Student Loan Delinquency: How It Impacts Your Credit

Table of Contents

Understanding Student Loan Delinquency

Student loan delinquency refers to the failure to make timely payments on your student loans. This includes both missed payments and late payments, each with escalating consequences. Delinquency is typically categorized into stages based on how long the payment is overdue: 30 days past due, 60 days past due, and 90+ days past due.

-

30 Days Past Due: While considered early delinquency, this can still negatively impact your credit score and trigger communication from your loan servicer.

-

60 Days Past Due: This signifies more serious delinquency, leading to further credit score damage and potentially more aggressive collection efforts.

-

90+ Days Past Due: At this stage, the consequences become far more severe. Your credit score will suffer significantly, and you may face wage garnishment, difficulty securing future loans (like mortgages or auto loans), and involvement from collection agencies.

-

Negative impact on credit score: Late payments significantly lower your credit score.

-

Potential for wage garnishment: The government can garnish your wages to recover the delinquent debt.

-

Difficulty securing future loans (mortgages, auto loans): Lenders view delinquency as a high risk.

-

Collection agency involvement: Your debt may be sold to a collection agency, further damaging your credit and potentially leading to legal action.

How Delinquency Affects Your Credit Score

Late student loan payments are reported to the three major credit bureaus: Equifax, Experian, and TransUnion. This negative information directly impacts your FICO score, a crucial factor in determining your creditworthiness. The severity of the score drop depends on the length of the delinquency. For example, a 30-day delinquency might result in a 30-50 point drop, while a 90+ day delinquency could cause a drop of 100 points or more. These negative marks typically remain on your credit report for seven years, continuing to hinder your creditworthiness.

- Lower credit score = higher interest rates on future loans: A lower credit score means you'll pay significantly more in interest over the life of any future loans.

- Difficulty getting approved for credit cards, rentals, etc.: Landlords and credit card companies often deny applications with poor credit history.

- Impact on insurance premiums: Your insurance premiums (auto, renters, etc.) can increase due to a lower credit score.

- Potential for denial of employment opportunities: Some employers perform credit checks as part of their hiring process.

Preventing Student Loan Delinquency

Preventing student loan delinquency requires proactive financial planning and responsible budgeting. Here are some key strategies:

- Create a realistic budget: Track your income and expenses meticulously to ensure you have enough to cover your student loan payments.

- Automate payments: Set up automatic payments to avoid missing deadlines due to oversight.

- Explore loan consolidation or refinancing options: Combining multiple loans into one with a potentially lower interest rate can simplify payments.

- Set up payment reminders: Utilize calendar alerts or reminder apps to stay on top of due dates.

- Consider forbearance or deferment (if eligible and understand the implications): These options temporarily suspend or reduce payments, but they usually have long-term consequences, such as accruing interest. Carefully weigh the pros and cons before choosing this option. Always communicate with your loan servicer.

Contacting your loan servicer early if you anticipate difficulties is crucial. They may offer repayment plans or other assistance programs to help you avoid delinquency.

Recovering from Student Loan Delinquency

If you're already experiencing student loan delinquency, it's vital to take immediate action:

- Negotiate a repayment plan with your lender: Contact your loan servicer to discuss options like repayment plans or hardship programs.

- Seek professional credit counseling: A credit counselor can help you create a budget, manage your debt, and develop a plan for credit repair.

- Monitor your credit report regularly: Check your credit report from all three bureaus (Equifax, Experian, and TransUnion) for accuracy and to track your progress.

- Dispute any inaccuracies on your credit report: If you find any errors, dispute them with the credit bureaus immediately.

- Rebuild your credit score through responsible financial habits: Consistent on-time payments, responsible credit usage, and maintaining a low debt-to-income ratio are crucial for rebuilding your credit.

Conclusion

Student loan delinquency severely impacts your credit score, leading to higher interest rates on future loans, difficulty securing credit, and potential legal ramifications. Preventing student loan delinquency is crucial for long-term financial health. Take control of your student loan debt today. Prevent student loan delinquency and protect your credit score. Learn more about managing your student loan debt and avoiding delinquency. Proactive planning, responsible budgeting, and open communication with your loan servicer are key to avoiding the negative consequences of student loan delinquency on your credit report and credit score.

Featured Posts

-

El Esquema Ponzi De Koriun Inversiones Una Explicacion Detallada

May 17, 2025

El Esquema Ponzi De Koriun Inversiones Una Explicacion Detallada

May 17, 2025 -

Lehigh Valley Live Com Severance Season 3 What We Know

May 17, 2025

Lehigh Valley Live Com Severance Season 3 What We Know

May 17, 2025 -

Open Ai Facing Ftc Investigation A Deep Dive Into The Implications

May 17, 2025

Open Ai Facing Ftc Investigation A Deep Dive Into The Implications

May 17, 2025 -

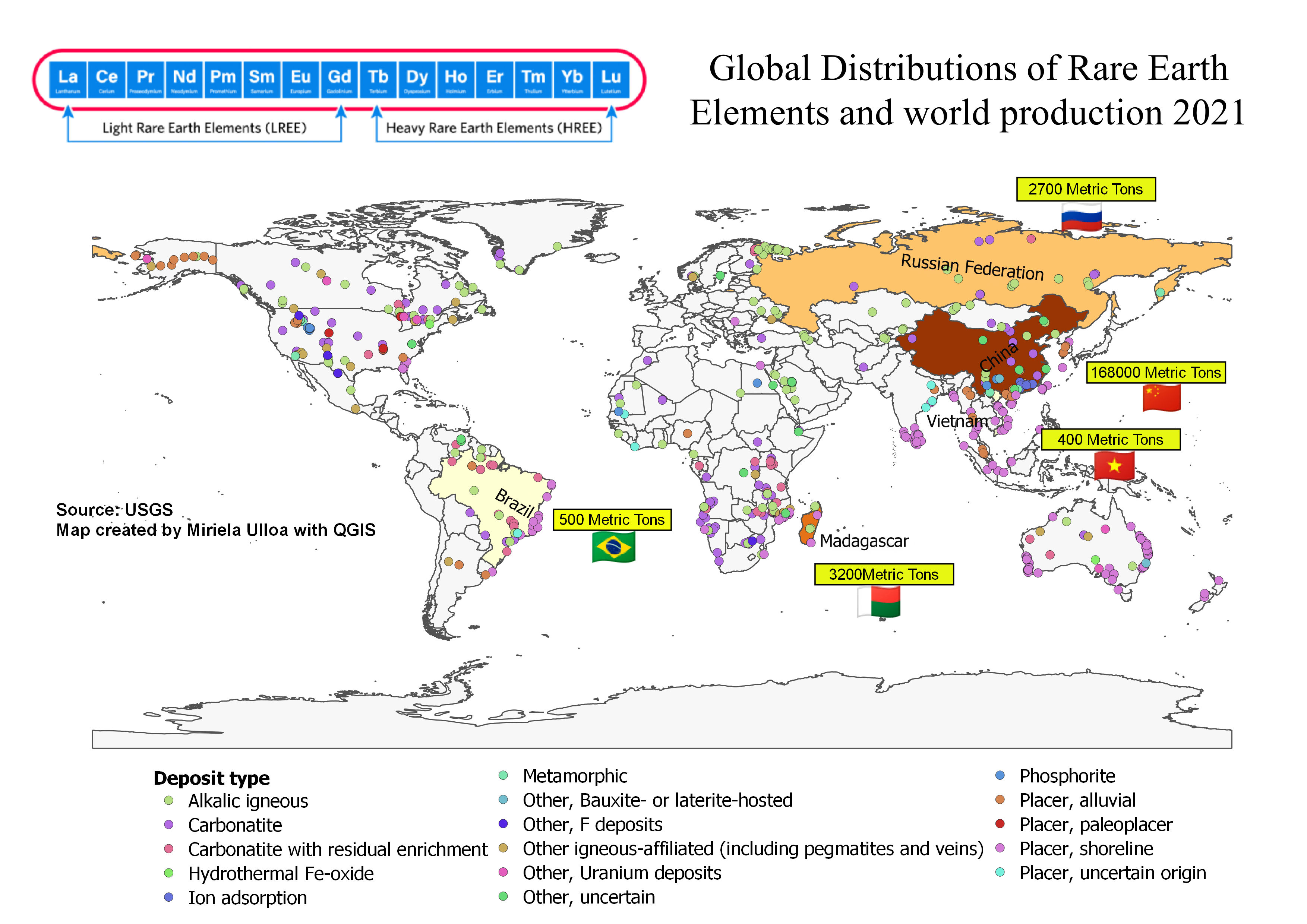

Global Heavy Rare Earths Market Lynass Rise As A Major Player

May 17, 2025

Global Heavy Rare Earths Market Lynass Rise As A Major Player

May 17, 2025 -

Ichiro Suzukis Enduring Legacy His Influence On Baseball Two Decades Later

May 17, 2025

Ichiro Suzukis Enduring Legacy His Influence On Baseball Two Decades Later

May 17, 2025

Latest Posts

-

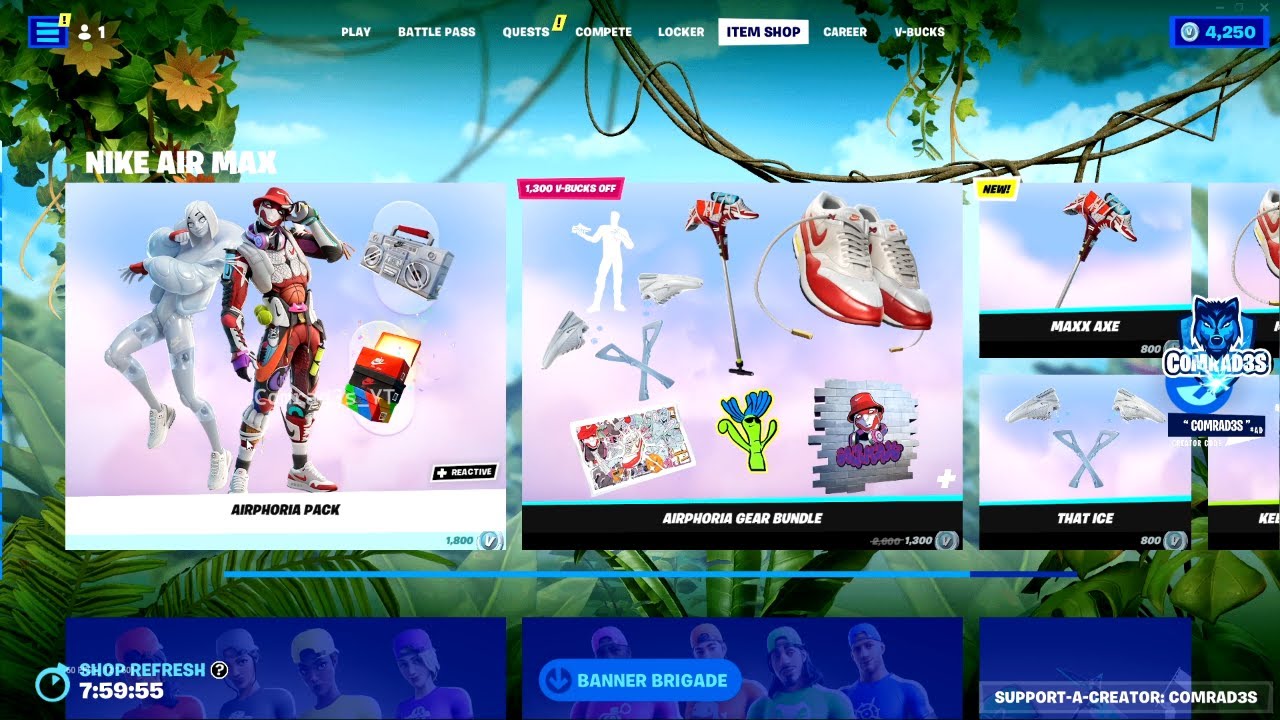

Highly Requested Fortnite Skins Back In The Item Shop After 1000 Days

May 17, 2025

Highly Requested Fortnite Skins Back In The Item Shop After 1000 Days

May 17, 2025 -

Fortnites 1000 Day Skin Comeback Item Shop Updates

May 17, 2025

Fortnites 1000 Day Skin Comeback Item Shop Updates

May 17, 2025 -

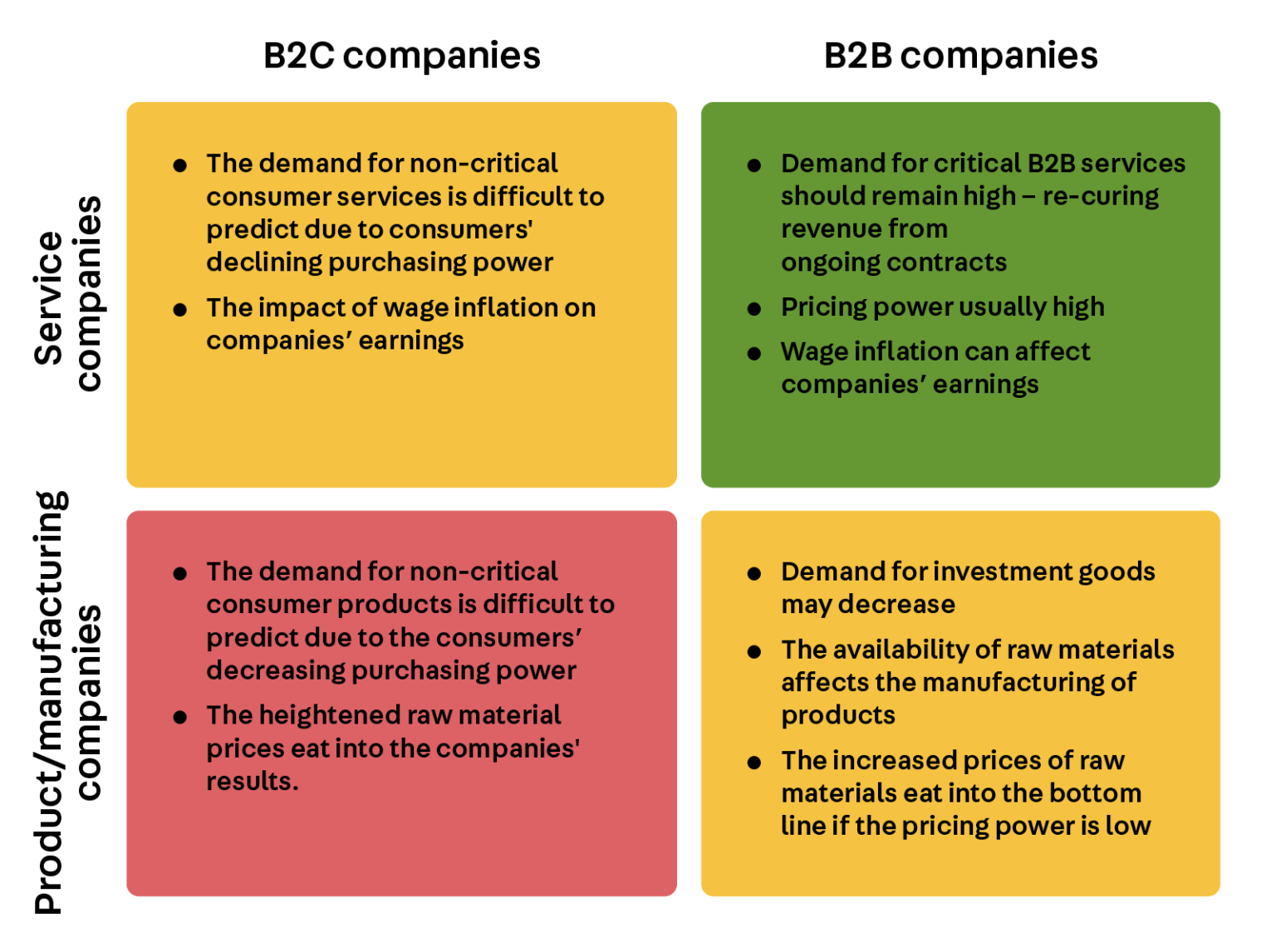

Uber Stock A Recession Resistant Investment Expert Analysis

May 17, 2025

Uber Stock A Recession Resistant Investment Expert Analysis

May 17, 2025 -

Is Uber Recession Proof Analyzing The Stocks Resilience

May 17, 2025

Is Uber Recession Proof Analyzing The Stocks Resilience

May 17, 2025 -

Uber Stock And Recession Why Analysts Remain Bullish

May 17, 2025

Uber Stock And Recession Why Analysts Remain Bullish

May 17, 2025