Impact Of 31% Pay Cut On BP's Chief Executive

Table of Contents

The Details of the Pay Cut

The specifics of Bernard Looney's pay reduction reveal a substantial decrease in his overall compensation. While precise figures may vary depending on the final accounting, reports indicate a significant reduction across the board. The reasons cited by BP for this salary reduction are multifaceted, likely a combination of factors. Performance-related metrics, increased pressure from shareholders concerned about executive compensation, and a shift in company priorities towards greater sustainability and social responsibility all played a role. Comparing this year's compensation to previous years highlights a dramatic difference. Looney's previous remuneration package placed him amongst the highest-paid executives in the oil and gas industry. This drastic cut represents a significant departure from this trend.

- Specific percentage reduction: Reports suggest a reduction of approximately 31% in total compensation, encompassing base salary, bonus, and long-term incentive plans.

- Total compensation: While precise pre- and post-cut figures remain subject to final accounting, the reduction amounts to millions of dollars.

- Context within BP's structure: The move contextualizes within BP's broader efforts to improve its image and address concerns about executive pay disparity within the company.

Shareholder Reaction and Activism

Shareholder reaction to the BP CEO pay cut has been largely positive, although some voiced concerns about the potential impact on Looney’s motivation. The role of activist investors in influencing this decision remains a subject of debate. While no single activist group directly claimed responsibility, increasing pressure from investor groups focused on responsible investing and executive pay alignment likely contributed to BP's decision. Shareholder concerns extend beyond this specific instance; the broader issue is aligning executive pay with company performance and ensuring fair compensation relative to employee salaries.

- Shareholder quotes: Several institutional investors have publicly praised the move, highlighting it as a step in the right direction towards better corporate governance.

- Shareholder resolutions: While no specific resolution directly targeting Looney’s pay was filed, the ongoing dialogue around executive compensation within the company suggests a broader shift in shareholder expectations.

- Relevant news articles: Major financial news outlets have extensively covered this event, providing further insights into shareholder sentiment and the debate surrounding executive pay.

Wider Implications for Corporate Governance

The BP CEO pay cut has significant implications for corporate governance, particularly within the energy sector. This action could trigger a domino effect, prompting other energy companies to reassess their executive compensation strategies and potentially adjust their policies. The changing expectations of stakeholders emphasize the importance of incorporating Environmental, Social, and Governance (ESG) factors into compensation decisions. This includes aligning executive pay with long-term sustainability goals and broader social responsibility initiatives. Future reforms in executive compensation are likely, driven by government regulation and the adoption of industry best practices.

- Examples in other companies: Several companies in other sectors have recently undertaken similar reviews of executive compensation, suggesting a broader shift in corporate attitudes.

- Trends in executive compensation: Analysis shows a growing trend towards more transparent and responsible executive pay practices, particularly within industries facing increased scrutiny from stakeholders.

- Predictions for future changes: Experts predict increased regulatory oversight and further pressure from investors demanding alignment between executive pay and long-term company value.

The Future of BP's Leadership Under Scrutiny

The 31% BP CEO pay cut significantly impacts Looney's standing, both within BP and the wider industry. It could affect employee morale and motivation, raising questions about fairness and equity within the company. The long-term effects of this decision on BP's strategic direction are uncertain. Whether this demonstrates a genuine commitment to responsible leadership or a reactive measure to appease shareholders remains to be seen.

- Possible scenarios for Looney's future: The pay cut could impact Looney’s long-term prospects at BP, despite his continued leadership role.

- Expert opinions: Industry experts offer diverse perspectives, with some viewing this as a positive step toward responsible corporate governance, while others express concern about its potential impact on leadership stability.

- Impact on employee retention: The pay cut's influence on employee retention and overall company morale remains a crucial factor to be monitored over time.

Conclusion

The BP CEO's 31% pay cut is a significant development, showcasing a shift in attitudes toward executive compensation. The financial details, shareholder response, and wider implications for corporate governance highlight the increasing pressure on companies to adopt more responsible and transparent pay structures. This event serves as a potential turning point, indicating a growing trend towards greater alignment between executive pay and long-term company value and sustainability.

The BP CEO pay cut is a significant development, prompting crucial questions about corporate responsibility and executive compensation. Stay informed about future developments in this evolving landscape and continue to monitor the impact of this decision on BP and the wider corporate world by following our coverage of executive pay and corporate governance. Learn more about the complexities of BP CEO pay and the impact of executive compensation on company performance.

Featured Posts

-

Iskrena Ispovest Vanje Mijatovic O Razvodu Puna Istina

May 22, 2025

Iskrena Ispovest Vanje Mijatovic O Razvodu Puna Istina

May 22, 2025 -

Racial Hatred Tweet Ex Tory Councillors Wife Seeks Sentence Appeal

May 22, 2025

Racial Hatred Tweet Ex Tory Councillors Wife Seeks Sentence Appeal

May 22, 2025 -

Late Snowfall Hits Southern French Alps Storm Impacts

May 22, 2025

Late Snowfall Hits Southern French Alps Storm Impacts

May 22, 2025 -

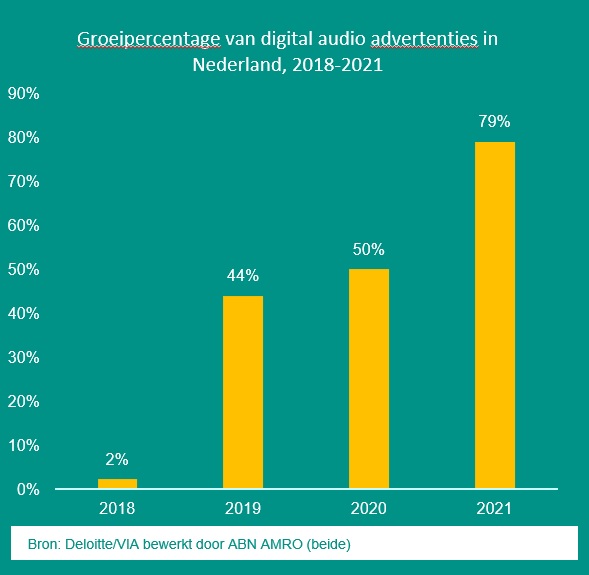

Abn Amro Aex Koersreactie Op Laatste Kwartaalcijfers

May 22, 2025

Abn Amro Aex Koersreactie Op Laatste Kwartaalcijfers

May 22, 2025 -

Aimscap Wtt Strategies For Success In The World Trading Tournament

May 22, 2025

Aimscap Wtt Strategies For Success In The World Trading Tournament

May 22, 2025

Latest Posts

-

Toenemend Autobezit Impact Op Occasionverkoop Bij Abn Amro

May 22, 2025

Toenemend Autobezit Impact Op Occasionverkoop Bij Abn Amro

May 22, 2025 -

Abn Amro Bonus Practices Under Scrutiny Potential Fine From Dutch Regulator

May 22, 2025

Abn Amro Bonus Practices Under Scrutiny Potential Fine From Dutch Regulator

May 22, 2025 -

Abn Amro Ziet Forse Groei In Occasionverkoop Dankzij Toenemend Autobezit

May 22, 2025

Abn Amro Ziet Forse Groei In Occasionverkoop Dankzij Toenemend Autobezit

May 22, 2025 -

Occasionverkoop Abn Amro Flink Gestegen Door Meer Autobezitters

May 22, 2025

Occasionverkoop Abn Amro Flink Gestegen Door Meer Autobezitters

May 22, 2025 -

Half Dome Agency Appointed For Abn Group Victoria Media

May 22, 2025

Half Dome Agency Appointed For Abn Group Victoria Media

May 22, 2025