Nicki Chapman Reveals How She Made £700,000 From A Country Property Investment

Table of Contents

Nicki Chapman's Property Investment Journey

Early Investments and Strategic Choices

Nicki Chapman's journey into property investment, while not publicly detailed in extensive interviews, likely began with a focus on understanding the market and identifying opportunities. Her initial investments probably reflected a cautious approach, common for many starting in the UK property investment market. While the specifics of her early purchases remain largely private, we can infer some likely characteristics based on her later successes.

- Examples of early property purchases: It's plausible she began with smaller-scale properties, perhaps focusing on fixer-uppers in less competitive areas, allowing for greater potential returns through renovation.

- Initial investment capital: Her initial investment capital was likely modest, possibly accumulated through her television career and supplemented by savings. This suggests a strategy of gradual growth and reinvestment.

- Location choices: Early purchases likely focused on areas with growth potential but lower entry costs than prime London locations. This points towards a strategy of seeking undervalued properties in up-and-coming rural areas.

- Types of properties: Her early portfolio likely consisted of renovation projects and potentially some buy-to-let properties, generating rental income while also appreciating in value.

- Risk tolerance and initial investment strategy: Her early strategy likely leaned towards conservative, carefully managing risk and prioritizing capital preservation while exploring opportunities for steady growth.

- Mentors or advisors: It’s likely she sought guidance from experienced property investors or financial advisors, assisting in her decision-making process and risk management.

Key Strategies for Country Property Investment Success (à la Nicki Chapman)

Identifying Undervalued Properties

Finding hidden gems is crucial for successful country property investment. While details of Nicki Chapman's specific methods remain private, her success suggests a keen eye for potential.

- Methods used to identify undervalued properties: Her approach likely involved a combination of thorough market research, leveraging local knowledge through networking within the community, and understanding the nuances of property valuations.

- Importance of due diligence: This involved comprehensive property inspections, reviewing legal documents, and potentially engaging professional surveyors to avoid hidden problems.

- Understanding property valuations: She likely mastered the art of assessing a property's true worth beyond the asking price, recognizing opportunities to negotiate favourable deals.

- Patience and perseverance: Finding the perfect investment takes time. Her success is a testament to the importance of patience and persistence in searching for undervalued opportunities.

- Buying at auction or via off-market deals: These strategies can offer significant discounts, demanding a level of expertise and speed that might have formed part of her strategy.

Renovation and Property Enhancement

Adding value through renovation is a cornerstone of many successful property investment strategies, and Nicki Chapman likely employed this approach effectively.

- Types of renovations undertaken: From cosmetic improvements to more substantial structural changes, renovations likely aimed to increase the property's market value and rental potential.

- Cost management techniques: A key element of success is managing renovation costs efficiently, likely through meticulous planning and careful selection of contractors.

- Building a strong team of contractors: Developing strong relationships with reliable and skilled contractors is essential for a smooth and cost-effective renovation process.

- Maximizing return on investment through renovations: Prioritizing renovations with high returns and avoiding unnecessary spending is crucial for maximizing profit.

- Property staging and presentation: Making a property visually appealing enhances its value and attracts buyers willing to pay a premium.

- Planning permission and building regulations: Strict adherence to regulations is paramount, avoiding potential delays and penalties.

Building a Diversified Property Portfolio

Mitigating risk through diversification is a key principle of sound investment, and Nicki Chapman likely diversified her portfolio geographically and in property type.

- Different types of properties in her portfolio: Her portfolio likely extends beyond residential properties to include other assets, potentially including commercial properties or even land for future development.

- Geographical diversification: Spreading investments across different regions reduces the impact of localized market downturns.

- Strategies for managing multiple properties: Effective management of multiple properties requires systems for handling tenants, maintenance, and finances efficiently.

- Long-term investment versus short-term flipping: Her strategy likely favoured long-term growth, although short-term flips might have played a role, particularly in the early stages.

- Managing rental properties: Efficient tenant management, prompt maintenance, and adhering to landlord regulations are essential for consistent rental income.

Lessons Learned and Advice for Aspiring Investors

The Importance of Research and Due Diligence

Thorough research is crucial before making any property investment. Nicki Chapman's success underscores the importance of due diligence.

- Understanding local market conditions: In-depth analysis of local market trends, supply and demand, and future development plans is key to identifying profitable opportunities.

- Conducting thorough property inspections: Identifying any potential problems before purchasing prevents costly surprises later.

- Seeking professional advice: Engaging solicitors, surveyors, and financial advisors provides expert guidance throughout the investment process.

- Risks of investing without adequate research: Ignoring thorough research increases the risks of making costly mistakes and losing investment capital.

- Market analysis and trend forecasting: Staying informed about market trends is crucial for making informed investment decisions.

Financial Planning and Risk Management

Sound financial planning and risk management are essential for successful property investment. Nicki Chapman's strategy likely incorporated these principles.

- Securing adequate financing: Finding suitable mortgages or other financing options is crucial, balancing loan terms and interest rates.

- Managing debt responsibly: Maintaining a healthy debt-to-income ratio is paramount to avoid financial stress.

- Diversifying investments to reduce risk: Spreading investments reduces exposure to potential losses in any single property or area.

- Protecting against unexpected costs and events: Building a financial buffer to absorb unforeseen expenses is prudent risk management.

- Having an emergency fund: An emergency fund provides financial security during unforeseen circumstances.

- Seeking professional financial advice: Consulting with a qualified financial advisor provides valuable guidance in managing finances effectively.

Conclusion

Nicki Chapman's success in country property investment demonstrates that significant wealth can be built through careful planning, diligent research, and a well-defined investment strategy. Her journey highlights the importance of identifying undervalued properties, adding value through renovation, and building a diversified portfolio. Her success story provides a compelling case study for those looking to achieve financial freedom through smart rural property investment.

Call to Action: Inspired by Nicki Chapman's success? Start your own journey towards building a profitable country property investment portfolio today! Learn more about strategies for successful UK property investment and unlock your potential for wealth creation in the thriving rural property market. Research potential investments and take the first step towards achieving your financial goals.

Featured Posts

-

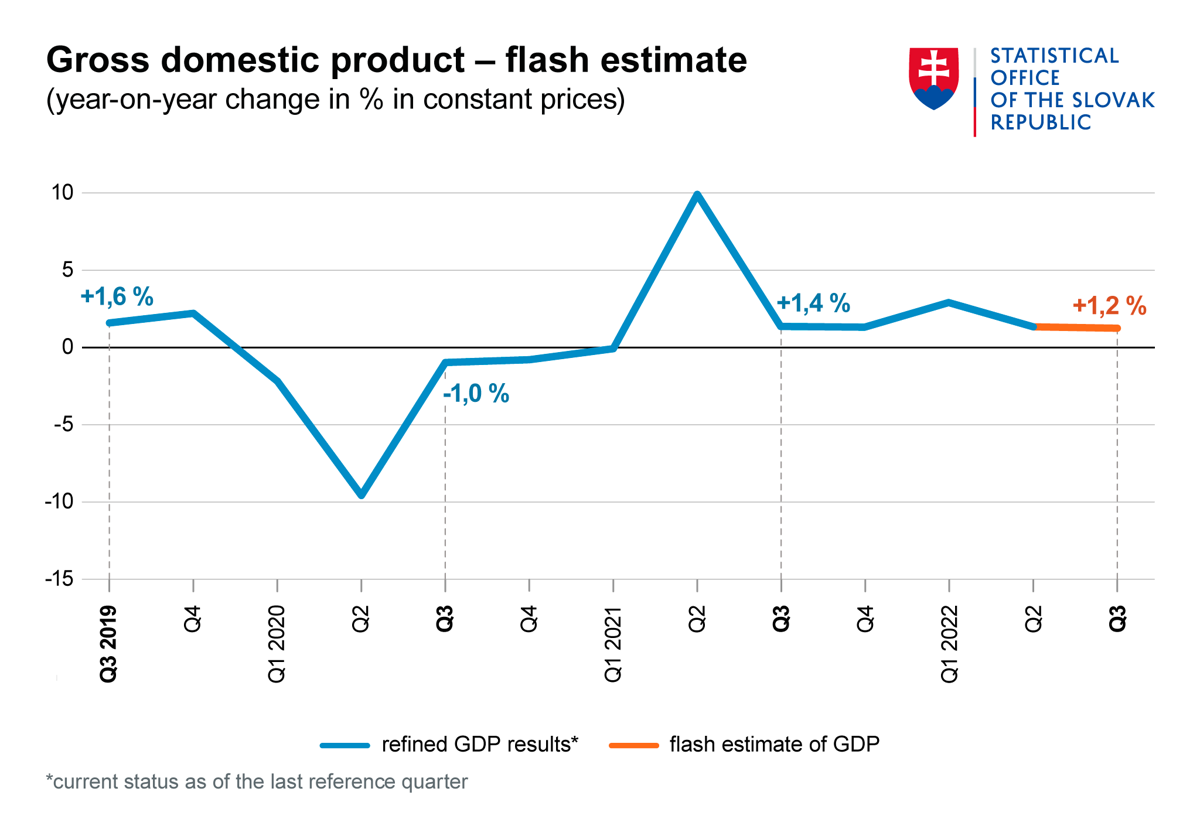

H Nonline Sk Nemecke Firmy A Masivne Prepustanie Dopady Hospodarskej Krizy

May 24, 2025

H Nonline Sk Nemecke Firmy A Masivne Prepustanie Dopady Hospodarskej Krizy

May 24, 2025 -

Porsche 956 Asili Sergi Teknik Detaylari Ve Sebepleri

May 24, 2025

Porsche 956 Asili Sergi Teknik Detaylari Ve Sebepleri

May 24, 2025 -

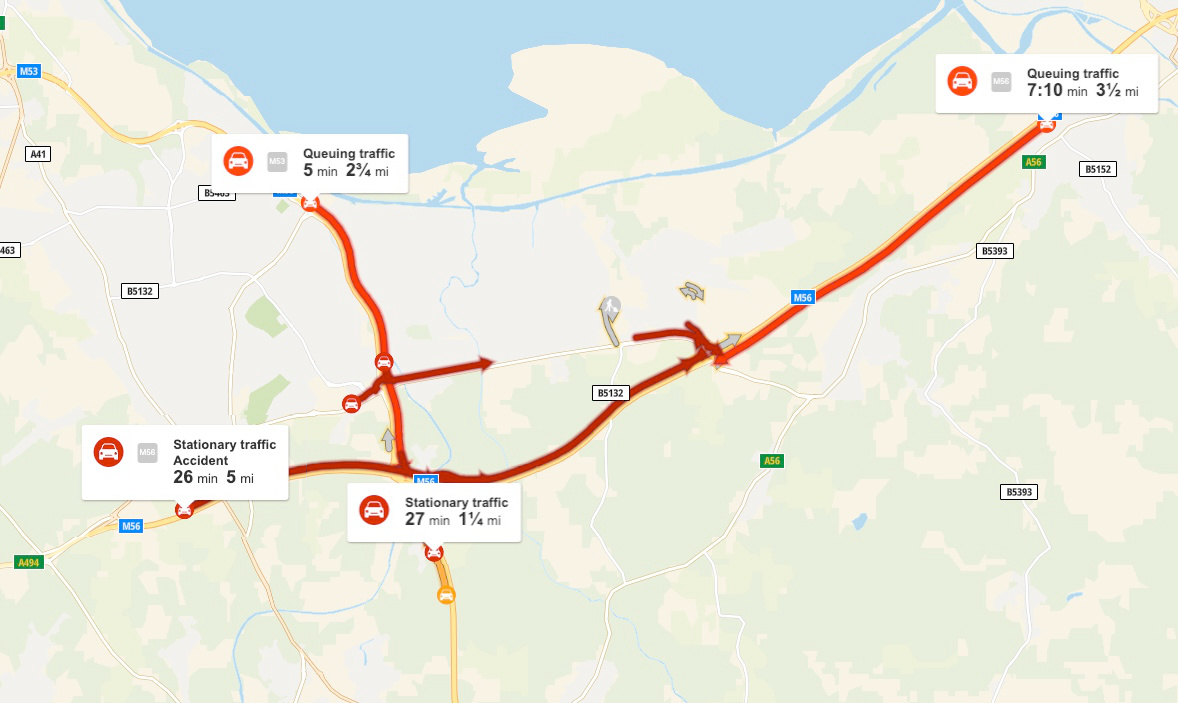

M56 Cheshire Deeside Traffic Update Following Collision

May 24, 2025

M56 Cheshire Deeside Traffic Update Following Collision

May 24, 2025 -

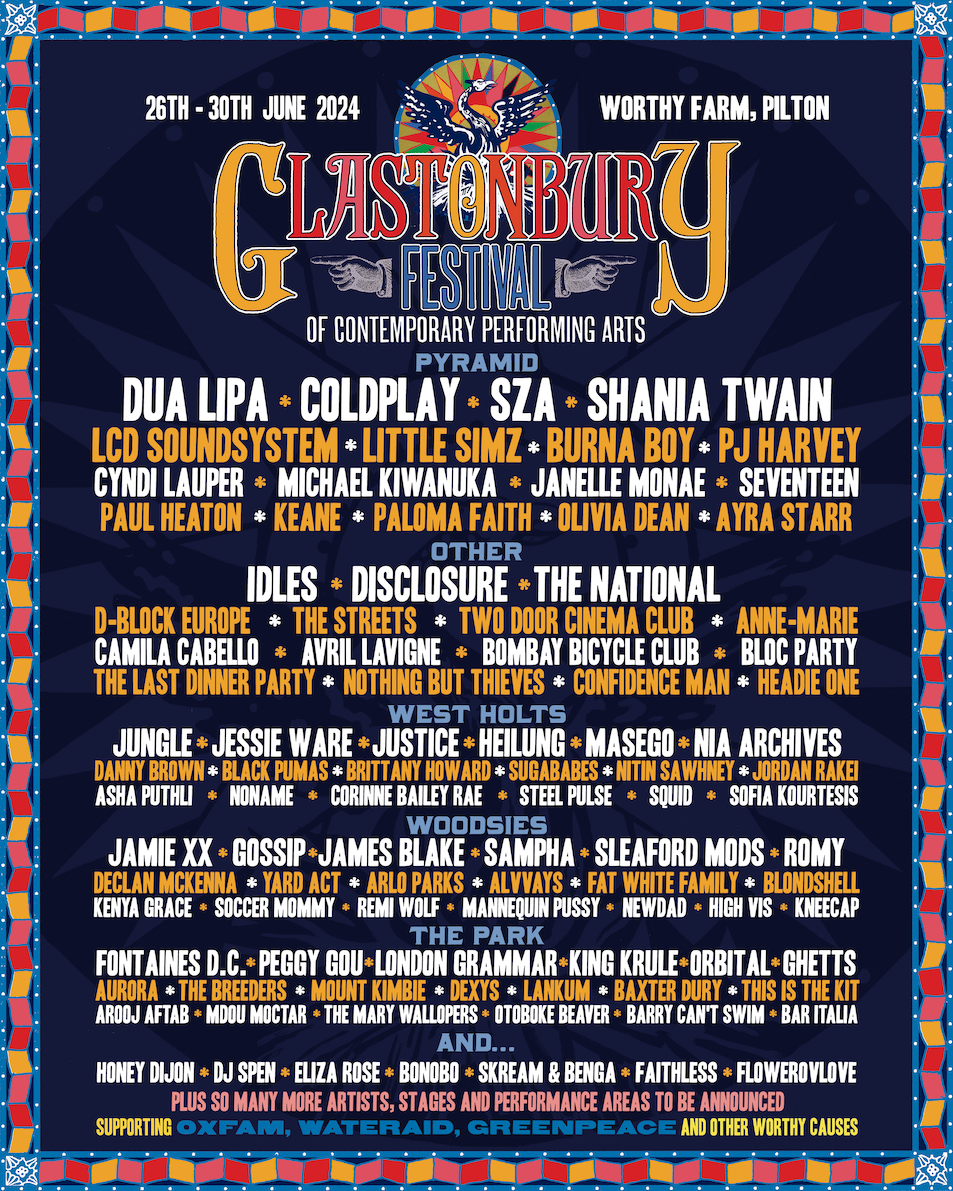

Glastonbury 2025 Lineup Announcement A Controversial Choice

May 24, 2025

Glastonbury 2025 Lineup Announcement A Controversial Choice

May 24, 2025 -

Ferrari Owners Guide Key Gear And Accessories

May 24, 2025

Ferrari Owners Guide Key Gear And Accessories

May 24, 2025

Latest Posts

-

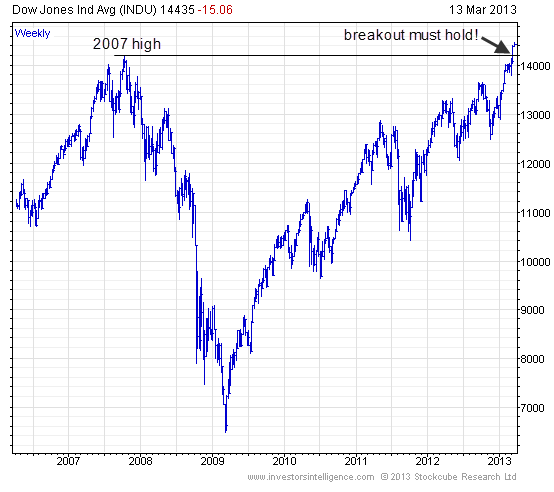

Amundi Dow Jones Industrial Average Ucits Etf A Nav Deep Dive

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Nav Deep Dive

May 24, 2025 -

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Drivers Face Hour Long Delays On M6 Southbound After Road Accident

May 24, 2025

Drivers Face Hour Long Delays On M6 Southbound After Road Accident

May 24, 2025 -

Significant Traffic Delays On M6 Southbound Following Collision

May 24, 2025

Significant Traffic Delays On M6 Southbound Following Collision

May 24, 2025 -

60 Minute Delays On M6 Southbound Due To Accident

May 24, 2025

60 Minute Delays On M6 Southbound Due To Accident

May 24, 2025