Public Sector Pensions: Examining The Financial Gamble

Table of Contents

The Promises and Perils of Defined Benefit Schemes

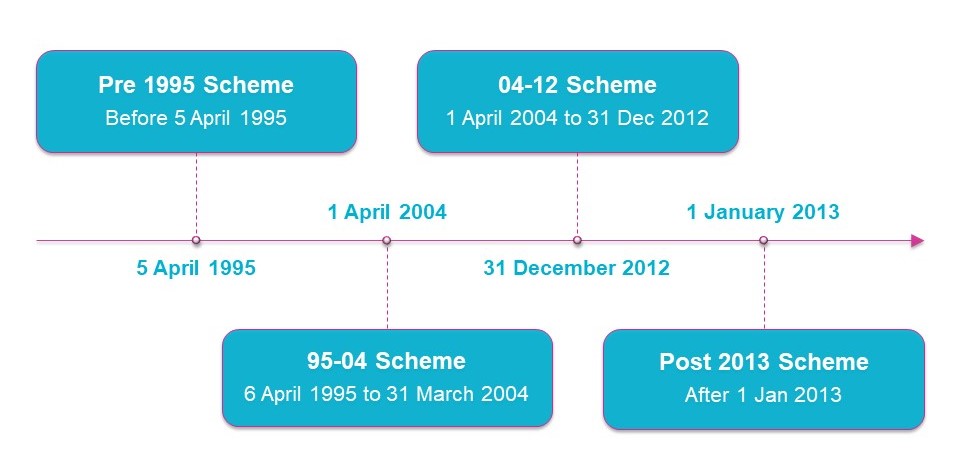

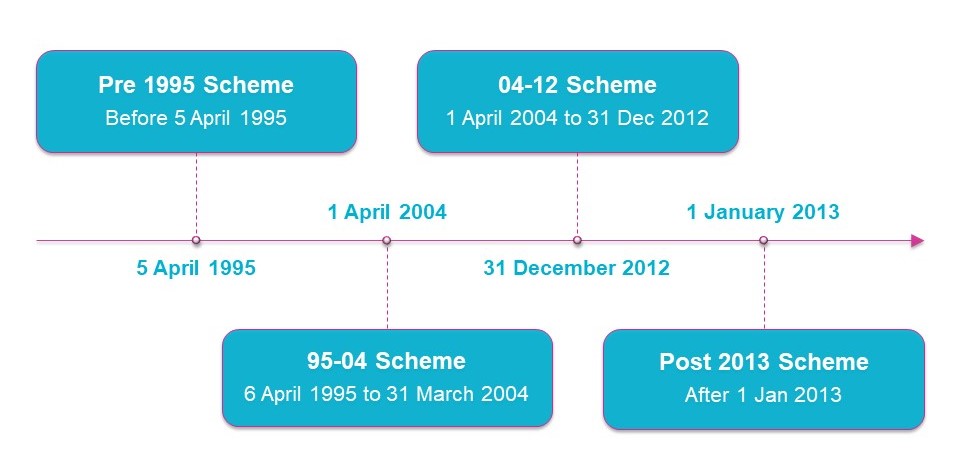

Public sector pension systems often rely heavily on defined benefit (DB) schemes. These schemes promise a guaranteed income to retirees based on their salary and years of service. This guaranteed income provides significant security and peace of mind in retirement, a key benefit attracting talent to the public sector. However, this seemingly straightforward promise masks significant financial risks.

-

High and Rising Liabilities: DB schemes face increasing liabilities due to several factors. Longer life expectancies mean pensioners receive payouts for longer periods. Low interest rates also increase the present value of future payouts, making the scheme more expensive to fund. This creates a considerable burden on taxpayers and government budgets.

-

Funding Shortfalls: Many public pension funds are experiencing significant funding shortfalls – the difference between the assets held by the fund and the present value of the promised benefits. This gap represents a substantial financial risk, potentially leading to reduced benefits or increased taxpayer contributions in the future.

-

Demographic Shifts: The aging population in many developed countries is exacerbating the funding problem. A shrinking workforce supporting a growing number of retirees creates a significant strain on the system's ability to meet its obligations. This demographic pressure is a key driver of the pension funding crisis in many countries.

-

Investment Performance Volatility: The value of pension fund assets is subject to market fluctuations. Poor investment performance can widen the funding gap and intensify the financial pressure on the scheme. Effective investment strategies are crucial to mitigating this risk.

The Shifting Landscape of Public Sector Pension Funding

Funding public sector pensions is a complex undertaking, relying on several key sources:

-

Taxpayer Contributions: The primary source of funding for most public sector pension schemes is taxpayer contributions through general taxation. This places a direct burden on the public purse and can lead to political tensions, especially during periods of budget constraints.

-

Investment Returns: Pension funds invest their assets to generate returns that help offset future benefit payments. Investment strategies play a crucial role in the long-term financial health of the scheme. However, reliance on investment returns carries inherent market risk.

-

Government Guarantees: In many cases, governments guarantee the payment of public sector pensions. This guarantee provides security to pensioners but also places a significant contingent liability on the government's balance sheet. This government backing can be a double-edged sword, offering security while increasing the potential for future taxpayer bailouts.

Government budget constraints increasingly impact pension funding. Balancing the needs of current pensioners with the financial capacity of the state is a constant challenge. Further complicating matters is increasing life expectancy, which extends the period over which pension payments are made, significantly increasing the present value of future obligations. Actuarial valuations, which estimate the funding needs of pension schemes, are essential tools in managing these complex financial issues. The interplay between these factors is a key driver of ongoing pension reform efforts.

Comparing Public Sector Pensions to Private Sector Alternatives

A critical comparison lies between defined benefit (DB) and defined contribution (DC) schemes. DB schemes, prevalent in the public sector, guarantee a specific income in retirement, while DC schemes, common in the private sector, offer contributions that are invested, with the final retirement income depending on market performance and individual savings.

Private sector pension plans, such as 401(k)s or personal pensions, often follow a defined contribution model, placing more responsibility for retirement savings on individuals. This shifts the investment risk from the employer or government to the employee. While this model offers flexibility, it also creates uncertainty about the final retirement income, depending on investment performance and individual saving behavior. The comparison highlights the different risk profiles and the trade-offs between security and individual responsibility in retirement planning. Understanding these differences is essential for a comprehensive analysis of public sector pension sustainability.

The Role of Government Policy and Reform

Government policies play a critical role in shaping the financial stability of public sector pensions. Pension reforms, often politically challenging, are frequently implemented to address funding shortfalls and ensure long-term sustainability. These reforms might involve changes to contribution rates, benefit levels, or investment strategies. The political complexities of pension reform are significant, requiring careful balancing of competing interests and potential long-term consequences. Political will, public understanding, and careful actuarial analysis are all crucial to effective reform.

Conclusion

Public sector pensions are a vital component of social security and retirement planning, but their financial sustainability is a complex issue that demands careful consideration. Understanding the promises and perils of defined benefit schemes, the ongoing challenges in funding these plans, and the comparisons with private sector alternatives is crucial. The ongoing need for government oversight and reform is undeniable. Further research into the financial aspects of public sector pensions and responsible engagement with the debate are crucial for ensuring a secure retirement for future generations. Therefore, continued examination of public sector pensions, including analysis of pension funding models and strategies for managing risks, is essential to mitigate risks and secure a financially sound future.

Featured Posts

-

Data Centers Negeri Sembilans Growing Digital Infrastructure

Apr 29, 2025

Data Centers Negeri Sembilans Growing Digital Infrastructure

Apr 29, 2025 -

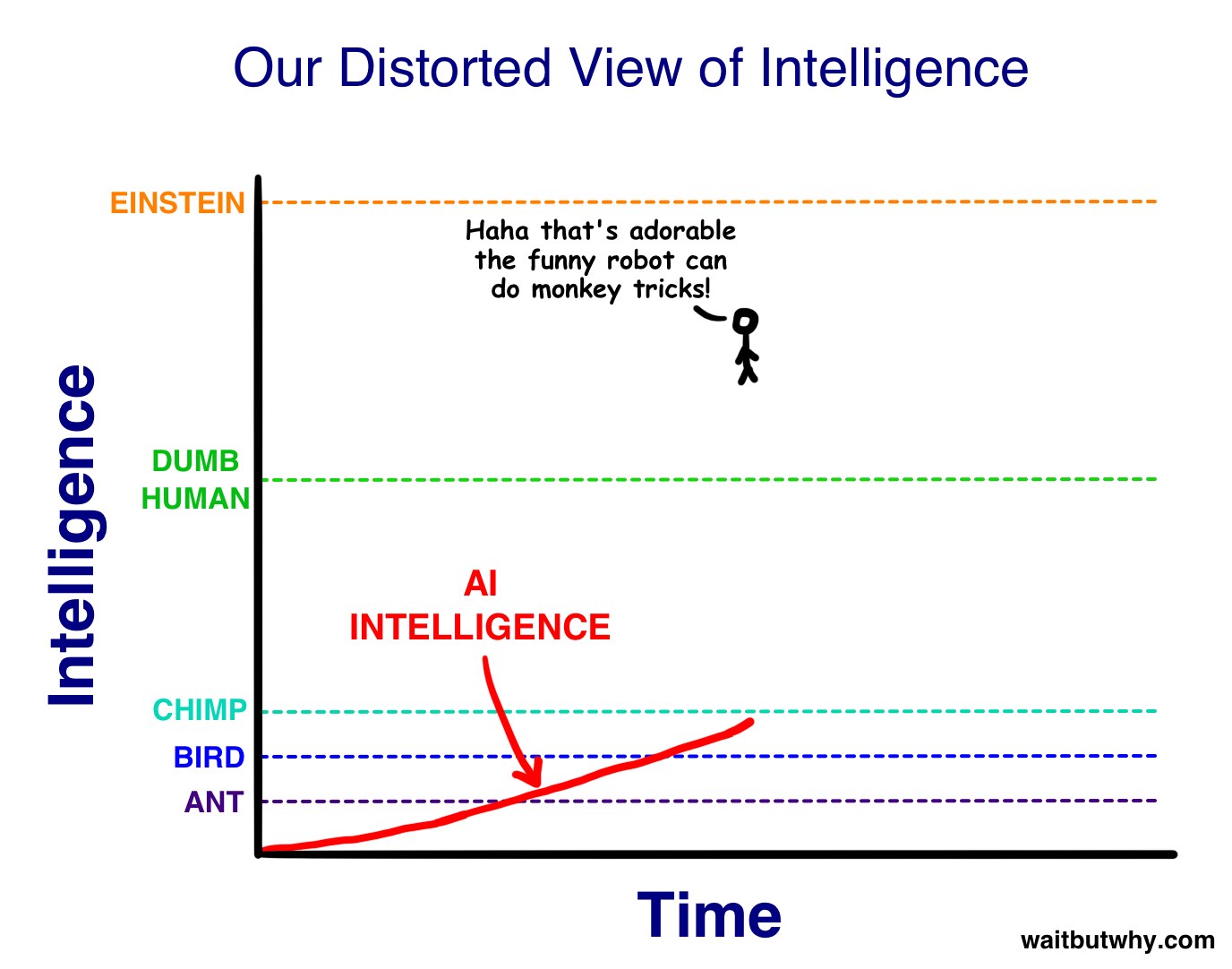

The Reality Of Ai Far From Human Level Thinking

Apr 29, 2025

The Reality Of Ai Far From Human Level Thinking

Apr 29, 2025 -

Ambanis Reliance Strong Earnings Signal For Indian Markets

Apr 29, 2025

Ambanis Reliance Strong Earnings Signal For Indian Markets

Apr 29, 2025 -

Chainalysis Acquisition Of Alterya A Strategic Move In Ai Powered Blockchain Analysis

Apr 29, 2025

Chainalysis Acquisition Of Alterya A Strategic Move In Ai Powered Blockchain Analysis

Apr 29, 2025 -

Tuesday February 11th Snow Fox Operational Status

Apr 29, 2025

Tuesday February 11th Snow Fox Operational Status

Apr 29, 2025

Latest Posts

-

Analyzing Trumps Stance On Cheap Oil Implications For The Energy Sector

May 12, 2025

Analyzing Trumps Stance On Cheap Oil Implications For The Energy Sector

May 12, 2025 -

Trumps Embrace Of Cheap Oil Challenges And Consequences For The Energy Industry

May 12, 2025

Trumps Embrace Of Cheap Oil Challenges And Consequences For The Energy Industry

May 12, 2025 -

The Trump Presidency And Cheap Oil An Analysis Of Industry Impact

May 12, 2025

The Trump Presidency And Cheap Oil An Analysis Of Industry Impact

May 12, 2025 -

Trump Administrations Oil Policies Balancing Low Prices And Industry Support

May 12, 2025

Trump Administrations Oil Policies Balancing Low Prices And Industry Support

May 12, 2025 -

Trumps Cheap Oil Policy Praise And Conflict With The Energy Sector

May 12, 2025

Trumps Cheap Oil Policy Praise And Conflict With The Energy Sector

May 12, 2025