Financial Instability: Practical Solutions For Long-Term Financial Wellness

Table of Contents

Assessing Your Current Financial Situation: The First Step to Stability

Before charting a course towards financial wellness, it's crucial to understand your current financial landscape. This involves a thorough assessment of your income, expenses, debts, and savings.

Creating a Realistic Budget

A realistic budget is the cornerstone of financial stability. This involves meticulously tracking your income and expenses. Many free budgeting apps and spreadsheet templates are available to simplify this process.

- Track Everything: Record every penny spent, whether it's on groceries, entertainment, or transportation.

- Categorize Expenses: Organize your expenses into categories (housing, food, transportation, etc.) to identify areas of overspending.

- Differentiate Needs vs. Wants: Clearly distinguish between essential needs (housing, food, utilities) and wants (eating out, entertainment). Cutting back on wants is often the easiest way to free up cash flow.

- Utilize Budgeting Apps: Explore apps like Mint, YNAB (You Need A Budget), or Personal Capital to automate tracking and provide insights into your spending habits.

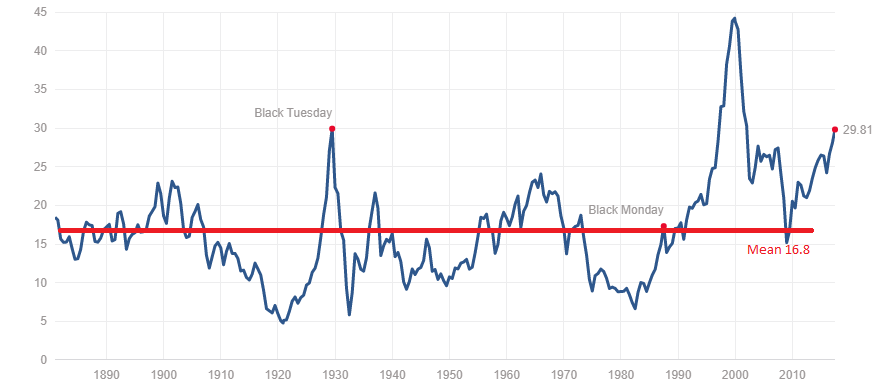

Analyzing Your Debt

High levels of debt significantly contribute to financial instability. Understanding the types and amount of your debt is paramount.

- Identify Debt Types: Categorize your debt (credit card debt, student loans, mortgages, etc.) to understand its composition.

- Calculate Your Debt-to-Income Ratio: This ratio shows the percentage of your income dedicated to debt payments. A high ratio indicates potential financial strain.

- Explore Debt Management Strategies: Consider strategies like debt consolidation (combining multiple debts into one loan) or the debt snowball/avalanche methods (paying off smallest or highest-interest debts first).

Evaluating Your Savings and Emergency Fund

Building a robust emergency fund is vital for weathering unexpected financial storms.

- The Importance of an Emergency Fund: Aim for 3-6 months' worth of living expenses in an easily accessible savings account.

- Strategies for Building an Emergency Fund: Automate regular transfers from your checking account to your savings account, even if it's a small amount. Identify areas where you can cut expenses to accelerate savings.

Building a Sustainable Financial Plan for Long-Term Wellness

Once you have a clear picture of your current financial situation, it's time to develop a sustainable plan for long-term financial wellness.

Setting Realistic Financial Goals

Setting SMART goals – Specific, Measurable, Achievable, Relevant, and Time-bound – is key to achieving your financial aspirations.

- Short-Term Goals: These could include paying off a small debt, increasing your emergency fund, or saving for a vacation.

- Mid-Term Goals: These might involve saving for a down payment on a house or paying off larger debts.

- Long-Term Goals: These typically include retirement planning, funding your children's education, or leaving an inheritance.

Investing for the Future

Investing your money allows it to grow over time, helping you build wealth and achieve your long-term financial goals.

- Investment Options: Explore various investment options such as stocks, bonds, mutual funds, and real estate, considering your risk tolerance and financial goals.

- Diversification: Don't put all your eggs in one basket. Diversify your investments across different asset classes to mitigate risk.

- Professional Advice: Consider consulting a financial advisor to help you develop an investment strategy tailored to your needs and risk tolerance.

Protecting Your Financial Future

Protecting your assets is a crucial aspect of long-term financial wellness.

- Insurance: Secure adequate insurance coverage, including health, life, disability, home, and auto insurance.

- Estate Planning: Create a will and consider other estate planning tools, such as trusts, to ensure your assets are distributed according to your wishes.

Overcoming Common Obstacles to Financial Stability

Even with a well-defined plan, unforeseen circumstances can derail your progress. It's essential to develop strategies to overcome these obstacles.

Managing Unexpected Expenses

Unexpected expenses, such as job loss, medical emergencies, or car repairs, can significantly impact your financial stability.

- Emergency Fund: A robust emergency fund serves as a crucial buffer against unexpected expenses.

- Contingency Planning: Develop a plan for handling various potential emergencies to minimize their impact.

Avoiding Impulsive Spending

Impulsive spending can quickly deplete your resources. Develop strategies to curb this habit.

- Mindful Spending: Before making a purchase, ask yourself if you truly need it and if it aligns with your financial goals.

- Delay Gratification: Wait a certain period before making a non-essential purchase. This allows you to assess whether the desire is fleeting or genuine.

- Utilize Financial Tracking Apps: Track your spending habits to identify impulsive spending patterns.

Seeking Professional Help

Don't hesitate to seek help from qualified professionals when needed.

- Financial Advisor: A financial advisor can provide personalized guidance on budgeting, investing, and financial planning.

- Credit Counselor: A credit counselor can help you manage and reduce high-interest debt.

Securing Your Financial Future: Taking Control of Financial Instability

Addressing financial instability requires a proactive approach. By creating a realistic budget, managing your debt effectively, investing wisely, protecting your assets, and developing strategies for handling unexpected expenses, you can build a strong foundation for long-term financial wellness. Start managing your financial instability today! Take control of your financial future by overcoming financial instability! Achieve long-term financial wellness by addressing your financial instability now!

Featured Posts

-

Late Snowfall Hits Southern French Alps Weather Update

May 21, 2025

Late Snowfall Hits Southern French Alps Weather Update

May 21, 2025 -

Klopps Liverpool A Retrospective Look At The Transformation

May 21, 2025

Klopps Liverpool A Retrospective Look At The Transformation

May 21, 2025 -

Post Roe America How Over The Counter Birth Control Reshapes Reproductive Healthcare

May 21, 2025

Post Roe America How Over The Counter Birth Control Reshapes Reproductive Healthcare

May 21, 2025 -

Bp Ceos Plan Double Valuation Remain On London Stock Exchange

May 21, 2025

Bp Ceos Plan Double Valuation Remain On London Stock Exchange

May 21, 2025 -

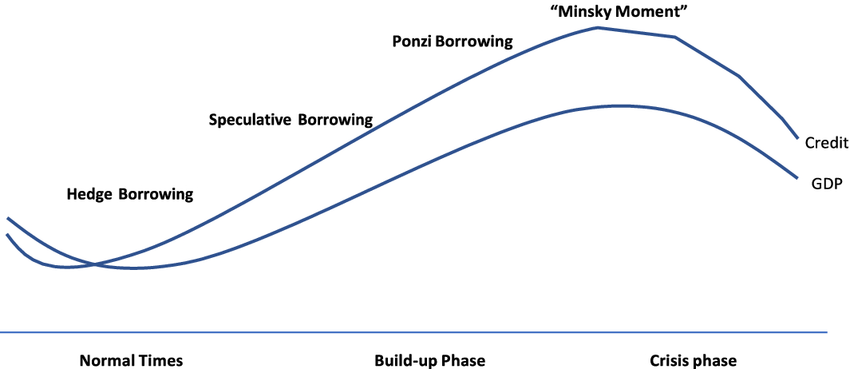

Brexit And The Uk Luxury Goods Market An Export Perspective

May 21, 2025

Brexit And The Uk Luxury Goods Market An Export Perspective

May 21, 2025

Latest Posts

-

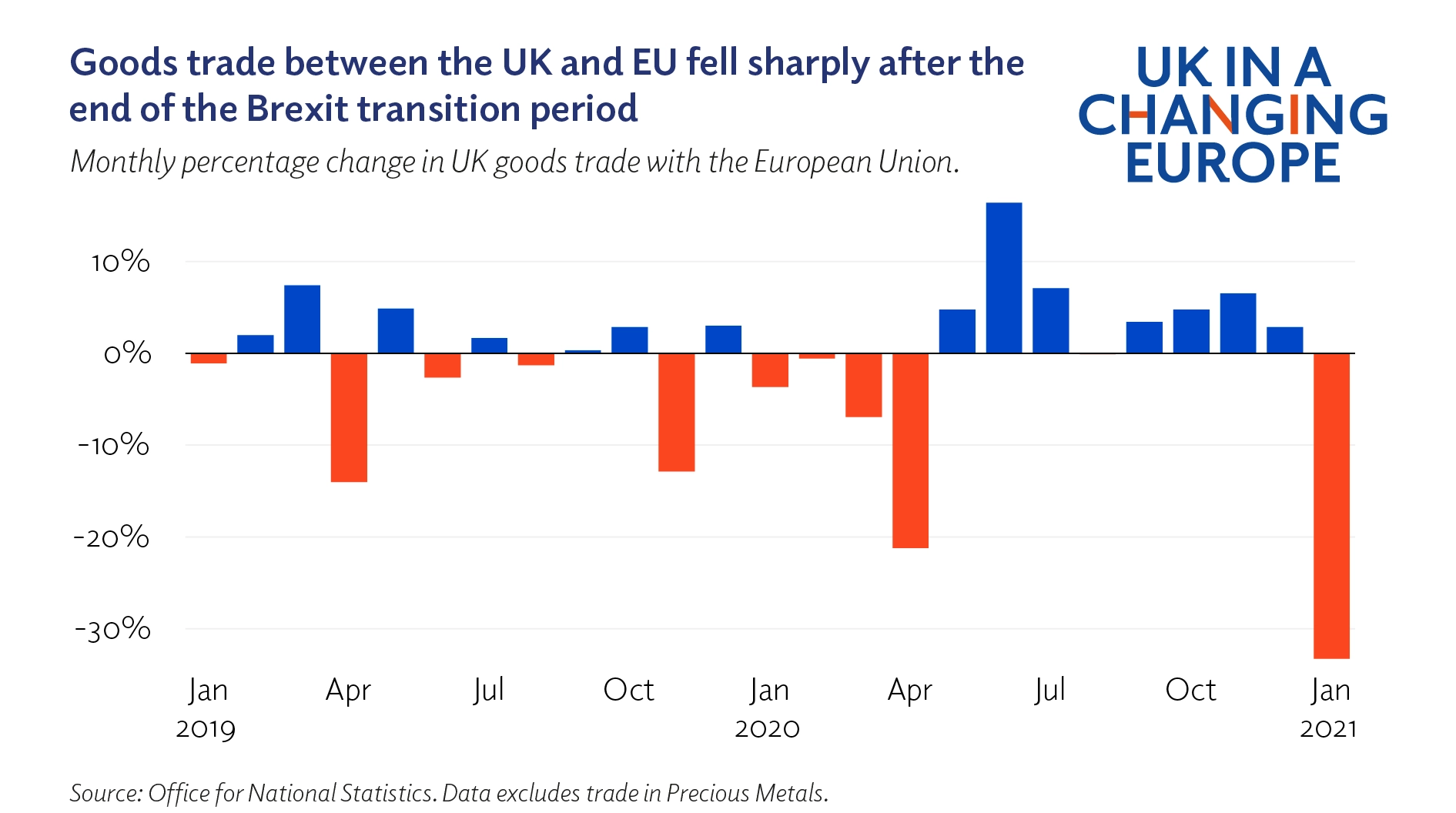

Addressing Stock Market Valuation Concerns Insights From Bof A

May 21, 2025

Addressing Stock Market Valuation Concerns Insights From Bof A

May 21, 2025 -

High Stock Market Valuations A Bof A Perspective For Investors

May 21, 2025

High Stock Market Valuations A Bof A Perspective For Investors

May 21, 2025 -

Brexit And The Uk Luxury Goods Market An Export Perspective

May 21, 2025

Brexit And The Uk Luxury Goods Market An Export Perspective

May 21, 2025 -

Analysis Brexits Negative Impact On Uk Luxury Exports To The Eu

May 21, 2025

Analysis Brexits Negative Impact On Uk Luxury Exports To The Eu

May 21, 2025 -

Post Brexit Challenges For Uk Luxury Exporters To The Eu

May 21, 2025

Post Brexit Challenges For Uk Luxury Exporters To The Eu

May 21, 2025