Canadian Private Investment: CAAT Pension Plan's Growth Strategy

Table of Contents

CAAT's Investment Philosophy and Risk Management

CAAT Pension Plan's success stems from a well-defined investment philosophy centered around prudent risk management and a diversified portfolio. This approach allows them to navigate market fluctuations while consistently delivering strong returns.

Diversification Strategy

CAAT employs a sophisticated diversification strategy across a range of asset classes to mitigate risk and optimize returns. This strategic asset allocation aims to balance potential gains with the inherent risks associated with each investment type.

- Public Equities: A core component of the portfolio, providing exposure to the broader market's performance.

- Private Equity: A significant allocation focused on long-term growth opportunities in promising Canadian companies. This provides diversification away from public market volatility.

- Real Estate: Investment in both direct property ownership and real estate investment trusts (REITs) offering stable income streams and potential capital appreciation.

- Infrastructure: Investing in essential infrastructure projects like transportation and utilities provides stable, long-term returns and contributes to the Canadian economy.

This diversified approach to asset allocation is crucial for risk mitigation in Canadian private markets, ensuring resilience against economic downturns.

Long-Term Investment Horizon

CAAT's long-term investment horizon is a cornerstone of its strategy. Unlike many investors focused on short-term gains, CAAT prioritizes patient capital, allowing investments to mature and deliver substantial returns over the long haul. This aligns perfectly with the nature of many private investment opportunities, which often require significant time for value creation.

- Investing in early-stage companies requiring several years to reach maturity.

- Long-term infrastructure projects with decades-long lifespans.

- Real estate holdings where appreciation occurs over many years.

This "endowment model" approach differentiates CAAT and contributes significantly to its success in Canadian private investment.

ESG Integration

CAAT is deeply committed to Environmental, Social, and Governance (ESG) factors, integrating them seamlessly into its investment decision-making process. This approach considers not only financial returns but also the broader societal and environmental impact of its investments.

- Prioritizing companies with strong ESG performance metrics.

- Investing in renewable energy projects and sustainable infrastructure.

- Engaging with portfolio companies to improve their ESG practices.

This commitment to responsible investing aligns with growing global trends in sustainable investing and impact investing, showcasing CAAT’s leadership in Canadian private markets.

Focus on Canadian Private Investment Opportunities

CAAT's commitment to Canadian private investment is a key driver of its success. The plan actively seeks opportunities across a range of sectors, capitalizing on the country's dynamic and growing private markets.

Private Equity Investments

CAAT has made significant investments in Canadian private equity firms, participating in various growth equity and venture capital deals. These investments often involve taking a stake in promising companies with high growth potential.

- Significant investments in technology companies poised for rapid expansion.

- Successful participation in leveraged buyouts of established businesses.

- Strategic partnerships with leading Canadian private equity managers.

This strategic approach to Canadian private equity has yielded impressive returns, showcasing the potential of this asset class.

Real Estate and Infrastructure

CAAT's real estate and infrastructure investments provide a stable foundation for its portfolio. These assets offer long-term income streams and resilience against market volatility.

- Investments in strategically located commercial real estate properties.

- Participation in large-scale infrastructure projects, including transportation and utilities.

- Focus on sustainable and environmentally responsible real estate and infrastructure developments.

This focus on Canadian real estate investment and infrastructure investment complements its private equity holdings, creating a well-balanced portfolio.

Venture Capital and Emerging Technologies

CAAT actively invests in Canadian venture capital and emerging technologies, recognizing the significant growth potential of innovative Canadian startups. This forward-looking strategy positions them to benefit from the next generation of disruptive technologies.

- Strategic partnerships with leading Canadian venture capital firms.

- Direct investments in promising startups across various sectors, including technology, healthcare, and clean energy.

- Active engagement with portfolio companies to support their growth and development.

This commitment to Canadian venture capital helps fuel innovation and economic growth within the country.

Performance and Future Outlook

CAAT’s investment performance consistently outperforms many benchmarks, a testament to its sound investment strategy.

Historical Performance Analysis

CAAT has demonstrated a strong track record of delivering consistent returns for its plan members. This success is attributed to its diversified portfolio, long-term focus, and active management approach.

- Consistently outperforming relevant benchmarks over various time horizons.

- Demonstrating strong risk-adjusted returns.

- Delivering stable and predictable returns for its plan members.

Future Investment Plans

CAAT anticipates continued growth in Canadian private investment, particularly in areas like technology, renewable energy, and sustainable infrastructure. The plan will continue to pursue opportunities that align with its investment philosophy and long-term goals.

- Increased allocation to technology-focused private equity investments.

- Expansion of investments in renewable energy projects and sustainable infrastructure.

- Exploration of new investment opportunities in emerging sectors within the Canadian economy.

Conclusion

CAAT Pension Plan's growth strategy, with its emphasis on Canadian private investment, exemplifies a successful approach to long-term value creation. Key takeaways include the importance of diversification, a long-term investment horizon, ESG integration, and a focus on the vibrant opportunities within Canadian private markets. This approach highlights the potential for substantial returns while contributing to the growth of the Canadian economy. Learn more about successful strategies in Canadian private investment by exploring CAAT's approach and discover how you can participate in the growth of the Canadian economy. Visit the CAAT website [insert link here] for more information.

Featured Posts

-

John Plassard Sur Usa Today Montee Des Depenses Militaires Face Aux Tensions Avec La Russie

Apr 23, 2025

John Plassard Sur Usa Today Montee Des Depenses Militaires Face Aux Tensions Avec La Russie

Apr 23, 2025 -

Erzurum Okullar Tatil Mi 24 Subat Son Dakika Okul Durumu Ve Valilik Aciklamasi

Apr 23, 2025

Erzurum Okullar Tatil Mi 24 Subat Son Dakika Okul Durumu Ve Valilik Aciklamasi

Apr 23, 2025 -

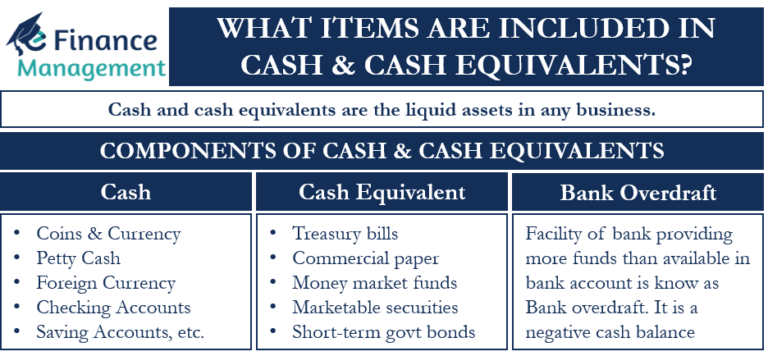

Gold Etfs And Cash Equivalents The Current Market Trend

Apr 23, 2025

Gold Etfs And Cash Equivalents The Current Market Trend

Apr 23, 2025 -

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

Apr 23, 2025

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

Apr 23, 2025 -

Bfm Bourse 17 Fevrier 15h 16h Decryptage Des Marches

Apr 23, 2025

Bfm Bourse 17 Fevrier 15h 16h Decryptage Des Marches

Apr 23, 2025

Latest Posts

-

Palantirs Path To A Trillion Dollar Market Cap A 2030 Projection

May 10, 2025

Palantirs Path To A Trillion Dollar Market Cap A 2030 Projection

May 10, 2025 -

Market Rally Shakes Up Palantir Stock New Analyst Forecasts

May 10, 2025

Market Rally Shakes Up Palantir Stock New Analyst Forecasts

May 10, 2025 -

Can Palantir Hit A Trillion Dollar Valuation By 2030

May 10, 2025

Can Palantir Hit A Trillion Dollar Valuation By 2030

May 10, 2025 -

Revised Palantir Stock Predictions Following Market Rally

May 10, 2025

Revised Palantir Stock Predictions Following Market Rally

May 10, 2025 -

Palantir Stock Price Surge Analysts Adjust Forecasts

May 10, 2025

Palantir Stock Price Surge Analysts Adjust Forecasts

May 10, 2025