Extreme Price Increase: Broadcom's VMware Acquisition Faces AT&T Backlash

Table of Contents

AT&T's Concerns Regarding Increased Prices and Reduced Competition

AT&T's objections to the Broadcom-VMware acquisition stem primarily from concerns about a substantial price increase for essential networking equipment and services. AT&T argues that Broadcom, with its already significant market share, will leverage the VMware acquisition to further consolidate its power, leading to less competition and ultimately higher prices for its customers. This would negatively impact AT&T's business and its ability to offer competitive telecommunications services.

- Increased prices for essential networking hardware and software: Broadcom's control over critical networking technologies post-acquisition could allow them to dictate prices, squeezing margins for telecommunications providers like AT&T and ultimately impacting consumers.

- Reduced competition leading to less innovation and choice for customers: A less competitive market reduces the incentive for innovation, potentially leading to stagnant technology and limited choices for consumers. AT&T argues that this merger will stifle innovation within the networking sector.

- Potential harm to AT&T's business and its ability to compete effectively: The resulting price increases could severely hamper AT&T's ability to offer competitive pricing plans, impacting its market share and overall profitability.

- Loss of competitive pricing options for telecommunications providers: The acquisition eliminates a significant competitor, limiting the options available to telecommunications companies for obtaining crucial networking equipment and services at competitive prices.

Broadcom's Response and Arguments in Favor of the Acquisition

Broadcom counters AT&T's claims by emphasizing the potential synergies between the two companies and the resulting benefits for consumers and the broader market. They argue that the merger will lead to improved efficiency, cost savings, and ultimately enhanced innovation.

- Broadcom's claims of improved efficiency and cost savings: Broadcom asserts that combining operations will streamline processes, leading to significant cost savings that could eventually translate into lower prices for consumers.

- Arguments for enhanced innovation through combined technologies: Broadcom suggests that integrating VMware's software expertise with its hardware capabilities will drive innovation, leading to more advanced and efficient networking solutions.

- Broadcom's projected benefits for consumers (if any): Broadcom has pointed to potential long-term benefits for consumers, such as improved performance and more integrated solutions, though specifics remain largely undefined.

- Potential for job creation or investment: While not explicitly emphasized, Broadcom may argue that the merger will stimulate economic growth through job creation or increased investment in research and development.

Regulatory Scrutiny and Potential Antitrust Implications

Given the significant size of the deal and the potential for anti-competitive practices, the Broadcom-VMware acquisition faces intense regulatory scrutiny from bodies like the FTC (Federal Trade Commission) in the US and the EU Commission in Europe. These organizations will investigate whether the merger will substantially lessen competition, potentially leading to a block or mandated modifications to the acquisition.

- Potential antitrust investigations by regulatory bodies: Both the FTC and the EU Commission are likely to conduct thorough antitrust reviews to assess the deal's impact on competition.

- The likelihood of the acquisition being blocked or modified: Depending on the findings of the investigations, there's a significant chance that the acquisition could be blocked entirely or forced to include remedies to mitigate anti-competitive concerns.

- The precedent set by previous mega-mergers and antitrust cases: Previous mega-mergers and antitrust cases will serve as precedent, informing the regulatory bodies' decision-making process.

- The impact of public opinion and lobbying efforts on the regulatory process: Public opinion, lobbying efforts from affected parties like AT&T, and the broader political climate will also play a role in shaping the regulatory outcome.

The Impact on Consumers and the Broader Tech Industry

The Broadcom-VMware acquisition has far-reaching implications for consumers and the tech industry as a whole. Higher prices, reduced innovation, and increased market consolidation are all significant concerns.

- Potential long-term effects on pricing for businesses and consumers: The merger could lead to higher prices for networking hardware, software, and services for businesses and consumers alike.

- Impact on innovation and the development of new technologies: Reduced competition may stifle innovation, leading to slower development of new technologies and a less dynamic market.

- Changes in the competitive landscape of the networking industry: The acquisition will significantly alter the competitive landscape, potentially leading to a more concentrated market dominated by a few large players.

- Potential implications for other tech companies and industry consolidation: This merger could trigger a wave of further consolidation in the tech industry, with other companies feeling pressure to merge or face increased competition from the combined entity.

Conclusion

The Broadcom-VMware acquisition is a complex deal with significant implications. AT&T's concerns regarding extreme price increases and reduced competition are valid and underscore the potential negative consequences of this merger. The regulatory scrutiny and the potential for antitrust violations add another layer of complexity. The long-term impact on consumers and the broader tech industry remains to be seen, but the potential for higher prices, less innovation, and increased market consolidation is a serious concern. Stay informed about developments in the Broadcom-VMware acquisition and its potential impact on the future of the technology industry. Keep checking back for updates on this evolving story of extreme price increases and antitrust concerns. Follow the debate surrounding this Broadcom VMware acquisition to stay ahead of the curve.

Featured Posts

-

The Best Cheap Stuff That Doesnt Suck A Consumers Guide

May 17, 2025

The Best Cheap Stuff That Doesnt Suck A Consumers Guide

May 17, 2025 -

2024 25 High School Confidential Week 26 Highlights

May 17, 2025

2024 25 High School Confidential Week 26 Highlights

May 17, 2025 -

Lynas The First Heavy Rare Earths Producer Outside China

May 17, 2025

Lynas The First Heavy Rare Earths Producer Outside China

May 17, 2025 -

Tam Krwz Ke Jwte Pr Mdah Ka Chrhna Swshl Mydya Pr Rdeml Ky Lhr

May 17, 2025

Tam Krwz Ke Jwte Pr Mdah Ka Chrhna Swshl Mydya Pr Rdeml Ky Lhr

May 17, 2025 -

Thrifty Shopping Getting High Quality Goods On A Budget

May 17, 2025

Thrifty Shopping Getting High Quality Goods On A Budget

May 17, 2025

Latest Posts

-

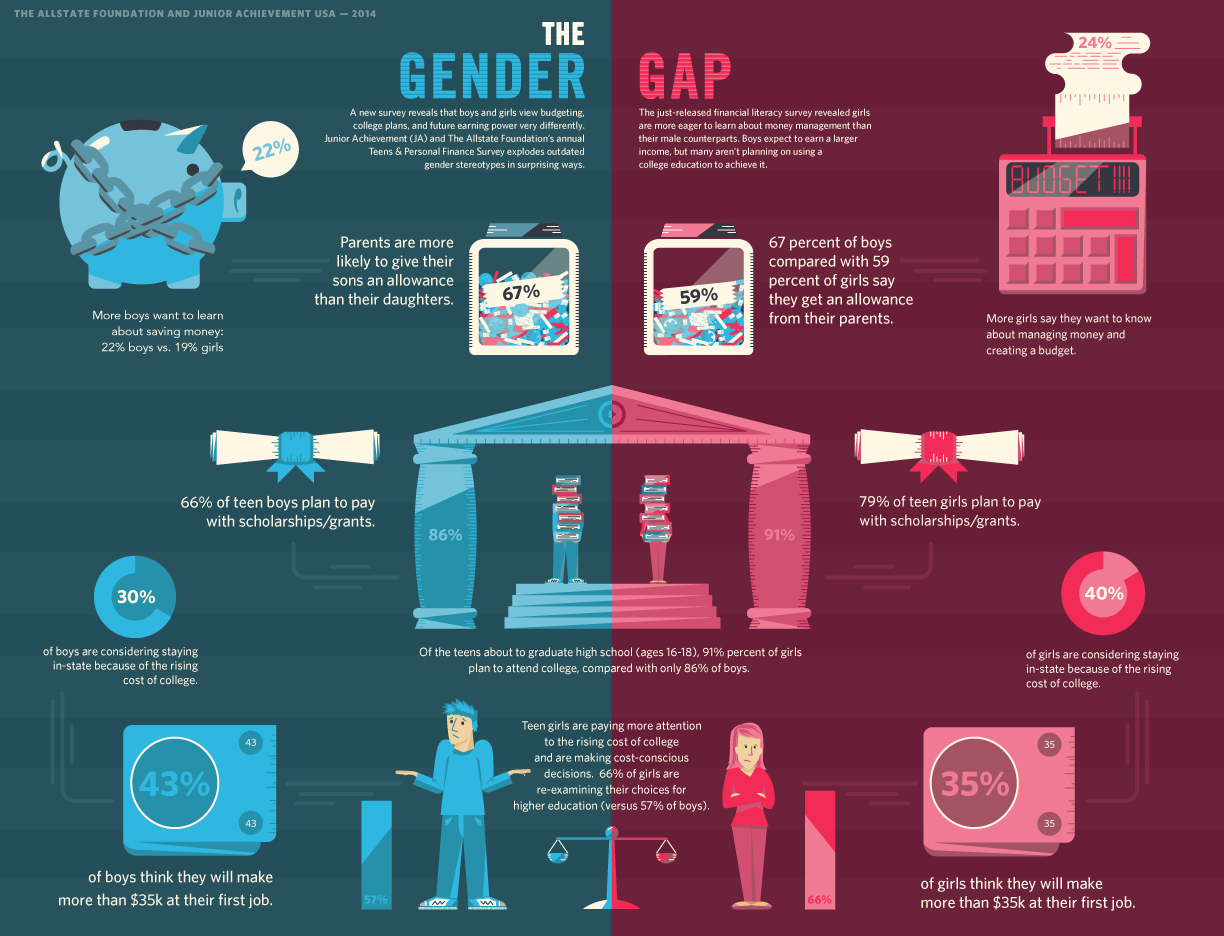

Survey Shows Fewer Parents Stressed About College Tuition Student Loan Reliance Remains

May 17, 2025

Survey Shows Fewer Parents Stressed About College Tuition Student Loan Reliance Remains

May 17, 2025 -

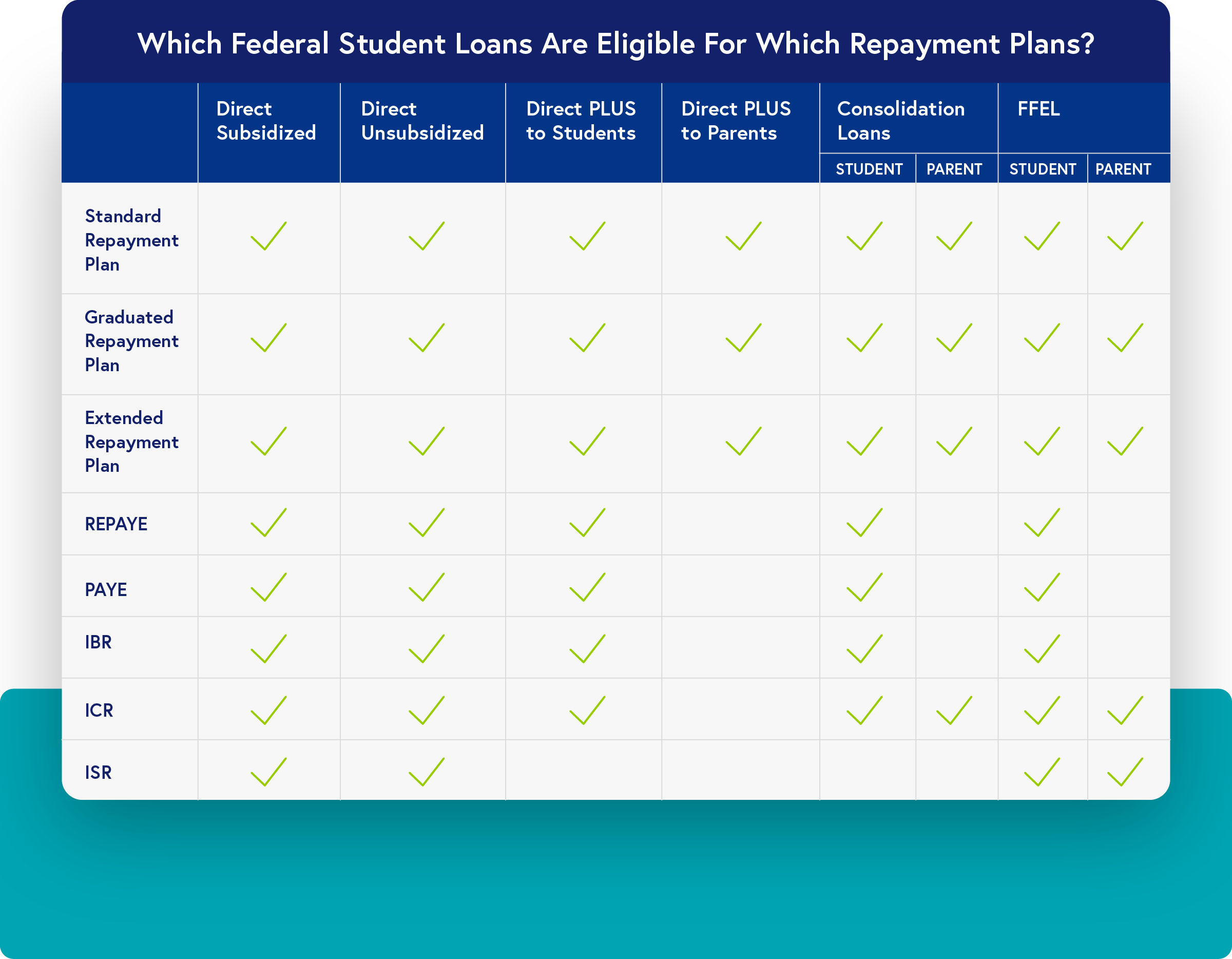

Understanding The Gops Proposed Student Loan Repayment Plan

May 17, 2025

Understanding The Gops Proposed Student Loan Repayment Plan

May 17, 2025 -

Parents Less Worried About College Costs New Survey Reveals Shift In Attitudes

May 17, 2025

Parents Less Worried About College Costs New Survey Reveals Shift In Attitudes

May 17, 2025 -

Rep Crocketts Criticism Of Trumps Economic Policies Inflation And Wages

May 17, 2025

Rep Crocketts Criticism Of Trumps Economic Policies Inflation And Wages

May 17, 2025 -

Gops Student Loan Plan What Pell Grant And Repayment Changes Mean For You

May 17, 2025

Gops Student Loan Plan What Pell Grant And Repayment Changes Mean For You

May 17, 2025