Canada's New Tariffs On US Goods Plummet: Near-Zero Rates And Key Exemptions

Table of Contents

Near-Zero Tariff Rates: A Detailed Breakdown

The Canadian government has implemented substantial tariff reductions on a wide range of goods imported from the United States. This move towards near-zero tariffs signifies a commitment to fostering stronger trade ties and boosting economic activity. Many previously taxed items now enter Canada with minimal or no tariffs.

- Examples of goods now subject to near-zero tariffs: This includes a broad spectrum of consumer goods, agricultural products, and manufactured items. Specific examples will vary based on the detailed tariff schedule released by the Canadian government.

The table below illustrates the old versus new tariff rates for some key product categories:

| Product Category | Old Tariff Rate (%) | New Tariff Rate (%) |

|---|---|---|

| Certain Processed Foods | 10 | 0 |

| Some Machinery Parts | 5 | 0.5 |

| Specific Textiles | 8 | 2 |

| Certain Wood Products | 6 | 0 |

The impact of these reduced rates is expected to be significant, potentially leading to:

- Lower consumer prices in Canada: Reduced import costs should translate to lower prices for Canadian consumers on a variety of goods.

- Increased competitiveness for Canadian businesses: Lower input costs can improve the competitiveness of Canadian firms that rely on imported US goods.

Bullet Points:

- Specific examples of product categories with significantly reduced tariffs include: processed foods, automotive parts, and certain chemicals.

- The percentage reduction for major import categories ranges from 5% to 100%, depending on the specific product.

- The effective date of these tariff reductions was [Insert Date Here]. It is crucial to refer to the official government documentation for precise dates and details.

Key Exemptions and Their Significance

While the majority of goods see significant tariff reductions, some categories remain exempt from these reductions. These exemptions often stem from considerations of national security, strategic industries, or other policy objectives.

- Examples of exempted goods and services: These may include items related to national defense, sensitive technologies, or products subject to specific trade regulations.

The rationale behind these exemptions usually involves protecting domestic industries or addressing specific concerns. Analyzing the impact of these exemptions requires a nuanced approach:

- Impact on specific sectors: Certain sectors in both Canada and the US may experience shifts in competitiveness depending on the specific exemptions. For example, exemptions for certain agricultural products could impact Canadian farmers.

Bullet Points:

- List of key exempted goods and services will be available on the official government websites (links provided below).

- Reasons for each exemption will be explicitly stated in government publications. This information should be carefully studied by businesses potentially impacted.

- Potential implications of these exemptions on future trade negotiations are subject to ongoing developments and require further monitoring.

Economic Impacts and Future Implications of Reduced Tariffs

The reduced tariffs on US goods are expected to yield several significant economic benefits for both Canada and the US. The short-term effects are likely to be noticeable fairly quickly, while the long-term implications will unfold over time.

-

Short-term benefits: Increased trade volumes, lower prices for consumers, and a potential boost in economic activity are expected.

-

Long-term benefits: Strengthened trade relationships, increased investment, and sustained economic growth are among the potential long-term outcomes. Canadian businesses importing US goods stand to benefit significantly from reduced costs.

Bullet Points:

- Projected increase in bilateral trade volume is expected to be substantial, though precise figures will require further analysis.

- Potential impact on Canadian consumer spending could be positive, with increased purchasing power due to lower prices.

- Analysis of potential job creation in relevant sectors requires detailed economic modeling, but increased economic activity suggests potential job growth.

- The long-term implications for trade relations are positive, fostering greater cooperation and interdependence.

Navigating the New Tariff Landscape: Resources and Support

To help businesses understand and adapt to the changes brought about by Canada's new tariffs, it's important to utilize available resources and support. The Canadian government provides various channels for accessing detailed information and assistance.

Bullet Points:

- Links to official government websites: [Insert Links Here – e.g., links to relevant pages on the Government of Canada website dealing with tariffs and trade.]

- Suggestions for businesses seeking to optimize their import strategies: Businesses should review their supply chains, analyze the impact of reduced tariffs on their costs, and potentially adjust their sourcing strategies.

- Contact information for relevant government agencies: [Insert Contact Information Here – e.g., contact information for the relevant departments within the Canadian government responsible for trade.]

Conclusion: Understanding and Leveraging Canada's New Tariffs on US Goods

The significant reduction in Canada's tariffs on US goods presents a new landscape for bilateral trade. Near-zero rates on many products, coupled with specific exemptions, offer both opportunities and challenges for businesses and consumers. Understanding these changes is key to leveraging the potential economic benefits. This includes lower costs for Canadian consumers, increased competitiveness for Canadian businesses, and the potential for enhanced economic growth in both countries.

Take advantage of Canada's significantly reduced tariffs on US goods – explore the new landscape and optimize your import strategy today! Staying informed about Canada's reduced tariffs on US goods, and the new Canadian tariff rates, is essential for navigating this evolving trade environment and maximizing the opportunities presented by this new phase in Canada-US trade relations.

Featured Posts

-

Pga Championship Upset In Round One As Unlikely Leader Emerges

May 17, 2025

Pga Championship Upset In Round One As Unlikely Leader Emerges

May 17, 2025 -

Updated Injury Report Mariners Vs Athletics March 27 30

May 17, 2025

Updated Injury Report Mariners Vs Athletics March 27 30

May 17, 2025 -

Week 26 Recap 2024 25 High School Confidential

May 17, 2025

Week 26 Recap 2024 25 High School Confidential

May 17, 2025 -

Ftc Probe Into Open Ai Chat Gpts Future And Data Privacy Concerns

May 17, 2025

Ftc Probe Into Open Ai Chat Gpts Future And Data Privacy Concerns

May 17, 2025 -

Seattle Mariners Vs Detroit Tigers Injury Update And Series Prediction March 31 April 2

May 17, 2025

Seattle Mariners Vs Detroit Tigers Injury Update And Series Prediction March 31 April 2

May 17, 2025

Latest Posts

-

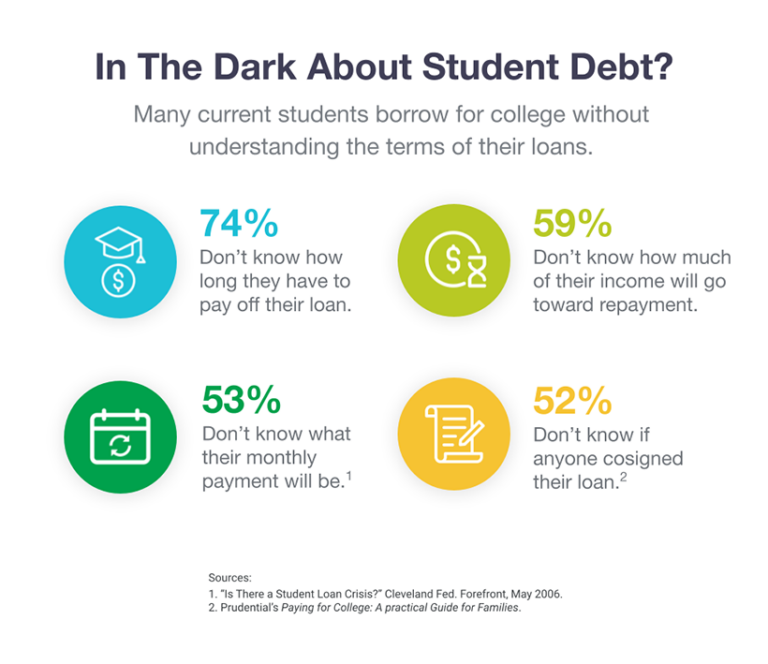

Refinance Federal Student Loans Weighing The Pros And Cons

May 17, 2025

Refinance Federal Student Loans Weighing The Pros And Cons

May 17, 2025 -

How Late Student Loan Payments Affect Your Financial Future

May 17, 2025

How Late Student Loan Payments Affect Your Financial Future

May 17, 2025 -

Buying A House Managing Student Loan Debt Effectively

May 17, 2025

Buying A House Managing Student Loan Debt Effectively

May 17, 2025 -

Should I Refinance My Federal Student Loans A Step By Step Analysis

May 17, 2025

Should I Refinance My Federal Student Loans A Step By Step Analysis

May 17, 2025 -

Student Loan Payment Problems Repairing Your Credit

May 17, 2025

Student Loan Payment Problems Repairing Your Credit

May 17, 2025