Dollar Weakness And Dow Futures Fall Following Moody's Action

Table of Contents

Moody's Downgrade and its Implications

The Specifics of Moody's Rating Action

Moody's recent downgrade reflects growing concerns about the US government's fiscal strength and increasing debt levels. The specific details of the downgrade, including the affected entities and the reasoning behind the decision, are crucial for understanding the market reaction.

- Downgrade details: [Insert specific details of the downgrade from Moody's report, e.g., from AAA to AA1, mention the specific rating affected].

- Affected entities: [Specify which US government bonds or debt instruments are directly affected by the downgrade].

- Reasoning: [Summarize the key reasons cited by Moody's for the downgrade, e.g., rising debt ceiling concerns, political gridlock hindering fiscal reforms].

[Insert links to relevant Moody's reports and news articles here]. This action follows a pattern of similar downgrades in the past [mention historical context, cite examples and their market impact]. For example, the [Previous Downgrade Example] resulted in [Specific Market Reaction]. Understanding this historical context provides valuable insight into the potential impact of the current downgrade.

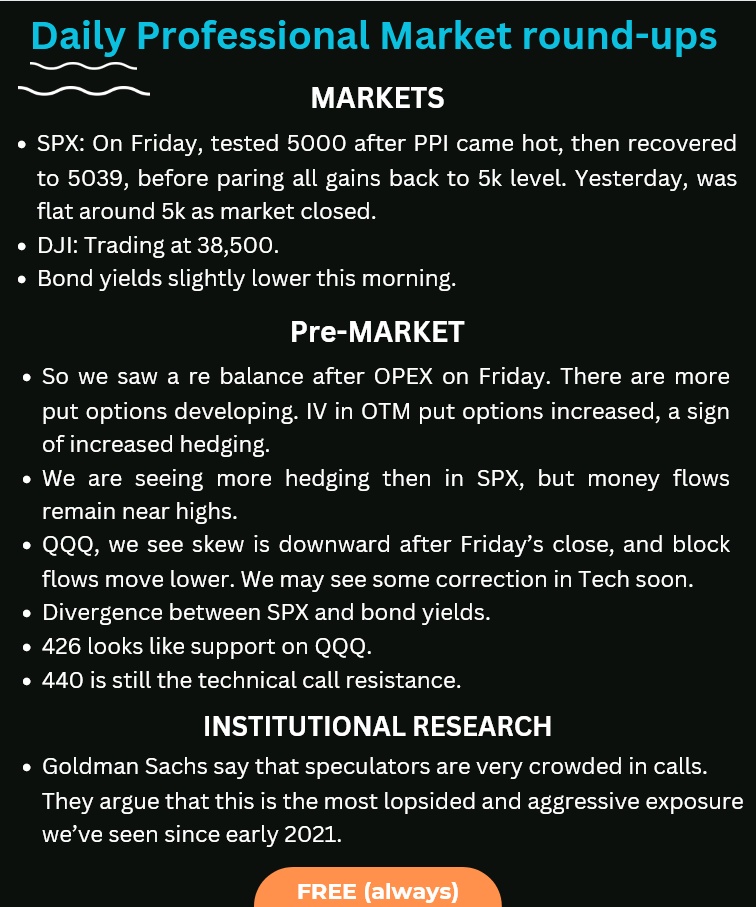

Immediate Market Reactions to the Downgrade

The immediate response to Moody's downgrade was swift and significant. Investors reacted with a wave of uncertainty, leading to increased volatility across multiple asset classes.

- Increased Volatility: Currency markets witnessed sharp fluctuations, with the US dollar experiencing a noticeable weakening against major currencies like the Euro and Yen.

- Flight to Safety: Investors sought refuge in safe-haven assets, such as gold and government bonds from countries with strong credit ratings.

- Decline in Stock Futures: Dow futures experienced a significant drop, reflecting concerns about the broader economic impact of the downgrade.

Dollar Weakness: Causes and Consequences

The Correlation between Moody's Action and Dollar Decline

The Moody's downgrade directly contributed to the weakening of the dollar through several mechanisms:

- Decreased Investor Confidence: The downgrade eroded investor confidence in the US economy and its ability to manage its debt, leading to reduced demand for US dollar-denominated assets.

- Capital Flight: Investors may shift their investments away from US assets, further weakening the dollar.

- Reduced Foreign Investment: Foreign investors may be less inclined to invest in the US, contributing to a lower demand for the dollar.

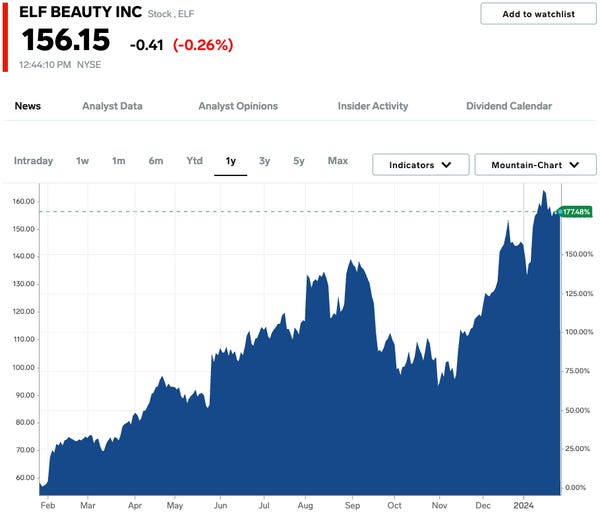

[Insert a chart or graph illustrating the dollar's decline against other major currencies since the Moody's announcement]. This dollar weakness can significantly impact the US economy, affecting both exports and imports. For example, weaker dollar makes US exports more competitive but increases the cost of imported goods.

Impact of Dollar Weakness on Other Markets

The weakening dollar has ripple effects across global markets:

- Emerging Markets: Emerging markets heavily reliant on dollar-denominated debt may face increased borrowing costs and financial instability.

- Inflationary Pressures: A weaker dollar can lead to increased import prices, potentially fueling inflationary pressures within the US.

- Global Trade Imbalances: Changes in exchange rates can exacerbate existing trade imbalances between countries.

Dow Futures Fall: Analyzing the Connection

The Relationship Between Dollar Weakness and Dow Futures

The decline in Dow futures is directly linked to the dollar's weakness:

- Investor Sentiment: A weaker dollar often signals decreased confidence in the US economy, negatively impacting investor sentiment towards US stocks.

- Global Market Interdependence: Global markets are interconnected. Dollar weakness reflects broader global economic uncertainty, influencing the Dow's performance.

- Foreign Investment: A weaker dollar can reduce foreign investment in US companies, putting downward pressure on stock prices.

Potential Future Impacts on the Dow

The continued impact of dollar weakness on the Dow remains uncertain, with several possible scenarios:

- Further Decline: If dollar weakness persists or worsens, it could lead to a sustained decline in Dow futures.

- Mitigating Factors: Positive economic data or policy changes could potentially mitigate the negative impact of dollar weakness on the Dow.

- Counter-Trends: Other global events or market forces could influence the Dow's trajectory independent of the dollar's movement.

Conclusion

Moody's downgrade, the subsequent dollar weakness, and the fall in Dow futures are interconnected events reflecting underlying concerns about the US economy. The interplay between these factors highlights the vulnerability of global markets to shifts in investor confidence and government fiscal policy. This situation warrants close monitoring, as the long-term implications for both the US and the global economy remain to be seen.

Stay informed about the evolving situation and its impact on your investments by following reputable financial news sources and monitoring the interplay between dollar weakness and Dow futures. Understanding the dynamics between these factors is crucial for navigating the current market uncertainty.

Featured Posts

-

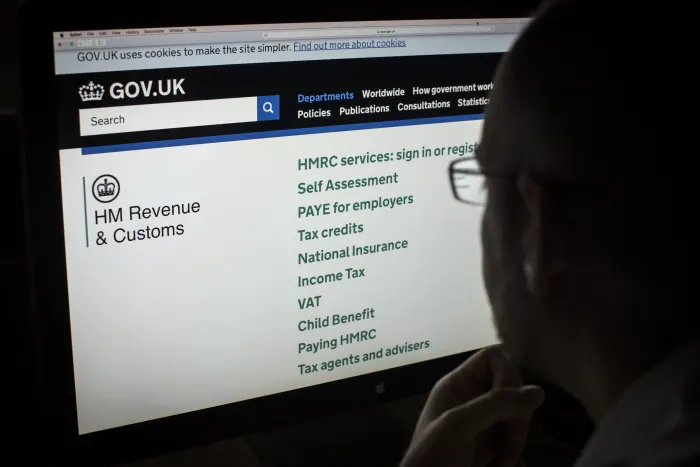

Uk Taxpayers Affected By Hmrc Website Outage

May 20, 2025

Uk Taxpayers Affected By Hmrc Website Outage

May 20, 2025 -

Pandemic Fraud Lab Owner Admits To Falsifying Covid Test Results

May 20, 2025

Pandemic Fraud Lab Owner Admits To Falsifying Covid Test Results

May 20, 2025 -

Status Dedushki Mikhael Shumakher

May 20, 2025

Status Dedushki Mikhael Shumakher

May 20, 2025 -

Bribery Charges Against Four Star Admiral Highlight Navys Cultural Challenges

May 20, 2025

Bribery Charges Against Four Star Admiral Highlight Navys Cultural Challenges

May 20, 2025 -

Find The Answers Nyt Mini Crossword April 25th

May 20, 2025

Find The Answers Nyt Mini Crossword April 25th

May 20, 2025

Latest Posts

-

D Wave Quantum Qbts Stock Crash Understanding Mondays Decline

May 20, 2025

D Wave Quantum Qbts Stock Crash Understanding Mondays Decline

May 20, 2025 -

Analyzing Qbts Stock Performance Before And After Earnings

May 20, 2025

Analyzing Qbts Stock Performance Before And After Earnings

May 20, 2025 -

How Will The Next Qbts Earnings Report Affect The Stock Price

May 20, 2025

How Will The Next Qbts Earnings Report Affect The Stock Price

May 20, 2025 -

Qbts Stock Predicting The Earnings Report Impact

May 20, 2025

Qbts Stock Predicting The Earnings Report Impact

May 20, 2025 -

Wayne Gretzkys Legacy The Controversy Surrounding His Trump Relationship

May 20, 2025

Wayne Gretzkys Legacy The Controversy Surrounding His Trump Relationship

May 20, 2025