelly Ripas Unforeseen Absence How It Affected Mark Consuelos On Live

May 13, 2025