Sharp Decline In Amsterdam Stock Index: Lowest Point In Over A Year

Table of Contents

The Amsterdam Stock Index (AEX) has plummeted to its lowest point in over a year, sending shockwaves through the Dutch financial market and raising concerns among investors both domestically and internationally. This significant decline represents a worrying trend, not only for the Dutch economy but potentially for wider European markets as well. This article will analyze the contributing factors behind this sharp drop, explore its implications for investors, and outline potential strategies for navigating this challenging period.

Factors Contributing to the AEX's Decline

Several interconnected factors have contributed to the recent sharp decline in the Amsterdam Stock Index. Understanding these elements is crucial for investors seeking to interpret the current market situation and plan for the future.

Global Economic Slowdown

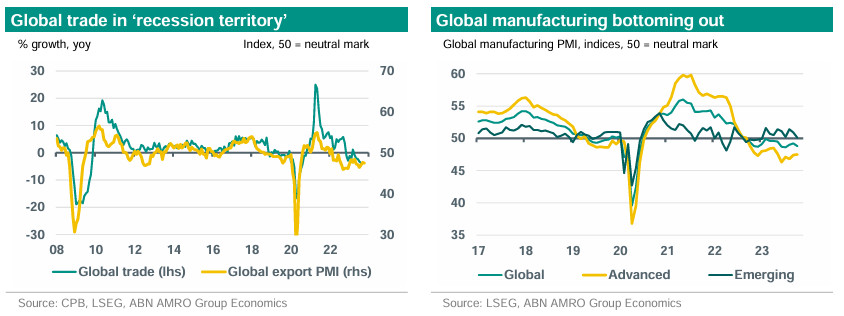

The global economic landscape is currently fraught with uncertainty. High inflation, rising interest rates, and the persistent threat of recession are significantly impacting investor confidence worldwide. This global malaise has naturally impacted the AEX.

- Rising Interest Rates: Central banks across the globe are aggressively raising interest rates to combat inflation, increasing borrowing costs for businesses and dampening economic activity. This has led to a sell-off in many asset classes, including equities.

- Energy Crisis: The ongoing energy crisis, exacerbated by geopolitical events, is driving up energy prices, impacting businesses' profitability and consumer spending. This inflationary pressure further fuels economic uncertainty.

- Supply Chain Disruptions: Persistent supply chain bottlenecks continue to hamper production and increase input costs, impacting businesses' bottom lines and investor sentiment.

- Geopolitical Instability: The war in Ukraine, ongoing trade tensions between major economies, and other geopolitical uncertainties contribute to a climate of risk aversion, prompting investors to move towards safer assets. For example, the uncertainty surrounding energy supplies directly impacts companies listed on the AEX. Data from the IMF suggests a global GDP growth slowdown of X%, further emphasizing the impact of these global headwinds.

Specific Sectoral Weakness

The decline in the AEX is not uniform across all sectors. Some sectors have been disproportionately affected, highlighting specific vulnerabilities within the Dutch economy.

- Energy Sector Performance: The energy sector, a significant component of the AEX, has experienced considerable volatility due to fluctuating energy prices and geopolitical events. Companies heavily reliant on energy imports are particularly vulnerable.

- Technology Sector Vulnerability: The technology sector, often sensitive to interest rate changes, has also witnessed a significant downturn. Higher borrowing costs make it more expensive for tech companies to fund growth initiatives, impacting their valuations.

- Impact on Financial Services: The financial services sector, another key component of the AEX, is not immune to the current market turmoil. Increased uncertainty and potential economic slowdown negatively impact lending activity and profitability. For example, [mention a specific Dutch financial institution and its performance].

Geopolitical Events

Geopolitical events have played a significant role in shaping investor sentiment and impacting the AEX's performance.

- War in Ukraine: The ongoing war in Ukraine has created significant uncertainty in global energy markets and supply chains, directly impacting numerous companies listed on the AEX. Financial analysts predict that the prolonged conflict will continue to weigh on investor sentiment.

- Trade Tensions: Escalating trade tensions between major economies contribute to uncertainty and risk aversion, further impacting global stock markets, including the AEX. [Quote a relevant financial expert].

Implications for Investors

The sharp decline in the AEX has significant implications for investors, both in the short-term and long-term.

Short-Term Impact

The immediate consequences of the AEX's fall are palpable.

- Portfolio Losses: Many investors have experienced significant losses in their portfolios, particularly those heavily invested in Dutch equities.

- Decreased Market Confidence: The sharp decline has eroded investor confidence, leading to increased market volatility and uncertainty.

- Potential for Further Losses: The risk of further losses remains, depending on the evolution of the global economic situation and geopolitical events. The impact on retirement funds and individual investors is considerable.

Long-Term Outlook

The long-term implications of the AEX's decline are multifaceted and depend on various factors.

- Potential for Recovery: A recovery is possible, particularly if global economic conditions improve and geopolitical tensions ease. However, this recovery may take time.

- Need for Diversification: The current situation emphasizes the need for well-diversified investment portfolios to mitigate risk.

- Long-Term Investment Strategies: Investors with a long-term investment horizon should consider adopting a buy-and-hold strategy, averaging down during periods of market weakness. Charts illustrating potential future scenarios, including a "V-shaped" recovery or a more gradual "U-shaped" recovery, are essential to providing investors with a clear picture of potential future outcomes.

Potential Recovery Strategies

Investors can employ several strategies to navigate the current market volatility and position themselves for a potential recovery.

Diversification

Diversifying investments across different asset classes, geographies, and sectors is paramount to mitigating risk.

- Asset Class Diversification: Include bonds, real estate, and alternative investments to balance equity exposure.

- Geographical Diversification: Invest in companies and markets beyond the Netherlands to reduce dependence on a single economy.

- Sector Diversification: Avoid over-concentration in specific sectors vulnerable to current market headwinds.

Risk Management

Effective risk management strategies are crucial during periods of market volatility.

- Stop-Loss Orders: Implement stop-loss orders to limit potential losses on individual investments.

- Hedging Strategies: Employ hedging techniques to protect portfolios against adverse market movements.

- Rebalancing Portfolios: Regularly rebalance portfolios to maintain the desired asset allocation and risk profile.

Long-Term Investment Horizon

Maintaining a long-term investment horizon is essential to weathering market fluctuations.

- Averaging Down: Consider buying additional shares of undervalued companies during periods of market weakness.

- Patience: Avoid making impulsive decisions based on short-term market movements.

- Riding Out Market Fluctuations: Remain invested and allow your portfolio to recover over time.

Conclusion

The sharp decline in the Amsterdam Stock Index represents a significant event, driven by a confluence of global economic slowdown, sectoral weaknesses, and geopolitical uncertainties. The implications for investors are substantial, highlighting the need for careful risk management and diversified portfolios. While the short-term outlook may be uncertain, employing sound investment strategies, including diversification and a long-term perspective, will be crucial for navigating this challenging market environment. The AEX's current low point underscores the importance of staying informed and adapting investment strategies accordingly. To make informed investment decisions and effectively mitigate risk, stay updated on the fluctuations in the Amsterdam Stock Index and other market trends. Learn more about effective risk management and portfolio diversification strategies to navigate market volatility. Consider consulting a financial advisor for personalized guidance on your investments in the wake of this significant decline in the AEX.

Featured Posts

-

La Replique Cinglante De Thierry Ardisson A Laurent Baffie

May 25, 2025

La Replique Cinglante De Thierry Ardisson A Laurent Baffie

May 25, 2025 -

Renewed Trade War Concerns Trigger Another Fall In Dutch Stocks

May 25, 2025

Renewed Trade War Concerns Trigger Another Fall In Dutch Stocks

May 25, 2025 -

What Is A Flash Flood Understanding Flood Warnings And Alerts

May 25, 2025

What Is A Flash Flood Understanding Flood Warnings And Alerts

May 25, 2025 -

Kapitaalmarktrentes Stijgen Verder Euro Boven 1 08

May 25, 2025

Kapitaalmarktrentes Stijgen Verder Euro Boven 1 08

May 25, 2025 -

Trade War Intensifies Amsterdam Stock Market Opens Down 7

May 25, 2025

Trade War Intensifies Amsterdam Stock Market Opens Down 7

May 25, 2025