Oil Prices Today (May 16): News And Market Insights

Table of Contents

Current Oil Price Movements and Key Benchmarks

As of this morning, May 16th, Brent crude oil is trading at $X per barrel, while West Texas Intermediate (WTI) crude oil stands at $Y per barrel. This represents a Z% increase/decrease compared to yesterday's closing prices and an A% change from last week's prices. Early morning trading has shown some price volatility, with fluctuations of approximately B% observed so far.

- Brent Crude: $X/barrel (Change: +Z% from yesterday, +A% from last week)

- WTI Crude: $Y/barrel (Change: +Z% from yesterday, +A% from last week)

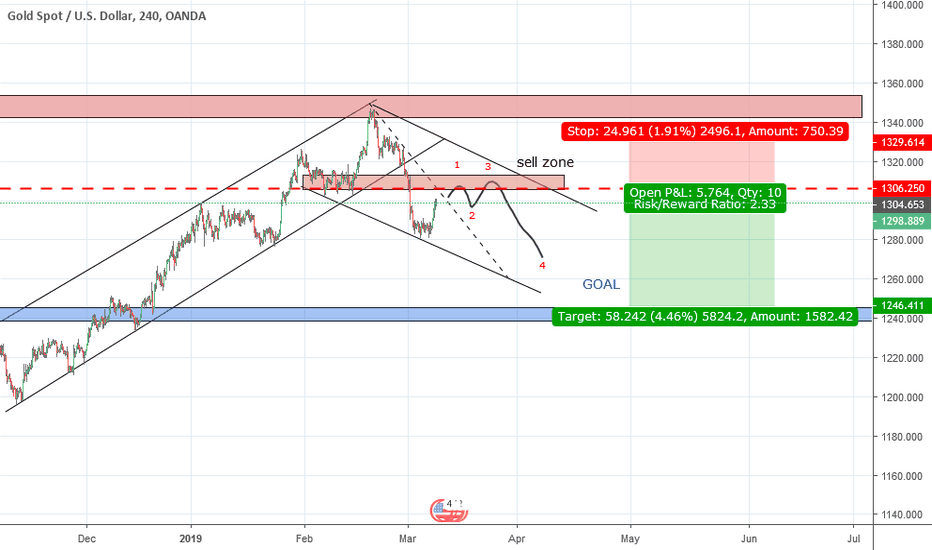

[Insert interactive chart here showing price movements of Brent and WTI crude oil over the past week. Clearly label axes and highlight significant price changes.]

The chart clearly illustrates the recent price surge/dip, highlighting the significant impact of [mention specific event, e.g., the OPEC+ announcement] on today's oil prices.

Factors Influencing Oil Prices Today

Several intertwined factors contribute to the current oil price dynamics. Understanding these drivers is crucial for navigating this complex market.

Geopolitical Events

Geopolitical risk remains a major influence on crude oil prices today. Ongoing tensions in [mention specific region, e.g., Eastern Europe], coupled with sanctions imposed on [mention specific country, e.g., Russia], continue to disrupt global oil supply chains, contributing to higher prices. The uncertainty surrounding future geopolitical developments adds further volatility to the market. Keywords: geopolitical risk, oil supply disruptions, sanctions impact.

OPEC+ Decisions

The recent OPEC+ decision to [explain the decision, e.g., further reduce oil production] is a key factor driving up today's oil prices. This move aims to [explain the stated goal, e.g., support oil prices and stabilize the market], but its long-term impact remains to be seen. Analysts are divided on whether this will effectively tighten supply or lead to unintended consequences. Keywords: OPEC+ production cuts, OPEC+ meeting, oil output.

Economic Indicators

Global economic indicators also play a significant role. Stronger-than-expected GDP growth in [mention specific region/country] boosts oil demand, while concerns about rising inflation in [mention specific region/country] could potentially dampen economic activity and reduce oil consumption. The interplay of these factors significantly influences the price outlook. Keywords: economic growth, inflation, oil demand outlook.

Energy Transition and Renewable Energy

The ongoing energy transition and the increasing adoption of renewable energy sources are gradually impacting long-term oil demand. However, the shift towards sustainable energy is a gradual process, and oil remains a crucial energy source in the foreseeable future. The increasing focus on ESG investing is also impacting investment decisions in the energy sector. Keywords: renewable energy, energy transition, ESG investing, sustainable energy.

Seasonal Demand

Seasonal fluctuations in demand also play a part. As we move into [mention season, e.g., summer], increased travel and industrial activity typically lead to higher oil consumption, potentially pushing prices upward.

Market Sentiment and Analyst Predictions

Overall market sentiment towards oil prices is currently [describe sentiment, e.g., cautiously bullish]. Many analysts believe that the recent OPEC+ decision, coupled with ongoing geopolitical uncertainties, will keep oil prices elevated in the near term.

- Analyst A: Predicts prices will reach $X by [date].

- Analyst B: Forecasts a price range of $X to $Y in the next quarter.

- Analyst C: Expresses concerns about potential downside risks related to [mention specific risk].

However, it's crucial to remember that oil price forecasts are inherently uncertain and subject to rapid changes based on unforeseen events.

Conclusion: Understanding Oil Prices Today and What's Next

Oil prices today reflect a complex interplay of geopolitical events, OPEC+ decisions, economic indicators, and market sentiment. The recent OPEC+ production cuts have significantly influenced the current price levels, with Brent and WTI crude exhibiting a notable increase. While the overall market sentiment is [reiterate sentiment], analysts hold diverse views on the short-term and long-term trajectory of oil prices. To stay informed about the ever-changing oil market and make well-informed decisions, understanding these dynamic factors is critical. Stay updated on oil prices today and future market insights by visiting [website/blog link] regularly and subscribing to our newsletter for daily updates on crude oil prices, oil market analysis and daily oil prices.

Featured Posts

-

Luxury And Tranquility Soundproof Apartments And Salons In Tokyos Real Estate Market

May 17, 2025

Luxury And Tranquility Soundproof Apartments And Salons In Tokyos Real Estate Market

May 17, 2025 -

Xauusd Gold Price Recovery Us Economic Data And Interest Rate Outlook

May 17, 2025

Xauusd Gold Price Recovery Us Economic Data And Interest Rate Outlook

May 17, 2025 -

Thrifty Shopping Getting High Quality Goods On A Budget

May 17, 2025

Thrifty Shopping Getting High Quality Goods On A Budget

May 17, 2025 -

Ev Mandate Opposition Grows Car Dealers Push Back

May 17, 2025

Ev Mandate Opposition Grows Car Dealers Push Back

May 17, 2025 -

Mariners Vs Reds Mlb Game Prediction Picks And Betting Odds

May 17, 2025

Mariners Vs Reds Mlb Game Prediction Picks And Betting Odds

May 17, 2025

Latest Posts

-

Josh Harts Impact On The Knicks A Draymond Green Comparison

May 17, 2025

Josh Harts Impact On The Knicks A Draymond Green Comparison

May 17, 2025 -

Josh Harts Status Will He Play Against The Celtics On February 23rd

May 17, 2025

Josh Harts Status Will He Play Against The Celtics On February 23rd

May 17, 2025 -

Learning From Setbacks A Weekly Review Of Failures

May 17, 2025

Learning From Setbacks A Weekly Review Of Failures

May 17, 2025 -

Josh Hart Injury Update Knicks Vs Celtics On February 23rd

May 17, 2025

Josh Hart Injury Update Knicks Vs Celtics On February 23rd

May 17, 2025 -

Week In Review Analyzing Failures For Future Success

May 17, 2025

Week In Review Analyzing Failures For Future Success

May 17, 2025