Analysis: SSE's £3 Billion Spending Reduction And Its Implications

Table of Contents

Reasons Behind SSE's £3 Billion Spending Reduction

SSE's decision to slash its spending by £3 billion is multifaceted, driven by a confluence of factors impacting the energy sector's investment landscape. Key drivers include:

-

Rising inflation and interest rates: The current economic climate, characterized by high inflation and soaring interest rates, significantly increases the cost of borrowing and reduces the feasibility of large-scale infrastructure projects. This makes securing financing for ambitious energy initiatives significantly more challenging.

-

Increased regulatory scrutiny and uncertainty: The regulatory environment surrounding the energy sector is becoming increasingly complex and unpredictable. Changes in government policy, evolving environmental regulations, and increased scrutiny of energy companies' practices create uncertainty and make long-term investment planning more difficult. This uncertainty contributes to a more cautious approach to capital expenditure.

-

Strategic reassessment of investment priorities: SSE is likely undertaking a strategic review, reassessing its portfolio of projects and focusing investment on core competencies and higher-return ventures. This involves prioritizing projects with the strongest potential for profitability and aligning with the company's long-term strategic goals.

-

Need to optimize capital allocation for maximum shareholder value: SSE's primary responsibility is to maximize shareholder value. This £3 billion spending reduction may be a strategic decision to optimize capital allocation, ensuring that resources are deployed where they generate the highest returns and minimizing exposure to risky or less profitable ventures.

-

Potential shift towards more profitable, less capital-intensive projects: The spending cut may reflect a shift away from large-scale, capital-intensive projects towards smaller, more agile, and potentially more profitable initiatives. This could involve a focus on optimizing existing assets and exploring less capital-intensive avenues for growth.

Impact on SSE's Renewable Energy Investments

The £3 billion spending reduction will inevitably impact SSE's ambitious renewable energy investment program. This has significant implications for the UK's green energy transition and SSE's commitment to net-zero targets. The potential consequences include:

-

Delays or cancellations of planned renewable energy projects: Some planned wind energy and solar power projects might face delays or even cancellations, potentially slowing down the expansion of renewable energy capacity. This has ramifications for reaching the UK's ambitious renewable energy targets.

-

Impact on SSE's commitment to net-zero targets and its green energy strategy: While SSE remains committed to its net-zero targets, the spending cut might necessitate a revised timeline and a more selective approach to green energy investments. The company may need to re-evaluate its green energy strategy to align with its revised financial constraints.

-

Potential consequences for the UK's renewable energy targets: The UK government has set ambitious targets for renewable energy generation. Delays or cancellations of SSE projects could hinder progress towards these targets, necessitating alternative strategies to ensure the country remains on track.

-

Evaluation of alternative financing options for green energy initiatives: SSE may need to explore alternative financing models, such as public-private partnerships or green bonds, to secure funding for crucial renewable energy projects. This will require innovative approaches to attract investment in the green energy sector.

-

Assessment of the impact on employment in the renewable energy sector: Project delays or cancellations could lead to job losses within the renewable energy sector, highlighting the need for careful planning and mitigation strategies to minimize the social and economic impact.

Financial Implications and Shareholder Value

The financial implications of SSE's £3 billion spending reduction are complex and will unfold over time. Key areas of consideration include:

-

Short-term and long-term impact on SSE's financial performance: In the short term, the reduction in capital expenditure might negatively affect revenue growth. However, in the long term, improved efficiency and a focus on profitable projects could lead to enhanced financial performance and profitability.

-

Impact on SSE's debt levels and credit rating: The spending cut could contribute to debt reduction, potentially improving SSE's credit rating and reducing financing costs. However, the impact on creditworthiness will depend on how effectively the company manages its financial resources.

-

Examination of how the spending reduction impacts shareholder returns and dividend payouts: The impact on shareholder returns will depend on the balance between reduced investment and improved profitability. Dividend payouts may be affected, depending on SSE's strategic priorities and financial performance.

-

Assessment of the market's reaction to the announcement and subsequent share price movements: The market's reaction to the announcement will be crucial in evaluating the success of this strategy. Share price movements will reflect investor sentiment regarding SSE's revised strategic direction and long-term prospects.

-

Discussion on the potential for improved profitability and efficiency: The primary aim of the spending reduction is to improve profitability and operational efficiency. The success of this strategy will depend on the company's ability to execute its revised plans effectively.

Potential for Restructuring and Job Losses

The significant spending reduction may necessitate restructuring initiatives within SSE, potentially leading to job losses. This requires careful management and consideration for the affected employees.

-

Assessment of potential job losses across different SSE divisions: Certain divisions might be disproportionately affected, requiring careful planning to mitigate the impact on the workforce.

-

Discussion of the potential impact on employee morale and productivity: Job losses can negatively impact employee morale and productivity. SSE needs to implement strategies to maintain a positive work environment and support its employees during this transition.

-

Analysis of any planned restructuring initiatives and their impact on the organization's structure: Restructuring initiatives should be carefully planned and implemented to minimize disruption and ensure the continued effective operation of the company.

-

Examination of support measures for affected employees: SSE should provide comprehensive support measures for affected employees, including outplacement services, retraining opportunities, and financial assistance.

Conclusion

SSE's £3 billion spending reduction represents a significant strategic shift with far-reaching implications for the company, its investors, and the wider energy sector. While it may lead to short-term challenges, the move aims to enhance long-term profitability and efficiency, particularly amidst a challenging economic and regulatory environment. The impact on renewable energy investments requires close monitoring, as does the potential for job losses and restructuring.

Call to Action: Stay informed on the evolving impact of SSE's £3 billion spending reduction by continuing to follow our analysis and insights into the UK energy sector. Understanding the implications of this significant cost-cutting measure is crucial for investors, energy professionals, and anyone interested in the future of the energy transition. For further in-depth analysis of SSE and its strategic decisions, explore our dedicated resource section.

Featured Posts

-

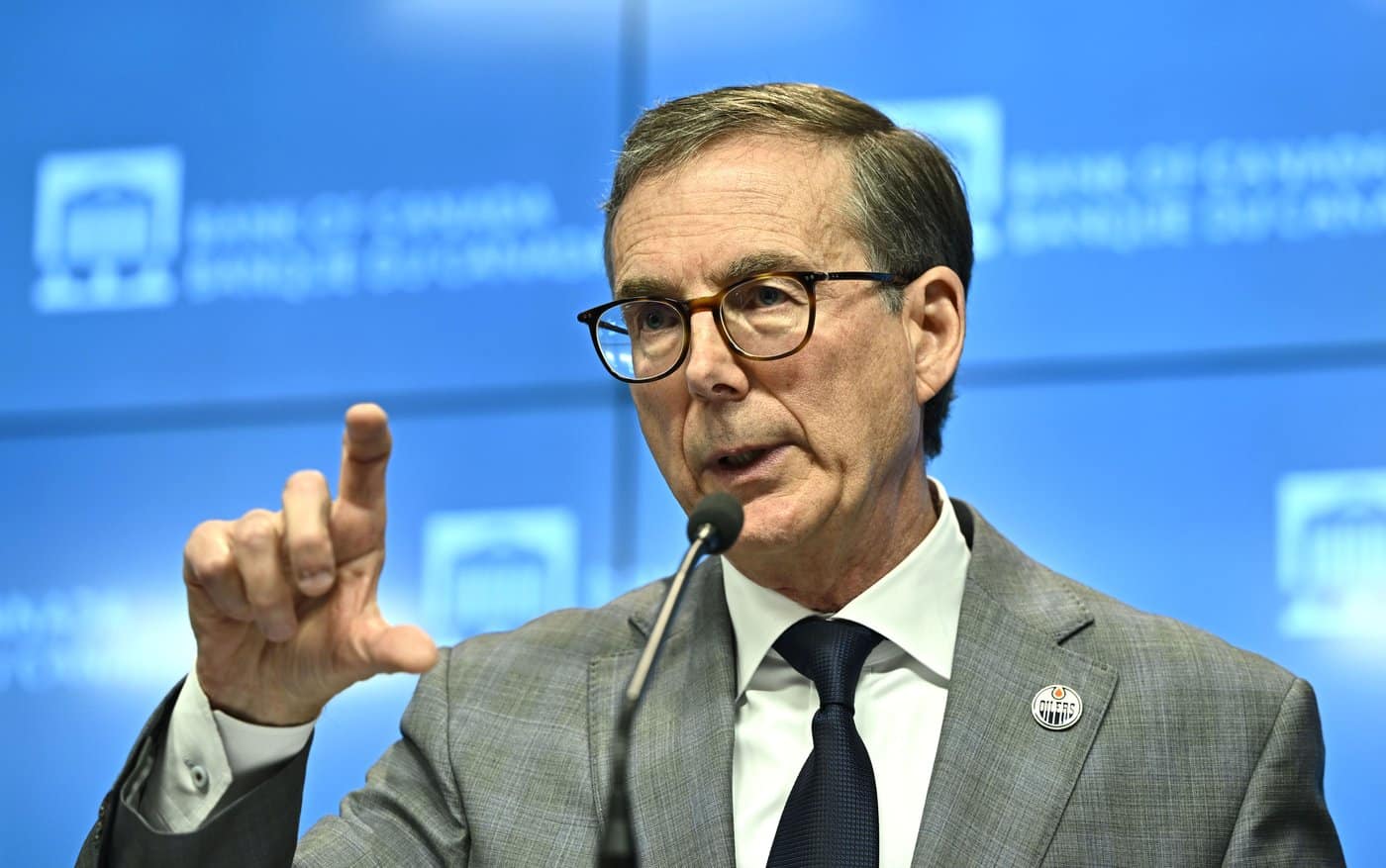

Bank Of Canada To Cut Rates Three More Times Desjardins Prediction

May 24, 2025

Bank Of Canada To Cut Rates Three More Times Desjardins Prediction

May 24, 2025 -

Nimi Muistiin Ferrarin 13 Vuotias Lupaus

May 24, 2025

Nimi Muistiin Ferrarin 13 Vuotias Lupaus

May 24, 2025 -

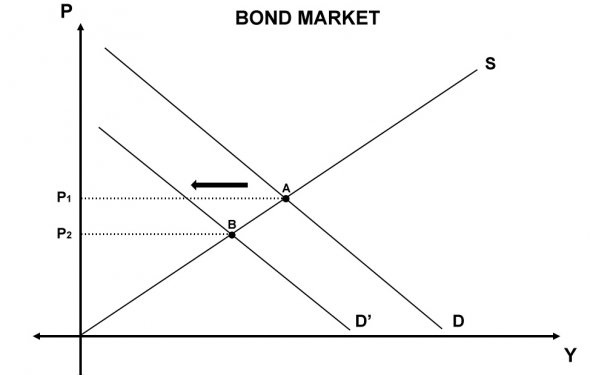

Global Bond Market Instability A Posthaste Warning

May 24, 2025

Global Bond Market Instability A Posthaste Warning

May 24, 2025 -

Is Kyle Walker Peters Headed To West Ham New Transfer Offer Reported

May 24, 2025

Is Kyle Walker Peters Headed To West Ham New Transfer Offer Reported

May 24, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Retirement

May 24, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Retirement

May 24, 2025

Latest Posts

-

Co Hosts Of Today Show Address Long Term Anchor Absence

May 24, 2025

Co Hosts Of Today Show Address Long Term Anchor Absence

May 24, 2025 -

Concerned Co Hosts Address Popular Today Show Anchors Absence

May 24, 2025

Concerned Co Hosts Address Popular Today Show Anchors Absence

May 24, 2025 -

Today Show Anchors Absence A Message From Her Co Hosts

May 24, 2025

Today Show Anchors Absence A Message From Her Co Hosts

May 24, 2025 -

Explanation For Anchors Absence From Today Show Co Hosts Speak Out

May 24, 2025

Explanation For Anchors Absence From Today Show Co Hosts Speak Out

May 24, 2025 -

Today Show Co Hosts Reveal Concerns During Anchors Absence

May 24, 2025

Today Show Co Hosts Reveal Concerns During Anchors Absence

May 24, 2025