Paytm Payments Bank: FIU-IND Imposes ₹5.45 Crore Fine For Money Laundering

Table of Contents

The FIU-IND's ₹5.45 Crore Fine on Paytm Payments Bank

On [Insert Date of Fine Imposition], the FIU-IND levied a ₹5.45 crore fine on Paytm Payments Bank for alleged violations of the Prevention of Money Laundering Act (PMLA), 2002. The FIU-IND's investigation revealed significant shortcomings in the bank's anti-money laundering framework. These shortcomings allegedly facilitated or enabled potential money laundering activities. The specifics of the alleged violations include:

-

Lack of adequate Know Your Customer (KYC) measures: Insufficient due diligence in verifying customer identities and backgrounds potentially allowed for the opening of accounts by individuals involved in illicit activities. This highlights a critical failure in implementing basic KYC compliance.

-

Insufficient transaction monitoring systems: The bank's systems reportedly failed to effectively identify and flag suspicious transactions, a key component of any robust AML program. This lack of proactive monitoring allowed potentially illicit financial flows to go undetected.

-

Failure to report suspicious activities: Even when suspicious activities were identified, the bank allegedly failed to report them to the relevant authorities in a timely manner, hindering investigations and potentially enabling money laundering to continue.

-

Weaknesses in internal controls: Overall, the investigation pointed to a systemic lack of robust internal controls and oversight in the bank’s AML compliance program, leaving significant loopholes that could be exploited.

Implications of the Fine for Paytm Payments Bank and its Customers

The ₹5.45 crore fine carries significant implications for Paytm Payments Bank, its customers, and the wider financial landscape. The penalty is likely to:

-

Damage the brand image and trust: The negative publicity surrounding the fine will undoubtedly impact Paytm Payments Bank's reputation and erode customer trust. Customers may question the security and reliability of their funds.

-

Increase scrutiny from regulatory bodies: The FIU-IND's action will likely trigger increased scrutiny from other regulatory bodies, leading to more rigorous audits and stricter compliance requirements for Paytm Payments Bank.

-

Impact investor confidence: The fine could negatively affect investor confidence in the bank, potentially impacting its ability to secure future funding or partnerships.

-

Lead to changes in KYC/AML procedures: In response to the fine, Paytm Payments Bank is expected to strengthen its KYC and AML procedures significantly, potentially leading to more stringent verification processes for new customers and tighter monitoring of existing accounts.

India's Anti-Money Laundering Regulations and the Role of FIU-IND

India has a comprehensive legal framework to combat money laundering, primarily through the Prevention of Money Laundering Act (PMLA), 2002. This legislation empowers authorities to investigate and prosecute individuals and entities involved in money laundering activities. The FIU-IND plays a pivotal role in this fight:

-

The Prevention of Money Laundering Act (PMLA): This act provides the legal foundation for India's anti-money laundering efforts, outlining offences, penalties, and investigative procedures.

-

FIU-IND's powers and investigative capabilities: The FIU-IND is responsible for receiving, analyzing, and disseminating financial intelligence related to money laundering and other financial crimes. It has broad investigative powers and can impose penalties like the one levied on Paytm Payments Bank.

-

Consequences of non-compliance with AML regulations: Non-compliance with AML regulations can result in significant financial penalties, reputational damage, legal action, and even the suspension or revocation of licenses for financial institutions. Strict KYC/AML compliance is paramount for the stability and integrity of the financial system.

Other Recent Cases of AML Violations in India's Fintech Sector

While Paytm Payments Bank's case is significant, it's not an isolated incident. [Insert examples of other fintech companies fined for similar violations, with links to relevant news articles where available]. These cases underscore the increasing importance of robust AML compliance measures within India's rapidly evolving fintech landscape.

Conclusion

The ₹5.45 crore fine imposed on Paytm Payments Bank by the FIU-IND serves as a stark reminder of the severe consequences of neglecting anti-money laundering regulations. The lack of adequate KYC measures, insufficient transaction monitoring, and failure to report suspicious activities led to this significant financial penalty. This case highlights the critical need for all financial institutions, especially those in the rapidly growing fintech sector, to prioritize robust KYC/AML compliance. Strengthening these measures is not merely a regulatory requirement but a crucial step in maintaining the integrity and stability of India's financial system.

Stay informed about the latest developments regarding Paytm Payments Bank and other financial institutions by regularly checking for updates on [mention relevant websites or news sources]. Understanding and adhering to anti-money laundering regulations is crucial for maintaining the integrity of the financial system. Learn more about Paytm Payments Bank's response to the FIU-IND fine and its commitment to strengthening its AML compliance measures.

Featured Posts

-

Effectieve Strategieen Tegen Grensoverschrijdend Gedrag Bij De Nederlandse Publieke Omroep Npo

May 15, 2025

Effectieve Strategieen Tegen Grensoverschrijdend Gedrag Bij De Nederlandse Publieke Omroep Npo

May 15, 2025 -

Androids Youthful Redesign A Closer Look

May 15, 2025

Androids Youthful Redesign A Closer Look

May 15, 2025 -

Gender Euphoria Scale A Potential Tool For Improving Transgender Wellbeing

May 15, 2025

Gender Euphoria Scale A Potential Tool For Improving Transgender Wellbeing

May 15, 2025 -

Gaza Airstrike Israel Targets Hamas Leader Mohammed Sinwar

May 15, 2025

Gaza Airstrike Israel Targets Hamas Leader Mohammed Sinwar

May 15, 2025 -

Exploring Androids Refreshed Design Language

May 15, 2025

Exploring Androids Refreshed Design Language

May 15, 2025

Latest Posts

-

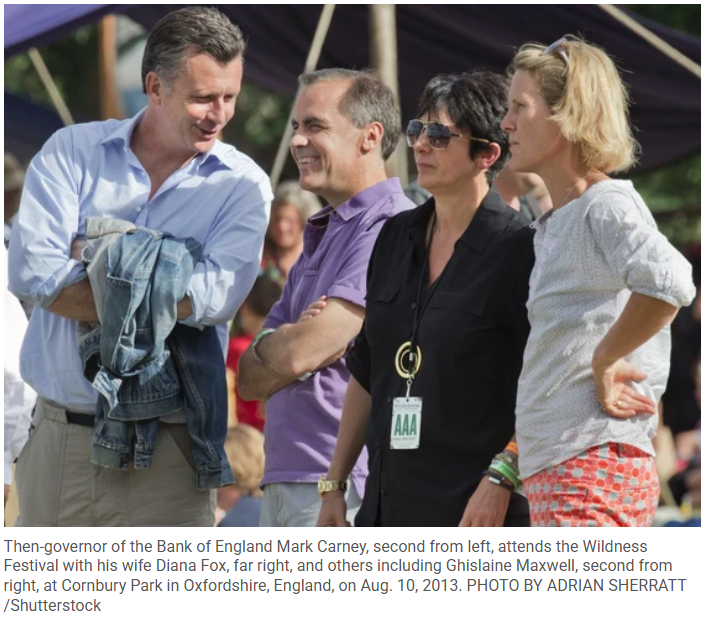

Significant Cabinet Changes Under Carney Ai Takes Center Stage

May 15, 2025

Significant Cabinet Changes Under Carney Ai Takes Center Stage

May 15, 2025 -

Office365 Data Breach Nets Millions For Hacker Fbi Alleges

May 15, 2025

Office365 Data Breach Nets Millions For Hacker Fbi Alleges

May 15, 2025 -

The Carney Cabinet Which Appointments Matter Most To Business

May 15, 2025

The Carney Cabinet Which Appointments Matter Most To Business

May 15, 2025 -

Millions Made From Exec Office365 Account Breaches Fbi Investigation

May 15, 2025

Millions Made From Exec Office365 Account Breaches Fbi Investigation

May 15, 2025 -

New Ai Ministry As Carney Unveils Reshuffled Cabinet

May 15, 2025

New Ai Ministry As Carney Unveils Reshuffled Cabinet

May 15, 2025