Florida Condo Market Crash: Why Owners Are Selling Now

Table of Contents

Rising Interest Rates and Mortgage Costs

Higher interest rates are significantly impacting the affordability of Florida condos. The Federal Reserve's efforts to combat inflation have resulted in a sharp increase in mortgage interest rates, making it more expensive for potential buyers to finance a purchase.

- Increased Monthly Payments: Higher interest rates translate directly into higher monthly mortgage payments, deterring many potential buyers from entering the market.

- Reduced Purchasing Power: With borrowing costs significantly increased, buyers can afford less expensive properties, decreasing demand for higher-priced condos.

- Lower Demand, Lower Prices: The combination of fewer buyers and increased borrowing costs creates a downward pressure on condo prices, accelerating the market correction.

For example, a 20% increase in interest rates can lead to a 20-30% reduction in purchasing power, making many previously affordable condos unattainable for potential buyers. This correlation between rising interest rates and falling condo prices in Florida is clearly evident in recent market data.

Increased Property Insurance Premiums

The Florida condo market crash is further exacerbated by the dramatic increase in property insurance premiums. Insurance costs have skyrocketed in recent years, adding a significant burden to condo ownership.

- Increased Cost of Ownership: High insurance premiums significantly increase the overall cost of owning a condo in Florida, impacting both buyers and sellers.

- Insurer Exodus: Several insurers have pulled out of the Florida market due to high claims and financial instability, resulting in a shortage of available insurance and further increasing premiums.

- Deterrent to Buyers and Sellers: The uncertainty and high cost of insurance create a climate of hesitancy, deterring both buyers and sellers from engaging in the market.

News reports consistently highlight the insurance crisis in Florida, showcasing its devastating impact on the real estate market and accelerating the Florida condo market crash.

Over-Saturation of the Market

A surplus of condos available for sale is contributing to the decline in prices. The market is currently experiencing a significant oversupply, creating a buyer's market.

- New Construction Continues: Despite reduced demand, new condo construction continues, adding to the existing inventory.

- Existing Owners Selling: Many existing condo owners, facing rising costs and economic uncertainty, are also selling their properties, further increasing the supply.

- High Supply, Low Demand: This imbalance between supply and demand is a major driver of the price reductions currently seen across the Florida condo market.

Statistics show a significant increase in the number of condos listed for sale in major Florida cities like Miami, Orlando, and Tampa, highlighting the oversaturation of the market.

Economic Uncertainty and Recession Fears

Broader economic concerns are playing a significant role in the Florida condo market crash. Inflation, potential recession, and job market uncertainty are influencing buyer behavior.

- Buyer Hesitancy: Inflation and the threat of a recession are causing many potential buyers to hesitate, delaying or canceling their purchase plans.

- Job Security Concerns: Worries about job security are affecting purchasing power and willingness to invest in expensive assets like Florida condos.

- Luxury Market Downturn: Economic uncertainty particularly impacts luxury markets like Florida condos, as buyers become more cautious in their spending habits.

Current inflation rates and economic forecasts paint a picture of uncertainty, reinforcing the cautionary sentiment among potential condo buyers.

Specific Examples of Price Decreases in Key Florida Cities

Miami has seen average condo prices fall by approximately 10% in the last quarter, while Orlando and Tampa have experienced similar declines, although varying by location and property type. This data underscores the broad nature of the Florida condo market crash.

Conclusion

The Florida condo market crash is a multifaceted issue stemming from rising interest rates, soaring insurance costs, market oversaturation, and broader economic uncertainty. These factors are compelling many condo owners to sell their properties, leading to increased inventory and decreased prices. Understanding the current dynamics of the Florida condo market crash is crucial for making informed decisions. Research thoroughly before investing in or selling your Florida condo. Don't get caught off guard by the Florida condo market downturn; seek expert advice before making your next move in this challenging market.

Featured Posts

-

Netflix Weathering The Tech Storm Attracting Investors Amidst Tariff Concerns

Apr 23, 2025

Netflix Weathering The Tech Storm Attracting Investors Amidst Tariff Concerns

Apr 23, 2025 -

Blue Origins Stumbles A Bigger Blow Than Katy Perrys Career Blips

Apr 23, 2025

Blue Origins Stumbles A Bigger Blow Than Katy Perrys Career Blips

Apr 23, 2025 -

Boosting Returns Caat Pension Plan Targets More Canadian Private Investments

Apr 23, 2025

Boosting Returns Caat Pension Plan Targets More Canadian Private Investments

Apr 23, 2025 -

Jadwal Tayang Program Tv Ramadan 2025 Temani Buka Puasa Dan Sahur Anda

Apr 23, 2025

Jadwal Tayang Program Tv Ramadan 2025 Temani Buka Puasa Dan Sahur Anda

Apr 23, 2025 -

William Contreras Impact On The Milwaukee Brewers Lineup

Apr 23, 2025

William Contreras Impact On The Milwaukee Brewers Lineup

Apr 23, 2025

Latest Posts

-

Revised Palantir Stock Predictions Following Market Rally

May 10, 2025

Revised Palantir Stock Predictions Following Market Rally

May 10, 2025 -

Palantir Stock Price Surge Analysts Adjust Forecasts

May 10, 2025

Palantir Stock Price Surge Analysts Adjust Forecasts

May 10, 2025 -

Palantir Stock Forecast Revised Understanding The Recent Market Rally

May 10, 2025

Palantir Stock Forecast Revised Understanding The Recent Market Rally

May 10, 2025 -

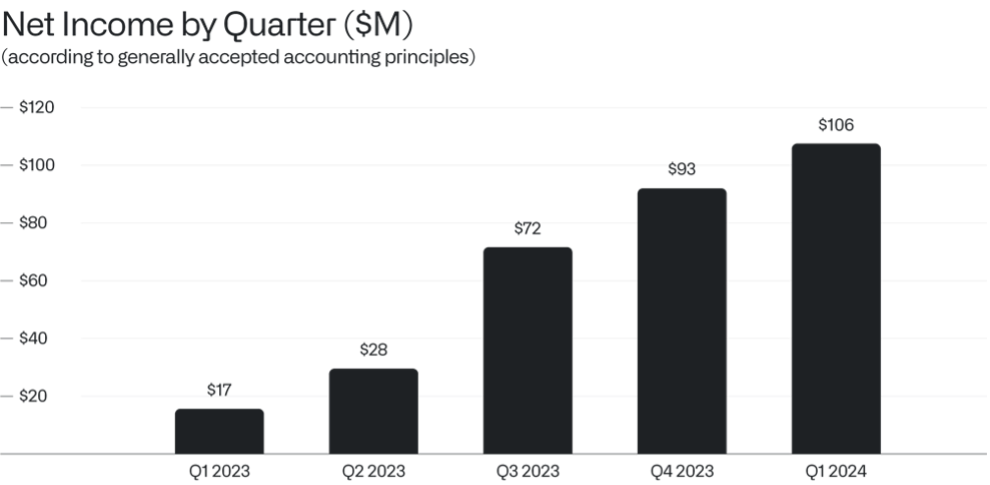

Palantir Stock Q1 2024 Earnings Reveal Trends In Government And Commercial Markets

May 10, 2025

Palantir Stock Q1 2024 Earnings Reveal Trends In Government And Commercial Markets

May 10, 2025 -

Predicting The Future Palantirs Impact On Public Sector Ai With Its Nato Deal

May 10, 2025

Predicting The Future Palantirs Impact On Public Sector Ai With Its Nato Deal

May 10, 2025