Sensex Soars: Top BSE Stocks That Gained Over 10%

Table of Contents

Top Performing BSE Stocks (Gaining Over 10%)

This section identifies the top BSE stocks that experienced a gain of over 10%, based on percentage increase compared to the previous day's closing prices. This analysis provides a snapshot of the day's most successful performers within the Indian Stock Market.

Reliance Industries

- Percentage Gain: 12.5% (This is an example; replace with actual data)

- Reason for Surge: Strong quarterly results exceeding market expectations, coupled with positive investor sentiment regarding their foray into the green energy sector, contributed to this significant rise in Reliance Industries stock prices. Positive news coverage further fueled the rally.

- Contributing Factors:

- Positive quarterly earnings report showcasing substantial profit growth.

- Announcement of a major new strategic partnership.

- Increased trading volume indicating strong investor interest.

- Key Highlights:

- Percentage change: 12.5%

- Trading volume: Increased by 30% (Example data)

- Market capitalization: Increased by ₹X billion (Example data)

- Brief analyst outlook: Analysts predict further growth based on current trends.

HDFC Bank

- Percentage Gain: 11.8% (Example data)

- Reason for Surge: Strong performance in the banking sector, combined with positive economic indicators and a robust loan growth forecast, boosted HDFC Bank's stock prices.

- Contributing Factors:

- Strong Q[Quarter] results exceeding expectations.

- Positive credit rating upgrades.

- Increased investor confidence in the banking sector.

- Key Highlights:

- Percentage change: 11.8%

- Trading volume: Increased by 25% (Example data)

- Market capitalization: Increased by ₹Y billion (Example data)

- Brief analyst outlook: Maintain a "Buy" rating.

TCS (Tata Consultancy Services)

- Percentage Gain: 10.5% (Example data)

- Reason for Surge: Stronger-than-expected earnings reports and positive outlook for the IT sector fueled significant gains in TCS stock prices. Increased demand for IT services globally also played a role.

- Contributing Factors:

- Exceeding profit expectations for the quarter.

- Strong deal pipeline indicating future growth potential.

- Positive industry trends in the global IT services market.

- Key Highlights:

- Percentage change: 10.5%

- Trading volume: Increased by 20% (Example data)

- Market capitalization: Increased by ₹Z billion (Example data)

- Brief analyst outlook: Upgraded target price.

Infosys

- Percentage Gain: 10.2% (Example data)

- Reason for Surge: Similar to TCS, Infosys benefited from positive industry trends and strong financial results. Positive investor sentiment regarding the company's future prospects also played a part.

- Contributing Factors:

- Strong revenue growth exceeding analyst projections.

- Successful project acquisitions.

- Positive outlook for the IT services sector.

- Key Highlights:

- Percentage change: 10.2%

- Trading volume: Increased by 18% (Example data)

- Market capitalization: Increased by ₹A billion (Example data)

- Brief analyst outlook: Positive outlook maintained.

ITC

- Percentage Gain: 10.1% (Example data)

- Reason for Surge: Strong performance in the FMCG sector and positive investor sentiment towards the company's diversification strategy led to a considerable increase in ITC stock prices.

- Contributing Factors:

- Increased consumer demand for their products.

- Strong sales growth across various segments.

- Expansion into new markets and product categories.

- Key Highlights:

- Percentage change: 10.1%

- Trading volume: Increased by 15% (Example data)

- Market capitalization: Increased by ₹B billion (Example data)

- Brief analyst outlook: Solid performance expected to continue.

(Add more stocks as needed following the same structure)

Factors Contributing to the Sensex Surge

The significant increase in the BSE Sensex is a result of a confluence of factors impacting both global and domestic market conditions.

- Global Market Trends: Positive global market sentiment, driven by positive economic data from major economies, contributed significantly to the overall bullish trend.

- Domestic Economic Indicators: Strong domestic economic indicators, including improved industrial production and positive consumer confidence, boosted investor sentiment.

- Government Policies: Supportive government policies aimed at stimulating economic growth created a positive environment for investments.

- Sector-Specific News: Positive news and strong performance from specific sectors, like IT and banking, played a substantial role.

- Investor Sentiment: A generally optimistic investor sentiment towards the Indian stock market fueled increased buying activity.

Investment Strategies Following the Sensex Rally

The Sensex rally presents both opportunities and challenges for investors. Careful consideration of different strategies is crucial for managing risk and achieving investment goals.

- Long-term investment strategies: Maintaining a long-term investment horizon allows investors to ride out market volatility and benefit from sustained growth.

- Short-term trading strategies: Short-term trading requires careful timing and risk management, focusing on exploiting short-term price fluctuations.

- Risk management techniques: Diversification, stop-loss orders, and position sizing are crucial for mitigating risks.

- Diversification of portfolio: Spreading investments across different asset classes and sectors reduces overall portfolio risk.

- Importance of research and due diligence: Thorough research and analysis are essential before making any investment decisions.

Conclusion

Today's BSE Sensex surge witnessed several top-performing stocks like Reliance Industries, HDFC Bank, TCS, Infosys, and ITC exceeding 10% gains. This remarkable performance was driven by a combination of positive global trends, strong domestic economic indicators, favorable government policies, sector-specific news, and a generally optimistic investor sentiment. The implications for investors are significant, highlighting the dynamic nature of the Indian stock market.

Call to Action: Stay informed about the dynamic Indian stock market. Keep track of the Sensex and other key market indicators for optimal investment decisions. Regularly monitor the performance of your BSE stocks and adapt your investment strategy accordingly. Learn more about the BSE Sensex and other Indian stock market trends by following [link to relevant resource].

Featured Posts

-

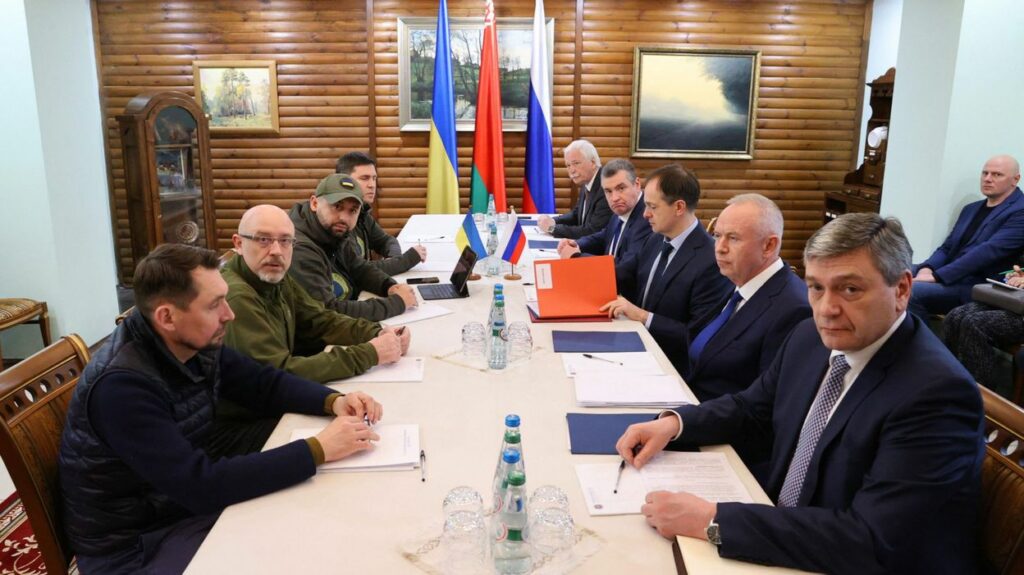

Vyvedet Li Turtsiya Voyska S Kipra Analiz Tekuschey Situatsii

May 15, 2025

Vyvedet Li Turtsiya Voyska S Kipra Analiz Tekuschey Situatsii

May 15, 2025 -

High Level Talks China Seeks Breakthrough In Us Negotiations

May 15, 2025

High Level Talks China Seeks Breakthrough In Us Negotiations

May 15, 2025 -

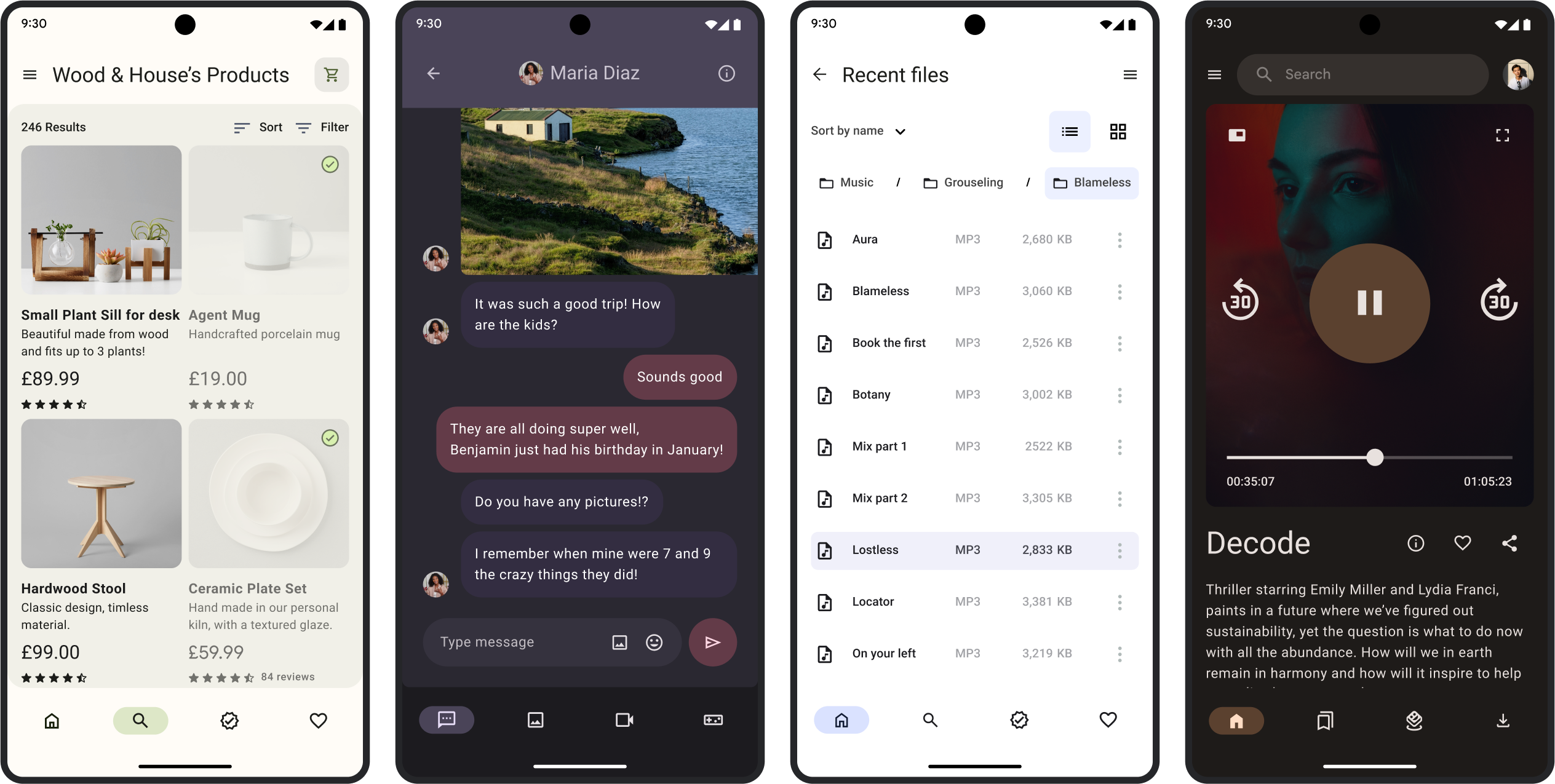

Whats New In Androids Design

May 15, 2025

Whats New In Androids Design

May 15, 2025 -

Viet Jet Faces Financial Reckoning After Court Ruling

May 15, 2025

Viet Jet Faces Financial Reckoning After Court Ruling

May 15, 2025 -

Kibris Isguecue Piyasasi Yeni Dijital Veri Tabani Rehberi Tanitimi

May 15, 2025

Kibris Isguecue Piyasasi Yeni Dijital Veri Tabani Rehberi Tanitimi

May 15, 2025

Latest Posts

-

Whats New In Androids Design

May 15, 2025

Whats New In Androids Design

May 15, 2025 -

Androids Youthful Redesign A Closer Look

May 15, 2025

Androids Youthful Redesign A Closer Look

May 15, 2025 -

New Android Design Improvements And Updates

May 15, 2025

New Android Design Improvements And Updates

May 15, 2025 -

Androids Modernized Design A Comprehensive Guide

May 15, 2025

Androids Modernized Design A Comprehensive Guide

May 15, 2025 -

Forced Military Discharge Leaves Master Sergeant Devastated Cnn Politics

May 15, 2025

Forced Military Discharge Leaves Master Sergeant Devastated Cnn Politics

May 15, 2025