Private Credit Investment Opportunity: Invesco And Barings Expand Access

Table of Contents

Invesco's Enhanced Private Credit Offerings

Invesco, a global investment management firm, has significantly expanded its private credit offerings, providing investors with diverse strategies to meet their investment goals.

Expanding Investment Strategies

Invesco offers a range of private credit strategies, catering to various risk appetites and investment horizons. These include:

- Direct Lending: Providing capital directly to companies, often for acquisitions, refinancing, or expansion projects. Invesco's direct lending funds focus on rigorous due diligence and strong covenant structures to mitigate risk.

- Mezzanine Financing: A hybrid form of financing combining debt and equity features, offering higher returns than traditional debt but with less risk than pure equity investments. Invesco's mezzanine financing strategies target established companies with strong growth potential.

- Distressed Debt: Investing in the debt of financially troubled companies, offering the potential for significant returns through restructuring or recovery. Invesco's distressed debt strategies leverage deep credit analysis and restructuring expertise. Invesco's private credit funds utilize these strategies across a diversified portfolio.

Targeting Specific Market Niches

Invesco's private credit strategies are not a one-size-fits-all approach. The firm focuses on sector-specific investments, offering expertise in various industries, including:

- Real Estate: Investing in private real estate debt, focusing on opportunities in both commercial and residential properties.

- Healthcare: Providing financing to healthcare providers, focusing on companies with strong fundamentals and growth potential.

- Technology: Supporting innovative technology companies, leveraging Invesco's deep understanding of the tech landscape.

This targeted approach allows Invesco to build a strong private credit portfolio across diverse sectors, effectively mitigating risk and capitalizing on specific market trends.

- Key Features of Invesco's Private Credit Funds:

- Minimum investment requirements vary depending on the specific fund.

- Targeted returns are generally higher than traditional fixed-income investments.

- Risk profiles are carefully managed and tailored to specific investor needs.

Barings' Broadened Reach in Private Credit

Barings, a global investment management firm with a long history in alternative investments, has significantly broadened its reach in the private credit market.

Global Private Credit Expertise

Barings boasts a global presence and a long-standing track record of success in private credit investments. Its global network allows it to identify and capitalize on attractive opportunities worldwide, offering a truly international private credit investment approach. Barings' investment strategy leverages its deep understanding of local markets and industry dynamics, providing a significant competitive advantage.

Access for a Wider Range of Investors

Barings is actively working to make private credit accessible to a broader investor base, including:

- Institutional Investors: Offering bespoke private credit solutions to pension funds, insurance companies, and other institutional investors seeking enhanced returns.

- High-Net-Worth Investors: Providing access to private credit opportunities through carefully constructed funds, enabling diversification and participation in this previously exclusive asset class. This increased access is reshaping the landscape of private credit fund access.

Barings' innovative fund structures and streamlined investment processes are crucial to expanding access for these investors.

- Successful Barings Private Credit Investments and Innovative Approaches:

- Successful investments in various sectors, including real estate, infrastructure, and technology.

- Innovative fund structures designed to optimize returns and manage risk effectively.

- A commitment to transparency and robust reporting for investors.

The Benefits of Increased Access to Private Credit

The increased access to private credit investments provided by firms like Invesco and Barings presents significant advantages for investors.

Diversification Advantages

Private credit offers compelling diversification benefits. Its low correlation with traditional asset classes like stocks and bonds can help reduce overall portfolio risk and improve risk mitigation strategies. As an alternative investment strategy, private credit strengthens portfolio resilience during market volatility.

Potential for Higher Returns

Private credit investments often offer the potential for higher returns compared to traditional fixed-income options like government bonds or corporate bonds. This yield enhancement comes from the higher risk associated with these investments, but experienced managers like Invesco and Barings work to carefully mitigate these risks. Strong investment performance is a key objective for both firms.

Addressing the Demand for Private Credit

The private credit market is experiencing significant growth, driven by increasing demand from investors seeking higher yields and diversification opportunities. Invesco and Barings are successfully meeting this increasing demand by providing innovative and accessible investment solutions. This is making private credit a more mainstream alternative asset class.

- Key Advantages of Investing in Private Credit with Invesco and Barings:

- Experienced and dedicated investment management teams.

- Rigorous due diligence processes to mitigate risk.

- Transparent reporting and regular communication with investors.

Capitalizing on the Private Credit Investment Opportunity

Private credit investments offer a compelling combination of potential for higher returns and enhanced portfolio diversification. Invesco and Barings are playing a crucial role in increasing access to these opportunities, making them available to a wider range of investors. The growing demand for private credit, coupled with the expertise of these leading firms, points towards a promising future for this increasingly popular asset class. Learn more about the private credit investment opportunities offered by Invesco and Barings today. Visit their websites to explore investment options and speak with a financial advisor. Consider diversifying your portfolio with Invesco private credit and Barings private credit offerings.

Featured Posts

-

Erzurum Okul Tatili 24 Subat Pazartesi Guencel Durum Ve Aciklama

Apr 23, 2025

Erzurum Okul Tatili 24 Subat Pazartesi Guencel Durum Ve Aciklama

Apr 23, 2025 -

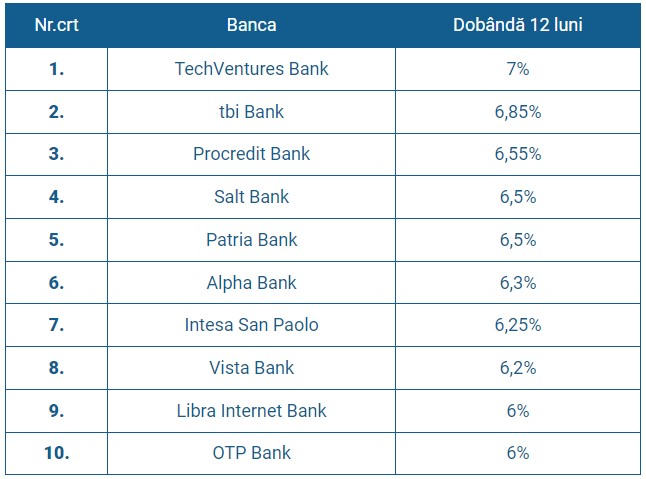

Depozite Bancare Martie 2024 Top Banci Cu Cele Mai Mari Dobanzi

Apr 23, 2025

Depozite Bancare Martie 2024 Top Banci Cu Cele Mai Mari Dobanzi

Apr 23, 2025 -

Across The Us Protests Against Trump And Their Demands

Apr 23, 2025

Across The Us Protests Against Trump And Their Demands

Apr 23, 2025 -

Analyzing Warren Buffetts Apple Sale Timing Strategy And Future Outlook

Apr 23, 2025

Analyzing Warren Buffetts Apple Sale Timing Strategy And Future Outlook

Apr 23, 2025 -

Bof A On Stock Market Valuations A Reason For Investor Calm

Apr 23, 2025

Bof A On Stock Market Valuations A Reason For Investor Calm

Apr 23, 2025

Latest Posts

-

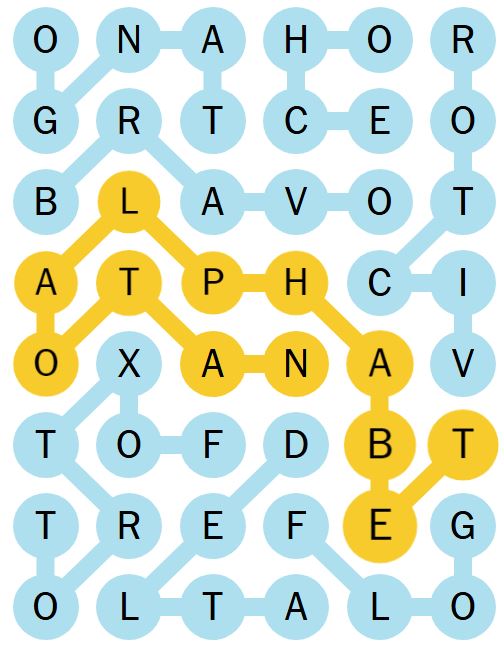

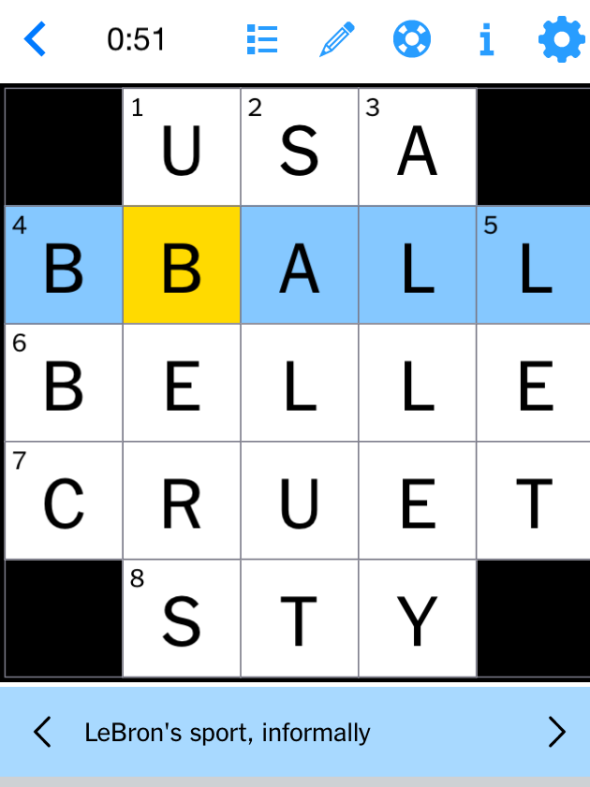

Nyt Strands Hints And Answers Game 403 Thursday April 10

May 10, 2025

Nyt Strands Hints And Answers Game 403 Thursday April 10

May 10, 2025 -

Solve Nyt Strands Game 403 Hints For Thursday April 10th

May 10, 2025

Solve Nyt Strands Game 403 Hints For Thursday April 10th

May 10, 2025 -

April 12th Nyt Strands Puzzle 405 Hints And Solutions

May 10, 2025

April 12th Nyt Strands Puzzle 405 Hints And Solutions

May 10, 2025 -

Nyt Strands Saturday April 12th Game 405 Answers And Clues

May 10, 2025

Nyt Strands Saturday April 12th Game 405 Answers And Clues

May 10, 2025 -

Unlocking The Nyt Strands April 9 2025 Puzzle With Clues And Spangram

May 10, 2025

Unlocking The Nyt Strands April 9 2025 Puzzle With Clues And Spangram

May 10, 2025