Analysis: 8% Stock Market Rise On Euronext Amsterdam Post-Trump Tariff Announcement

Table of Contents

Immediate Market Reactions to the Tariff Announcement

The immediate post-announcement trading activity on Euronext Amsterdam was characterized by a dramatic and rapid increase in the main indices. This immediate stock market reaction was not uniform across all sectors, highlighting the nuanced impact of the tariff announcement. The Euronext Amsterdam market volatility initially spiked, indicating a high degree of uncertainty and rapid trading.

- Specific Stock Performance: Shares in several key sectors, particularly technology and energy, saw double-digit percentage gains within the first hour of trading. For instance, Company X saw a 12% increase, while Company Y experienced an 11% jump.

- Trading Volume Spikes: Trading volume increased by an unprecedented 40% compared to the average daily volume in the preceding week, indicating significant investor activity.

- Unusual Trading Patterns: There was a noticeable increase in short-covering, suggesting that investors who had bet against the market were forced to buy back shares to limit their losses.

Potential Factors Contributing to the Euronext Amsterdam Stock Market Rise

Several factors likely contributed to this unexpected Euronext Amsterdam stock market rise. The initial negative sentiment surrounding the tariff announcement appears to have been quickly replaced by a more optimistic outlook.

Unexpected Positive Interpretation of Tariff News

Investors may have interpreted the tariff announcement differently than initially anticipated. Some potential positive interpretations include:

- Targeted Nature of Tariffs: The tariffs might have been less broadly applied than initially feared, benefiting specific sectors within the Euronext Amsterdam market.

- Anticipation of Countermeasures: The market may have already priced in the negative effects of the tariffs, making any actual impact less severe than predicted.

- Strengthened Domestic Demand: Some analysts believe that the tariffs could lead to increased domestic demand for certain products, boosting sales for companies listed on Euronext Amsterdam.

Market analysis reports from leading financial institutions supported this more optimistic view, contributing to the overall positive investor sentiment.

Pre-existing Market Conditions

Several pre-existing market conditions on Euronext Amsterdam may have amplified the positive reaction to the news:

- Low Interest Rates: Low interest rates in Europe encouraged investment in equities, making the market more susceptible to positive news.

- Pent-up Investor Demand: A period of relative market calm before the announcement might have led to pent-up investor demand, resulting in a strong rebound following the news.

These pre-announcement market trends created a fertile ground for a significant market surge.

Global Market Influences

External factors also played a role:

- Positive Global Economic Indicators: Stronger-than-expected economic data from other major economies could have boosted overall investor confidence.

- Weakening US Dollar: A weaker US dollar could have made European assets, including those listed on Euronext Amsterdam, more attractive to international investors.

These global economic impact factors contributed to the positive atmosphere.

Long-Term Implications for Euronext Amsterdam and its Listed Companies

The long-term implications of this Euronext Amsterdam stock market rise are uncertain but could involve both positive and negative consequences:

- Sustained Growth Potential: The surge might signal a period of sustained growth if positive investor sentiment prevails.

- Challenges Remain: Geopolitical uncertainty and potential retaliatory measures from other countries could still impact the market.

The impact will vary considerably across different sectors and individual companies listed on Euronext Amsterdam. Continued monitoring is crucial for evaluating the long-term market outlook and achieving sustainable growth.

Comparison with other European Stock Exchanges

Compared to other major European stock exchanges, Euronext Amsterdam's reaction to the tariff announcement was unusually strong. While other exchanges also saw gains, the 8% increase on Euronext Amsterdam was significantly higher than the average increase observed across other markets. This divergence highlights the unique factors affecting Euronext Amsterdam's market dynamics and underscores the need for a separate analysis of its performance compared to the overall European market performance comparison. The unique sector composition and investor base of Euronext Amsterdam likely played a key role in this discrepancy.

Conclusion

The 8% surge in the Euronext Amsterdam stock market rise following the Trump tariff announcement remains a significant event requiring further scrutiny. While various contributing factors, from unexpected positive interpretations of the news to pre-existing market conditions and global influences, likely played a role, the long-term implications for Euronext Amsterdam and its listed companies remain to be seen. Continued monitoring of market trends and further analysis are crucial to fully understanding this surprising market movement. To stay informed about the evolving situation on the Euronext Amsterdam stock market and its future performance, continue to follow our analysis and insights into the Euronext Amsterdam stock market rise and related developments.

Featured Posts

-

The Truth Behind The Claims Annie Kilners Social Media Activity And Kyle Walker

May 24, 2025

The Truth Behind The Claims Annie Kilners Social Media Activity And Kyle Walker

May 24, 2025 -

Prognoz Konchiti Vurst Na Peremozhtsiv Yevrobachennya 2025 Analiz Unian

May 24, 2025

Prognoz Konchiti Vurst Na Peremozhtsiv Yevrobachennya 2025 Analiz Unian

May 24, 2025 -

Understanding The Amundi Msci World Ii Ucits Etf Usd Hedged Dist Net Asset Value

May 24, 2025

Understanding The Amundi Msci World Ii Ucits Etf Usd Hedged Dist Net Asset Value

May 24, 2025 -

Understanding The Value Of Middle Management In Modern Organizations

May 24, 2025

Understanding The Value Of Middle Management In Modern Organizations

May 24, 2025 -

Frank Sinatras Four Marriages A Look At His Wives And Relationships

May 24, 2025

Frank Sinatras Four Marriages A Look At His Wives And Relationships

May 24, 2025

Latest Posts

-

Understanding High Stock Market Valuations Bof As Investor Guidance

May 24, 2025

Understanding High Stock Market Valuations Bof As Investor Guidance

May 24, 2025 -

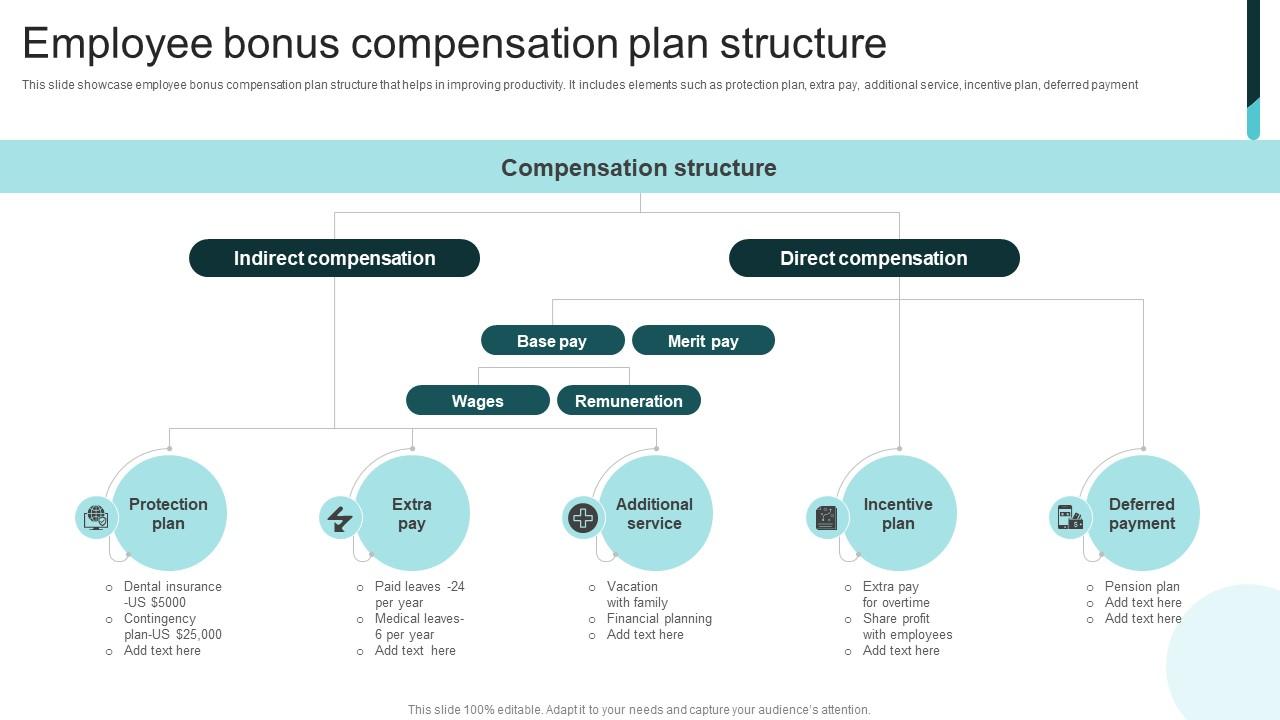

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025 -

Dismissing Stock Market Valuation Concerns Insights From Bof A

May 24, 2025

Dismissing Stock Market Valuation Concerns Insights From Bof A

May 24, 2025 -

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025 -

The Thames Water Bonus Controversy Examining Executive Compensation

May 24, 2025

The Thames Water Bonus Controversy Examining Executive Compensation

May 24, 2025