Buyer Budget Cuts Cause 5.6% Drop In Fremantle's Q1 Revenue

Table of Contents

The Impact of Buyer Budget Cuts on Fremantle's Q1 Performance

Fremantle's Q1 2024 financial performance reflects a challenging market. The company reported a 5.6% decrease in revenue compared to the same period last year. While the exact financial figures haven't been publicly disclosed in detail, reports suggest a substantial impact on the bottom line. This downturn significantly affects Fremantle's profitability and, consequently, its stock price.

- Specific areas hit hard: The impact was most acutely felt in drama production and unscripted television, segments particularly vulnerable to fluctuating buyer spending.

- Financial implications: The revenue drop necessitates a reassessment of Fremantle’s short-term and long-term strategies, potentially impacting future project greenlights and overall expansion plans.

- Stock market reaction: The news likely caused negative reactions in the stock market, highlighting the seriousness of the situation for investors and stakeholders.

Analysis of the Underlying Causes of Reduced Buyer Spending

Several interconnected factors contributed to the reduction in buyer spending that impacted Fremantle's Q1 revenue.

- The Streaming Wars Intensify: The fierce competition among streaming giants has led to increased content acquisition costs, forcing platforms to prioritize and become more selective in their commissioning decisions. This selectivity directly impacts the number of projects greenlit and, consequently, the revenue for production companies like Fremantle.

- Economic Slowdown and Recessionary Fears: The current economic climate, marked by inflation and potential recession, has prompted cost-cutting measures across numerous industries, including the media sector. Broadcasters and streamers are scrutinizing budgets more closely, leading to decreased spending on new content.

- Reduced Advertising Revenue: Traditional broadcasters are experiencing a decline in advertising revenue, reducing their capacity to invest heavily in new programming. This makes securing funding for high-budget productions more challenging.

- Rising Production Costs: The costs associated with television and film production continue to increase, fueled by factors such as inflation, crew salaries, and technological advancements. This cost inflation makes it harder to deliver profitable projects within tighter budgets.

Fremantle's Strategies to Mitigate the Impact of Budget Cuts

Fremantle is actively implementing strategies to navigate this challenging period and mitigate the impact of reduced buyer spending.

- Cost-Cutting Measures: The company is likely streamlining operations, optimizing production workflows, and potentially reducing its workforce in certain areas to cut costs and improve efficiency.

- Content Strategy Adjustments: Fremantle may be shifting its focus towards lower-budget productions or genres that are less expensive to produce but still attract significant audiences. This could involve a strategic focus on formats that are easily adaptable across different territories.

- International Expansion and Diversification: Expanding into new international markets and diversifying its content portfolio (e.g., exploring new genres or formats) can help reduce dependence on single markets and revenue streams.

- Exploring Alternative Funding Sources: Exploring collaborations and partnerships with other companies, or potentially seeking private equity funding, could provide additional financial support to weather the current market conditions.

Potential Long-Term Effects on the Media Industry

The reduced buyer spending isn't just impacting Fremantle; it’s a significant trend impacting the entire media industry.

- Consolidation and Mergers: We may see increased consolidation within the industry, with larger companies acquiring smaller ones to gain a competitive edge and improve cost efficiencies.

- Shift in Content Creation: The focus may shift towards lower-budget, high-impact content that maximizes reach and engagement on a smaller budget.

- Impact on Independent Producers: Independent production companies may face significant challenges, potentially leading to increased reliance on larger entities for funding and production.

- The Future of Television: The current situation will undoubtedly reshape the future of television, likely leading to more diverse and potentially riskier content strategies as companies try to capture viewers in a highly competitive market.

Conclusion

Buyer budget cuts have significantly impacted Fremantle's Q1 revenue, resulting in a notable 5.6% drop. This decline is attributable to a confluence of factors: intensified streaming competition, economic uncertainty, reduced advertising revenue, and rising production costs. Fremantle is responding with strategic cost-cutting measures, content strategy adjustments, and international expansion. However, the long-term effects on the broader media industry remain to be seen. Stay informed about the evolving media landscape and the impact of buyer budget cuts on the future of content creation. Follow our updates for further analysis of Fremantle's performance and the broader media industry trends. Learn more about the challenges and opportunities in the television and film industry, and continue to follow the impact of buyer budget cuts on Fremantle’s revenue and the wider media landscape.

Featured Posts

-

Impact Of 5 30 Year Yield On The Sell America Strategy

May 21, 2025

Impact Of 5 30 Year Yield On The Sell America Strategy

May 21, 2025 -

Little Britains Continued Popularity Understanding Gen Zs Appeal

May 21, 2025

Little Britains Continued Popularity Understanding Gen Zs Appeal

May 21, 2025 -

Little Britains Future Matt Lucas Addresses Revival Speculation

May 21, 2025

Little Britains Future Matt Lucas Addresses Revival Speculation

May 21, 2025 -

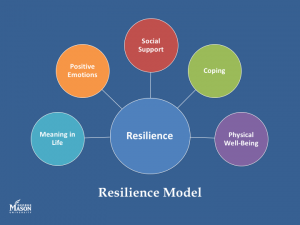

Resilience And Mental Wellbeing From Adversity To Growth

May 21, 2025

Resilience And Mental Wellbeing From Adversity To Growth

May 21, 2025 -

Quantum Computing And Ai D Waves Qbts Impact On Pharmaceutical Research

May 21, 2025

Quantum Computing And Ai D Waves Qbts Impact On Pharmaceutical Research

May 21, 2025

Latest Posts

-

Remont Pivdennogo Mostu Pidryadniki Vartist Ta Termini

May 22, 2025

Remont Pivdennogo Mostu Pidryadniki Vartist Ta Termini

May 22, 2025 -

Huizenmarktprognose Abn Amro Stijgende Prijzen Dalende Rente

May 22, 2025

Huizenmarktprognose Abn Amro Stijgende Prijzen Dalende Rente

May 22, 2025 -

Optimalisatie Van Uw Kamerbrief Certificaten Verkoopprogramma Bij Abn Amro

May 22, 2025

Optimalisatie Van Uw Kamerbrief Certificaten Verkoopprogramma Bij Abn Amro

May 22, 2025 -

Abn Amro Rentedaling En Verwachte Huizenprijsstijging

May 22, 2025

Abn Amro Rentedaling En Verwachte Huizenprijsstijging

May 22, 2025 -

De Afhankelijkheid Van Goedkope Arbeidsmigranten In De Nederlandse Voedingsindustrie Een Abn Amro Perspectief

May 22, 2025

De Afhankelijkheid Van Goedkope Arbeidsmigranten In De Nederlandse Voedingsindustrie Een Abn Amro Perspectief

May 22, 2025