10%+ Gains On BSE: Sensex Rally And Top Performing Stocks

Table of Contents

Understanding the Sensex Rally: Factors Contributing to 10%+ Gains

The recent 10%+ surge in the BSE Sensex wasn't a random event; it was driven by a confluence of factors impacting both domestic and global markets. Understanding these factors is crucial for navigating future market trends and maximizing investment opportunities.

Economic Indicators and Positive Sentiment

- Strong GDP Growth: India's robust GDP growth, exceeding expectations in recent quarters, injected significant positive sentiment into the market. This demonstrated the resilience of the Indian economy.

- Controlled Inflation: Relatively controlled inflation, compared to global trends, boosted investor confidence and attracted further investment.

- Increased FII Investment: Significant Foreign Institutional Investor (FII) inflows poured into the Indian market, further fueling the Sensex rally. These inflows reflect a positive global outlook on India's economic prospects.

- Supportive Government Policies: Government initiatives focused on infrastructure development, digitalization, and ease of doing business created a favorable environment for businesses and investors, contributing to the positive BSE Sensex performance.

Sector-Specific Growth Drivers

The Sensex rally wasn't uniform across all sectors. Specific sectors experienced disproportionately strong growth, significantly contributing to the overall index performance.

- IT Sector Growth: The IT sector, benefiting from global demand and technological advancements, saw exceptional growth, with many IT stocks among the top Sensex gainers. The "IT sector growth" directly impacted the overall Sensex gains.

- FMCG Stocks: Strong consumer demand and steady earnings propelled many Fast-Moving Consumer Goods (FMCG) stocks, contributing significantly to the BSE Sensex's positive performance. Analyzing "FMCG stocks" reveals key market trends.

- Pharmaceutical Index: The pharmaceutical sector, driven by robust domestic and international demand, also showed impressive growth. The strength of the "Pharmaceutical index" bolstered the overall Sensex rally.

Global Market Influences

Global events also played a role in shaping the BSE Sensex rally.

- Geopolitical Stability: Relative geopolitical stability in certain regions contributed to a more positive global investment climate, benefiting the Indian stock market.

- Global Economic Recovery: Signs of global economic recovery, although uneven, boosted investor confidence and encouraged investment in emerging markets like India.

- International Investment: The correlation between international markets and the Indian stock market's performance is undeniable; positive global trends often translate into positive performance for the BSE Sensex.

Top Performing Stocks: Identifying Winners in the BSE Sensex Rally

Pinpointing the top performers during the Sensex rally provides valuable insights for future investment strategies.

Analyzing Top 10 Performing Stocks

While specific rankings fluctuate, here's a hypothetical example of top-performing stocks (replace with actual data at the time of publication):

- Reliance Industries (RELIANCE): +15% (Example percentage gain) - Energy & Conglomerate

- Infosys (INFY): +12% (Example percentage gain) - IT Services

- HDFC Bank (HDFCBANK): +10% (Example percentage gain) - Banking

- (Include 7 more top-performing stocks with ticker symbols, descriptions, and percentage gains)

Note: Remember to replace this example with the actual top 10 performing stocks and their respective data at the time of publishing for maximum accuracy.

Investment Strategies for Future Gains

Capitalizing on future Sensex rallies requires a well-defined investment strategy.

- Value Investing: Identify undervalued stocks with strong fundamentals and long-term growth potential.

- Growth Investing: Focus on companies with high growth rates and the potential for significant returns, even at higher valuations.

- Portfolio Diversification: Diversify investments across sectors to mitigate risk and maximize potential returns. A diversified portfolio is crucial for long-term success in the BSE Sensex.

- Risk Management: Implement appropriate risk management techniques, such as stop-loss orders, to protect your investments.

Conclusion: Capitalizing on Future BSE Sensex Rallies and 10%+ Gains

The recent BSE Sensex rally highlights the potential for significant gains through careful analysis of market trends, sector-specific growth, and strategic investments. Understanding economic indicators, global influences, and identifying top-performing stocks like those listed above are key to navigating the market effectively. By staying informed about market dynamics and utilizing effective investment strategies, you can position yourself to capitalize on future BSE Sensex rallies and potentially achieve 10%+ gains. Start your research today! Remember to always conduct thorough due diligence before making any investment decisions.

Featured Posts

-

Kibris Ta Sehitlerimiz Erbakandan Oenemli Aciklama

May 15, 2025

Kibris Ta Sehitlerimiz Erbakandan Oenemli Aciklama

May 15, 2025 -

Trumps Oil Price Outlook Goldman Sachs Assessment Of Public Posts

May 15, 2025

Trumps Oil Price Outlook Goldman Sachs Assessment Of Public Posts

May 15, 2025 -

Ensuring Compliance For Crypto Exchanges In India A Step By Step Guide 2025

May 15, 2025

Ensuring Compliance For Crypto Exchanges In India A Step By Step Guide 2025

May 15, 2025 -

What Makes A Crypto Exchange Compliant In India A Simple Guide For 2025

May 15, 2025

What Makes A Crypto Exchange Compliant In India A Simple Guide For 2025

May 15, 2025 -

The Ultimate Guide To Creatine Benefits Risks And Dosage

May 15, 2025

The Ultimate Guide To Creatine Benefits Risks And Dosage

May 15, 2025

Latest Posts

-

Ai Therapy Privacy Concerns And The Potential For Surveillance

May 15, 2025

Ai Therapy Privacy Concerns And The Potential For Surveillance

May 15, 2025 -

The Surveillance State And Ai Therapy A Critical Examination

May 15, 2025

The Surveillance State And Ai Therapy A Critical Examination

May 15, 2025 -

Pandemic Fraud Lab Owner Convicted For False Covid Test Results

May 15, 2025

Pandemic Fraud Lab Owner Convicted For False Covid Test Results

May 15, 2025 -

Ai Therapy Surveillance In A Police State

May 15, 2025

Ai Therapy Surveillance In A Police State

May 15, 2025 -

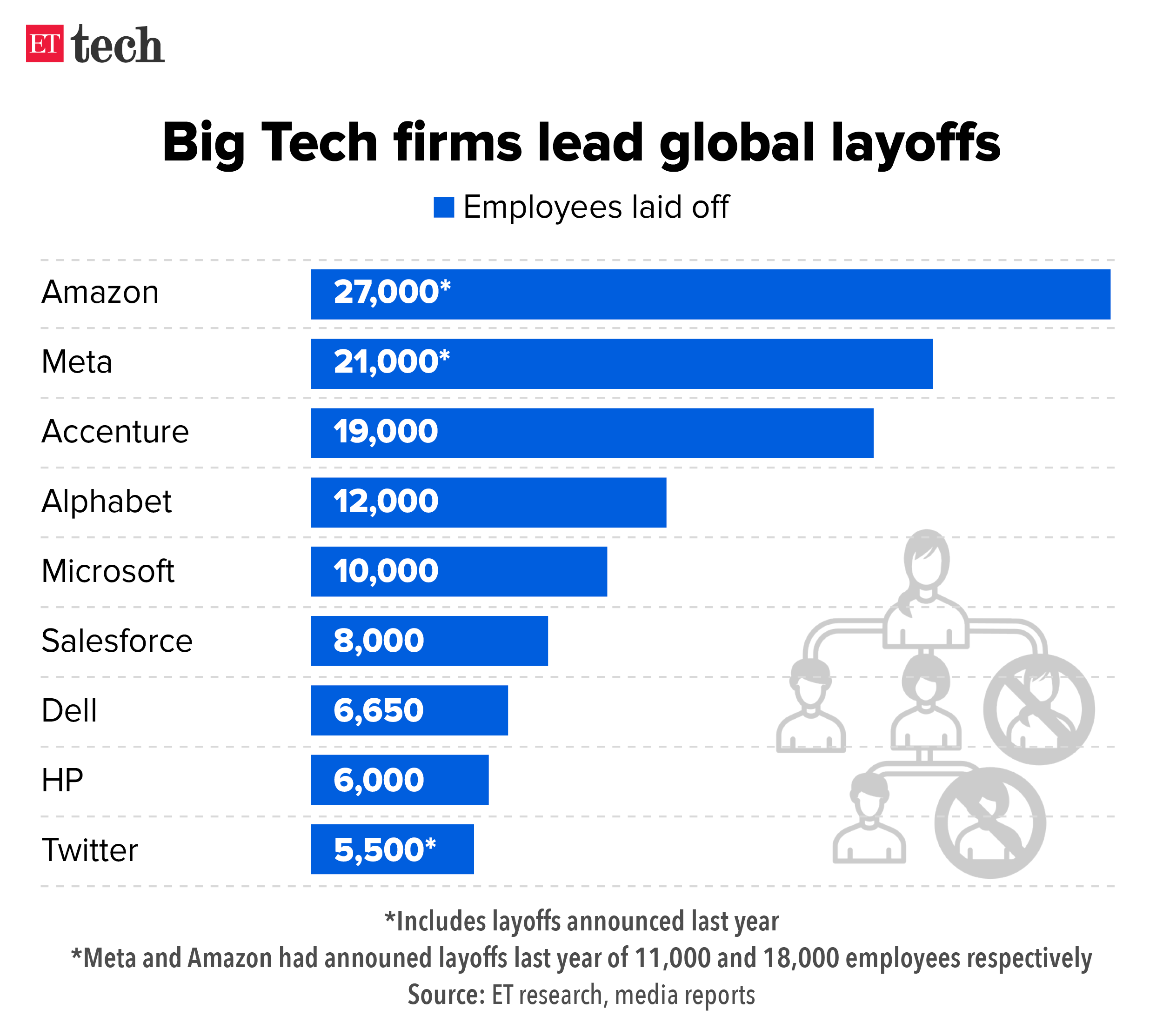

Microsofts Layoff Announcement Impact On Employees And The Tech Industry

May 15, 2025

Microsofts Layoff Announcement Impact On Employees And The Tech Industry

May 15, 2025