Amundi MSCI All Country World UCITS ETF USD Acc: NAV Analysis And Tracking

Table of Contents

Amundi MSCI All Country World UCITS ETF USD Acc: A Deep Dive

Understanding the ETF's Investment Strategy

The Amundi MSCI All Country World UCITS ETF USD Acc aims to replicate the performance of the MSCI All Country World Index. This index is a broad market-capitalization weighted index that covers large, mid, and small-cap equities from developed and emerging markets around the globe. This global diversification offers several key benefits:

- Reduced Risk: By investing across numerous countries and sectors, you're less exposed to the volatility of any single market.

- Potential for Higher Returns: Access to a wider range of investment opportunities can potentially lead to better long-term returns compared to regional or country-specific investments.

- Simplified Portfolio Management: Instead of managing individual stocks across the globe, this ETF offers a simple and convenient way to achieve significant international diversification.

Analyzing the ETF's Expense Ratio

It's crucial to consider the ETF's expense ratio when making investment choices. The expense ratio represents the annual cost of owning the ETF, expressed as a percentage of your investment. A lower expense ratio directly translates to higher returns over the long term. While the exact expense ratio may vary slightly depending on the platform, it's generally low, making it competitive with similar globally diversified ETFs.

- Impact of Low Expense Ratios: Even small differences in expense ratios can significantly impact returns over time, particularly during long-term investment horizons. This makes expense ratio comparisons critical when choosing between similar ETFs.

Currency Considerations (USD Acc)

The USD Acc (Accumulation) share class means that any dividends generated by the underlying holdings are automatically reinvested, compounding your returns. This is beneficial for long-term growth but also introduces currency risk. The ETF's performance is ultimately tied to the USD, so fluctuations in exchange rates can impact the NAV expressed in other currencies.

- Currency Risk: If the USD weakens against your home currency, the value of your investment (in your local currency) might decrease, even if the ETF's underlying assets are performing well.

- Currency Benefits: Conversely, if the USD strengthens, your investment can benefit from favorable exchange rates.

NAV Analysis: Tracking Performance and Fluctuations

Interpreting NAV Data

The NAV (Net Asset Value) represents the value of the ETF's assets minus its liabilities, divided by the number of outstanding shares. It's calculated daily at the close of the market. The NAV is distinct from the market price; while they are usually very close, they might differ slightly due to trading volume and market demand. You can typically find the daily NAV on the ETF provider's website or through your brokerage account.

- How NAV is Calculated: A calculation of all the ETF's underlying assets, minus its liabilities and divided by the number of shares outstanding, giving a per-share value.

- Finding NAV Data: Check Amundi's official website, financial news sites, or your brokerage platform for real-time or historical NAV data.

Factors Influencing NAV Changes

Several factors influence the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc:

- Market Movements: Positive movements in global or regional markets (e.g., strong performance in the US, Asian, or European markets) generally lead to an increase in the NAV. Conversely, negative market trends will usually decrease the NAV.

- Currency Fluctuations: Changes in exchange rates, especially the USD against other currencies, impact the NAV.

- Dividends and Distributions: With the USD Acc share class, dividend reinvestment directly contributes to NAV growth.

Tracking Error Analysis

Tracking error measures how closely the ETF's performance matches that of its benchmark index (the MSCI All Country World Index). A lower tracking error indicates a more accurate replication of the index. Historical data for the Amundi MSCI All Country World UCITS ETF USD Acc usually shows a low tracking error, suggesting effective index tracking.

- Factors Affecting Tracking Error: Transaction costs, management fees, and the ETF's replication methodology (e.g., full replication versus sampling) all play a role.

Comparing the Amundi MSCI All Country World UCITS ETF USD Acc to Competitors

Identifying Key Competitors

Several ETFs offer similar global diversification strategies. Direct competitors include other MSCI All Country World Index trackers from different providers. When comparing, focus on:

- Expense Ratios: Choose the ETF with the lowest expense ratio.

- Tracking Errors: Opt for an ETF with a consistently low tracking error.

Comparative NAV Analysis

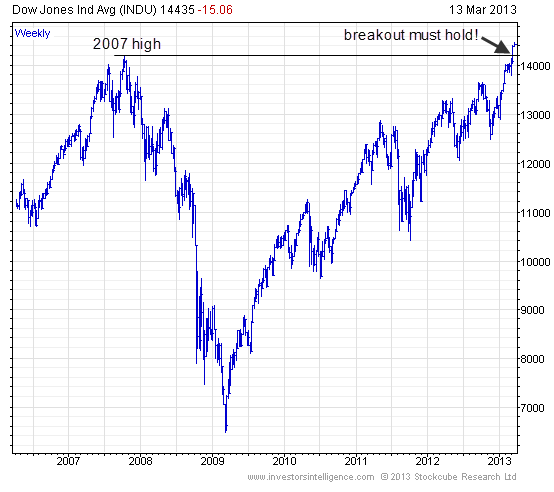

Comparing historical NAV performance with competitors requires analyzing charts and graphs showcasing the NAV over specific time periods. This allows for a direct visual comparison of how the Amundi ETF's NAV has performed relative to its rivals.

Conclusion: Making Informed Decisions About the Amundi MSCI All Country World UCITS ETF USD Acc

Understanding the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is essential for making informed investment decisions. By analyzing its NAV, tracking performance, and comparing it to competitors, you can assess whether this ETF aligns with your investment goals and risk tolerance. Remember to conduct thorough research and consider consulting a financial advisor before making any investment decisions. Start your Amundi MSCI All Country World UCITS ETF USD Acc NAV analysis today! Learn more about investing in this global ETF and its NAV performance! Understand the Amundi MSCI All Country World UCITS ETF USD Acc NAV and make informed investment decisions.

Featured Posts

-

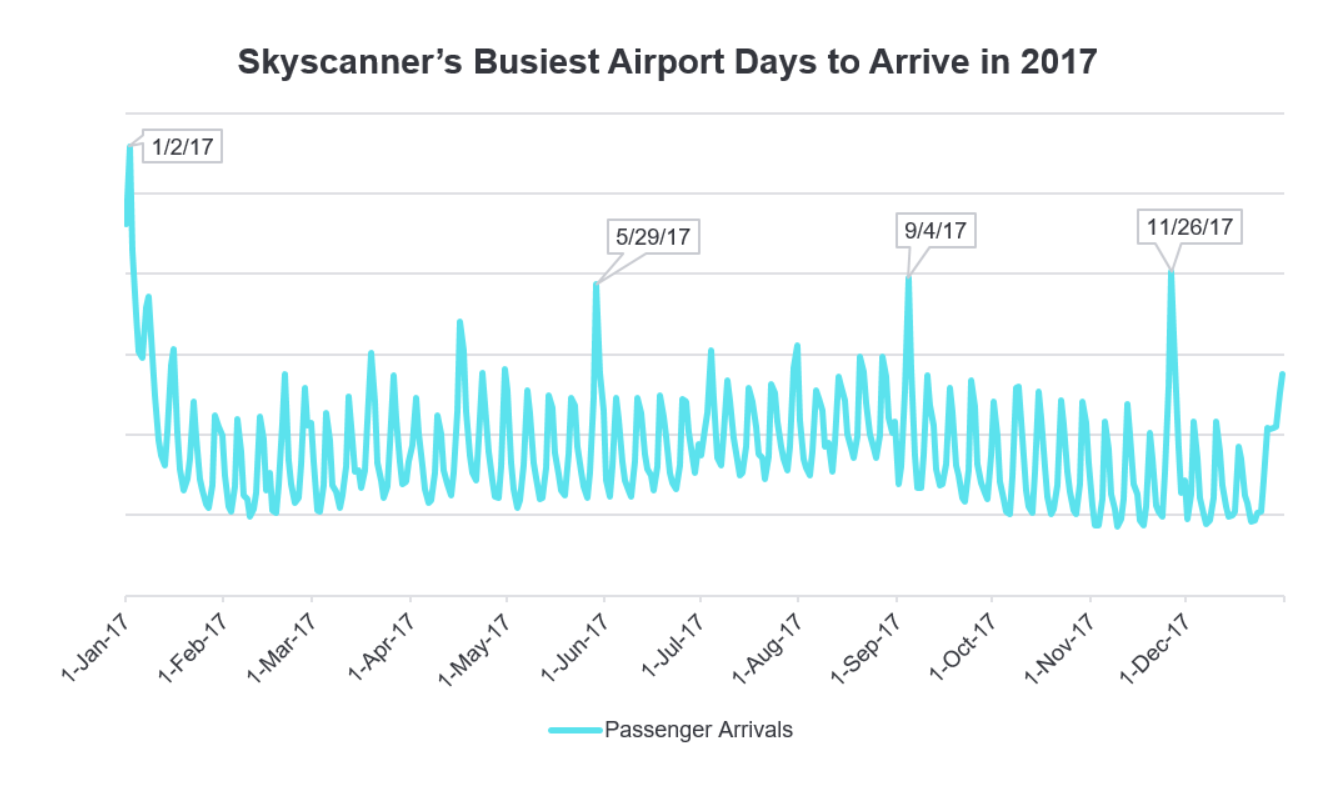

Avoid Memorial Day Travel Chaos The Busiest Flight Days In 2025

May 24, 2025

Avoid Memorial Day Travel Chaos The Busiest Flight Days In 2025

May 24, 2025 -

Konchita Vurst Zhivott Sled Bradatata Na Evroviziya

May 24, 2025

Konchita Vurst Zhivott Sled Bradatata Na Evroviziya

May 24, 2025 -

Frankfurt Equities Opening Dax Continues Record Breaking Ascent

May 24, 2025

Frankfurt Equities Opening Dax Continues Record Breaking Ascent

May 24, 2025 -

Escape To The Country Finding Your Perfect Country Home

May 24, 2025

Escape To The Country Finding Your Perfect Country Home

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Calculation And Implications

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Calculation And Implications

May 24, 2025

Latest Posts

-

Amundi Dow Jones Industrial Average Ucits Etf A Nav Deep Dive

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Nav Deep Dive

May 24, 2025 -

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Drivers Face Hour Long Delays On M6 Southbound After Road Accident

May 24, 2025

Drivers Face Hour Long Delays On M6 Southbound After Road Accident

May 24, 2025 -

Significant Traffic Delays On M6 Southbound Following Collision

May 24, 2025

Significant Traffic Delays On M6 Southbound Following Collision

May 24, 2025 -

60 Minute Delays On M6 Southbound Due To Accident

May 24, 2025

60 Minute Delays On M6 Southbound Due To Accident

May 24, 2025