Gold (XAUUSD) Rally: Lower Interest Rate Bets Boost Precious Metal Prices

Table of Contents

Lower Interest Rates and the Inverse Relationship with the Dollar (USD)

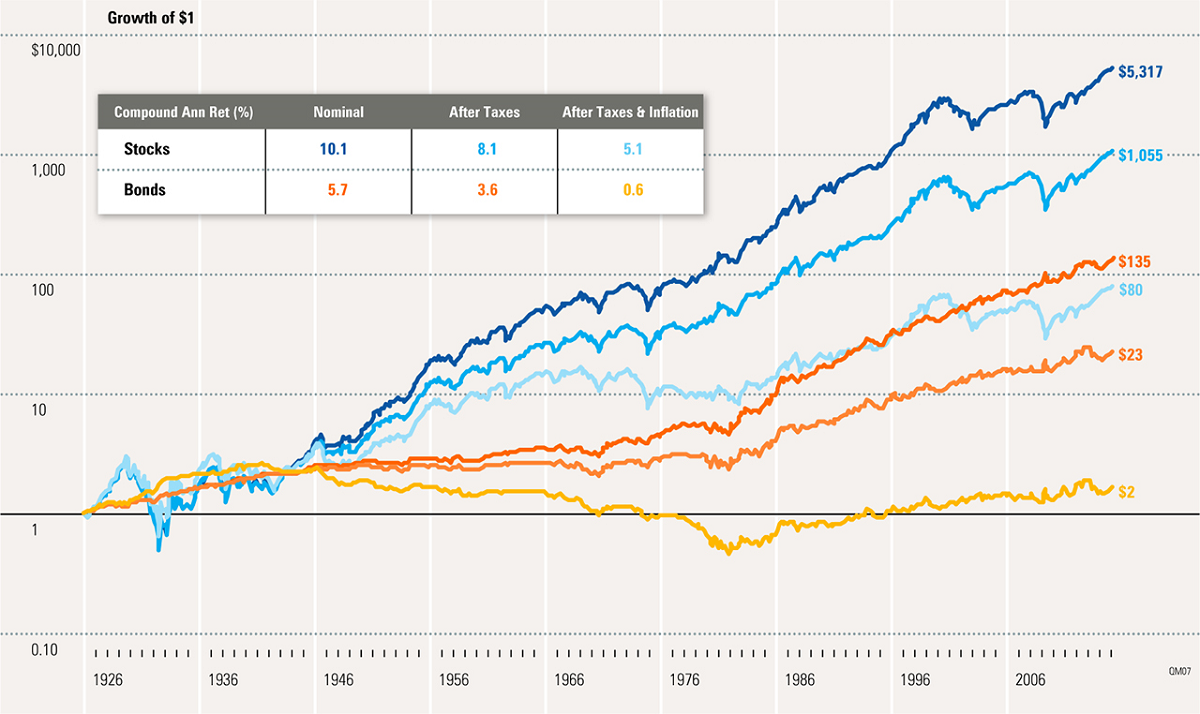

The US dollar and gold prices share an inverse correlation; as one rises, the other tends to fall, and vice versa. This relationship is particularly pronounced when expectations of lower interest rates emerge. Lower interest rates in the US decrease the attractiveness of US dollar-denominated assets, including government bonds and high-yield savings accounts. This reduced attractiveness weakens the dollar, making it less desirable for international investors.

Consequently, investors seek alternative assets to preserve their capital and potentially gain returns. Gold, a traditional safe haven asset, becomes a more appealing option. The decreased demand for the USD increases the relative demand for gold, thus pushing the XAUUSD price upwards.

- Lower interest rates decrease the attractiveness of US dollar-denominated assets.

- A weaker dollar increases the demand for gold as a safe haven asset.

- This increased demand pushes gold prices upward.

[Insert chart here illustrating the inverse correlation between USD and XAUUSD, ideally showing recent price movements]

Gold as a Safe Haven Asset in Times of Economic Uncertainty

Gold's appeal isn't solely tied to interest rate movements; it also functions as a vital safe-haven asset during periods of economic uncertainty and geopolitical instability. When investors perceive increased risk in traditional markets (stocks, bonds), they often flock to gold as a store of value that historically holds its worth, even during turbulent times.

Inflation further contributes to gold's attractiveness. As inflation erodes the purchasing power of fiat currencies, gold retains its intrinsic value, making it a hedge against inflation.

- Gold is considered a hedge against inflation.

- Geopolitical instability increases the demand for safe-haven assets like gold.

- Uncertainty about future economic growth boosts gold's appeal.

Recent geopolitical events, such as [mention specific recent geopolitical events or economic indicators], have likely contributed to the increased demand for gold as a safe haven, thus further bolstering the XAUUSD price.

Technical Analysis of the XAUUSD Chart: Identifying Support and Resistance Levels

Analyzing the XAUUSD chart through a technical lens reveals key support and resistance levels that shed light on potential future price movements. By studying technical indicators like moving averages (e.g., 50-day, 200-day), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD), traders can gauge momentum and potential trend reversals.

- Key technical indicators (e.g., moving averages, RSI, MACD) suggest [mention specific technical analysis findings, e.g., upward trend, strong momentum].

- Significant support levels are currently around [mention specific price levels].

- Resistance levels are observed near [mention specific price levels].

- Based on this analysis, potential price targets could be [mention potential price targets with a caveat about market volatility].

[Insert a clear and well-labeled chart here showing the technical analysis, including support and resistance levels and key indicators.]

It is crucial to remember that technical analysis provides insights, but it's not a foolproof prediction method. Market conditions are dynamic, and unexpected events can significantly influence prices.

Impact of Central Bank Actions on Gold Prices

Central banks play a critical role in shaping gold prices through their monetary policy decisions. Quantitative easing (QE), a policy involving the injection of money into the economy, has historically been associated with higher gold prices. QE increases the money supply, potentially leading to inflation, thus increasing the demand for gold as an inflation hedge.

Conversely, interest rate hikes can decrease gold prices, as higher yields on interest-bearing assets make them more competitive against non-interest-bearing gold. The impact of future monetary policy changes remains to be seen, but it's a crucial factor to monitor for potential implications on the XAUUSD market.

- Quantitative easing (QE) can increase gold prices due to its inflationary impact.

- Interest rate cuts tend to support gold prices, while rate hikes may put downward pressure.

- Central bank gold reserves act as a floor for gold prices, providing support in times of market uncertainty.

Conclusion: Capitalizing on the Gold (XAUUSD) Rally: A Strategic Outlook

The current gold rally is driven by a combination of lower interest rate expectations, increased demand as a safe-haven asset, and positive signals from technical analysis. The inverse relationship between the US dollar and gold prices, particularly in a low-interest-rate environment, remains a significant factor driving the XAUUSD market.

While the outlook for further gold price appreciation seems positive, it's crucial to acknowledge the inherent market risks and volatility. A diversified investment strategy that incorporates gold should always consider risk management and individual financial goals.

Stay informed on the latest XAUUSD market trends and consider incorporating gold into your portfolio diversification strategy. Learn more about gold investment options and risk management techniques to make informed decisions about your investment strategy.

Featured Posts

-

Dismissing Stock Market Valuation Worries A Bof A Analysis

May 17, 2025

Dismissing Stock Market Valuation Worries A Bof A Analysis

May 17, 2025 -

Hailey Van Lith And Angel Reese A Chicago Reunion Amidst Old Tensions

May 17, 2025

Hailey Van Lith And Angel Reese A Chicago Reunion Amidst Old Tensions

May 17, 2025 -

The Impact Of False Angel Reese Quotes On Public Perception

May 17, 2025

The Impact Of False Angel Reese Quotes On Public Perception

May 17, 2025 -

Stock Market Valuations Bof As Analysis And Reasons For Investor Calm

May 17, 2025

Stock Market Valuations Bof As Analysis And Reasons For Investor Calm

May 17, 2025 -

Seven Months Salary Bonus Singapore Airlines Rewards Staff

May 17, 2025

Seven Months Salary Bonus Singapore Airlines Rewards Staff

May 17, 2025

Latest Posts

-

Week In Review Turning Failures Into Opportunities

May 17, 2025

Week In Review Turning Failures Into Opportunities

May 17, 2025 -

Josh Hart And Draymond Green Comparing Their Roles And Impact On Their Teams

May 17, 2025

Josh Hart And Draymond Green Comparing Their Roles And Impact On Their Teams

May 17, 2025 -

Analyzing Setbacks A Weekly Review Of Business Challenges

May 17, 2025

Analyzing Setbacks A Weekly Review Of Business Challenges

May 17, 2025 -

Is Josh Hart The Knicks Version Of Draymond Green Analyzing His Contributions

May 17, 2025

Is Josh Hart The Knicks Version Of Draymond Green Analyzing His Contributions

May 17, 2025 -

From Failure To Growth A Weekly Review

May 17, 2025

From Failure To Growth A Weekly Review

May 17, 2025