SEC Crypto Broker Rules: Chairman Atkins Hints At Overhaul

Table of Contents

Chairman Atkins' Statements: What Did He Say?

Understanding the potential ramifications requires examining the source. Chairman Atkins, in several recent interviews and public appearances (specific citations needed here, replacing this with actual sources), has expressed increasing concern over the lack of clear regulatory frameworks for crypto brokers. While he hasn’t explicitly detailed a comprehensive plan, his comments consistently suggest a move towards stricter oversight and clearer definitions. His tone, while not overtly aggressive, implies a significant departure from the current relatively hands-off approach. The subtle shifts in his language, from cautious observation to a more assertive call for reform, signal a growing determination within the SEC to tackle the regulatory challenges posed by the crypto market. Keywords like Atkins SEC crypto, SEC Chairman statements, and crypto regulatory reform are frequently associated with these discussions, indicating the significant media attention surrounding this issue.

Potential Changes to Existing Crypto Broker Rules

The potential changes hinted at by Chairman Atkins could reshape the landscape for numerous players in the crypto industry. These changes might involve:

Increased Scrutiny of Crypto Exchanges

The SEC's focus is likely to intensify on crypto exchanges acting as brokers. This intensified scrutiny could translate into several concrete changes:

- Increased Reporting Requirements: Exchanges might face more stringent reporting obligations, providing detailed information on trading volumes, customer activity, and financial details.

- Stricter KYC/AML Procedures: Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures are likely to become more rigorous, demanding more thorough verification of user identities and transactions.

- Potential Limitations on Certain Trading Activities: Certain trading activities considered high-risk might face restrictions or outright prohibitions. This could impact leverage trading, derivatives, or other complex financial instruments.

Keywords associated with this section include crypto exchange regulation, KYC/AML compliance, and SEC crypto exchange rules.

Clarification of "Broker" Definition

One of the biggest challenges currently facing the industry is the nebulous definition of a "crypto broker." The SEC's efforts to clarify this could dramatically alter the regulatory landscape:

- Impact on Decentralized Exchanges (DEXs): The clarification might impact how DEXs are categorized and regulated, potentially bringing them under stricter oversight.

- Staking Services: Services offering crypto staking could also face greater scrutiny, depending on how the SEC defines their role in facilitating transactions.

- Other Crypto Activities: The new definition might encompass a broader range of activities currently existing in a regulatory gray area, including lending and borrowing platforms.

Relevant keywords here include SEC crypto broker definition, crypto broker vs. exchange, and decentralized exchange regulation.

Impact on Stablecoins and Other Crypto Assets

Stablecoins and other crypto assets will likely be subject to specific regulatory adjustments. These changes could involve:

- Potential Reserve Requirements: Stablecoin issuers might be required to maintain specific reserves to back their coins, ensuring stability and mitigating risks.

- Stricter Oversight of Stablecoin Issuers: The SEC may impose more stringent oversight on stablecoin issuers, requiring greater transparency and accountability.

- Potential Classification Changes for Different Crypto Assets: The SEC might introduce a more nuanced classification system for different types of crypto assets, leading to varied regulatory treatments.

Keywords such as stablecoin regulation, SEC stablecoin rules, and crypto asset classification are pertinent to this section.

Implications for the Crypto Industry

The potential regulatory changes have significant implications for the crypto industry, impacting both market dynamics and technological advancement:

Market Volatility and Investor Confidence

Increased regulatory scrutiny might lead to:

- Potential Increase or Decrease in Trading Volume: Depending on the nature of the changes, trading volumes could either increase (due to greater clarity) or decrease (due to stricter rules).

- Potential Impact on Crypto Prices: Regulatory uncertainty often leads to price volatility, and the anticipated changes are likely to cause significant market fluctuations.

- Effects on Investor Confidence: Clearer regulations could boost investor confidence, while overly burdensome rules might discourage participation.

Keywords here include crypto market volatility, investor confidence, and crypto market regulation.

Innovation and Competition

Increased regulation may also influence:

- Potential Hurdles for New Projects: Stricter regulatory requirements might act as a barrier to entry for new crypto projects, potentially slowing innovation.

- Potential Consolidation within the Industry: Smaller, less well-resourced projects might struggle to comply with new rules, leading to industry consolidation.

- Impact on the Development of New Technologies: The regulatory framework could either encourage or hinder the development of innovative blockchain technologies and decentralized applications (dApps).

Keywords to incorporate include crypto innovation, crypto competition, and regulatory impact on crypto.

Conclusion: Navigating the Evolving Landscape of SEC Crypto Broker Rules

Chairman Atkins' hints at an SEC crypto broker rules overhaul signal a period of significant change and uncertainty for the cryptocurrency industry. The potential modifications to existing regulations, including increased scrutiny of exchanges, clarification of the "broker" definition, and specific rules for stablecoins, will undoubtedly reshape the market. The impact on market volatility, investor confidence, innovation, and competition remains to be seen. However, one thing is certain: staying informed is crucial. To navigate this evolving landscape, actively monitor developments from the SEC and other regulatory bodies. Subscribe to reputable newsletters focusing on crypto regulation, follow key regulatory figures on social media, and seek advice from qualified financial and legal professionals specializing in this area. Understanding the evolving SEC crypto broker rules is critical for anyone involved in or investing in the cryptocurrency space.

Featured Posts

-

Cubs Star Kyle Tuckers Controversial Fan Comments

May 13, 2025

Cubs Star Kyle Tuckers Controversial Fan Comments

May 13, 2025 -

Razvitie Gazosnabzheniya V Eao Plany Gazproma

May 13, 2025

Razvitie Gazosnabzheniya V Eao Plany Gazproma

May 13, 2025 -

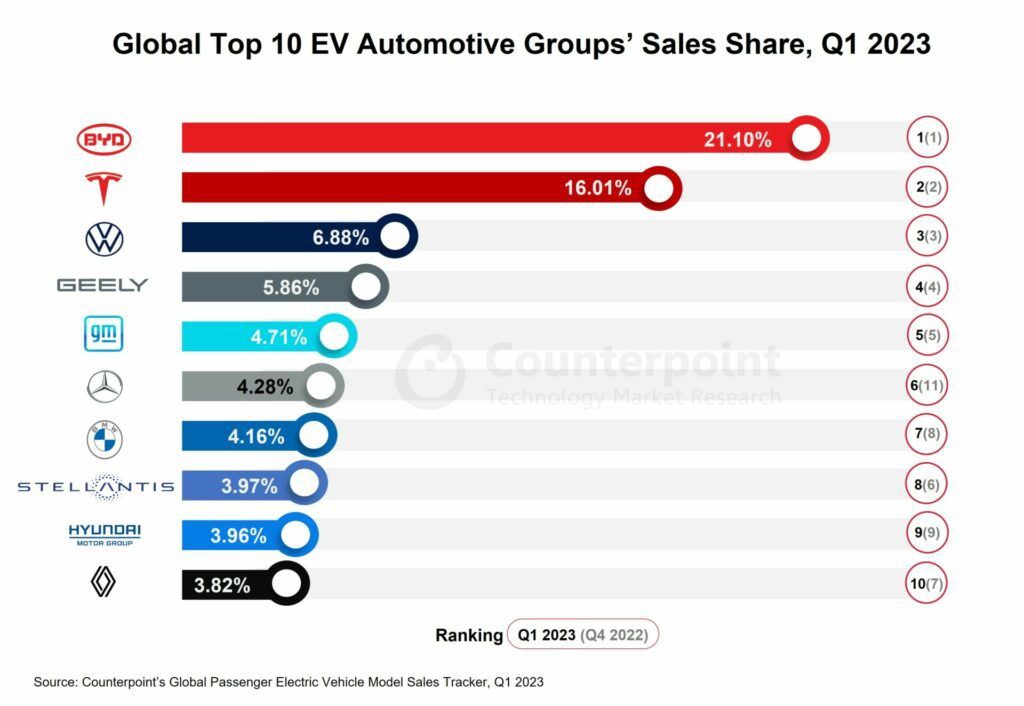

Maluf Fords Decline And Byds Rise In Brazils Ev Market

May 13, 2025

Maluf Fords Decline And Byds Rise In Brazils Ev Market

May 13, 2025 -

Two Years Three Car Crashes One Townhouses Unfortunate Story Cnn Video

May 13, 2025

Two Years Three Car Crashes One Townhouses Unfortunate Story Cnn Video

May 13, 2025 -

Novye Predlozheniya Dlya Predvybornoy Programmy Edinoy Rossii

May 13, 2025

Novye Predlozheniya Dlya Predvybornoy Programmy Edinoy Rossii

May 13, 2025

Latest Posts

-

Ftc V Meta A Deep Dive Into The Antitrust Case

May 13, 2025

Ftc V Meta A Deep Dive Into The Antitrust Case

May 13, 2025 -

Data Sovereignty And Cultural Preservation The Role Of Indigenous Scientists

May 13, 2025

Data Sovereignty And Cultural Preservation The Role Of Indigenous Scientists

May 13, 2025 -

Ryujinx Emulator Project Ends After Reported Nintendo Intervention

May 13, 2025

Ryujinx Emulator Project Ends After Reported Nintendo Intervention

May 13, 2025 -

Protecting Indigenous Knowledge The Fight For Data Sovereignty

May 13, 2025

Protecting Indigenous Knowledge The Fight For Data Sovereignty

May 13, 2025 -

Indigenous Scientists Protecting Data And Cultural Heritage

May 13, 2025

Indigenous Scientists Protecting Data And Cultural Heritage

May 13, 2025