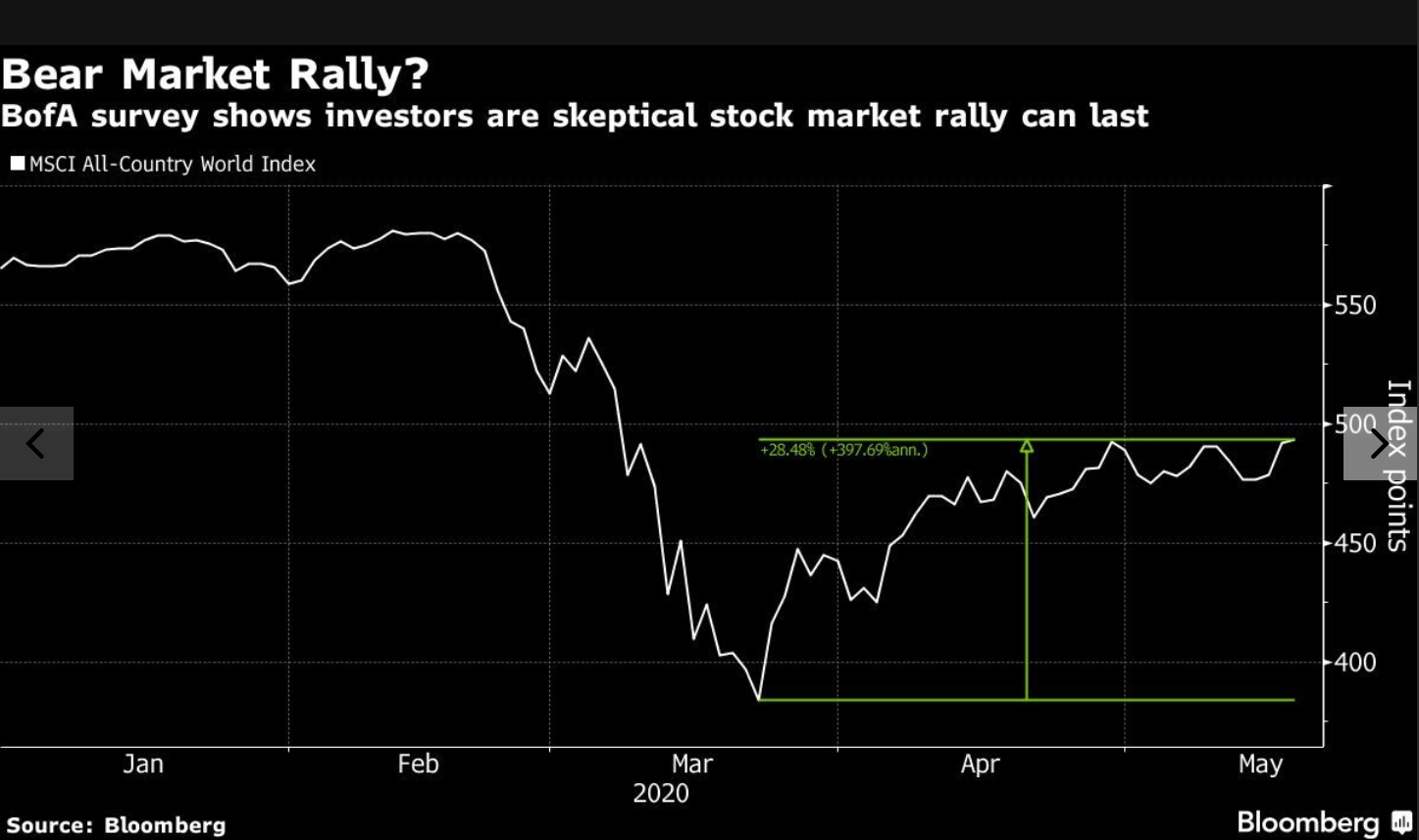

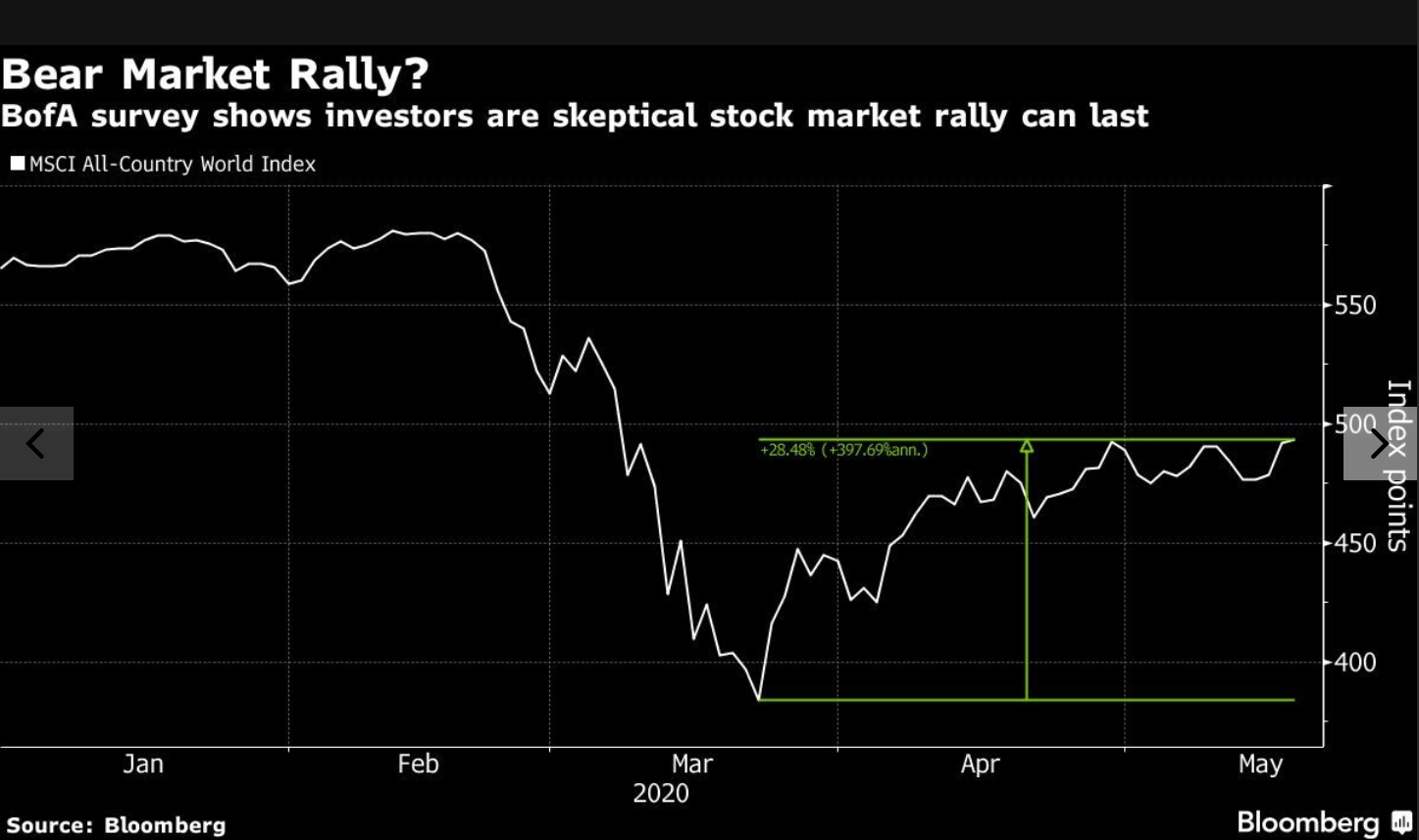

High Stock Market Valuations: Why BofA Believes Investors Shouldn't Panic

Table of Contents

BofA's Key Arguments Against Market Panic

BofA's measured optimism isn't based on blind faith; it's rooted in a detailed analysis of several key market indicators. Their perspective challenges the immediate reaction of many to high stock market valuations, suggesting a more nuanced approach is warranted.

Strong Corporate Earnings and Profitability

BofA's analysis points to robust corporate earnings as a key counterpoint to high stock market valuations. Despite elevated stock prices, many companies continue to demonstrate strong financial performance, exceeding market expectations. This suggests that current valuations, while high, might not be entirely unjustified.

-

Strong revenue growth across various sectors: Companies across diverse sectors are reporting impressive revenue growth, indicating a healthy overall economy. This sustained growth fuels increased profitability and supports higher stock prices. For example, the technology sector has consistently demonstrated strong revenue growth, driven by the increasing demand for software-as-a-service (SaaS) and cloud computing solutions.

-

Improved profit margins due to efficiency gains: Many businesses have implemented cost-cutting measures and improved operational efficiencies, resulting in improved profit margins. These gains contribute directly to higher earnings per share (EPS), a key driver of stock valuations.

-

Positive future earnings guidance from major companies: A significant number of major corporations have provided positive future earnings guidance, signaling continued optimism about their prospects and further bolstering investor confidence. This positive outlook contributes to the belief that current high stock market valuations are sustainable.

Low Interest Rates and Monetary Policy

The current environment of low interest rates plays a significant role in BofA's assessment. These low rates influence stock valuations in several ways, affecting investor behavior and market stability.

-

Accommodative monetary policy supporting economic growth: Central banks globally maintain accommodative monetary policies, keeping interest rates low to stimulate economic growth. This environment encourages investment and supports higher stock prices.

-

Low borrowing costs encouraging business investment: Low interest rates make borrowing cheaper for businesses, encouraging investment in expansion, innovation, and job creation. This positive economic activity underpins higher stock market valuations.

-

Potential for continued low interest rates in the near future: Many analysts predict that low interest rates will likely persist in the near future. This sustained environment of cheap borrowing further supports economic growth and justifies higher valuations from an investor perspective.

Long-Term Growth Potential and Technological Innovation

BofA's long-term view emphasizes the potential for continued economic growth fueled by technological innovation. This perspective emphasizes the enduring value of certain investments despite short-term valuation fluctuations.

-

Continued advancements in technology driving productivity gains: Technological advancements continue to drive productivity gains across various industries, leading to increased efficiency and profitability. This sustained innovation is a major long-term driver of economic growth.

-

Emerging technologies creating new investment opportunities: Emerging technologies, such as artificial intelligence (AI), biotechnology, and renewable energy, present new investment opportunities with significant growth potential, mitigating concerns about overvaluation in more mature sectors.

-

Long-term growth potential outweighing short-term valuation concerns: BofA suggests that the long-term growth potential of the market outweighs the concerns surrounding short-term valuation metrics. This long-term perspective is crucial for investors to maintain a calm and strategic approach.

Addressing Valuation Concerns: A Balanced Perspective

BofA acknowledges that high stock market valuations are a legitimate concern. However, they present a balanced perspective that considers various factors to mitigate these risks.

-

Valuation metrics need to be considered within the context of growth: Simply looking at price-to-earnings (P/E) ratios without considering earnings growth can be misleading. High valuations can be justified by strong future growth prospects.

-

Specific sectors may be overvalued, but the market as a whole is not necessarily overvalued: BofA's analysis suggests that while some sectors might be overvalued, the market as a whole is not necessarily in a bubble. A diversified portfolio can mitigate sector-specific risks.

-

Focus on fundamental analysis over solely valuation-based metrics: Instead of focusing solely on valuation metrics, investors should consider a broader fundamental analysis that includes revenue growth, profit margins, and future growth potential.

Conclusion

While high stock market valuations are a legitimate concern, BofA's analysis suggests that investors shouldn't react with panic. Strong corporate earnings, accommodative monetary policy, and significant long-term growth potential, particularly driven by technological innovation, offer a more nuanced perspective. Investors should adopt a balanced approach, prioritizing fundamental analysis and focusing on long-term growth opportunities. Don't let seemingly high stock market valuations deter you. Research BofA's detailed analysis and develop a robust investment strategy based on a thorough understanding of the current market conditions. Remember to research thoroughly before making any investment decisions related to high stock market valuations.

Featured Posts

-

Stock Market Today Dow Jones And S And P 500 Live Updates May 27

May 28, 2025

Stock Market Today Dow Jones And S And P 500 Live Updates May 27

May 28, 2025 -

Chto Izvestno O Novom Filme Uesa Andersona

May 28, 2025

Chto Izvestno O Novom Filme Uesa Andersona

May 28, 2025 -

Jannik Sinner And Pope Leo Xiv Photo From The Italian Open

May 28, 2025

Jannik Sinner And Pope Leo Xiv Photo From The Italian Open

May 28, 2025 -

Salengs Salary Comparison Moroka Swallows And Orlando Pirates

May 28, 2025

Salengs Salary Comparison Moroka Swallows And Orlando Pirates

May 28, 2025 -

Check Todays Personal Loan Interest Rates And Apply

May 28, 2025

Check Todays Personal Loan Interest Rates And Apply

May 28, 2025

Latest Posts

-

Did Bryan Cranstons How I Met Your Mother Joke About Pete Rose Come True

May 29, 2025

Did Bryan Cranstons How I Met Your Mother Joke About Pete Rose Come True

May 29, 2025 -

The Bryan Cranston Pete Rose Joke A 20 Year Old How I Met Your Mother Prediction

May 29, 2025

The Bryan Cranston Pete Rose Joke A 20 Year Old How I Met Your Mother Prediction

May 29, 2025 -

Bryan Cranstons How I Met Your Mother Pete Rose Joke A 20 Year Prophecy

May 29, 2025

Bryan Cranstons How I Met Your Mother Pete Rose Joke A 20 Year Prophecy

May 29, 2025 -

Exploring Bryan Cranstons Wealth Income And Net Worth Projections For 2025

May 29, 2025

Exploring Bryan Cranstons Wealth Income And Net Worth Projections For 2025

May 29, 2025 -

Bryan Cranston Net Worth 2025 How Much Has He Earned

May 29, 2025

Bryan Cranston Net Worth 2025 How Much Has He Earned

May 29, 2025