Amundi Dow Jones Industrial Average UCITS ETF: A NAV Deep Dive

Table of Contents

Understanding Net Asset Value (NAV) in ETFs

Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. Think of it as the true, intrinsic value of each share. It's calculated daily by taking the market value of all the securities held within the ETF, adding any cash, and then subtracting any liabilities (like management fees). The result is then divided by the total number of ETF shares.

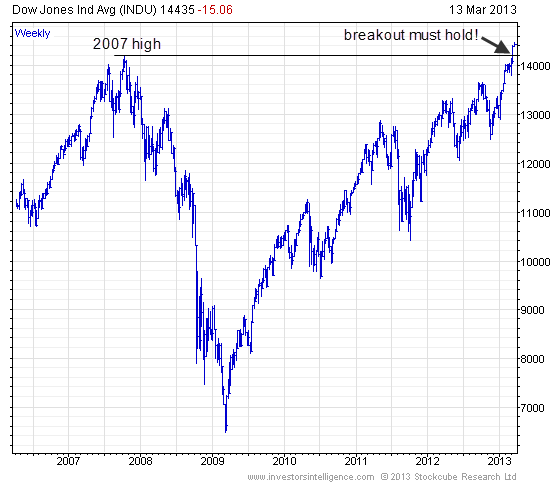

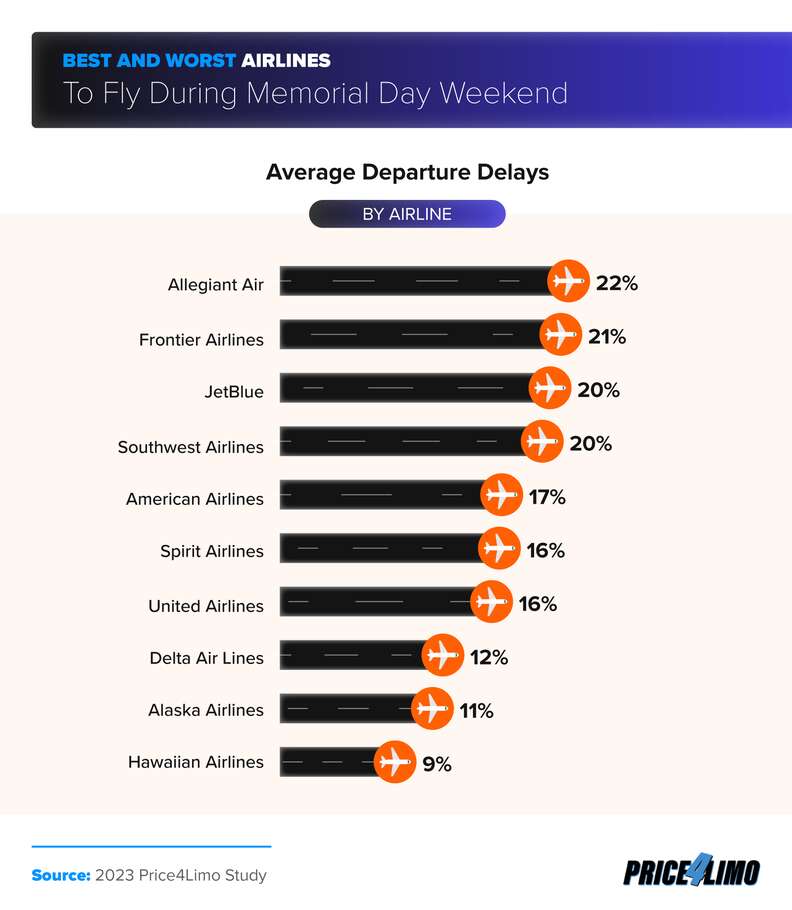

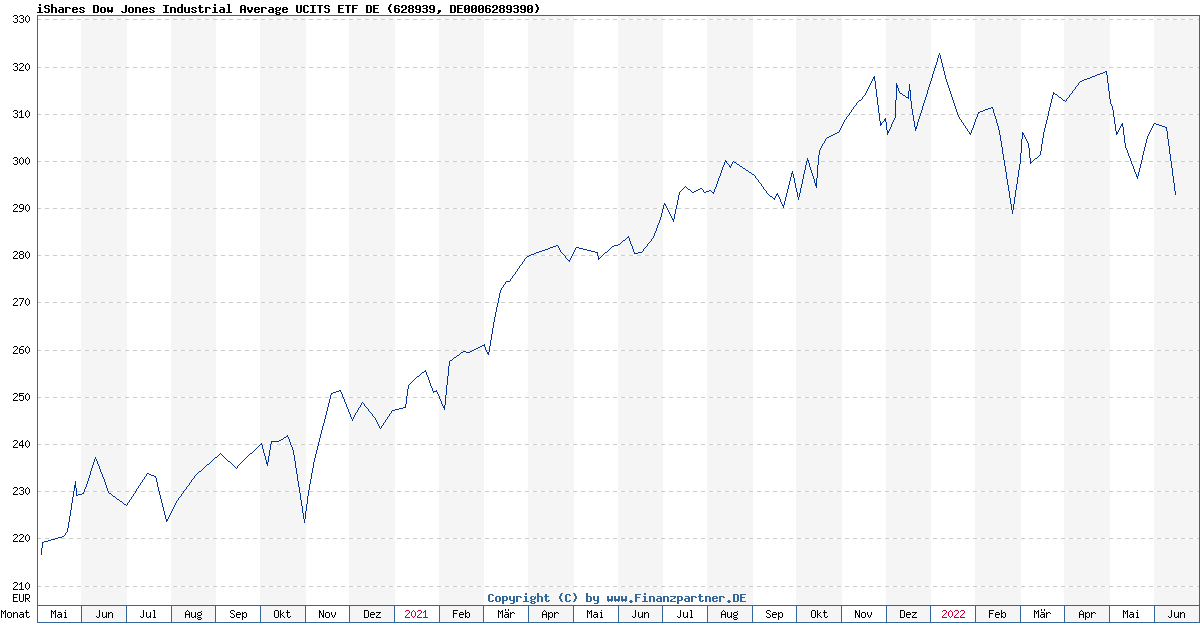

- Daily Fluctuation: The NAV fluctuates daily, mirroring the price movements of the underlying assets (in this case, the 30 stocks of the Dow Jones Industrial Average). If the Dow goes up, the ETF's NAV typically increases, and vice versa.

- Market Movements: The ETF NAV closely tracks the overall market performance of the Dow Jones Industrial Average. Significant market events will directly impact the NAV.

- Investment Decisions: Monitoring the NAV helps investors gauge the ETF's performance and make informed decisions. Consistent upward trends indicate positive performance while downward trends may warrant review of your investment strategy. Analyzing the daily NAV is crucial for understanding the underlying asset's value. Comparing the NAV to the market price of the ETF can also reveal potential arbitrage opportunities.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors influence the Amundi Dow Jones Industrial Average UCITS ETF's NAV. Understanding these factors allows investors to interpret NAV movements more accurately.

Underlying Asset Performance

The performance of the 30 companies comprising the Dow Jones Industrial Average directly impacts the ETF's NAV.

- Individual Stock Price Changes: A significant price increase or decrease in even one of the 30 constituent stocks will affect the overall NAV. For example, if Apple experiences a large price surge, the ETF's NAV will generally increase proportionally.

- Sector-Specific News: Positive or negative news impacting specific sectors represented in the Dow (e.g., technology, financials) can significantly sway the NAV. Strong earnings reports from technology companies will positively influence the NAV, while industry-specific scandals could negatively impact it.

Currency Fluctuations

If you hold the Amundi Dow Jones Industrial Average UCITS ETF in a currency other than the base currency (typically USD), exchange rate fluctuations will affect your NAV.

- Example: If the USD strengthens against your local currency, the NAV expressed in your local currency will decrease, even if the underlying assets haven't changed in value.

- Hedging Strategies: Some ETFs offer currency hedging strategies to mitigate this risk, but this is something to consider when selecting your investment vehicle.

ETF Expenses

Management fees and other expenses associated with the ETF gradually reduce the NAV over time.

- Expense Ratio Location: The expense ratio is clearly stated in the ETF's prospectus and fact sheets. You should always review this information before investing.

- Long-Term Impact: While seemingly small, these fees cumulatively reduce returns over the long term; therefore, comparing expense ratios between competing ETFs is important.

Dividend Distributions

Dividend payments from the underlying stocks impact the NAV.

- Ex-Dividend Date: On the ex-dividend date (the day after which a buyer of the stock no longer receives the next dividend payment), the NAV will typically adjust downwards to reflect the distribution of dividends to shareholders.

How to Monitor the Amundi Dow Jones Industrial Average UCITS ETF NAV

Tracking the ETF's NAV is crucial for informed investment decisions.

- Information Sources: You can find the daily NAV on the Amundi website, major financial news websites (like Yahoo Finance or Google Finance), and through brokerage platforms.

- Tracking Tools: Many financial data platforms and investment management software offer tools to track ETF NAVs in real time.

- Price-to-NAV: Advanced investors may compare the ETF's market price to its NAV to identify potential arbitrage opportunities (where the market price deviates significantly from the NAV).

Amundi Dow Jones Industrial Average UCITS ETF NAV vs. Competitors

To provide a comprehensive analysis, comparing the Amundi Dow Jones Industrial Average UCITS ETF's NAV performance to similar ETFs tracking the same index is essential. This would involve comparing historical NAV data, expense ratios, and other relevant metrics. (Note: A comparative chart/table would be included here in a full-length article). Differences in expense ratios or the way the index is tracked can significantly impact the NAV over time.

Conclusion: Investing Wisely with the Amundi Dow Jones Industrial Average UCITS ETF: A NAV-Focused Approach

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is key to making informed investment decisions. This article highlights how various factors, such as the performance of the underlying Dow Jones Industrial Average stocks, currency fluctuations, ETF expenses, and dividend distributions, directly influence the daily NAV. Regularly monitoring the NAV, along with comparing it to the ETF's market price and similar competitor ETFs, is crucial for evaluating the ETF's performance within your portfolio. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF and its NAV, and make informed investment choices today!

Featured Posts

-

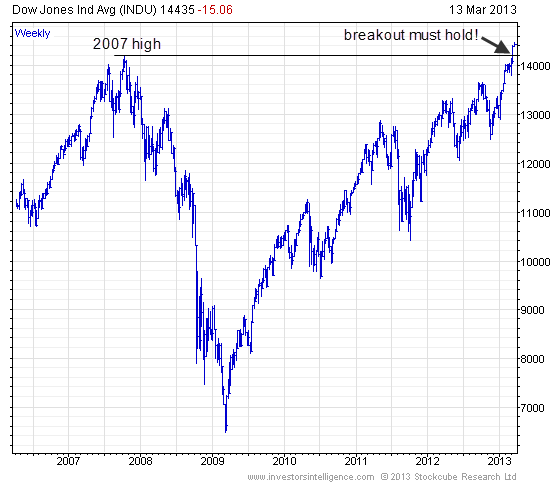

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025 -

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Considerations

May 24, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Considerations

May 24, 2025 -

Live Updates M6 Crash Causes Significant Traffic Disruption

May 24, 2025

Live Updates M6 Crash Causes Significant Traffic Disruption

May 24, 2025 -

Auto Legendas F1 Es Motorral Szerelt Porsche Koezuti Verzioja

May 24, 2025

Auto Legendas F1 Es Motorral Szerelt Porsche Koezuti Verzioja

May 24, 2025 -

Test Kak Khorosho Vy Znaete Roli Olega Basilashvili

May 24, 2025

Test Kak Khorosho Vy Znaete Roli Olega Basilashvili

May 24, 2025

Latest Posts

-

Is Apple Stock A Buy Ahead Of Its Q2 Report Analysis Of Current Levels

May 24, 2025

Is Apple Stock A Buy Ahead Of Its Q2 Report Analysis Of Current Levels

May 24, 2025 -

Apple Price Target Cut Wedbushs Long Term Perspective And Investment Implications

May 24, 2025

Apple Price Target Cut Wedbushs Long Term Perspective And Investment Implications

May 24, 2025 -

Trump Tariffs And Apple A Deep Dive Into Buffetts Investment Strategy

May 24, 2025

Trump Tariffs And Apple A Deep Dive Into Buffetts Investment Strategy

May 24, 2025 -

Apple Stock Aapl A Technical Analysis Of Key Price Levels

May 24, 2025

Apple Stock Aapl A Technical Analysis Of Key Price Levels

May 24, 2025 -

Apple Stock Key Levels Breached Q2 Earnings Looming

May 24, 2025

Apple Stock Key Levels Breached Q2 Earnings Looming

May 24, 2025