The Bank Of England And QE: A Case For Moderation In Future Interventions

Table of Contents

Defining Quantitative Easing (QE)

Quantitative easing is a monetary policy tool employed by central banks to increase the money supply and lower long-term interest rates when conventional methods, such as lowering the base interest rate, are ineffective. It involves a central bank purchasing assets, primarily government bonds, from commercial banks and other financial institutions. This injection of liquidity increases the money supply, aiming to stimulate lending, investment, and ultimately, economic growth. The BoE's QE programs have significantly expanded its balance sheet, demonstrating the scale of its interventions.

The Effectiveness of QE in the UK Context

Successes of Previous QE Programs

Previous QE programs in the UK have demonstrably contributed to economic stability. During the 2008 financial crisis, QE helped avert a deeper recession by injecting liquidity into the banking system and lowering borrowing costs for businesses and consumers.

- Increased lending: QE facilitated increased lending to businesses, supporting investment and job creation.

- Reduced borrowing costs: Lower long-term interest rates made borrowing cheaper, stimulating economic activity.

- Improved asset prices: QE helped to stabilize and even boost asset prices, preventing a sharp decline in wealth.

Limitations and Unintended Consequences

Despite its successes, QE is not without limitations and potential downsides.

- Inflationary pressures: The substantial increase in the money supply can lead to inflationary pressures, eroding purchasing power and impacting long-term economic stability.

- Asset price inflation: QE can inflate asset prices, potentially creating asset bubbles in certain sectors, increasing financial vulnerability.

- Wealth inequality: The benefits of QE may not be evenly distributed, potentially exacerbating wealth inequality as asset owners disproportionately benefit.

Alternative Monetary Policy Tools

Exploring Forward Guidance and Negative Interest Rates

The BoE possesses a wider monetary policy toolkit than just QE.

- Forward guidance: Communicating the central bank's future policy intentions can influence market expectations and shape long-term interest rates without requiring asset purchases.

- Negative interest rates: While not yet implemented in the UK on the same scale as other countries, negative interest rates can incentivize banks to lend more and stimulate economic activity. However, this strategy has potential drawbacks, such as impacting bank profitability.

The Role of Fiscal Policy in Economic Stabilization

Effective economic management requires coordination between monetary and fiscal policies.

- Fiscal stimulus: Government spending and tax cuts can provide direct economic stimulus, complementing the effects of QE.

- Targeted support: Fiscal policy can be targeted towards specific sectors or demographics, addressing inequalities and promoting sustainable growth. This can reduce the reliance on QE's broader, less targeted effects.

Risks Associated with Excessive QE

Inflationary Risks and Long-Term Economic Stability

Excessive QE poses significant risks to long-term economic stability.

- Inflation expectations: If the public anticipates persistent inflation, this can become a self-fulfilling prophecy, leading to wage-price spirals and economic instability.

- Interest rate hikes: To combat inflation caused by excessive QE, the BoE may be forced to implement sharp interest rate hikes, potentially triggering a recession.

- Reduced long-term growth: High and volatile inflation can negatively affect long-term economic growth prospects.

Moral Hazard and Financial Instability

QE can create moral hazard by encouraging excessive risk-taking in financial markets.

- Reduced risk aversion: The provision of ample liquidity can reduce risk aversion among financial institutions, leading them to take on excessive leverage.

- Asset bubbles: Easy access to credit can fuel asset bubbles, potentially leading to sharp corrections and financial instability.

- Systemic risk: The interconnectedness of the financial system means that the failure of one institution can have cascading effects, creating systemic risk.

The Bank of England, QE, and the Path Forward

This article has argued for a more cautious approach to QE interventions by the BoE. Excessive reliance on QE carries significant risks, including inflation, asset bubbles, and financial instability. Alternative monetary policy tools, such as forward guidance and negative interest rates, alongside coordinated fiscal policy, offer potentially less risky avenues for economic stabilization.

Key Takeaways:

- QE has been effective in mitigating economic shocks but carries substantial risks.

- Alternative monetary and fiscal policy tools should be prioritized over excessive QE.

- A balanced and coordinated approach to monetary and fiscal policy is crucial for long-term economic stability.

Call to Action: The future effectiveness of the UK economy depends on responsible QE implementation. We need a thoughtful discussion on moderated QE interventions and optimal monetary policy strategies, balancing the need for economic stimulus with the potential downsides of excessive liquidity. Engage with the BoE, participate in public forums, and encourage further research on the long-term impacts of QE to promote informed policymaking.

Featured Posts

-

The Bank Of England And Qe A Case For Moderation In Future Interventions

Apr 23, 2025

The Bank Of England And Qe A Case For Moderation In Future Interventions

Apr 23, 2025 -

Retail Giants Walmart And Target Confront Trump Over Tariffs

Apr 23, 2025

Retail Giants Walmart And Target Confront Trump Over Tariffs

Apr 23, 2025 -

Alerte Trader Identifier Et Exploiter Les Seuils Techniques Importants

Apr 23, 2025

Alerte Trader Identifier Et Exploiter Les Seuils Techniques Importants

Apr 23, 2025 -

Solutions 30 Analyse Boursiere Et Previsions De Cours

Apr 23, 2025

Solutions 30 Analyse Boursiere Et Previsions De Cours

Apr 23, 2025 -

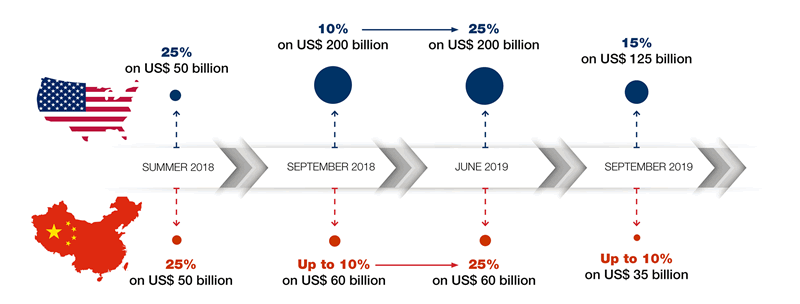

Impact Of Us China Trade War Chinas Increased Canadian Oil Imports

Apr 23, 2025

Impact Of Us China Trade War Chinas Increased Canadian Oil Imports

Apr 23, 2025

Latest Posts

-

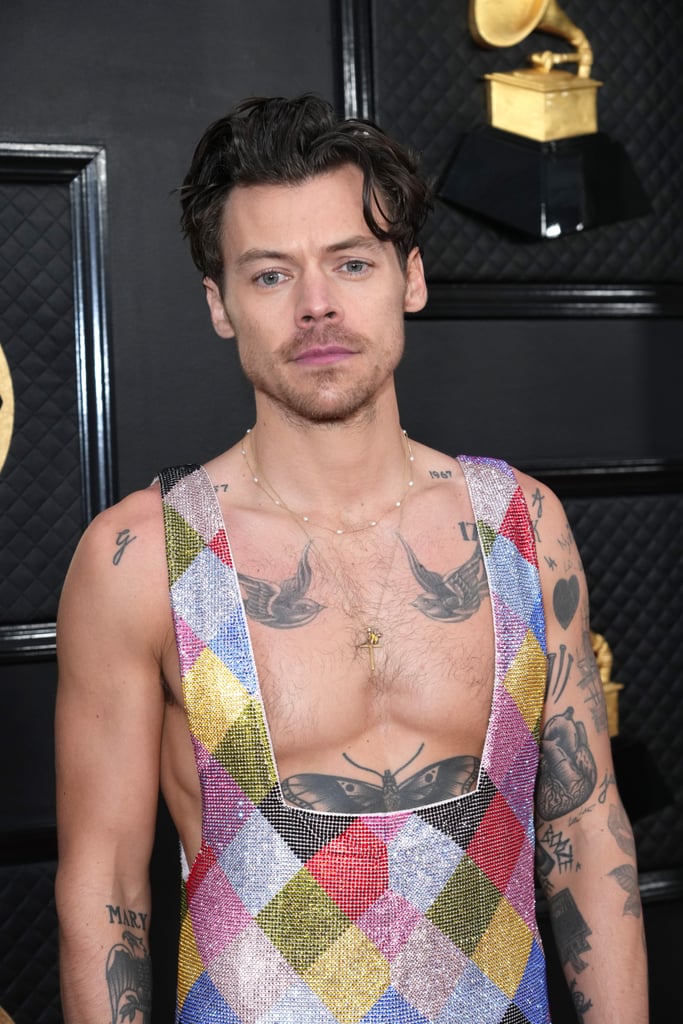

How Harry Styles Reacted To His Subpar Snl Impression

May 10, 2025

How Harry Styles Reacted To His Subpar Snl Impression

May 10, 2025 -

The Snl Impression That Left Harry Styles Devastated

May 10, 2025

The Snl Impression That Left Harry Styles Devastated

May 10, 2025 -

Snls Bad Harry Styles Impression The Singers Response

May 10, 2025

Snls Bad Harry Styles Impression The Singers Response

May 10, 2025 -

Snls Failed Harry Styles Impression The Singers Response

May 10, 2025

Snls Failed Harry Styles Impression The Singers Response

May 10, 2025 -

Snls Impression Of Harry Styles The Singers Disappointed Response

May 10, 2025

Snls Impression Of Harry Styles The Singers Disappointed Response

May 10, 2025