Apple Stock Price Drops On Tariff Concerns

Table of Contents

The Impact of Tariffs on Apple's Supply Chain

Tariffs significantly increase the cost of manufacturing Apple products, primarily because many components are sourced from China. These increased manufacturing costs directly impact Apple's profitability and ultimately, its stock price. The escalating trade war and resulting tariffs represent a substantial threat to Apple's intricate and globally dispersed supply chain.

- Increased Costs of Key Components: Tariffs directly impact the price of essential components like:

- Displays sourced from Chinese manufacturers.

- Processors and other semiconductors manufactured in China and Taiwan.

- Various other smaller components integrated into iPhones, iPads, and Macs.

- Potential Price Increases for Consumers: To maintain profit margins, Apple may be forced to pass on these increased costs to consumers through higher product prices. This could dampen consumer demand, further impacting Apple's revenue and stock price.

- Mitigation Strategies: Apple is exploring alternative sourcing strategies to lessen its reliance on Chinese manufacturers. This involves potentially shifting production to other countries, a complex and costly undertaking. However, finding reliable and cost-effective alternatives will be crucial in mitigating the long-term impact of tariffs on Apple's supply chain. This includes exploring options in Vietnam, India, and other Southeast Asian countries.

- Related Keywords: Apple supply chain, China tariffs, manufacturing costs, component sourcing, price increase, Vietnam manufacturing, India manufacturing.

Investor Sentiment and Market Reaction

The immediate market reaction to the news of increased tariffs was swift and negative. The Apple stock price drop reflects a broader investor concern regarding future profitability and sales. This uncertainty is leading to market volatility and a decrease in investor confidence.

- Market Volatility: The Apple stock price drop is not isolated. The overall tech sector experienced a downturn, illustrating the interconnectedness of the global market and the sensitivity of tech stocks to geopolitical events.

- Analyst Predictions: Many analysts have lowered their price targets for Apple stock, citing concerns about reduced demand and increased production costs. The consensus is that the impact of tariffs will be significant, at least in the short term.

- Investor Confidence: The drop in Apple stock reflects a decline in investor confidence, not only in Apple itself but also in the broader tech sector's ability to navigate this challenging geopolitical landscape. This uncertainty is likely to persist until there's more clarity on the future of trade relations.

- Related Keywords: Investor confidence, market volatility, stock market reaction, analyst predictions, tech sector downturn, geopolitical risk.

Potential Long-Term Implications for Apple

Sustained trade tensions and ongoing tariff increases could significantly impact Apple's long-term business model. The company faces several crucial challenges that may affect its future innovation and growth.

- Manufacturing Relocation: Shifting manufacturing operations to other countries is a long-term solution, but it involves significant investment and logistical challenges. This includes setting up new facilities, training workers, and managing a more geographically diverse supply chain.

- Impact on Innovation: The disruption caused by tariffs could slow down Apple's product development cycles. Resource allocation and prioritization may shift towards mitigating the effects of tariffs rather than focusing solely on innovation.

- Increased Competition: Higher prices and supply chain disruptions could create opportunities for competitors to gain market share. This increased competition could pressure Apple's profit margins and limit its growth potential.

- Related Keywords: Long-term impact, business model, manufacturing relocation, global competition, product development delays, competitive landscape.

Strategies for Investors

Investors holding Apple stock need to carefully consider their risk tolerance and adjust their investment strategies accordingly.

- Diversification: Diversifying investments across different sectors and asset classes is crucial to mitigate risk. Reducing exposure to the tech sector might be a prudent strategy in the current climate.

- Hedging Strategies: Investors could consider hedging strategies to protect against further declines in Apple's stock price. This could involve using options or other derivative instruments.

- Alternative Investments: Exploring alternative investment options within the tech sector or other less volatile sectors is recommended. Careful market analysis is essential before making any significant changes to an investment portfolio.

- Stay Informed: Continuously monitor market news and trade developments to make informed investment decisions. Consulting with a financial advisor is highly recommended for personalized guidance.

- Related Keywords: Investment strategy, risk management, hedging, diversification, market analysis, financial advisor, portfolio management.

Conclusion

The Apple stock price drop is largely attributed to escalating tariff concerns and their impact on Apple's supply chain and profitability. The implications are far-reaching, affecting investor sentiment, market volatility, and Apple's long-term prospects. Investors need to carefully assess the risks and consider adjusting their strategies accordingly. Stay informed about the latest developments concerning Apple stock price drops and tariff concerns. Monitor market news and consult with a financial advisor to make informed investment decisions.

Featured Posts

-

Ecb Faiz Indirimi Avrupa Borsalarinda Karisik Bir Guen

May 24, 2025

Ecb Faiz Indirimi Avrupa Borsalarinda Karisik Bir Guen

May 24, 2025 -

2026 Porsche Cayenne Ev Spy Shots What We Know So Far

May 24, 2025

2026 Porsche Cayenne Ev Spy Shots What We Know So Far

May 24, 2025 -

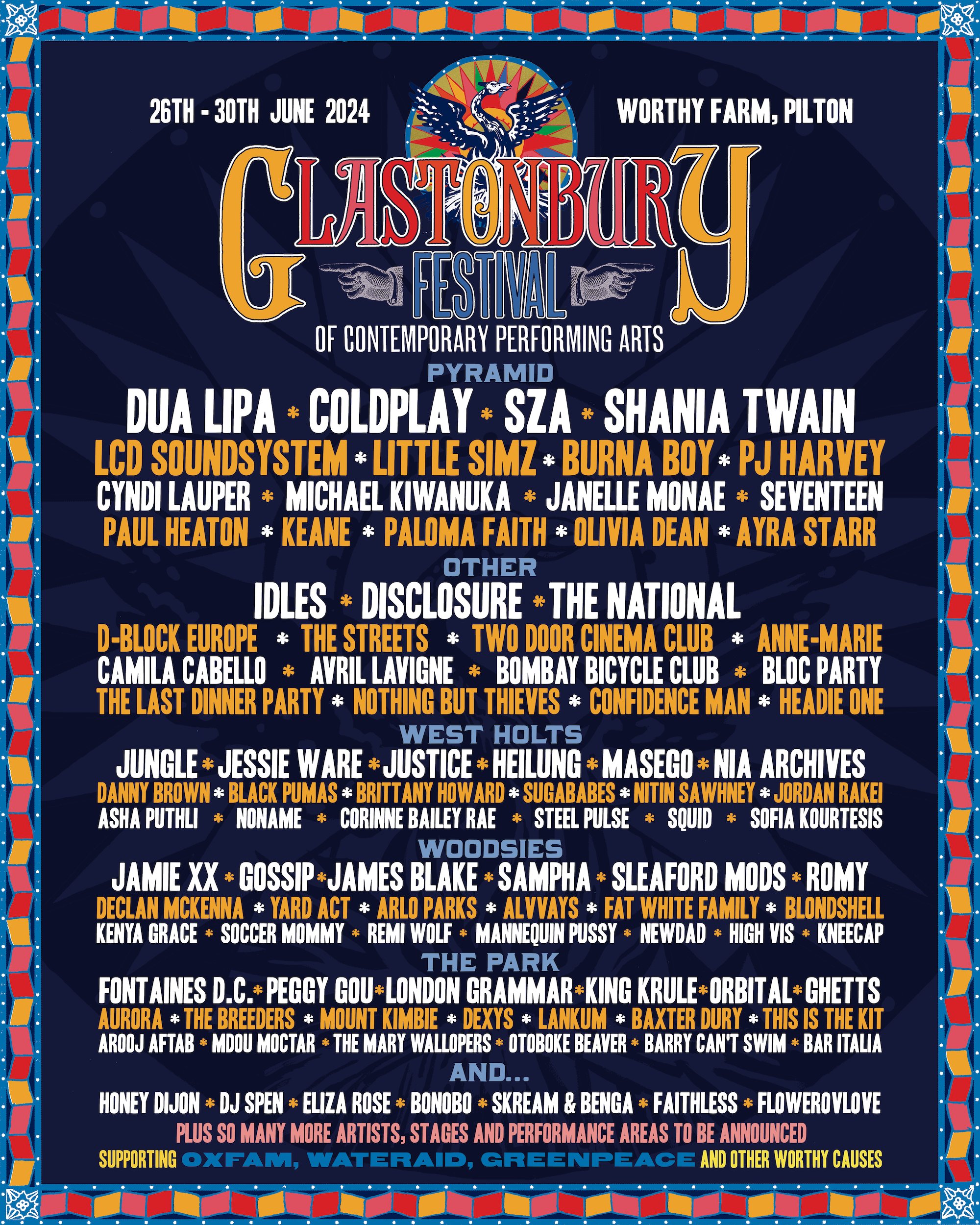

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025 -

Exploring New Opportunities Bangladesh Europe Economic Partnerships

May 24, 2025

Exploring New Opportunities Bangladesh Europe Economic Partnerships

May 24, 2025 -

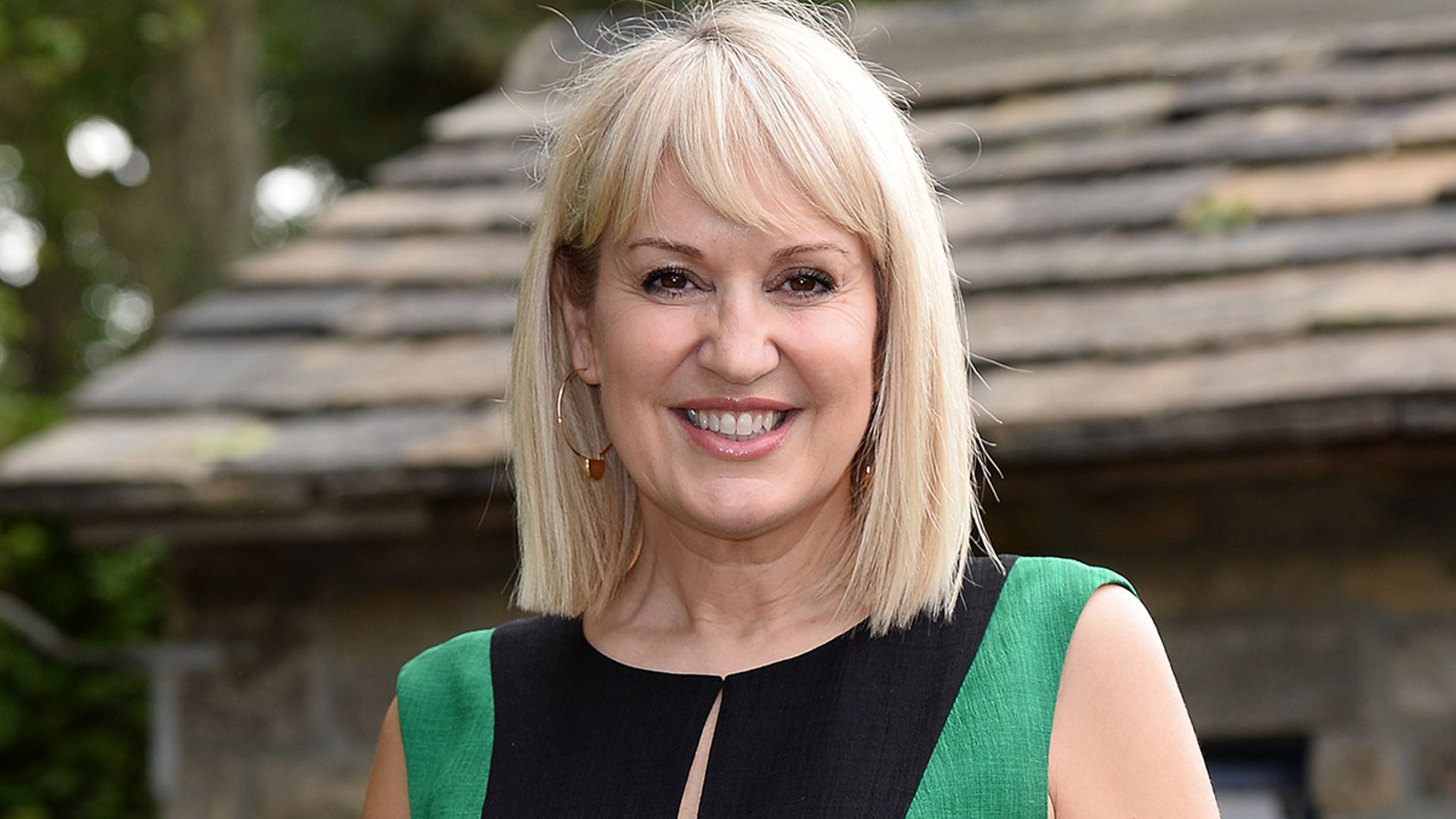

Escape To The Country Designing A Garden Like Nicki Chapmans

May 24, 2025

Escape To The Country Designing A Garden Like Nicki Chapmans

May 24, 2025

Latest Posts

-

Broadcoms V Mware Deal At And T Highlights Extreme Cost Increase

May 24, 2025

Broadcoms V Mware Deal At And T Highlights Extreme Cost Increase

May 24, 2025 -

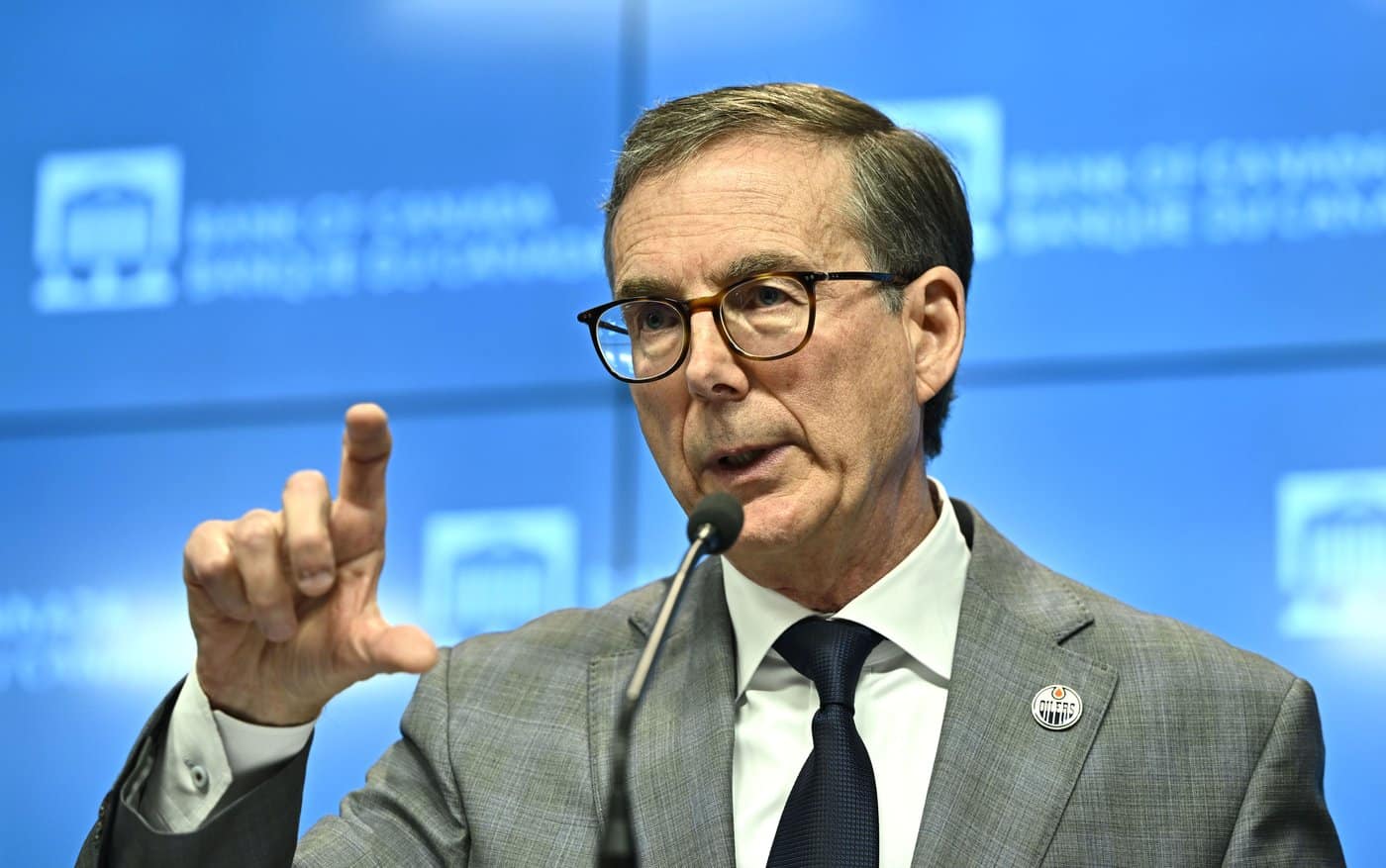

Bank Of Canada To Cut Rates Three More Times Desjardins Prediction

May 24, 2025

Bank Of Canada To Cut Rates Three More Times Desjardins Prediction

May 24, 2025 -

1 050 V Mware Price Increase At And Ts Concerns Over Broadcom Acquisition

May 24, 2025

1 050 V Mware Price Increase At And Ts Concerns Over Broadcom Acquisition

May 24, 2025 -

Desjardins Forecasts Three Further Bank Of Canada Interest Rate Reductions

May 24, 2025

Desjardins Forecasts Three Further Bank Of Canada Interest Rate Reductions

May 24, 2025 -

Extreme Price Hike Broadcoms V Mware Acquisition Impacts At And T

May 24, 2025

Extreme Price Hike Broadcoms V Mware Acquisition Impacts At And T

May 24, 2025