Moody's Downgrade: Impact On Dow Futures And The Dollar

Table of Contents

Immediate Impact on Dow Futures

The announcement of the Moody's downgrade triggered an immediate and noticeable decline in Dow Jones Industrial Average futures contracts. This reflects investor apprehension regarding the implications of the downgrade on corporate earnings and overall economic growth. The impact on Dow futures was multifaceted:

- Increased Volatility: Dow futures experienced heightened volatility in the hours following the downgrade, reflecting the uncertainty gripping the market. Rapid price swings became the norm as traders reacted to the news.

- Selling Pressure: Investors responded by selling off futures contracts, contributing significantly to the decline. This selling pressure was driven by a combination of fear and uncertainty about the future.

- Short-Term Impact vs. Long-Term Implications: The initial drop in Dow futures may be short-lived, but the sustained negative impact will depend heavily on the broader economic response to the downgrade and the Federal Reserve's actions. Long-term implications are still unfolding.

The Effect on the US Dollar

The downgrade's impact on the US dollar proved complex. While some anticipated a weakening of the dollar, its status as a safe-haven asset played a significant role.

- Initial Weakening: Some investors initially viewed the downgrade negatively, leading to a slight weakening of the US dollar against other major currencies. This reaction was based on concerns about the US economy's future.

- Safe-Haven Demand: Conversely, the uncertainty created by the downgrade also led some investors to seek the perceived safety of the US dollar, potentially strengthening its value against other currencies considered riskier. This is a typical reaction to global uncertainty.

- Interest Rate Implications: The Federal Reserve's response to the downgrade and its potential impact on interest rates will be crucial in determining future dollar movements. Higher interest rates could attract investment, strengthening the dollar, but could also slow economic growth.

Understanding Moody's Rationale for the Downgrade

Moody's cited several key factors in its decision to downgrade the US credit rating. Understanding these factors is essential for grasping the full implications of the downgrade.

- Fiscal Challenges: High and rising government debt levels were a primary concern. The US has a large and growing national debt, putting a strain on government finances.

- Debt Ceiling Debate: The recurring political battles surrounding the debt ceiling further eroded confidence in the US government's ability to manage its finances effectively. The repeated near-misses with default damaged investor confidence.

- Erosion of Governance Strength: Moody's also pointed to a deterioration in the quality of governance and a weakening of fiscal strength, highlighting concerns about political polarization and its impact on responsible fiscal policy.

Long-Term Implications and Potential Scenarios

The Moody's downgrade carries significant long-term implications for the US economy, influencing various aspects of the economic landscape.

- Potential for Increased Inflation: The downgrade might contribute to inflationary pressures, as the government may struggle to control spending without increasing borrowing costs.

- Increased Borrowing Costs: The US government may face significantly increased borrowing costs, potentially impacting future spending on vital programs and slowing economic growth.

- Recessionary Risks: The downgrade could elevate the risks of a recession, especially if combined with other negative economic factors. Careful risk management strategies are crucial for investors.

Conclusion

The Moody's downgrade represents a significant event with far-reaching implications for Dow futures, the US dollar, and the broader global economy. The immediate market reactions offer only a snapshot of the potential long-term consequences. Understanding the rationale behind the downgrade and its potential impact on key economic indicators is crucial for investors and policymakers alike. Staying informed about the evolving situation and its effect on the Moody's downgrade, Dow futures, and the dollar is essential for navigating the complexities of the current market landscape. Continue to monitor news and analysis to adapt your investment strategies accordingly. Understanding the impact of this Moody's downgrade is vital for informed decision-making.

Featured Posts

-

Alito And Roberts Third Decade A Look Back And Ahead

May 21, 2025

Alito And Roberts Third Decade A Look Back And Ahead

May 21, 2025 -

Access To Birth Control The Impact Of Over The Counter Options In A Post Roe World

May 21, 2025

Access To Birth Control The Impact Of Over The Counter Options In A Post Roe World

May 21, 2025 -

Real Madrid Manager Speculation Klopps Agent Speaks Out

May 21, 2025

Real Madrid Manager Speculation Klopps Agent Speaks Out

May 21, 2025 -

Nantes Impact De La Construction Sur L Emploi Des Cordistes

May 21, 2025

Nantes Impact De La Construction Sur L Emploi Des Cordistes

May 21, 2025 -

Restauration Du Patrimoine Breton Plouzane Et Clisson Selectionnes Pour La Mission Patrimoine 2025

May 21, 2025

Restauration Du Patrimoine Breton Plouzane Et Clisson Selectionnes Pour La Mission Patrimoine 2025

May 21, 2025

Latest Posts

-

Wintry Mix Of Rain And Snow Impacts And Safety Precautions

May 21, 2025

Wintry Mix Of Rain And Snow Impacts And Safety Precautions

May 21, 2025 -

Driving Safely During A Wintry Mix Of Rain And Snow

May 21, 2025

Driving Safely During A Wintry Mix Of Rain And Snow

May 21, 2025 -

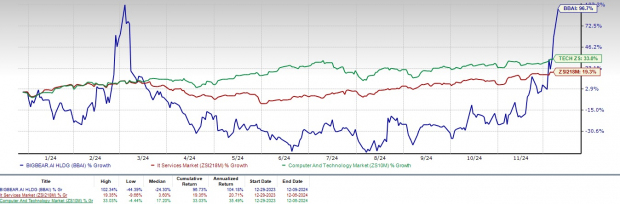

Investing In Big Bear Ai A Practical Guide Based On Motley Fool Insights

May 21, 2025

Investing In Big Bear Ai A Practical Guide Based On Motley Fool Insights

May 21, 2025 -

Big Bear Ai Stock Current Market Analysis And Investment Potential

May 21, 2025

Big Bear Ai Stock Current Market Analysis And Investment Potential

May 21, 2025 -

Big Bear Ai To Buy Or Not To Buy An In Depth Stock Evaluation

May 21, 2025

Big Bear Ai To Buy Or Not To Buy An In Depth Stock Evaluation

May 21, 2025