D-Wave Quantum (QBTS) Stock Plunge: Understanding Monday's Decline

Table of Contents

Market-Wide Factors Influencing QBTS Stock

Several macroeconomic factors contributed to the overall market downturn, impacting even specialized sectors like quantum computing. Understanding these broader trends is crucial to interpreting the QBTS stock plunge.

Overall Tech Stock Performance

The broader tech sector experienced a downturn on Monday, impacting numerous stocks, including QBTS. This negative sentiment spilled over into specialized areas like quantum computing.

- NASDAQ Decline: The NASDAQ Composite, a key indicator of technology stock performance, experienced a significant percentage drop on Monday (insert percentage data if available). This overall market weakness significantly affected investor confidence in growth stocks like QBTS.

- Negative Market Sentiment: General investor risk aversion and negative sentiment towards the tech sector played a major role. Concerns about inflation, interest rate hikes, and geopolitical instability contributed to this pessimistic outlook.

- Investor Flight to Safety: Investors often shift from riskier investments, like growth stocks in the quantum computing sector, to safer options like government bonds during periods of economic uncertainty. This shift away from risk likely contributed to the QBTS stock decline.

This negative sentiment towards the tech sector as a whole created a ripple effect, impacting even promising companies like D-Wave Quantum.

Interest Rate Hikes and Inflation

Persistent inflation and subsequent interest rate hikes by central banks worldwide significantly impact investor confidence in growth stocks.

- Higher Discount Rates: Rising interest rates increase the discount rate used to value future cash flows. This makes high-growth companies, which often rely on future earnings projections, appear less attractive to investors.

- Reduced Investor Appetite for Risk: Higher interest rates make safer, fixed-income investments more appealing, reducing investor appetite for riskier growth stocks like QBTS.

- Valuation Adjustments: The increased discount rate necessitates adjustments to valuations, potentially leading to a downward revision of the perceived value of QBTS.

D-Wave Quantum (QBTS) Specific News and Developments

Beyond the broader market forces, several company-specific factors may have contributed to the QBTS stock plunge.

Absence of Positive News or Catalysts

The lack of positive news or significant developments in the lead-up to Monday's decline might have fueled negative speculation.

- Recent Earnings Reports: Analyze the latest earnings report (if available) for any indications of underperformance or missed expectations. Lackluster financial results can negatively impact investor confidence.

- Partnership Announcements: Were there any anticipated partnerships or collaborations that failed to materialize, leading to disappointment among investors?

- Product Launches or Milestones: The absence of significant product announcements or the achievement of key milestones could contribute to the negative sentiment surrounding QBTS. Market expectations play a crucial role here, and a lack of positive news can easily lead to selling pressure.

The absence of positive catalysts created a vacuum that was quickly filled with negative speculation.

Potential Negative Press or Analyst Downgrades

Negative press coverage or analyst downgrades can significantly impact investor sentiment and trigger sell-offs.

- Negative News Articles: Were there any negative news stories released prior to Monday's decline? This could include articles questioning the company's technology, financial stability, or future prospects. Identifying the source and analyzing the content of such articles is essential.

- Analyst Ratings: Did any prominent investment firms downgrade their rating for QBTS stock? Analyst opinions can significantly influence investor behavior. Identifying these downgrades and their justifications can provide valuable context.

- Social Media Sentiment: Negative sentiment expressed on social media platforms might also have played a role, amplifying the existing negative news and accelerating the stock price decline.

Negative press, if any, acted as a catalyst, exacerbating the already present negative market sentiment.

Technical Analysis of QBTS Chart Patterns

Technical analysis of QBTS chart patterns might have offered additional insight into the decline.

- Support and Resistance Levels: Did the stock price break through significant support levels, indicating a potential trend reversal?

- Trading Volume: Was there a significant increase in trading volume on Monday, suggesting a high level of selling pressure?

- Technical Indicators: Did technical indicators like moving averages or Relative Strength Index (RSI) signal an impending decline?

Technical indicators often provide early warning signs of potential price movements, enabling investors to make informed decisions.

Conclusion

The D-Wave Quantum (QBTS) stock plunge on Monday resulted from a confluence of factors. The broader tech market downturn, fueled by concerns about inflation and rising interest rates, created a negative environment for growth stocks. Simultaneously, the absence of positive company-specific news and possibly the presence of negative press or analyst downgrades amplified the sell-off. Analyzing QBTS's chart patterns provided further context.

While Monday's decline in D-Wave Quantum (QBTS) stock was significant, understanding these underlying factors allows investors to make informed decisions. Continue to monitor QBTS stock performance closely, analyze future news releases, and remain informed about the broader quantum computing market and economic trends to navigate the inherent volatility in QBTS and other quantum computing investments. Stay updated on D-Wave Quantum (QBTS) news and developments to make informed decisions about your investment strategy.

Featured Posts

-

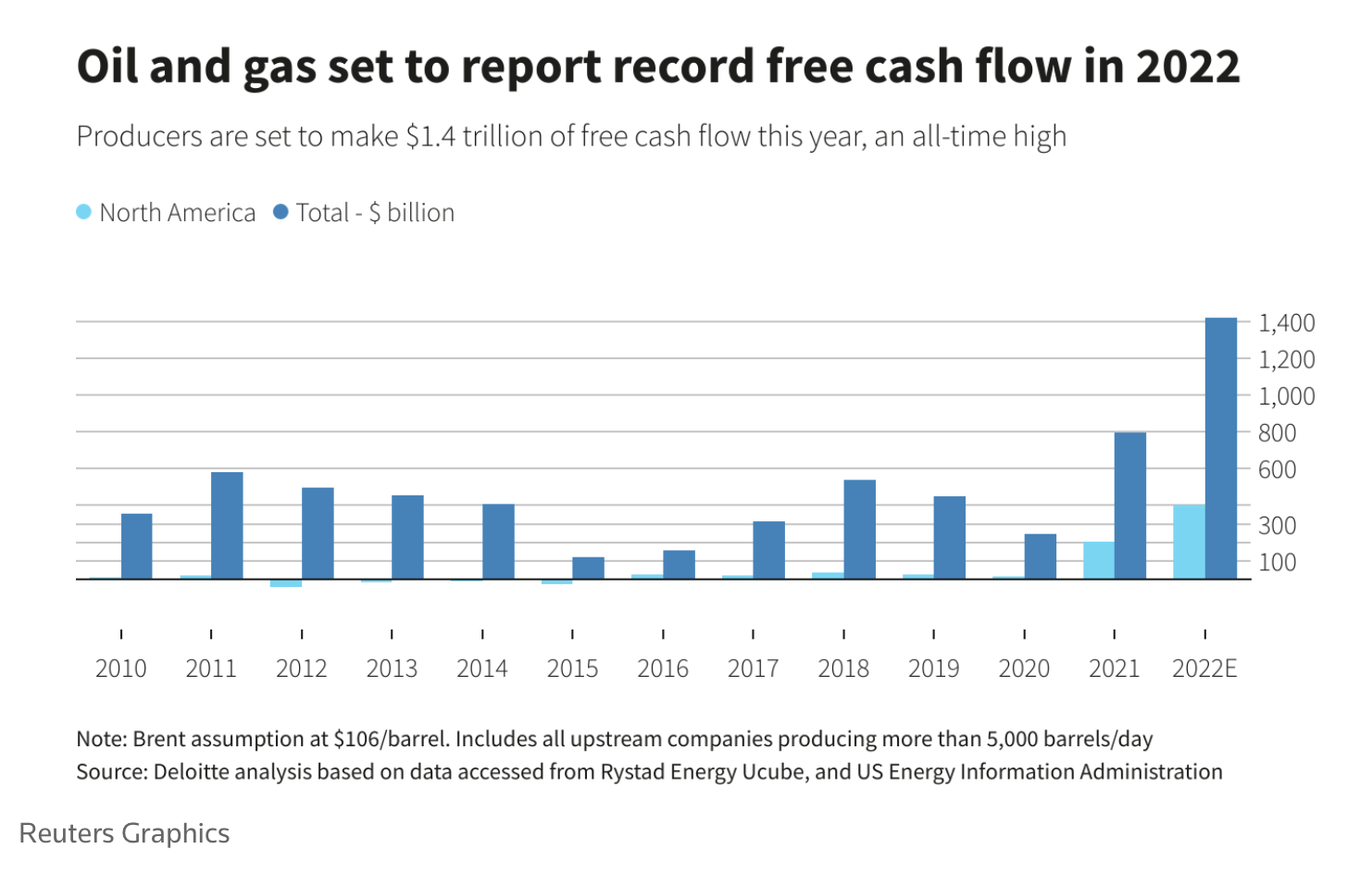

Representatives Push For 1 231 Billion In Oil Company Repayments

May 20, 2025

Representatives Push For 1 231 Billion In Oil Company Repayments

May 20, 2025 -

New Ai Powered Writing Course Agatha Christie Style Bbc

May 20, 2025

New Ai Powered Writing Course Agatha Christie Style Bbc

May 20, 2025 -

April 18 2025 Nyt Mini Crossword Puzzle Answers And Hints

May 20, 2025

April 18 2025 Nyt Mini Crossword Puzzle Answers And Hints

May 20, 2025 -

Sasols 2023 Strategy Update What Investors Need To Know

May 20, 2025

Sasols 2023 Strategy Update What Investors Need To Know

May 20, 2025 -

Jennifer Lawrence Expands Her Family With Second Child

May 20, 2025

Jennifer Lawrence Expands Her Family With Second Child

May 20, 2025

Latest Posts

-

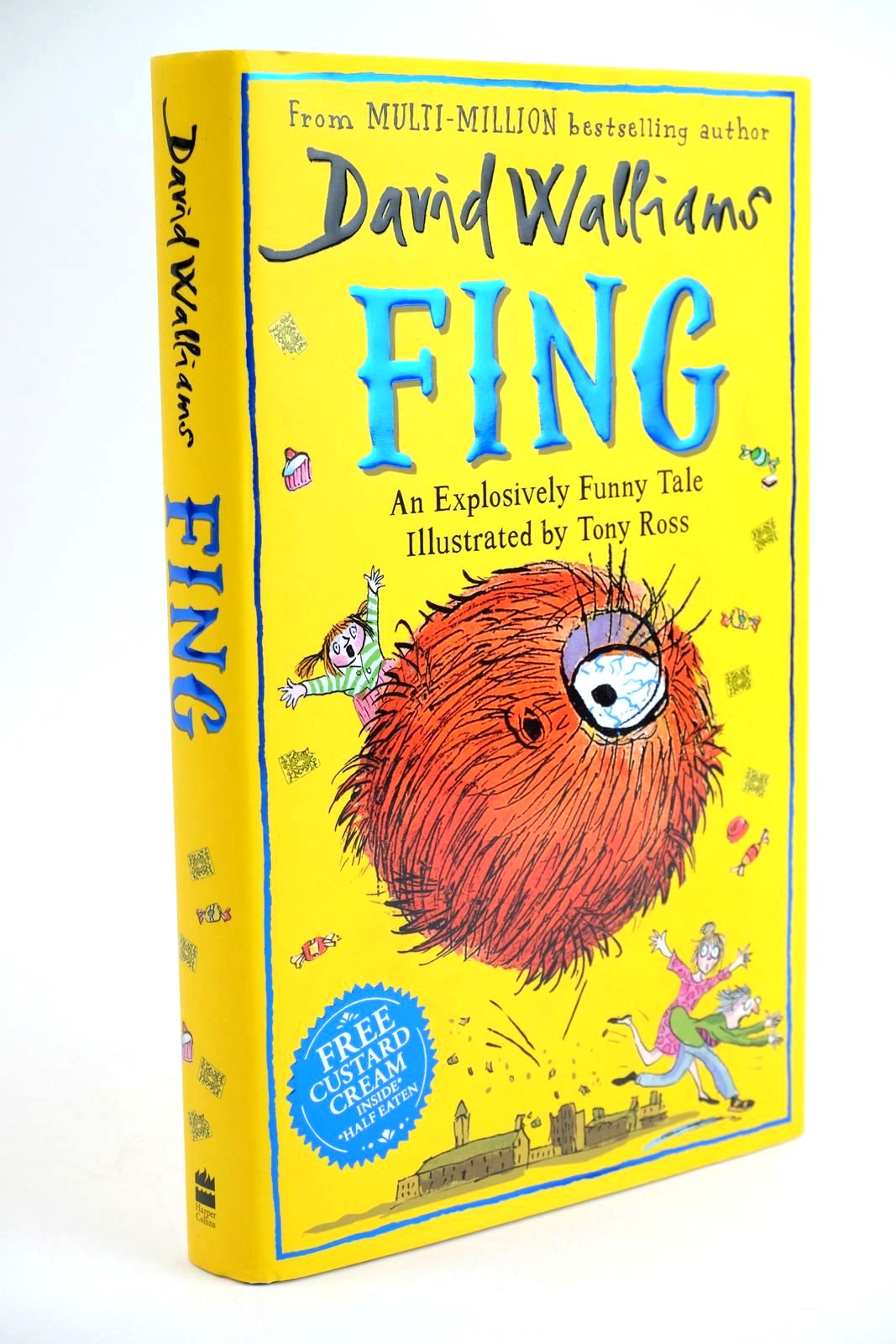

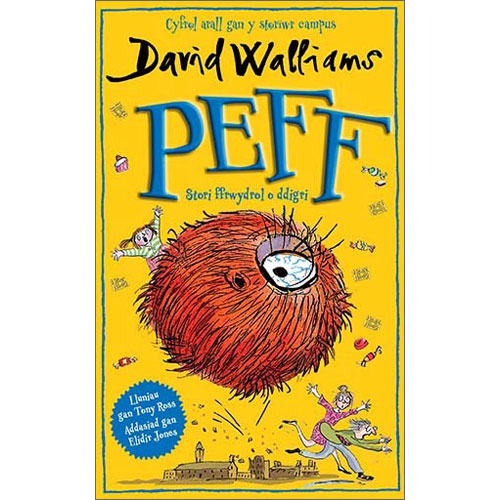

David Walliams Fing The Fantasy Film Greenlit By Stan

May 21, 2025

David Walliams Fing The Fantasy Film Greenlit By Stan

May 21, 2025 -

Everything You Need To Know About Sandylands U On Tv

May 21, 2025

Everything You Need To Know About Sandylands U On Tv

May 21, 2025 -

Fing A Look At David Walliams New Fantasy Project Greenlit By Stan

May 21, 2025

Fing A Look At David Walliams New Fantasy Project Greenlit By Stan

May 21, 2025 -

Sandylands U Full Episode Guide And Air Dates

May 21, 2025

Sandylands U Full Episode Guide And Air Dates

May 21, 2025 -

David Walliams Fing Stans Greenlight And Production Details

May 21, 2025

David Walliams Fing Stans Greenlight And Production Details

May 21, 2025