Philips Shareholders' Meeting: Decisions And Announcements

Table of Contents

Key Decisions Made at the Philips Shareholders' Meeting

Shareholder Resolutions and Voting Outcomes

The Annual General Meeting (AGM) saw several crucial resolutions put to the shareholders' vote. These resolutions covered a range of vital aspects of corporate governance and financial strategy. The voting outcomes provide a clear indication of shareholder sentiment and support for the company's direction.

- Resolution 1: Approval of the 2022 Financial Statements: This resolution passed with an overwhelming majority, indicating shareholder confidence in the company's financial reporting and transparency. 98% of votes cast were in favor.

- Resolution 2: Election of Board Members: Several board member elections were held, with all candidates receiving significant shareholder approval. The high percentage of votes in favor demonstrates continued support for the current board's composition and leadership. Specific details of individual voting percentages are available in the official meeting minutes.

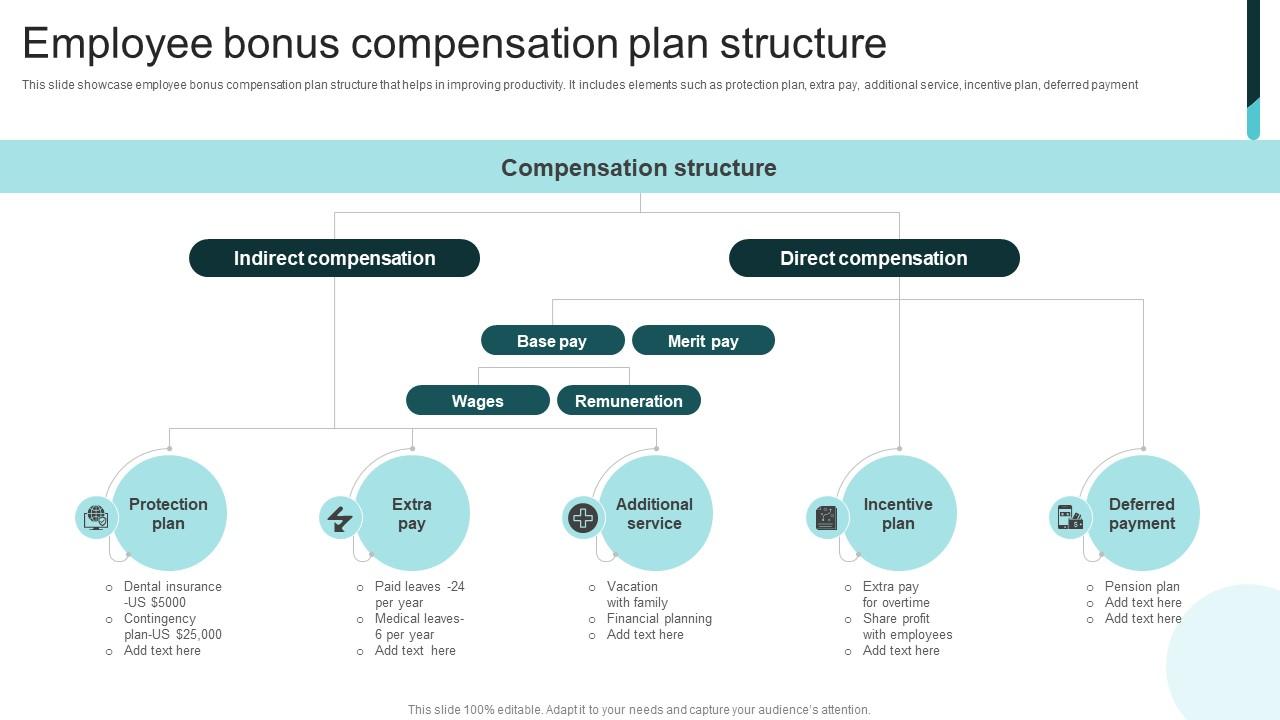

- Resolution 3: Executive Compensation Plan: The proposed executive compensation plan, designed to align executive incentives with long-term shareholder value creation, was approved by a substantial majority of shareholders. This signifies agreement with the company’s approach to executive remuneration.

Appointment of New Board Members (if applicable)

While the existing board members were largely re-elected, the AGM saw the appointment of [Name], a seasoned expert in [Area of Expertise], to the board of directors. [Name]'s extensive experience in [Specific Industry/Field] will bring valuable insights and strategic guidance to Philips. This appointment strengthens the board's expertise in areas crucial for Philips' future growth and innovation.

- [Name]: [Brief Background and Expertise]. Focus: [Area of expertise impacting Philips' strategic plan]

- [Name (If Applicable)]: [Brief Background and Expertise]. Focus: [Area of expertise impacting Philips' strategic plan]

This addition reflects Philips' commitment to maintaining a high-caliber board capable of navigating the complexities of the healthcare technology sector.

Dividend Announcements and Financial Projections

Philips announced a dividend payout of [amount] per share, representing a [percentage]% increase compared to the previous year. This decision reflects the company's strong financial performance and commitment to returning value to shareholders. The dividend payout ratio is [percentage]%, indicating a balanced approach to reinvesting in growth and rewarding shareholders. Future dividend projections remain positive, contingent upon continued successful execution of the strategic plan.

- Dividend per share: [Amount]

- Payout ratio: [Percentage]%

- Comparison to previous year: [Percentage]% increase

- Projected future dividends: Subject to future performance and board approval.

Significant Announcements and Future Strategic Plans

Updates on Key Strategic Initiatives

Philips provided updates on several key strategic initiatives, showcasing its commitment to innovation and growth. The company highlighted significant progress in its focus areas.

- New Product Launches: Several new products in the healthcare technology sector were showcased, emphasizing advancements in [Specific Technology/Area]. These launches are expected to drive revenue growth and strengthen Philips' market position.

- Market Expansion: The company detailed its plans for expansion into new geographic markets, focusing on regions with significant growth potential in healthcare technology. This expansion strategy aims to diversify revenue streams and reduce dependence on existing markets.

- Sustainability Initiatives: Philips reiterated its commitment to sustainable practices, outlining further initiatives to reduce its carbon footprint and enhance its environmental, social, and governance (ESG) performance.

Financial Results and Performance Review

Philips reported strong financial results for the past year. Key highlights include:

- Revenue: [Amount], showing a [percentage]% increase year-over-year.

- Profit Margins: [Percentage]%, indicating improved operational efficiency.

- Market Share: [Percentage]%, highlighting Philips' leading position in key market segments. The strong performance reinforces the success of the company's strategic initiatives.

These results demonstrate the effectiveness of the company's strategies and provide a solid foundation for future growth.

Address to Shareholders and CEO's Outlook

The CEO's address emphasized Philips' commitment to innovation, customer focus, and long-term sustainable growth. The overall outlook for the company remains positive, despite challenges in the global economic environment. Key takeaways included a focus on strategic partnerships, further R&D investment, and a continued commitment to digital transformation.

- Key Message: Focus on innovation and long-term value creation.

- Future Growth Plans: Expansion in key markets and product categories.

- Challenges and Opportunities: Navigating global economic uncertainty while capitalizing on emerging market opportunities.

Conclusion

The Philips Shareholders' Meeting provided valuable insights into the company's performance, strategic direction, and future outlook. The shareholder votes, new appointments (if applicable), dividend announcements, and updates on key initiatives signal confidence in the company's leadership and future prospects. The positive financial results and strong commitment to innovation further strengthen this positive outlook.

Call to Action: Stay updated on future Philips Shareholders' Meetings and learn more about Philips' strategic plans by visiting the official investor relations website. Follow Philips' investor relations for the latest announcements and insights into the company's ongoing success. Understanding the key decisions from these meetings is crucial for all Philips stakeholders.

Featured Posts

-

Apresentacao Oficial Ferrari 296 Speciale E Seu Motor Hibrido De 880 Cv

May 24, 2025

Apresentacao Oficial Ferrari 296 Speciale E Seu Motor Hibrido De 880 Cv

May 24, 2025 -

Demna Gvasalias Vision For Gucci A Look Ahead

May 24, 2025

Demna Gvasalias Vision For Gucci A Look Ahead

May 24, 2025 -

Understanding The Net Asset Value Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Understanding The Net Asset Value Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025 -

Apple Stock Sell Off 900 Million Tariff Hit Projected

May 24, 2025

Apple Stock Sell Off 900 Million Tariff Hit Projected

May 24, 2025

Latest Posts

-

Understanding High Stock Market Valuations Bof As Investor Guidance

May 24, 2025

Understanding High Stock Market Valuations Bof As Investor Guidance

May 24, 2025 -

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025 -

Dismissing Stock Market Valuation Concerns Insights From Bof A

May 24, 2025

Dismissing Stock Market Valuation Concerns Insights From Bof A

May 24, 2025 -

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025 -

The Thames Water Bonus Controversy Examining Executive Compensation

May 24, 2025

The Thames Water Bonus Controversy Examining Executive Compensation

May 24, 2025