Is A Housing Market Correction Imminent In Canada? A Posthaste Look

Table of Contents

Rising Interest Rates and Their Impact

Rising interest rates are a significant factor influencing the Canadian housing market. The Bank of Canada's interest rate hikes directly impact borrowing costs and mortgage affordability. Increased mortgage payments significantly reduce the purchasing power of potential homebuyers, leading to decreased demand. This reduced demand can, in turn, trigger price reductions and a potential market correction. Several key aspects demonstrate this impact:

-

Impact of Bank of Canada rate increases on variable-rate mortgages: Variable-rate mortgages are directly affected by Bank of Canada rate changes, leading to immediate increases in monthly payments. This can put significant pressure on borrowers, potentially leading to defaults or a reduced ability to participate in the market.

-

Increased stress test requirements for mortgages: The stricter stress test requirements for mortgages make it more difficult for buyers to qualify for loans, further dampening demand. This reduced access to financing limits the number of potential buyers actively searching for properties.

-

Reduced purchasing power due to higher interest rates: Higher interest rates translate to larger monthly mortgage payments, reducing the amount buyers can afford to spend on a home. This shrinks the pool of potential buyers and impacts pricing pressures.

-

Potential for increased foreclosures and distressed sales: As borrowers struggle with higher mortgage payments, the potential for increased foreclosures and distressed sales rises. These distressed sales can put downward pressure on prices and accelerate a market correction.

Overvalued Housing Markets in Specific Canadian Cities

Certain Canadian cities exhibit potentially overvalued housing markets. A comparison of price-to-income ratios and other valuation metrics with historical data and international benchmarks reveals potential vulnerabilities. While some markets remain strong, others show signs of being stretched beyond sustainable levels.

-

Case studies of specific cities with high price-to-income ratios: Cities like Toronto and Vancouver consistently rank among those with the highest price-to-income ratios, indicating potential overvaluation. Analyzing these ratios against historical averages and international comparisons provides valuable insights into market sustainability.

-

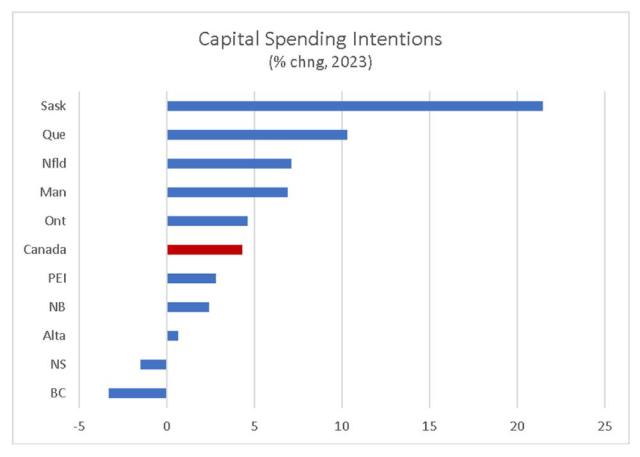

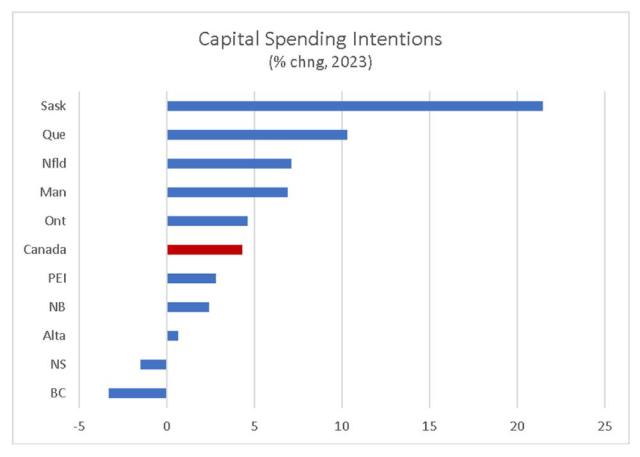

Analysis of market fundamentals in different regions: A regional market analysis reveals disparities across Canada. While some areas might experience sustained growth, others are more susceptible to a correction. Understanding these regional differences is crucial for accurate market forecasting.

-

Comparison with international housing market valuations: Comparing Canadian housing prices with those in other developed countries provides valuable context. This comparison helps identify whether Canadian prices are significantly out of line with international norms.

-

Identification of potential hotspots for correction: By analyzing these factors, we can pinpoint specific cities and regions that are more vulnerable to a housing market correction in the near future.

Inventory Levels and Market Supply

The current housing inventory levels and their impact on market dynamics are critical considerations. A significant imbalance between supply and demand can influence price fluctuations. The potential for increased supply to ease market pressures is a key factor in assessing the likelihood of a correction.

-

Comparison of current inventory levels with historical data: Analyzing current inventory levels relative to historical data provides context and reveals potential trends. A significant increase in inventory could signal a shift in market dynamics.

-

Analysis of new construction starts and completions: The rate of new housing construction directly influences supply. An increase in new listings can ease the pressure on prices and reduce the likelihood of a steep correction.

-

Impact of immigration on housing demand: Canada's immigration policies significantly impact housing demand. A high rate of immigration increases demand, placing upward pressure on prices.

-

The potential for increased new listings to affect prices: An increase in new listings could lead to a more balanced market, putting downward pressure on prices and moderating potential price increases.

Economic Factors Influencing the Canadian Housing Market

The broader economic context significantly influences the Canadian housing market. Key economic indicators such as inflation, unemployment, and consumer confidence play a crucial role. An economic slowdown could potentially trigger a market correction.

-

Impact of inflation on housing affordability: High inflation reduces purchasing power and makes mortgages more expensive, impacting affordability. This can lead to a reduction in demand and potentially lower prices.

-

Effects of unemployment rates on buyer demand: High unemployment rates reduce buyer confidence and decrease demand, contributing to price stabilization or even declines.

-

Influence of consumer confidence on housing market sentiment: Consumer confidence strongly influences housing market sentiment. Lower confidence can lead to reduced buying activity and slower price growth.

-

Potential for an economic slowdown to trigger a market correction: A significant economic slowdown can trigger a correction, as buyers become more cautious and lenders tighten lending standards.

Conclusion

Several factors point to the potential for a housing market correction in Canada. Rising interest rates, overvalued markets in specific cities, and potential economic slowdowns all contribute to this possibility. However, the timing and severity of any correction remain uncertain. Monitoring interest rates, housing inventory, and broader economic conditions is crucial.

Call to Action: Stay informed about the evolving Canadian housing market. Regularly check for updates on interest rates, inventory levels, and economic forecasts to make informed decisions regarding your Canadian real estate investments. Understanding the potential for a Canadian housing market correction is crucial for navigating the market successfully. Continue to research the potential for a Canadian housing market correction to make informed decisions.

Featured Posts

-

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

May 22, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

May 22, 2025 -

Thuc Trang Va Trien Vong Phat Trien Ha Tang Giao Thong Tp Hcm Binh Duong

May 22, 2025

Thuc Trang Va Trien Vong Phat Trien Ha Tang Giao Thong Tp Hcm Binh Duong

May 22, 2025 -

Women And Finance 3 Costly Errors To Prevent

May 22, 2025

Women And Finance 3 Costly Errors To Prevent

May 22, 2025 -

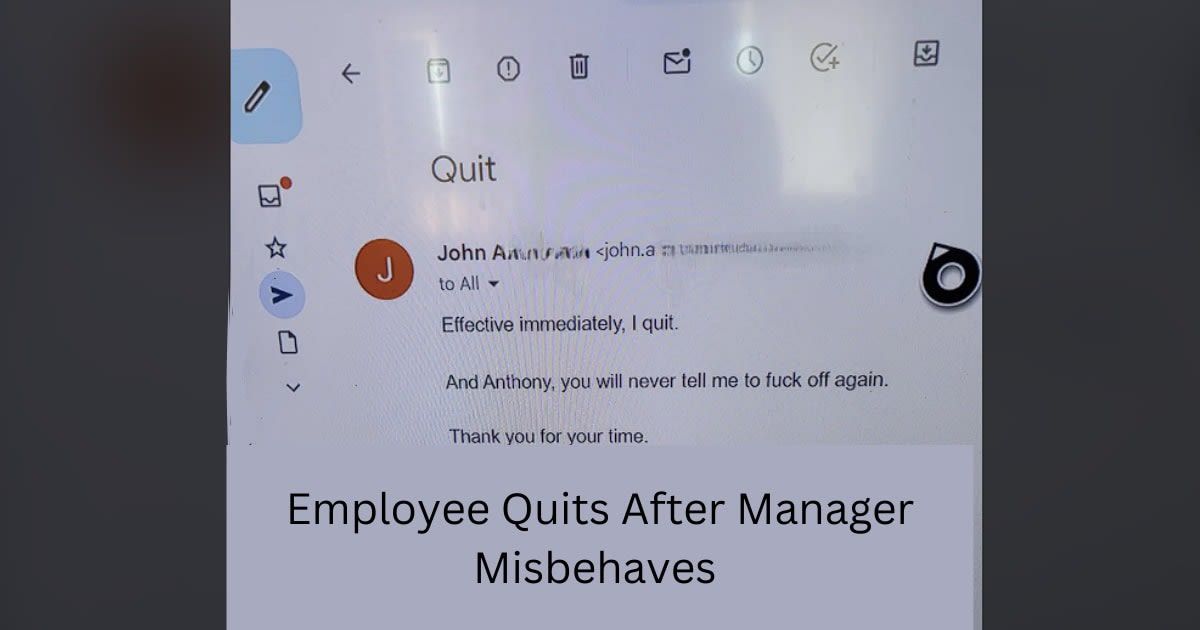

Landladys Explosive Outburst Employee Resignation Sparks Angry Tirade

May 22, 2025

Landladys Explosive Outburst Employee Resignation Sparks Angry Tirade

May 22, 2025 -

Core Weave Initial Public Offering 40 Listing Price Announced

May 22, 2025

Core Weave Initial Public Offering 40 Listing Price Announced

May 22, 2025

Latest Posts

-

Recent Drop In Illinois Gas Prices Part Of National Pattern

May 22, 2025

Recent Drop In Illinois Gas Prices Part Of National Pattern

May 22, 2025 -

Route 15 On Ramp Closed Motor Vehicle Accident

May 22, 2025

Route 15 On Ramp Closed Motor Vehicle Accident

May 22, 2025 -

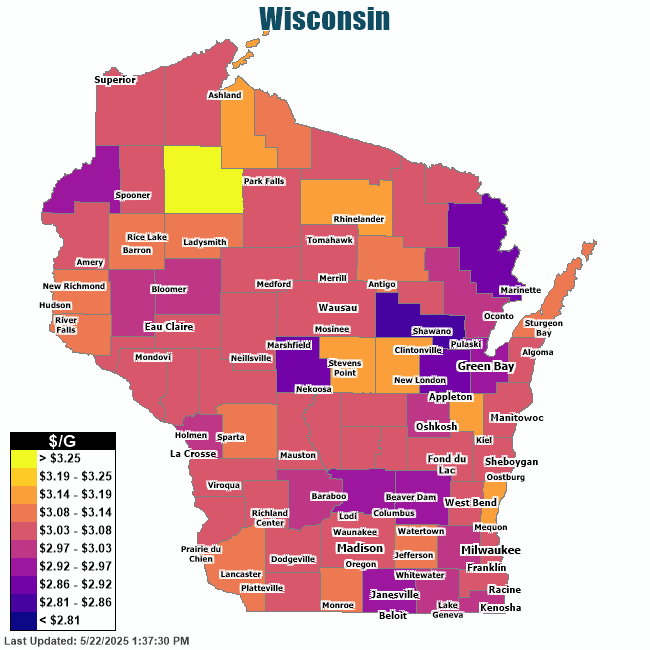

Why Are Gas Prices So High In Southeast Wisconsin

May 22, 2025

Why Are Gas Prices So High In Southeast Wisconsin

May 22, 2025 -

Understanding The Aftermath Of The Lancaster City Stabbing Incident

May 22, 2025

Understanding The Aftermath Of The Lancaster City Stabbing Incident

May 22, 2025 -

Illinois Gas Prices Continue Downward Trend Nationwide

May 22, 2025

Illinois Gas Prices Continue Downward Trend Nationwide

May 22, 2025