Are Gold And Cash-Like ETFs The Best Investment Strategy For Safety?

Table of Contents

Understanding Gold ETFs as a Safe Haven Investment

The History of Gold as a Safe Haven Asset

Gold has a long and storied history as a safe haven asset, prized for its ability to preserve value during times of economic uncertainty and inflation. Throughout history, gold has often held its value or even appreciated while other assets declined.

- Key Historical Events:

- The Great Depression: Gold prices soared as investors sought refuge from the collapsing global economy.

- The 1970s Oil Crisis: Gold acted as a hedge against inflation driven by rising energy costs.

- The 2008 Financial Crisis: Gold prices increased significantly as investors lost confidence in traditional financial markets. This demonstrated gold's role as a safe haven during systemic risk.

This historical performance underlines gold's role as a crucial component of any robust investment strategy focused on safety. Investing in gold offers protection against inflation and economic downturns. The price of gold, however, is affected by global events, making it a volatile asset.

Analyzing the Performance of Gold ETFs

Gold ETFs offer investors a convenient and cost-effective way to gain exposure to gold without the need to physically store the precious metal. Their performance reflects the underlying price of gold. However, past performance is not indicative of future results.

-

Positive Aspects:

- Historically acted as a negative correlation to stocks, offering diversification benefits.

- Relatively easy to buy and sell, providing liquidity.

- Transparent pricing, determined by the gold market.

-

Negative Aspects:

- Subject to price volatility, influenced by various factors including global economic conditions and currency fluctuations.

- Does not generate dividend income.

The performance of Gold ETFs is directly tied to the gold price. Analyzing charts and graphs showcasing gold ETF performance across different market cycles is crucial before incorporating it into your investment strategy. Understanding the historical context of gold investment alongside potential future scenarios is key to successful risk management.

Risks Associated with Gold ETF Investments

While Gold ETFs offer diversification benefits, it's crucial to acknowledge associated risks:

- Price Volatility: Gold prices fluctuate based on supply and demand, geopolitical events, and currency movements, creating volatility in Gold ETF returns. This needs to be carefully considered as part of your investment strategy.

- Lack of Income: Gold ETFs don't pay dividends, meaning your returns depend entirely on price appreciation.

- Storage and Security: While ETF ownership eliminates the need for physical gold storage, the underlying gold is still subject to risks related to the custodian's security measures.

Understanding these risks is vital to formulating a sound investment strategy that utilizes Gold ETFs effectively.

Evaluating Cash-Like ETFs for Stability and Liquidity

Types of Cash-Like ETFs

Cash-like ETFs provide exposure to short-term, highly liquid assets aiming for stability and capital preservation. These usually include:

- Money Market Funds ETFs: Invest in short-term, high-quality debt securities, such as Treasury bills and commercial paper.

- Short-Term Bond ETFs: Focus on bonds with maturities of one year or less.

These ETFs prioritize capital preservation over significant returns, making them suitable for risk-averse investors.

Advantages of Cash-Like ETFs

Cash-like ETFs provide several advantages for investors seeking safety:

- Low Risk: The underlying assets are generally considered low-risk, making them suitable for preserving capital.

- High Liquidity: They are easily traded, allowing for quick access to funds if needed.

- Stability: They are designed to maintain relatively stable value, especially compared to equities. This stability can be a significant benefit during market downturns.

These attributes make cash-like ETFs ideal for maintaining liquidity and stability within a diversified portfolio.

Limitations of Cash-Like ETFs

Despite their advantages, cash-like ETFs also have drawbacks:

- Low Returns: Returns are typically modest, often lagging behind inflation.

- Interest Rate Sensitivity: Changes in interest rates can impact the value of short-term debt securities.

- Inflation Risk: The low returns can be eroded by inflation, reducing the real value of your investment over time.

Understanding these limitations is critical for integrating cash-like ETFs into your investment strategy.

Comparing Gold and Cash-Like ETFs: A Balanced Investment Strategy?

Diversification Benefits

Combining Gold and Cash-like ETFs in a portfolio offers significant diversification benefits. Gold's inverse correlation with stocks can help offset losses during market downturns, while cash-like ETFs provide stability and liquidity. This approach reduces overall portfolio risk and enhances safety.

- Reduced Volatility: The combination mitigates the impact of market fluctuations, leading to a smoother investment experience.

- Enhanced Safety: The portfolio becomes more resilient to economic shocks and market corrections.

The combination offers a strategic approach to risk management.

Optimal Allocation Strategies

Determining the ideal allocation between Gold and Cash-like ETFs depends on individual risk tolerance and investment goals.

- Conservative Investors: May favor a higher allocation to cash-like ETFs to prioritize capital preservation.

- Moderate Investors: Might seek a balanced approach, splitting investments between Gold and Cash-like ETFs.

- Aggressive Investors (less focused on safety): Will likely have a lower allocation to both, focusing on growth assets.

Consider your personal investment goals and risk tolerance before making any allocation decisions. Seek advice from a financial advisor if needed. Proper asset allocation is vital to building a robust and secure portfolio.

Conclusion

Gold and Cash-like ETFs each offer unique advantages for safety-conscious investors. Gold ETFs can act as an inflation hedge and provide diversification against traditional asset classes, while Cash-like ETFs offer stability and liquidity. However, both come with inherent risks; Gold ETFs are subject to price volatility, while Cash-like ETFs offer low returns and are sensitive to interest rate changes. The best investment strategy for safety often involves a diversified approach. Consider a balanced portfolio incorporating both Gold and Cash-like ETFs to enhance safety and capital preservation. Learn more about building your own safe and secure portfolio with Gold and Cash-like ETFs today! Conduct thorough research before making any investment decisions.

Featured Posts

-

Nestor Cortes Strong Return Leads To Reds Third Straight Loss

Apr 23, 2025

Nestor Cortes Strong Return Leads To Reds Third Straight Loss

Apr 23, 2025 -

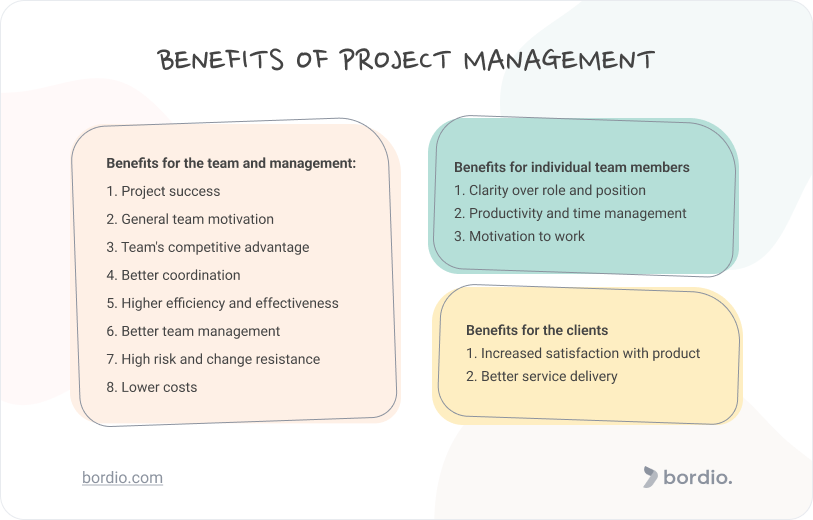

The Crucial Role Of Middle Management Benefits For Companies And Employees

Apr 23, 2025

The Crucial Role Of Middle Management Benefits For Companies And Employees

Apr 23, 2025 -

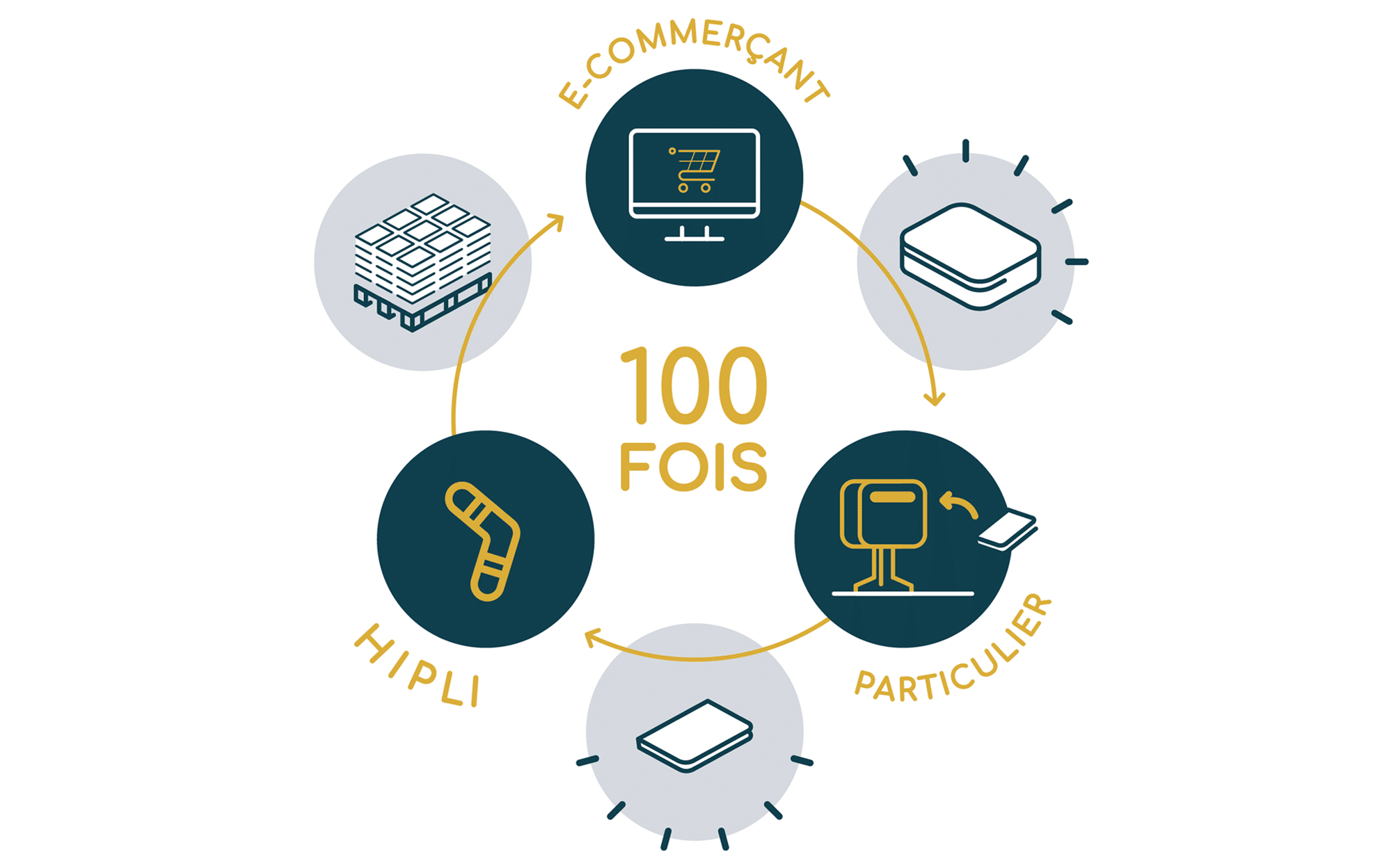

Hipli La Solution De Colis Reutilisables Pour Une Livraison Durable

Apr 23, 2025

Hipli La Solution De Colis Reutilisables Pour Une Livraison Durable

Apr 23, 2025 -

Los Angeles Wildfires A Reflection Of Societal Attitudes Towards Betting On Tragedy

Apr 23, 2025

Los Angeles Wildfires A Reflection Of Societal Attitudes Towards Betting On Tragedy

Apr 23, 2025 -

Cub Southpaw Shota Imanagas Mlb Best Splitter A Deep Dive

Apr 23, 2025

Cub Southpaw Shota Imanagas Mlb Best Splitter A Deep Dive

Apr 23, 2025

Latest Posts

-

The Embrace Of Divine Mercy Religious Life And Gods Compassion In 1889

May 10, 2025

The Embrace Of Divine Mercy Religious Life And Gods Compassion In 1889

May 10, 2025 -

Palantir Prediction 2 Stocks To Watch For Higher Returns In 3 Years

May 10, 2025

Palantir Prediction 2 Stocks To Watch For Higher Returns In 3 Years

May 10, 2025 -

Stock Market Prediction 2 Companies To Outpace Palantir Within 3 Years

May 10, 2025

Stock Market Prediction 2 Companies To Outpace Palantir Within 3 Years

May 10, 2025 -

2 Stocks Poised To Surpass Palantirs Value In 3 Years

May 10, 2025

2 Stocks Poised To Surpass Palantirs Value In 3 Years

May 10, 2025 -

2 Stocks Poised To Surpass Palantirs Value In 3 Years A Prediction

May 10, 2025

2 Stocks Poised To Surpass Palantirs Value In 3 Years A Prediction

May 10, 2025