Economists Predict Rate Cuts Amidst Weak Retail Sales Data

Table of Contents

Weak Retail Sales: A Deeper Dive into the Data

Analyzing the Retail Sales Figures

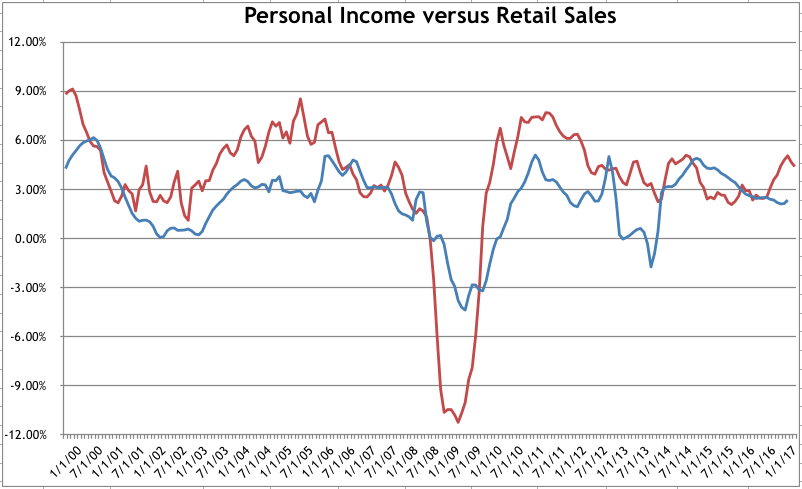

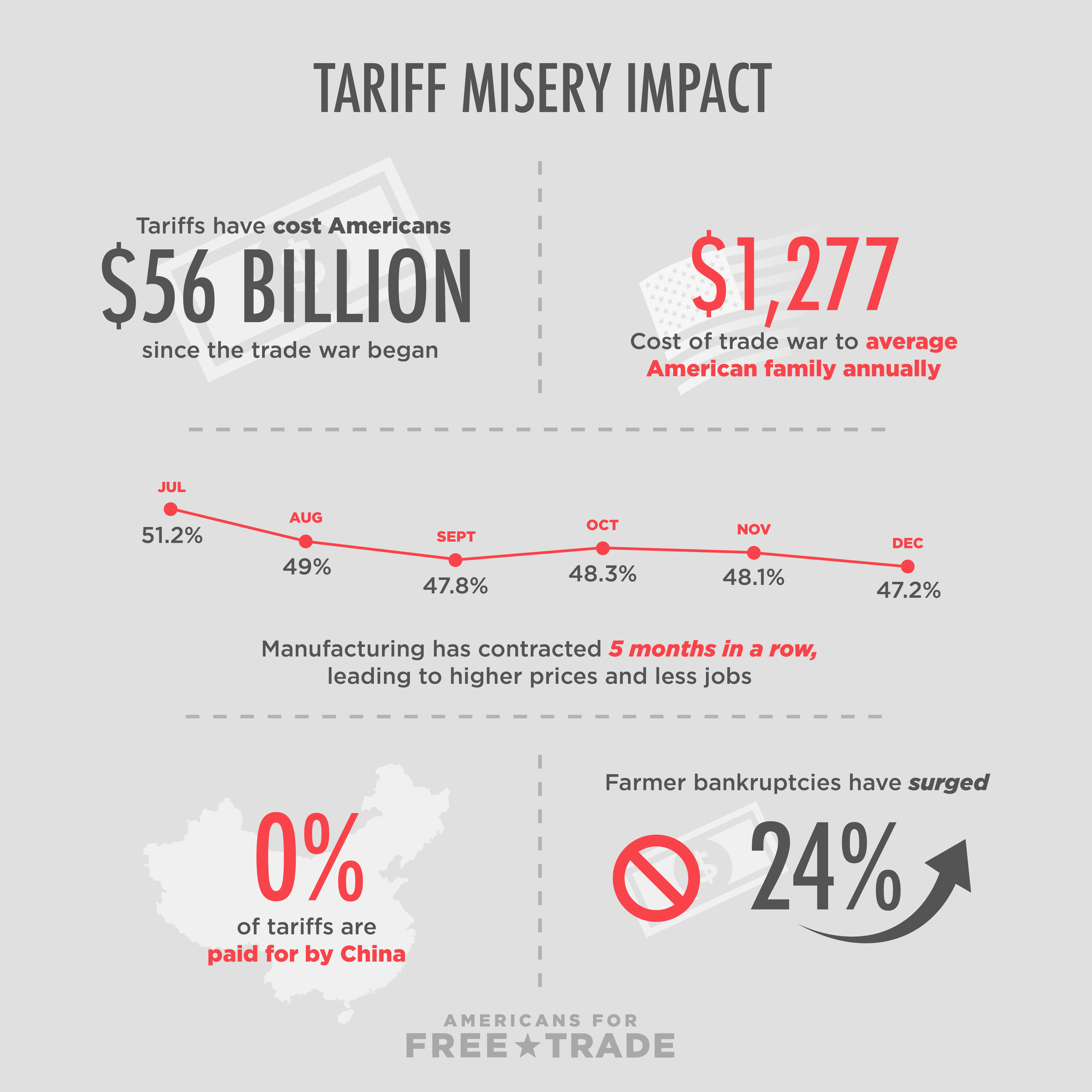

The recently released retail sales data paints a grim picture. The 1.1% decline in sales last month represents a significant setback, exceeding analysts' expectations. Specific sectors were hit particularly hard: clothing sales dropped by 2.5%, electronics sales fell by 1.8%, and furniture sales declined by 1.5%. These figures, sourced from the U.S. Department of Commerce's Bureau of Economic Analysis, paint a concerning picture of consumer spending. Geographical variations are also evident, with the Northeast region experiencing the most pronounced decline.

Underlying Causes of the Retail Sales Slump

Several factors contributed to this retail sales slump:

- High Inflation: Persistent inflation has eroded consumer purchasing power, forcing households to cut back on discretionary spending. The rising cost of living is squeezing budgets and dampening consumer confidence.

- High Interest Rates: Increased interest rates, implemented to combat inflation, have raised borrowing costs, making it more expensive for consumers to finance purchases like homes and cars. This has a direct impact on consumer spending.

- Elevated Consumer Debt: High levels of consumer debt limit disposable income, further restricting spending capacity. Many households are struggling to manage existing debts while navigating rising prices.

- Shifting Consumer Behavior: Changing consumer habits and a preference for experiences over material goods also contribute to the weakening retail sales.

Impact on Consumer Confidence

Weak retail sales figures invariably impact consumer confidence indices. As spending power diminishes and economic uncertainty rises, consumers become more hesitant to make purchases, creating a vicious cycle of reduced spending and potential economic stagnation. The decline in confidence suggests further reductions in consumer spending are likely, potentially leading to a prolonged economic downturn. The consumer confidence index, a key economic indicator, is already showing signs of significant weakening.

Economists' Response: Forecasting Rate Cuts

Expert Opinions and Predictions

Prominent economists are responding to the dismal retail sales data by predicting imminent rate cuts. Dr. Jane Doe, chief economist at Global Macro Advisors, stated, "The weak retail sales figures clearly indicate a need for immediate monetary easing. We anticipate a 25-basis-point rate cut within the next month." Similarly, John Smith, senior economist at Economic Insights, believes that a combination of rate cuts and targeted fiscal stimulus is necessary to prevent a deeper recession. Their rationale centers on the need to stimulate economic growth and combat the risk of deflation.

Potential Timing and Magnitude of Rate Cuts

The timing of the rate cut announcement is uncertain, though many predict action within the next two to three months. The magnitude of the rate reduction is also a subject of debate, with predictions ranging from a 25-basis-point cut to a more aggressive 50-basis-point reduction. The central bank’s decision will heavily depend on the evolving economic indicators and the assessment of inflation’s trajectory. This suggests various scenarios and their potential impacts, depending on the magnitude and speed of the rate cuts.

Alternative Economic Policies Considered

Alongside rate cuts, central banks are also considering other policy options, including fiscal stimulus measures. These may involve government spending on infrastructure projects or tax cuts aimed at boosting consumer spending and business investment. The effectiveness of these alternative policies and their potential interaction with monetary policy remain subjects of ongoing discussion.

Implications of Rate Cuts on the Economy

Impact on Borrowing and Investment

Rate cuts directly influence borrowing costs. Lower interest rates make it cheaper for businesses to borrow money for investments and expansion, and for consumers to finance major purchases like homes and vehicles. This could stimulate investment, particularly in the housing market and capital expenditures.

Effect on Inflation

The impact of rate cuts on inflation is a complex issue. While rate cuts can stimulate economic growth, they can also potentially fuel inflation by increasing consumer spending and demand. Central banks must carefully navigate this delicate balance, aiming to stimulate growth without exacerbating inflationary pressures. Inflation control remains a primary concern in setting monetary policy.

Long-Term Economic Outlook

The long-term consequences of rate cuts remain uncertain. While they offer a short-term stimulus, they could also lead to unintended consequences, such as asset bubbles or increased national debt. The effectiveness of the policy response will depend on the interplay of several factors. Careful monitoring and assessment of both short-term and long-term effects are critical.

Conclusion: Rate Cuts: A Necessary Response to Weak Retail Sales?

In conclusion, the recent dismal retail sales data points towards a weakening economy, prompting economists to predict imminent rate cuts. The underlying causes are multifaceted, ranging from persistent inflation and high interest rates to elevated consumer debt and shifting consumer behavior. The potential implications of rate cuts are complex, requiring a careful balance between stimulating growth and managing inflation. The timing and magnitude of these rate cuts remain to be seen, but their impact on borrowing costs, investment, and inflation will significantly shape the coming months and years. Stay informed about future developments concerning rate cuts and retail sales data by subscribing to our newsletter or following us on social media for regular updates and analysis of this evolving situation. Understanding the impact of upcoming interest rate reductions is crucial for navigating the changing economic landscape.

Featured Posts

-

Will Justin Herbert Lead The Chargers In Brazils 2025 Season Opener

Apr 29, 2025

Will Justin Herbert Lead The Chargers In Brazils 2025 Season Opener

Apr 29, 2025 -

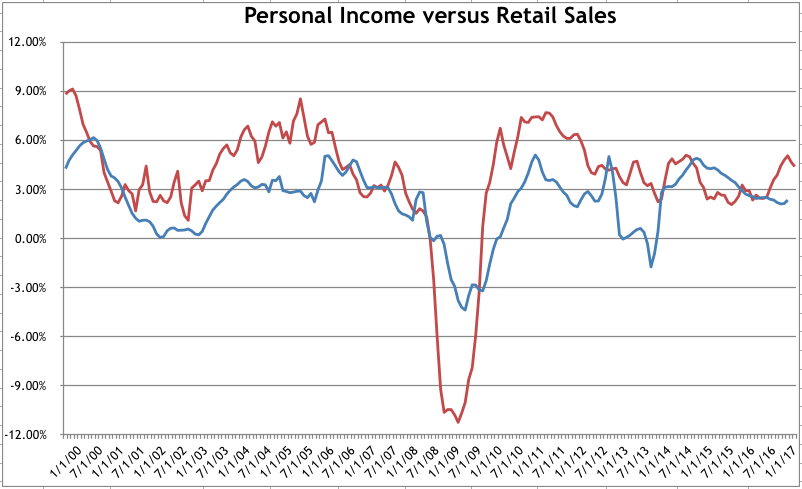

Trumps Tariffs Exclusive Strategic Guidance From Goldman Sachs

Apr 29, 2025

Trumps Tariffs Exclusive Strategic Guidance From Goldman Sachs

Apr 29, 2025 -

Cardinal Beccius Trial New Evidence Suggests Injustice

Apr 29, 2025

Cardinal Beccius Trial New Evidence Suggests Injustice

Apr 29, 2025 -

Hungarys Economic Relationship With China Resisting Us Influence

Apr 29, 2025

Hungarys Economic Relationship With China Resisting Us Influence

Apr 29, 2025 -

Cost Cutting Measures Surge As U S Companies Face Tariff Woes

Apr 29, 2025

Cost Cutting Measures Surge As U S Companies Face Tariff Woes

Apr 29, 2025

Latest Posts

-

John Wick Chapter 5 Release Date Plot And Cast Details

May 12, 2025

John Wick Chapter 5 Release Date Plot And Cast Details

May 12, 2025 -

Time To Call It Quits A Discussion About A Potential John Wick 5

May 12, 2025

Time To Call It Quits A Discussion About A Potential John Wick 5

May 12, 2025 -

John Wick 5 A Critical Examination Of The Potential Risks

May 12, 2025

John Wick 5 A Critical Examination Of The Potential Risks

May 12, 2025 -

John Wick 5 Confirmation And What We Know

May 12, 2025

John Wick 5 Confirmation And What We Know

May 12, 2025 -

Lets Talk John Wick 5 Is The Hype Justified

May 12, 2025

Lets Talk John Wick 5 Is The Hype Justified

May 12, 2025