China Approves Hengrui Pharma's Hong Kong Share Offering

Table of Contents

Details of Hengrui Pharma's Hong Kong Share Offering

Offering Size and Pricing

While the exact final figures may vary slightly, initial reports suggest a substantial offering size. The offering price per share and the total number of shares will be crucial factors determining the overall capital raised. Details regarding any over-allotment options, which allow underwriters to increase the offering size based on market demand, will also be closely watched. Official announcements from Hengrui Pharma and the involved underwriters will provide definitive details as the IPO proceeds.

Investment Highlights

This Hong Kong share offering presents a compelling investment opportunity for several key reasons:

- Strong Revenue Growth: Hengrui Pharma has demonstrated consistent and impressive revenue growth in recent years, indicating a healthy and expanding market share.

- Market Leadership: The company holds a leading position in several key therapeutic areas within the Chinese pharmaceutical market, providing a stable foundation for future growth.

- Promising Drug Pipeline: Hengrui Pharma boasts a robust pipeline of innovative drugs currently undergoing clinical trials, showcasing a commitment to research and development and the potential for future blockbuster medications.

- Experienced Management Team: The company benefits from a highly experienced and capable management team with a proven track record in the pharmaceutical industry.

Use of Proceeds

Hengrui Pharma intends to utilize the funds raised from the Hong Kong share offering strategically to fuel its continued growth and expansion. The planned allocation of funds includes:

- Investment in R&D: A significant portion will be dedicated to accelerating research and development efforts, furthering the development of innovative drugs and strengthening their competitive edge.

- Facility Upgrades and Expansion: Investments in state-of-the-art manufacturing facilities will enhance production capacity and efficiency.

- Strategic Acquisitions: The funds may be used to pursue strategic acquisitions of promising companies or technologies to further expand their product portfolio and market reach.

- Debt Reduction: A portion of the proceeds may be allocated to reduce existing debt, strengthening the company's overall financial health.

Impact on Hengrui Pharma

Enhanced Financial Position

The successful completion of the Hong Kong share offering will significantly bolster Hengrui Pharma's financial strength. The influx of capital will provide a solid foundation for long-term growth initiatives and reduce reliance on external financing.

Increased Global Visibility

Listing on the Hong Kong Stock Exchange will dramatically increase Hengrui Pharma's international visibility and attract the attention of global investors. This heightened profile will enhance the company's brand reputation and open doors to new collaborations and partnerships.

Access to Capital Markets

The Hong Kong listing grants Hengrui Pharma access to a deeper and more diverse pool of investors, facilitating easier access to future funding rounds as needed for continued expansion and innovation. This expanded access to capital markets is vital for long-term sustainable growth.

Impact on the Chinese Pharmaceutical Sector

Attracting Foreign Investment

The success of Hengrui Pharma's Hong Kong share offering is expected to serve as a catalyst for other Chinese pharmaceutical companies considering similar listings. This will attract significant foreign investment, boosting the overall growth and development of the sector.

Strengthening Market Confidence

The successful IPO demonstrates confidence in the growth potential of China's pharmaceutical industry, signaling a positive outlook for the sector's future and attracting further investment.

Boosting Innovation

Increased access to capital through international listings can stimulate innovation and accelerate drug development within the Chinese pharmaceutical industry, leading to the creation of new and improved treatments for a range of diseases.

Conclusion

Hengrui Pharma's approved Hong Kong share offering marks a pivotal moment for the company and a significant development for the Chinese pharmaceutical sector. The offering promises to substantially improve Hengrui Pharma's financial position, enhance its global visibility, and provide access to a broader pool of investors. This success story is likely to encourage other Chinese pharmaceutical companies to pursue similar listings, boosting foreign investment and fostering innovation within the sector. The impact on the Hong Kong stock market is also anticipated to be substantial.

Call to Action: Stay informed about future developments in the Chinese pharmaceutical market and consider exploring investment opportunities arising from the success of the Hengrui Pharma Hong Kong share offering. For more information, consult reputable financial news sources and visit Hengrui Pharma's investor relations page.

Featured Posts

-

You Tube A New Home For Older Viewers Favorite Tv Shows

Apr 29, 2025

You Tube A New Home For Older Viewers Favorite Tv Shows

Apr 29, 2025 -

Nba Disciplines Anthony Edwards With 50 K Fine For Inappropriate Conduct

Apr 29, 2025

Nba Disciplines Anthony Edwards With 50 K Fine For Inappropriate Conduct

Apr 29, 2025 -

The Becciu Case A Deeper Look At Allegations Of Unfair Proceedings

Apr 29, 2025

The Becciu Case A Deeper Look At Allegations Of Unfair Proceedings

Apr 29, 2025 -

Brazil Game Confirmed Justin Herbert Leads Chargers In 2025 Opener

Apr 29, 2025

Brazil Game Confirmed Justin Herbert Leads Chargers In 2025 Opener

Apr 29, 2025 -

160km Mlb

Apr 29, 2025

160km Mlb

Apr 29, 2025

Latest Posts

-

Trump Tariffs A New York Courts Crucial Decision

May 12, 2025

Trump Tariffs A New York Courts Crucial Decision

May 12, 2025 -

Russ Voughts New Role Shaping The Dogecoin Agenda

May 12, 2025

Russ Voughts New Role Shaping The Dogecoin Agenda

May 12, 2025 -

New York Court To Decide Fate Of Trumps Tariffs

May 12, 2025

New York Court To Decide Fate Of Trumps Tariffs

May 12, 2025 -

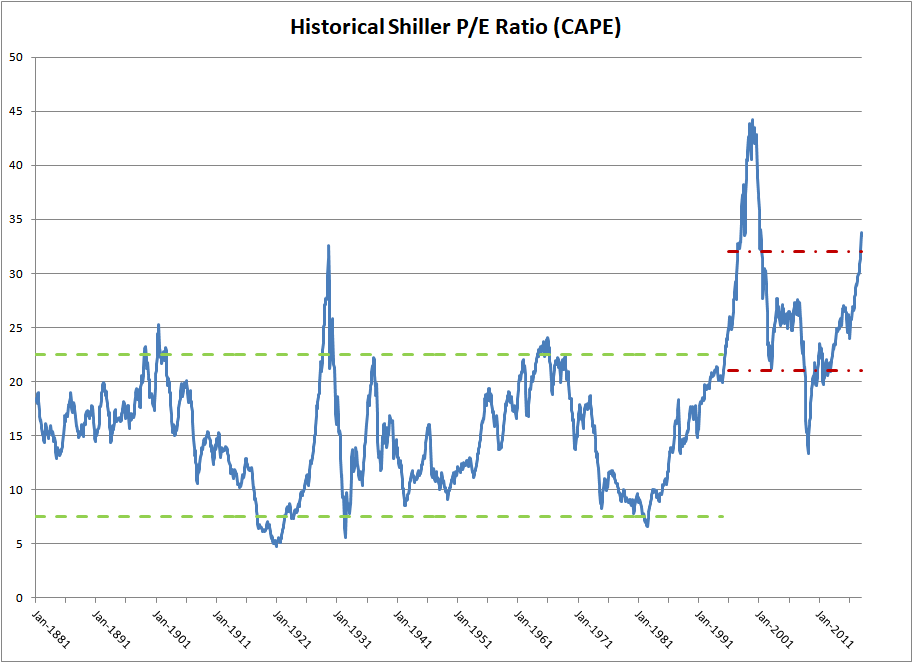

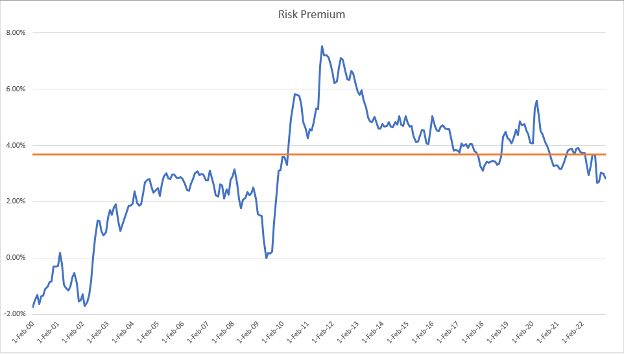

Elevated Stock Market Valuations Why Bof A Remains Confident

May 12, 2025

Elevated Stock Market Valuations Why Bof A Remains Confident

May 12, 2025 -

High Stock Valuations Bof As View And Investor Implications

May 12, 2025

High Stock Valuations Bof As View And Investor Implications

May 12, 2025