BofA's View: Why Current Stock Market Valuations Shouldn't Deter Investors

Table of Contents

BofA's Positive Outlook on Long-Term Economic Growth

BofA's positive outlook on long-term economic growth forms the cornerstone of their argument for continued investment. Their analysis points to several key factors supporting this optimistic forecast, suggesting that the current valuations are justified by strong underlying economic fundamentals. BofA Global Research highlights:

-

Strong Corporate Earnings Projections: Many companies are projecting robust earnings growth for the coming years, fueled by increasing consumer demand and successful cost-cutting measures. This suggests that current stock prices, while seemingly high, are supported by the potential for future earnings.

-

Positive Consumer Spending Trends: Consumer spending remains a significant driver of economic growth, and indicators suggest continued strength. This sustained consumer confidence contributes to the positive outlook for corporate profits and overall economic expansion.

-

Government Infrastructure Investments: Significant government investments in infrastructure projects promise to stimulate economic activity and create jobs, further boosting long-term growth prospects. This investment is expected to have a multiplier effect, benefitting various sectors of the economy.

-

Technological Innovation Driving Productivity Gains: Ongoing technological advancements are leading to increased productivity across various industries. This enhances efficiency and profitability for businesses, ultimately contributing to sustained economic growth and higher stock valuations.

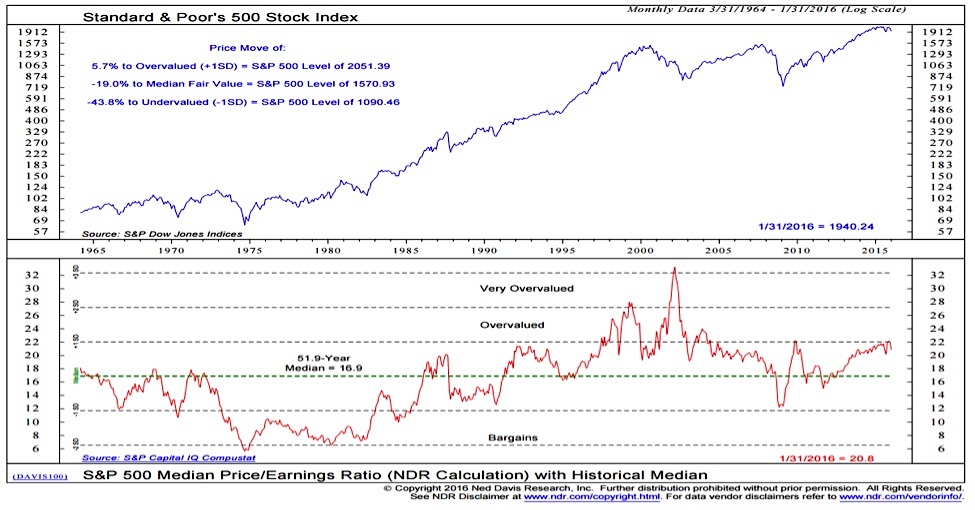

Addressing Concerns about High Stock Market Valuations

It's undeniable that current stock market valuations appear high compared to historical averages. This understandably raises concerns among investors. However, BofA counters these concerns with several key arguments:

-

Low Interest Rates Justify Higher P/E Ratios: The current low-interest-rate environment allows companies to borrow money cheaply, supporting higher levels of investment and ultimately justifying higher price-to-earnings (P/E) ratios than seen in periods of higher interest rates. This is a crucial factor in understanding the relationship between market multiples and earnings growth.

-

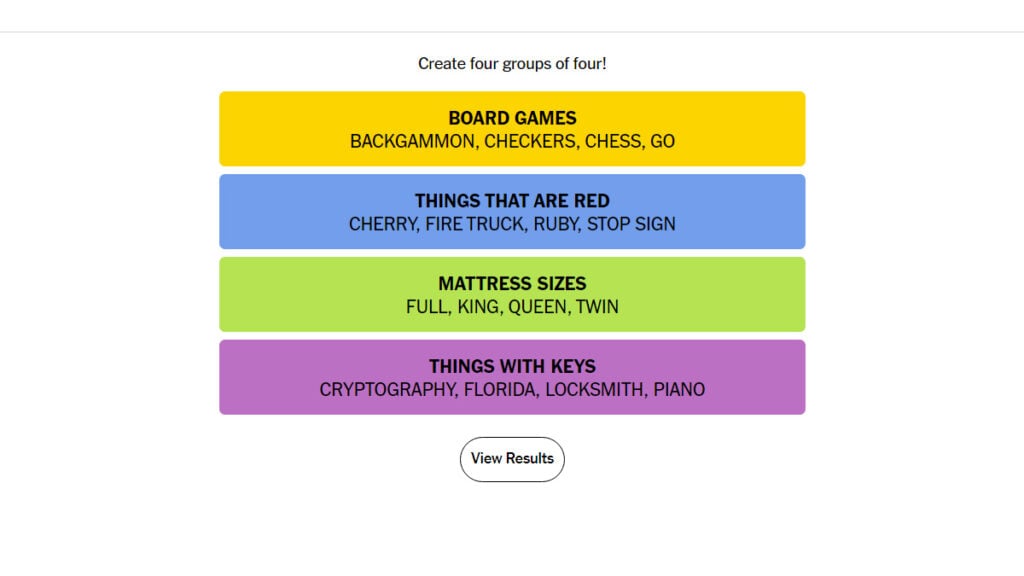

Strong Company Fundamentals Support Current Valuations: Many companies exhibit strong balance sheets, solid cash flows, and innovative business models. These fundamental strengths support the current market valuations, suggesting that they aren't simply inflated bubbles.

-

Potential for Further Earnings Growth: BofA anticipates further earnings growth in the coming years, indicating that current valuations might still be conservative compared to future earnings potential. This future growth is expected to justify current stock prices.

The Importance of Diversification and Long-Term Investing

Addressing concerns about stock market valuations also requires considering the importance of investment strategy. BofA emphasizes the critical roles of diversification and long-term investing:

-

Reducing Portfolio Volatility Through Diversification: A well-diversified portfolio, spread across different asset classes and sectors, reduces exposure to individual stock performance and mitigates the overall risk of market fluctuations.

-

The Power of Compounding Returns Over Time: Long-term investing allows investors to leverage the power of compounding returns, where returns earn further returns over time. This significantly increases wealth accumulation over the long haul, allowing investors to weather short-term market corrections.

-

Avoiding Emotional Investment Decisions Based on Short-Term Market Noise: A long-term strategy helps investors avoid impulsive decisions based on short-term market movements, which can often be driven by irrational exuberance or fear.

Specific Sectors BofA Favors

While a comprehensive sector-specific analysis requires reviewing BofA's full report, their research generally favors sectors poised for strong growth in the coming years. These often include technology (driven by innovation), healthcare (driven by aging populations), and renewable energy (driven by environmental concerns and government incentives). This is not an exhaustive list, and individual stock picking remains crucial for success.

Why BofA's View on Stock Market Valuations Should Influence Your Investment Strategy

In summary, despite seemingly high stock market valuations, BofA's analysis presents a compelling case for continued investment. Their positive long-term economic outlook, coupled with counterarguments to valuation concerns and the crucial roles of diversification and long-term investing, paints a picture of opportunity. By understanding current stock market valuations through the lens of BofA's research, investors can make more informed decisions. We encourage you to learn more about BofA's research and consider adjusting your investment strategies to reflect their insights into navigating stock market valuations and understanding current market conditions. Don't let perceived high valuations deter you from exploring the potential for growth; instead, use BofA's perspective on stock valuations to build a robust and successful investment plan.

Featured Posts

-

Record A Abidjan Le Msc Diletta Le Plus Grand Navire Jamais Vu Est Arrive

May 20, 2025

Record A Abidjan Le Msc Diletta Le Plus Grand Navire Jamais Vu Est Arrive

May 20, 2025 -

Solve The Nyt Mini Crossword April 8 2025 Tuesday Answers And Hints

May 20, 2025

Solve The Nyt Mini Crossword April 8 2025 Tuesday Answers And Hints

May 20, 2025 -

Tragedia Na Tijuca Incendio Em Escola Gera Indignacao E Lembrancas

May 20, 2025

Tragedia Na Tijuca Incendio Em Escola Gera Indignacao E Lembrancas

May 20, 2025 -

Efl Trophy Victory Darren Ferguson Leads Peterborough To Historic Win

May 20, 2025

Efl Trophy Victory Darren Ferguson Leads Peterborough To Historic Win

May 20, 2025 -

Arsenal And Manchester United Vie For Matheus Cunha

May 20, 2025

Arsenal And Manchester United Vie For Matheus Cunha

May 20, 2025

Latest Posts

-

Understanding The Factors Behind D Wave Quantum Qbts Stocks Thursday Drop

May 20, 2025

Understanding The Factors Behind D Wave Quantum Qbts Stocks Thursday Drop

May 20, 2025 -

1 Reason To Buy This Ai Quantum Computing Stock During A Market Dip

May 20, 2025

1 Reason To Buy This Ai Quantum Computing Stock During A Market Dip

May 20, 2025 -

Factors Contributing To D Wave Quantum Inc Qbts Stocks Monday Increase

May 20, 2025

Factors Contributing To D Wave Quantum Inc Qbts Stocks Monday Increase

May 20, 2025 -

D Wave Quantum Qbts Stock Performance On Thursday A Detailed Look

May 20, 2025

D Wave Quantum Qbts Stock Performance On Thursday A Detailed Look

May 20, 2025 -

Investigating The Reasons Behind D Wave Quantum Qbts Stocks Friday Gain

May 20, 2025

Investigating The Reasons Behind D Wave Quantum Qbts Stocks Friday Gain

May 20, 2025