XAUUSD Gold Price Recovery: US Economic Data And Interest Rate Outlook

Table of Contents

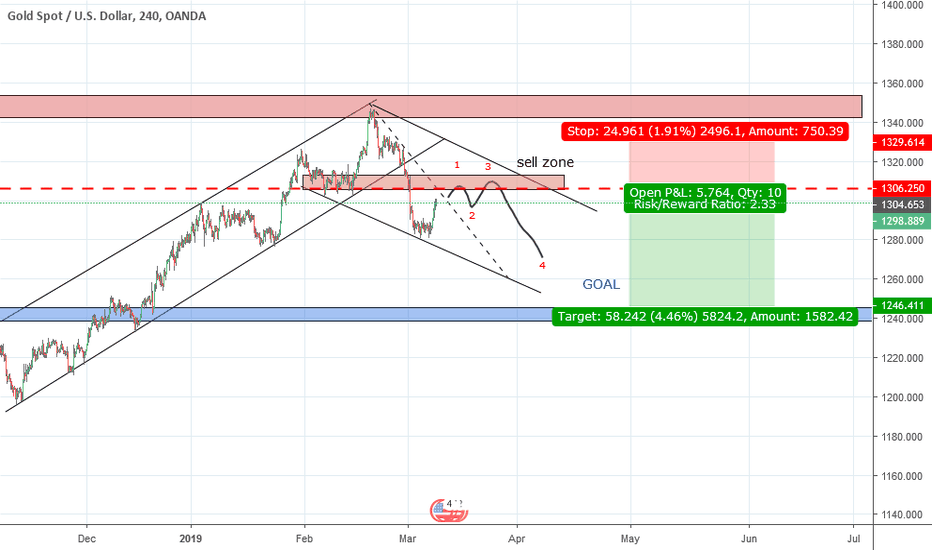

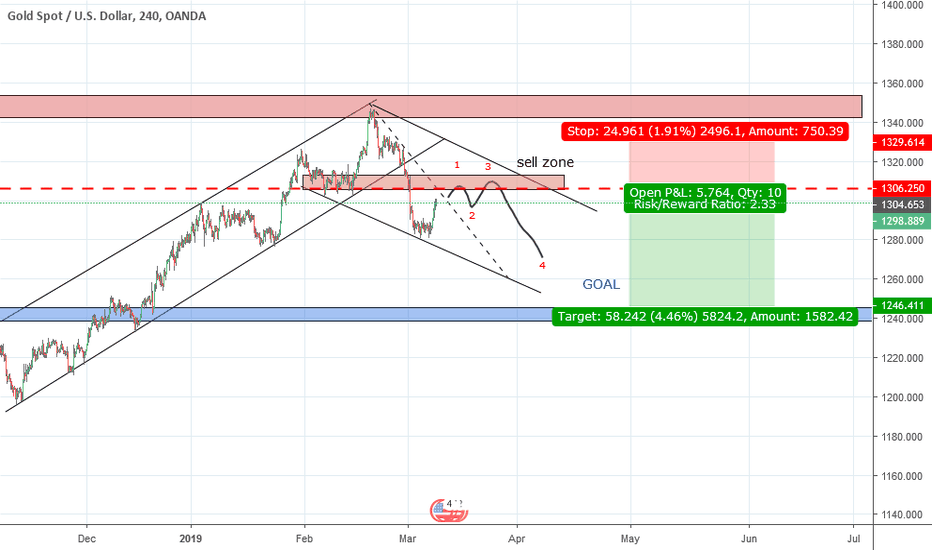

Impact of US Economic Data on XAUUSD

US economic data releases significantly impact the XAUUSD gold price. Understanding the correlation between these indicators and gold's performance is vital for navigating the market.

2.1.1. Inflation Data and its Correlation with Gold Prices

Gold often serves as an inflation hedge. When inflation is high, the purchasing power of fiat currencies decreases, leading investors to seek refuge in assets like gold, which historically maintains its value. Key inflation indicators like the Consumer Price Index (CPI) and Producer Price Index (PPI) are closely watched.

- CPI: Measures the average change in prices paid by urban consumers for a basket of consumer goods and services.

- PPI: Measures the average change over time in the selling prices received by domestic producers for their output.

High CPI and PPI readings generally indicate strong inflationary pressure, potentially boosting XAUUSD prices. For instance, the surge in inflation during the late 2021 and early 2022 period saw a corresponding rise in the XAUUSD price, as investors sought to protect their portfolios from eroding purchasing power. Conversely, lower-than-expected inflation figures can lead to a decline in XAUUSD.

2.1.2. Non-Farm Payroll (NFP) and its Influence on the XAUUSD

The Non-Farm Payroll (NFP) report, released monthly by the Bureau of Labor Statistics, provides crucial insights into US employment. Strong NFP numbers suggest a healthy economy, often leading to a stronger US dollar (USD). A stronger USD typically puts downward pressure on the XAUUSD, as gold is priced in USD. Conversely, weak NFP reports can weaken the dollar and potentially boost gold prices.

- Strong NFP: USD strengthens, XAUUSD weakens.

- Weak NFP: USD weakens, XAUUSD strengthens.

The NFP report’s influence extends beyond its direct impact on the dollar. It also significantly influences the Federal Reserve's monetary policy decisions, as strong employment data might encourage further interest rate hikes.

2.1.3. GDP Growth and its Effect on XAUUSD

Gross Domestic Product (GDP) growth reflects the overall health of the US economy. Strong GDP growth usually signals a robust economy, encouraging the Federal Reserve to raise interest rates to control inflation. Higher interest rates tend to increase the attractiveness of the dollar, leading to a decline in XAUUSD. Conversely, weak GDP growth or recessionary fears can increase the demand for safe-haven assets like gold, boosting the XAUUSD.

- High GDP Growth: Higher interest rates, potentially weaker XAUUSD.

- Low GDP Growth: Potential for lower interest rates or quantitative easing, potentially stronger XAUUSD.

The Federal Reserve's Interest Rate Decisions and XAUUSD

The Federal Reserve's monetary policy, particularly its interest rate decisions, exerts a significant influence on the XAUUSD.

2.2.1. Interest Rate Hikes and Their Impact on Gold Prices

Higher interest rates typically strengthen the US dollar, making gold, priced in USD, more expensive for investors holding other currencies. This often leads to a decline in XAUUSD. The Fed's actions aim to curb inflation by making borrowing more expensive, reducing consumer spending and economic activity.

- Rate hikes signal a strong economy (initially) and strengthen the dollar, thus weakening XAUUSD.

- Aggressive rate hikes can signal concerns about runaway inflation, leading to uncertainty and influencing XAUUSD volatility.

2.2.2. Interest Rate Cuts and Their Potential to Boost XAUUSD

Conversely, interest rate cuts by the Federal Reserve can weaken the dollar and potentially increase demand for gold. Rate cuts are often implemented during economic downturns or to stimulate economic growth. This can lead to increased investment in gold as a safe-haven asset, thus boosting the XAUUSD. Furthermore, quantitative easing (QE) programs, where central banks inject liquidity into the market, can also boost gold prices.

- Rate cuts often signal economic weakness, potentially boosting demand for safe-haven assets like gold.

- QE programs inject liquidity, potentially increasing inflationary pressures and boosting gold's appeal.

Conclusion: XAUUSD Gold Price Recovery - A Forward Look

The XAUUSD gold price is intricately linked to US economic data and the Federal Reserve's actions. Understanding the relationship between inflation (CPI, PPI), employment (NFP), GDP growth, and interest rate decisions is critical for predicting potential XAUUSD price movements. While strong economic indicators might initially support the dollar and depress gold prices, recessionary fears or unexpectedly high inflation could create safe-haven demand, boosting the XAUUSD. Continuous monitoring of these economic indicators and the Fed's pronouncements is vital for accurate XAUUSD gold price predictions. To gain a deeper understanding of the future outlook for XAUUSD gold price recovery, stay informed about upcoming economic releases and Federal Reserve policy announcements. Explore further resources for in-depth XAUUSD analysis and consider diversifying your investment portfolio accordingly. Stay informed and refine your XAUUSD trading strategy based on this crucial market data.

Featured Posts

-

Exploring The Reebok X Angel Reese Collection Details And Release Dates

May 17, 2025

Exploring The Reebok X Angel Reese Collection Details And Release Dates

May 17, 2025 -

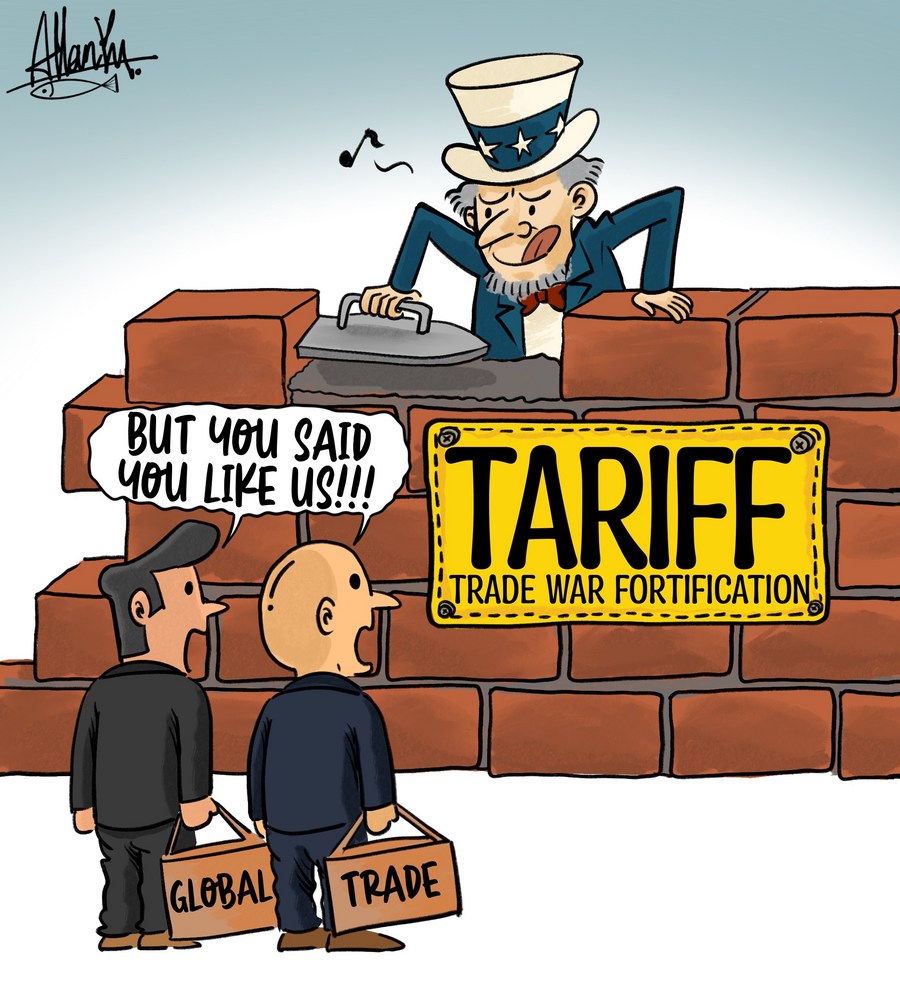

Hondas Us Tariff Challenges Increased Production In Canada

May 17, 2025

Hondas Us Tariff Challenges Increased Production In Canada

May 17, 2025 -

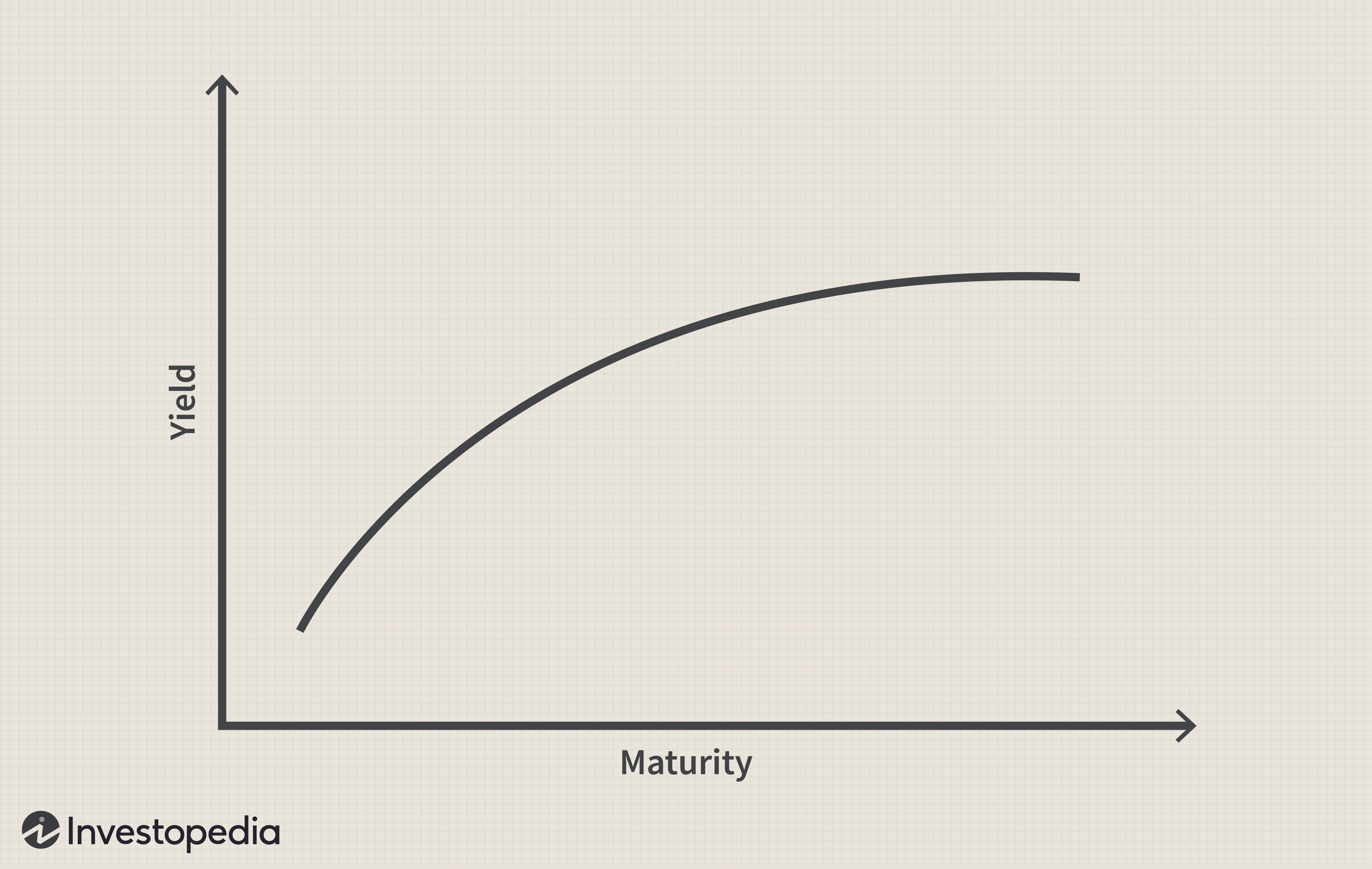

Navigating The Risks Japans Steep Bond Yield Curve And Investment Strategies

May 17, 2025

Navigating The Risks Japans Steep Bond Yield Curve And Investment Strategies

May 17, 2025 -

Stock Market Valuations Bof As Analysis And Reasons For Investor Calm

May 17, 2025

Stock Market Valuations Bof As Analysis And Reasons For Investor Calm

May 17, 2025 -

The Closure Of Anchor Brewing Company What It Means For Craft Beer

May 17, 2025

The Closure Of Anchor Brewing Company What It Means For Craft Beer

May 17, 2025

Latest Posts

-

The Impact Of Reeboks Partnership With Angel Reese

May 17, 2025

The Impact Of Reeboks Partnership With Angel Reese

May 17, 2025 -

New York Knicks Thibodeaus Take On Game 2 Referee Performance

May 17, 2025

New York Knicks Thibodeaus Take On Game 2 Referee Performance

May 17, 2025 -

Exploring The Reebok X Angel Reese Collection Details And Release Dates

May 17, 2025

Exploring The Reebok X Angel Reese Collection Details And Release Dates

May 17, 2025 -

Post Game Antics Thibodeaus Comments On Game 2 Officiating

May 17, 2025

Post Game Antics Thibodeaus Comments On Game 2 Officiating

May 17, 2025 -

Reeboks Ss 25 Drop A Collaboration With Angel Reese

May 17, 2025

Reeboks Ss 25 Drop A Collaboration With Angel Reese

May 17, 2025