Hong Kong Share Sale Greenlit For Hengrui Pharma

Table of Contents

Details of the Hong Kong Share Sale

Hengrui Pharma's Hong Kong share sale represents a substantial capital raising event. The exact number of shares offered and the expected fundraising amount will be revealed closer to the listing date. However, market whispers suggest a significant share issuance aimed at attracting a broad base of international and domestic investors. Leading investment banking firms are acting as underwriters, playing a crucial role in pricing the shares and managing the share issuance process. Their expertise will be instrumental in ensuring a successful capital raising for Hengrui Pharma.

- Share price range: (To be announced)

- Timeline for listing on the Hong Kong Stock Exchange: (To be announced)

- Expected market capitalization post-listing: (To be announced – estimations from analysts can be included here if available)

Strategic Implications for Hengrui Pharma

Hengrui Pharma's decision to pursue a Hong Kong listing is a strategic move driven by several factors. Accessing the Hong Kong capital market offers significant advantages, including a vastly expanded investor base beyond China's mainland. This move significantly improves investor relations and allows Hengrui Pharma to tap into a wider pool of capital for future growth initiatives. The enhanced brand building and increased global reach associated with a Hong Kong listing will further strengthen Hengrui Pharma's international presence.

- Improved access to international capital: This will fuel research and development, acquisitions, and expansion into new markets.

- Enhanced brand recognition in Asia and globally: Listing on a reputable exchange like the Hong Kong Stock Exchange enhances credibility and attracts global investors.

- Potential for mergers and acquisitions opportunities: Increased capital and market visibility create opportunities for strategic acquisitions to expand the company's product portfolio and market share.

Market Reaction and Analyst Outlook

The news of the approved Hong Kong share sale was met with largely positive market sentiment. Initial reactions from investors indicate a strong level of interest in Hengrui Pharma's offering. Industry analysts have expressed generally positive outlooks, with many highlighting the company's strong financial performance and growth potential. However, as with any investment, potential risks and challenges exist, including market volatility and competition within the pharmaceutical sector.

- Initial stock price movement: (To be updated post-listing)

- Analyst ratings and price targets: (Include specific analyst quotes and ratings if available)

- Potential risks and challenges: Increased competition, regulatory hurdles, and fluctuations in global markets.

Comparison with other Pharmaceutical IPOs in Hong Kong

Several other pharmaceutical companies have successfully launched IPOs in Hong Kong in recent years. A comparative analysis of Hengrui Pharma's share sale with these previous IPOs reveals both similarities and differences. Factors such as fundraising amounts, market valuations, and post-IPO performance can be compared to gauge the potential success of Hengrui Pharma's offering. Understanding these market trends and the competitive landscape within the Hong Kong pharmaceutical sector provides crucial context.

- Similar companies that have listed in Hong Kong: (List examples and briefly describe their performance)

- Comparison of fundraising amounts and market valuations: (Comparative data table if available)

- Analysis of post-IPO performance: (Analyze the stock performance of comparable companies)

Conclusion: Investing in Hengrui Pharma's Future through the Hong Kong Share Sale

The approval of Hengrui Pharma's Hong Kong share sale marks a pivotal moment for the company and the broader pharmaceutical industry in China. This strategic move will significantly enhance the company's access to capital, expand its global reach, and strengthen its brand recognition. While market risks exist, the overall outlook for Hengrui Pharma remains positive based on analyst forecasts and initial market reaction. The Hengrui Pharma Hong Kong share sale presents a compelling investment opportunity for those interested in the growth of the Chinese pharmaceutical sector. Stay updated on future developments and consider learning more about this exciting investment opportunity. (Link to relevant resources, if available)

Featured Posts

-

Nyt Strands Game 422 Hints And Answers For April 29th Tuesday

Apr 29, 2025

Nyt Strands Game 422 Hints And Answers For April 29th Tuesday

Apr 29, 2025 -

Financial Update How Xs Debt Sale Reshaped The Company

Apr 29, 2025

Financial Update How Xs Debt Sale Reshaped The Company

Apr 29, 2025 -

Cost Cutting Measures Surge As U S Faces Tariff Uncertainty

Apr 29, 2025

Cost Cutting Measures Surge As U S Faces Tariff Uncertainty

Apr 29, 2025 -

Negative European Electricity Prices A Solar Energy Success Story

Apr 29, 2025

Negative European Electricity Prices A Solar Energy Success Story

Apr 29, 2025 -

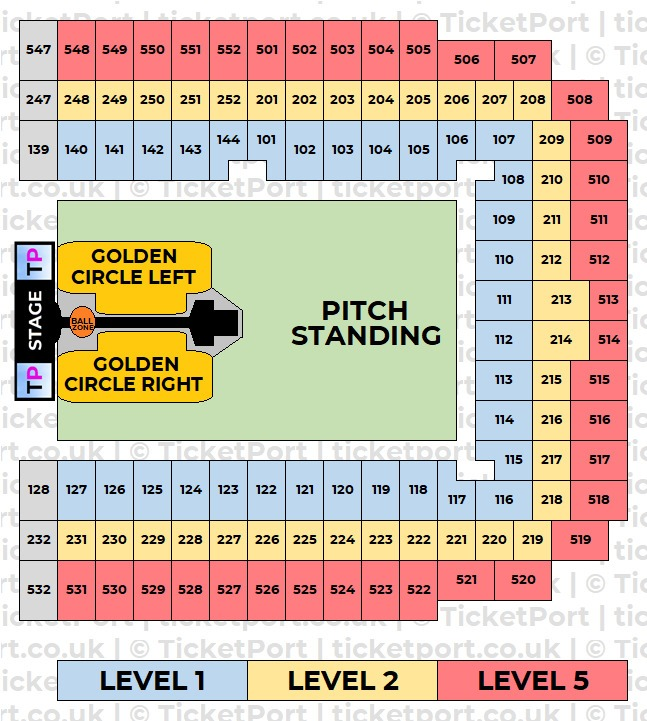

Capital Summertime Ball 2025 How To Purchase Tickets Successfully

Apr 29, 2025

Capital Summertime Ball 2025 How To Purchase Tickets Successfully

Apr 29, 2025

Latest Posts

-

The Devastating Nightmare The Impact Of The Gaza Hostage Crisis On Families

May 13, 2025

The Devastating Nightmare The Impact Of The Gaza Hostage Crisis On Families

May 13, 2025 -

Gaza Hostage Crisis The Nightmare Continues For Families

May 13, 2025

Gaza Hostage Crisis The Nightmare Continues For Families

May 13, 2025 -

Prolonged Hostage Crisis In Gaza The Human Cost For Families

May 13, 2025

Prolonged Hostage Crisis In Gaza The Human Cost For Families

May 13, 2025 -

Nightmare For Families The Ongoing Gaza Hostage Crisis

May 13, 2025

Nightmare For Families The Ongoing Gaza Hostage Crisis

May 13, 2025 -

The Prolonged Suffering Of Families With Hostages In Gaza

May 13, 2025

The Prolonged Suffering Of Families With Hostages In Gaza

May 13, 2025