Palantir Stock Prediction 2025: Should You Invest Now?

Table of Contents

Keywords: Palantir stock prediction, Palantir stock forecast, Palantir investment, PLTR stock, Palantir future, should I buy Palantir stock, Palantir 2025, Palantir stock analysis, Palantir Technologies

The future of Palantir Technologies (PLTR) is a subject of intense debate among investors. This article provides a Palantir stock prediction for 2025, examining crucial factors that could impact its price and assisting you in making an informed investment decision. We'll delve into the company's current performance, future prospects, and potential risks to help you answer the question: should you buy Palantir stock now?

Palantir's Current Market Position and Financial Performance

Revenue Growth and Profitability

Palantir's recent financial reports offer insights into its growth trajectory and financial health. Analyzing key performance indicators (KPIs) is crucial for any Palantir stock forecast.

- Year-over-Year Revenue Growth: Examining the percentage increase in revenue year-on-year reveals the pace of expansion. Consistent, strong growth indicates a healthy business model.

- Operating Income and Net Income: These metrics show Palantir's profitability. Positive and increasing figures signal a move towards sustainable profitability, a vital factor in any Palantir investment.

- Customer Acquisition and Retention Rates: High customer acquisition and retention demonstrate the effectiveness of Palantir's sales and marketing strategies and the value its platform provides. Recurring revenue from retained clients is key to long-term success.

- Significant Partnerships and Contracts: Large contracts with major government agencies or private sector companies can significantly impact Palantir's financial performance and should be closely monitored as indicators for future PLTR stock price movements.

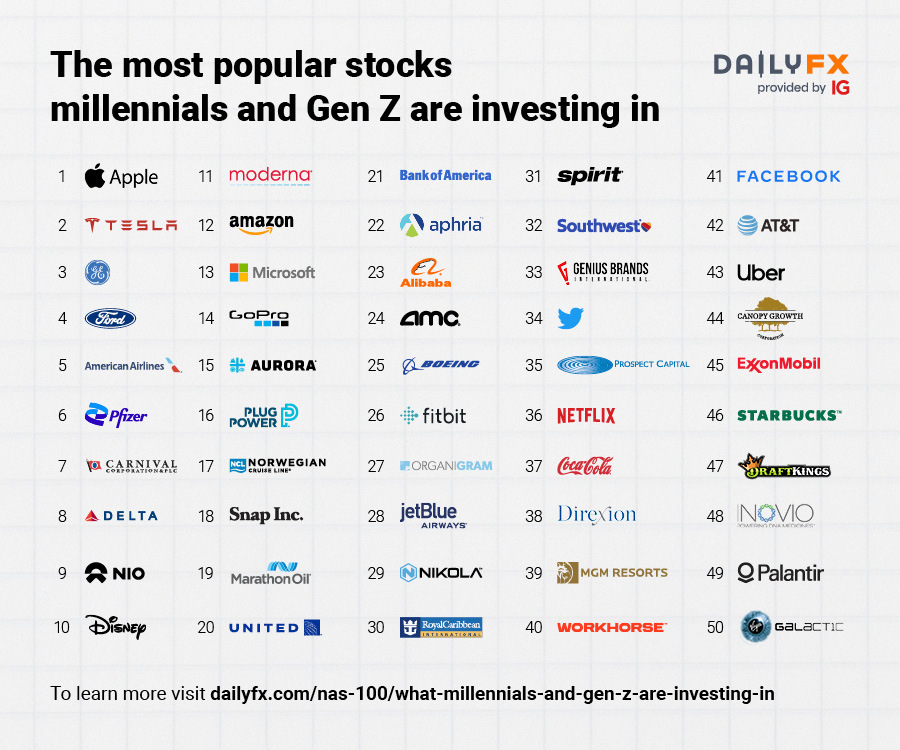

(Note: For a comprehensive analysis, include relevant charts and graphs illustrating these KPIs.)

Competitive Landscape and Market Share

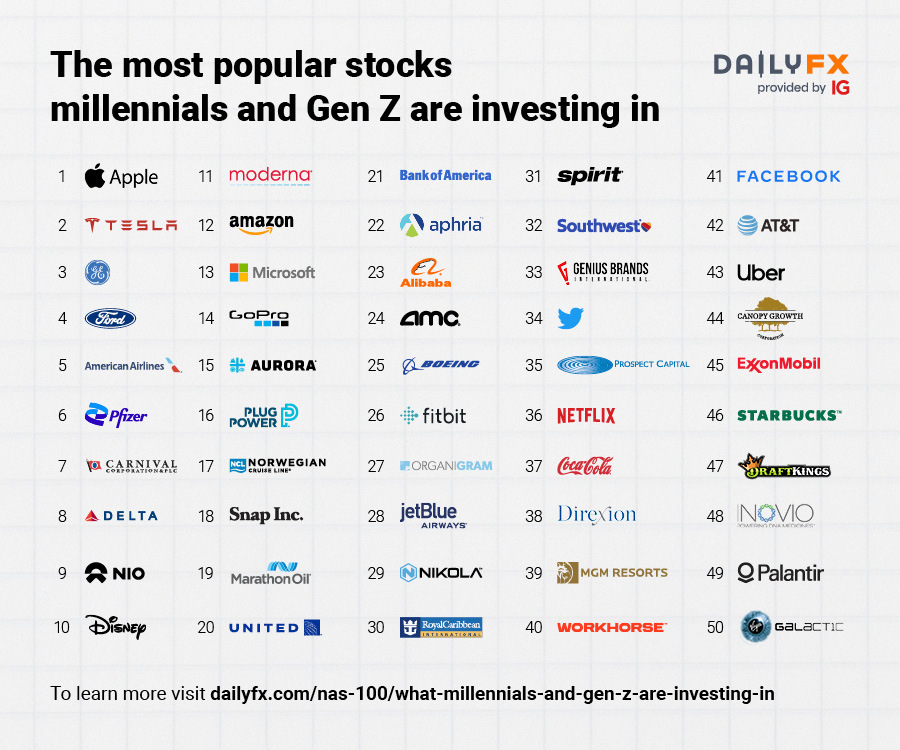

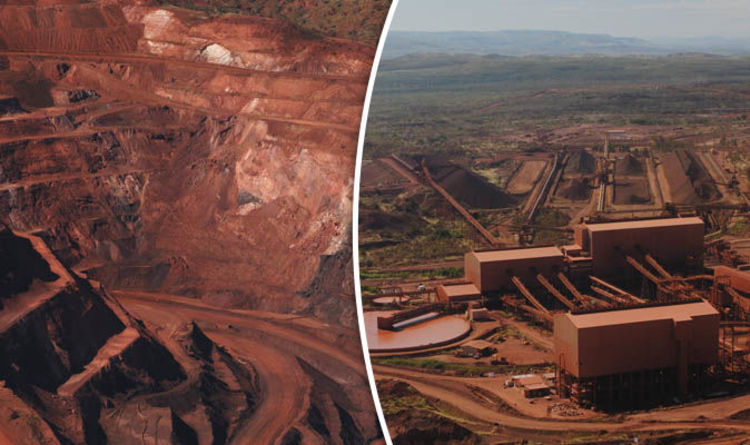

Palantir operates in a competitive landscape of big data analytics and government contracting. Understanding its position relative to competitors is crucial for a robust Palantir stock prediction.

- Major Competitors: Identify key competitors like AWS, Microsoft Azure, Google Cloud, and other data analytics firms. Assess their strengths and weaknesses in relation to Palantir.

- Palantir's Competitive Advantages: Palantir's proprietary technology, particularly its Gotham platform for government clients and Foundry for commercial clients, provides a key advantage. Strong relationships within government circles are another significant asset.

- Potential Threats and Challenges: Increased competition, particularly from cloud giants, represents a threat to Palantir's market share. The company needs to maintain its technological edge and adapt to evolving market demands.

Key Factors Influencing Palantir Stock Price in 2025

Government Contracts and Public Sector Growth

Palantir's substantial reliance on government contracts makes this sector a critical driver of its future performance.

- Geopolitical Landscape: Global political events and shifts in government spending directly impact Palantir's prospects. Increased international tensions could lead to higher demand for its services.

- Adoption by Government Agencies: Expansion into new government agencies and increased usage of existing clients are key factors influencing the Palantir stock forecast. Long-term contracts offer stability, while new contracts fuel growth.

- Risks Associated with Government Contracts: Dependence on government contracts exposes Palantir to budgetary constraints, political changes, and potential contract cancellations. Diversification into the commercial sector mitigates this risk.

Commercial Market Expansion and Private Sector Adoption

The private sector offers significant growth opportunities for Palantir. Success here is vital for a positive Palantir stock prediction.

- Growth Potential of the Commercial Market: The commercial market for big data analytics is vast, and Palantir's Foundry platform is poised to capture a significant share. This offers higher potential for revenue growth compared to government contracts.

- Strategies for Attracting and Retaining Commercial Clients: Palantir's ability to effectively market its platform and deliver tangible results to commercial clients is crucial. Building strong relationships and demonstrating ROI are essential.

- Challenges in Penetrating the Commercial Market: The commercial market is highly competitive. Palantir needs to differentiate its offerings, demonstrate value, and compete on price with established players.

Technological Advancements and Innovation

Continuous innovation is essential for Palantir's long-term success and a favorable Palantir stock forecast.

- Technological Roadmap and Future Product Developments: Palantir's ongoing investments in R&D and its commitment to developing new technologies are vital for maintaining its competitive edge.

- Impact of Emerging Technologies: The company's ability to integrate and leverage emerging technologies like AI and machine learning will be crucial in sustaining its growth.

- Adaptability to Changing Market Demands: Flexibility and agility are key to adapting to changing technological landscapes and evolving client needs. A rigid approach to development could hamper growth.

Potential Risks and Challenges

Economic Uncertainty and Market Volatility

Broader economic conditions significantly impact Palantir's stock price.

- Impact of Recessions or Economic Downturns: Economic downturns often lead to reduced government and private sector spending, impacting Palantir's revenue.

- Influence of Interest Rate Changes: Rising interest rates can negatively affect Palantir's valuation, as investors may favor less risky investments.

Regulatory Scrutiny and Compliance

Palantir operates in a regulated environment, exposing it to compliance risks.

- Data Privacy Concerns and Regulatory Compliance Requirements: Strict adherence to data privacy regulations, like GDPR and CCPA, is crucial for maintaining its reputation and avoiding penalties.

- Impact of Regulatory Changes: Changes in data privacy regulations or government procurement policies could significantly impact Palantir's business.

Conclusion

This Palantir stock prediction 2025 analysis reveals a complex picture. While substantial growth opportunities exist in both public and private sectors, the company faces considerable risks including market volatility and regulatory scrutiny. A successful Palantir investment hinges on its ability to navigate these challenges and leverage its technological advantages. A positive Palantir stock forecast depends on continued innovation, successful commercial expansion, and navigating potential economic and regulatory headwinds.

Call to Action: Before making any investment decisions regarding Palantir stock (PLTR), conduct thorough due diligence and consult a financial advisor. Further research into Palantir stock prediction 2025 and its future prospects is highly recommended. Remember, this is not financial advice; the information provided here is for informational and educational purposes only.

Featured Posts

-

Surge In Car Break Ins At Elizabeth City Apartment Complexes

May 10, 2025

Surge In Car Break Ins At Elizabeth City Apartment Complexes

May 10, 2025 -

Red Wings Fall To Golden Knights Playoff Chances Fade

May 10, 2025

Red Wings Fall To Golden Knights Playoff Chances Fade

May 10, 2025 -

Derecho A Usar El Bano El Arresto De Una Universitaria Transgenero Desata Polemica

May 10, 2025

Derecho A Usar El Bano El Arresto De Una Universitaria Transgenero Desata Polemica

May 10, 2025 -

Palantir Stock Down 30 Is This A Buying Opportunity

May 10, 2025

Palantir Stock Down 30 Is This A Buying Opportunity

May 10, 2025 -

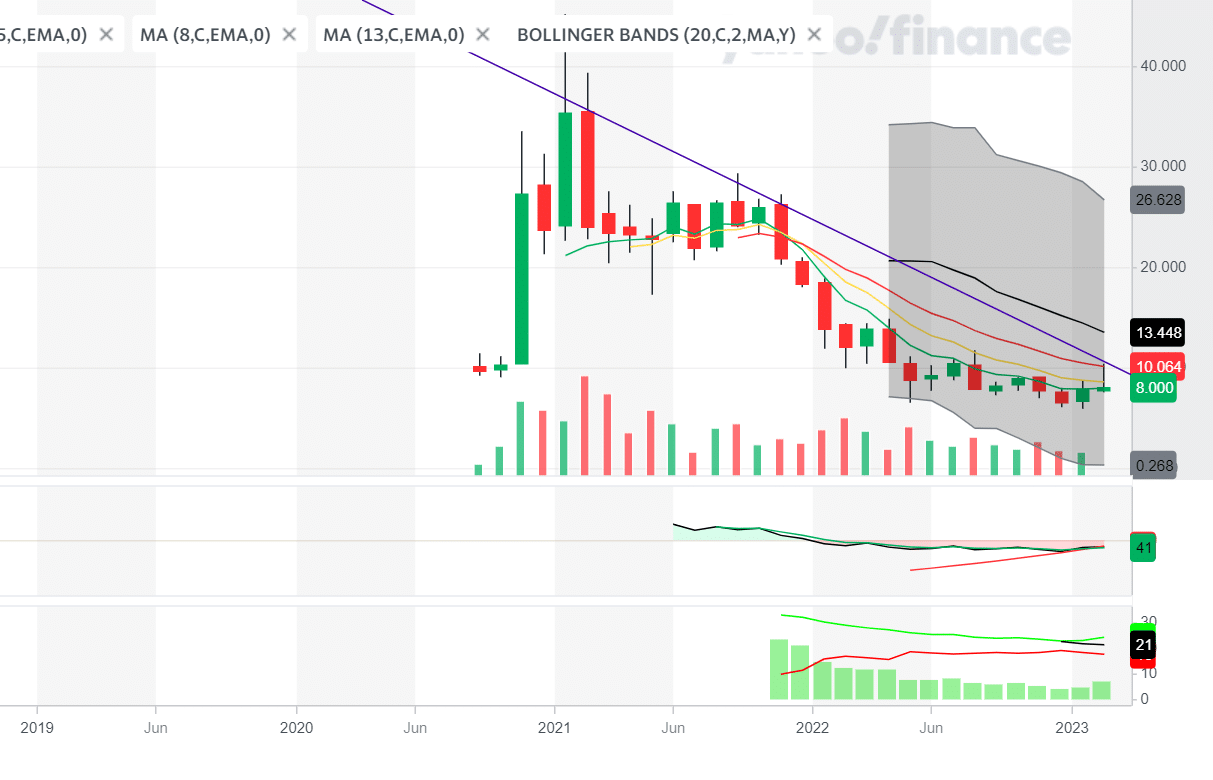

Iron Ore Price Drop Analysis Of Chinas Steel Industry Restrictions

May 10, 2025

Iron Ore Price Drop Analysis Of Chinas Steel Industry Restrictions

May 10, 2025