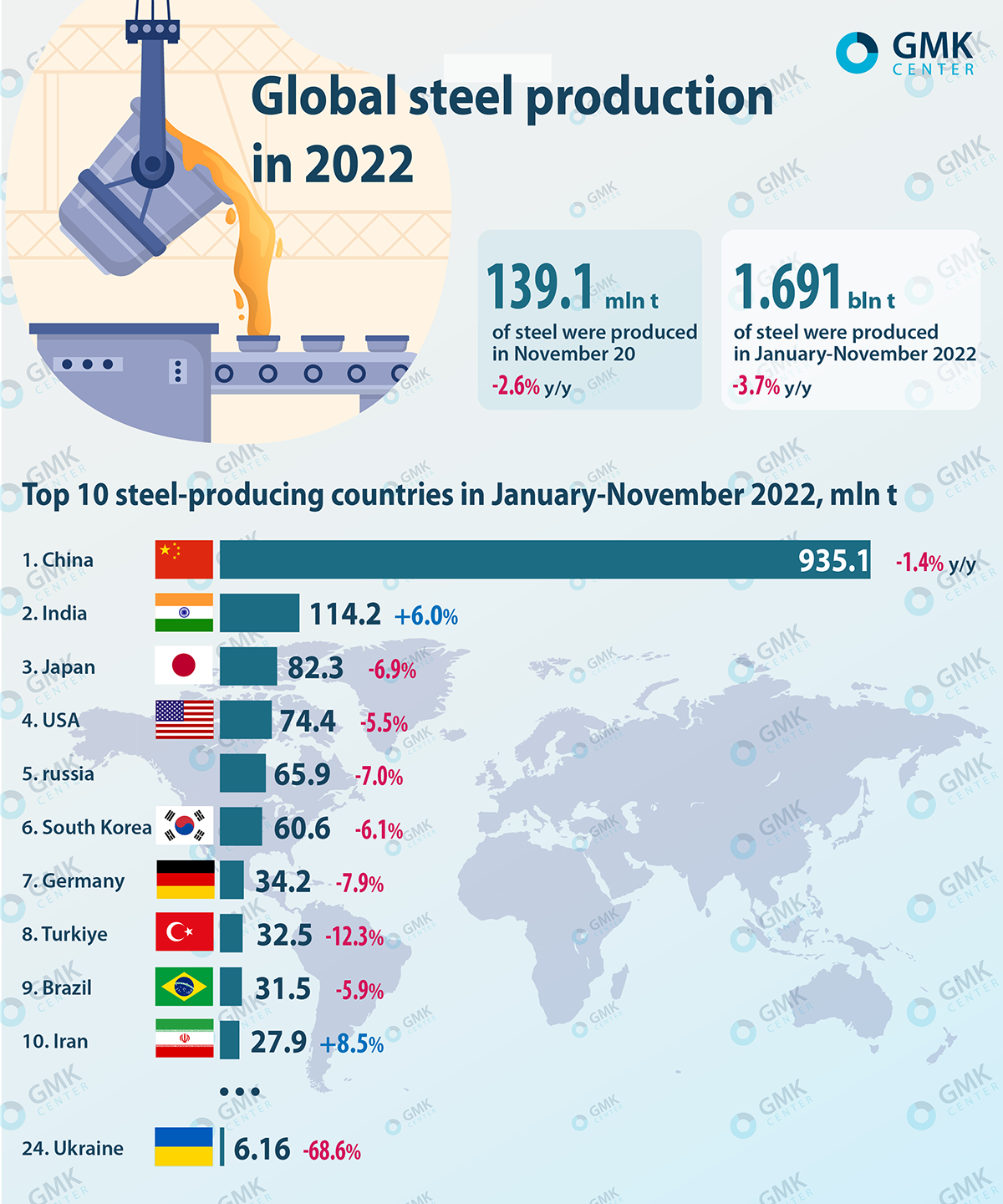

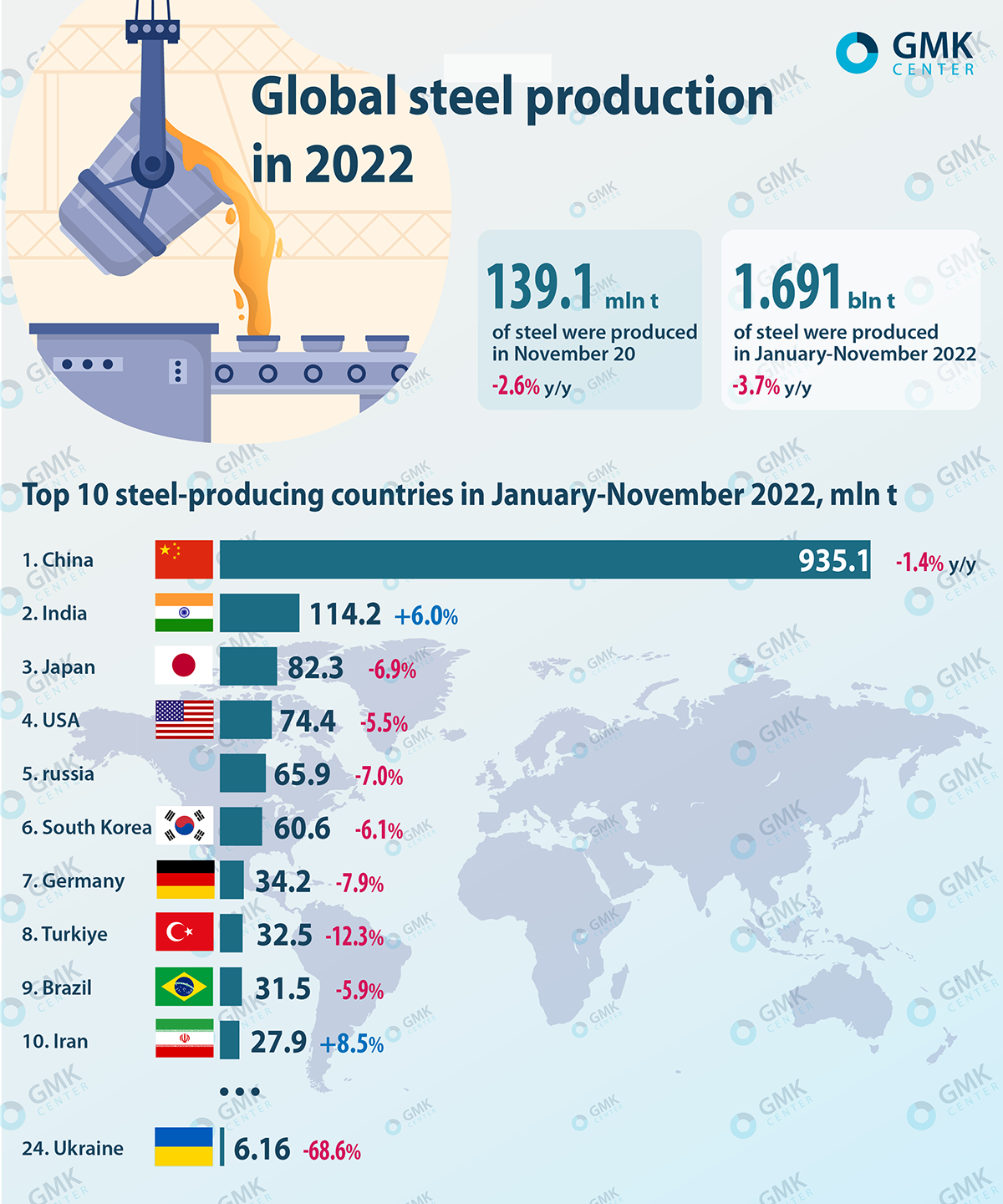

Falling Iron Ore Prices: China's Steel Production Slowdown

Table of Contents

Reduced Steel Demand in China

China, the world's largest steel producer and consumer, is experiencing a significant reduction in steel demand. This is primarily attributed to a confluence of factors impacting the construction sector and overall economic activity. The weakening of China steel demand has significant repercussions on the global iron ore market.

-

A slowdown in the Chinese construction sector: A prolonged real estate crisis has significantly hampered construction activity, directly impacting the demand for steel. Falling property sales and construction starts are directly correlated to reduced steel consumption. Government efforts to curb excessive debt in the real estate sector are further contributing to this slowdown.

-

Decreased infrastructure spending: Compared to previous years, China's infrastructure spending has decreased. Reduced investment in large-scale infrastructure projects like high-speed rail and new city developments directly translates to lower steel demand, and consequently lower iron ore demand. This reflects a broader shift in China's economic priorities.

-

Weakening domestic and global economic growth: Overall industrial activity in China has slowed, impacting steel consumption across various sectors. Weakening domestic and global economic growth affects investment and manufacturing, further reducing the need for steel and consequently impacting iron ore prices.

Increased Iron Ore Supply

The global supply of iron ore has remained relatively robust, despite the reduced demand. Major iron ore producers such as Australia and Brazil continue to maintain high production levels, contributing to a surplus in the market and exacerbating the downward pressure on iron ore prices.

-

Australia and Brazil maintain significant output: These two countries remain the dominant players in the global iron ore market, with their mining operations continuing to produce large quantities of iron ore, despite reduced global demand.

-

Mining companies strive for profitability: Despite falling iron ore prices, mining companies are striving to maintain profitability by focusing on efficiency and cost reduction measures. This further contributes to a sustained supply of iron ore in the market.

-

Increased efficiency in mining operations: Technological advancements and improved mining techniques have led to increased efficiency, contributing to a higher supply of iron ore despite reduced investment.

Impact on Global Iron Ore Market and Prices

The combination of reduced demand from China and sustained supply has led to a significant drop in iron ore prices. This volatility affects global commodity markets and the wider economy. This impacts the financial performance of mining companies and economies heavily reliant on iron ore exports.

-

Iron ore prices are expected to remain under pressure: The short-term outlook for iron ore prices remains bearish, with continued downward pressure expected until a significant shift in demand or supply occurs.

-

Market volatility is likely to continue: The situation in China, and indeed the global economy, remains fluid. This uncertainty will likely continue to fuel market volatility. Careful monitoring of the situation is crucial for all stakeholders.

-

The global economic outlook is key: The overall global economic outlook will play a significant role in determining future iron ore prices. A robust global recovery could stimulate demand, while a further slowdown could exacerbate the price decline.

Potential for Future Price Rebound

While the current outlook is bearish, there is potential for a price rebound. This depends on several factors:

-

China economic stimulus: Government-led stimulus packages in China aimed at boosting infrastructure investment could significantly increase steel demand, and consequently, the demand for iron ore.

-

Increased infrastructure investment: A renewed focus on infrastructure projects in China and other developing economies could lead to a surge in steel and iron ore demand, driving prices upwards.

-

Steel industry recovery: A broader recovery in the global steel industry, driven by improved economic conditions, would increase demand for iron ore.

Conclusion

The decline in iron ore prices is largely a consequence of China's slowing steel production, driven by reduced demand in the construction and infrastructure sectors. The interplay of supply and demand, coupled with broader economic factors, creates a complex and volatile market. Monitoring the economic situation in China, global economic growth, and the actions of major iron ore producers will be crucial for anticipating future trends in falling iron ore prices. Stay informed on the latest developments in the iron ore market to make informed decisions regarding this crucial commodity.

Featured Posts

-

Strengthened Capital Market Collaboration The Pakistan Sri Lanka Bangladesh Agreement

May 10, 2025

Strengthened Capital Market Collaboration The Pakistan Sri Lanka Bangladesh Agreement

May 10, 2025 -

Povernennya Stivena Kinga V Kh Kritika Trampa Ta Maska

May 10, 2025

Povernennya Stivena Kinga V Kh Kritika Trampa Ta Maska

May 10, 2025 -

New Uk Immigration Policy Increased Scrutiny For Asylum Claims From Specific Countries

May 10, 2025

New Uk Immigration Policy Increased Scrutiny For Asylum Claims From Specific Countries

May 10, 2025 -

Analyzing The Canadian Billionaire Warren Buffetts Unexpected Successor

May 10, 2025

Analyzing The Canadian Billionaire Warren Buffetts Unexpected Successor

May 10, 2025 -

Indonesias Falling Reserves Analyzing The Impact Of The Weakening Rupiah

May 10, 2025

Indonesias Falling Reserves Analyzing The Impact Of The Weakening Rupiah

May 10, 2025