The High Cost Of Making It In America

Table of Contents

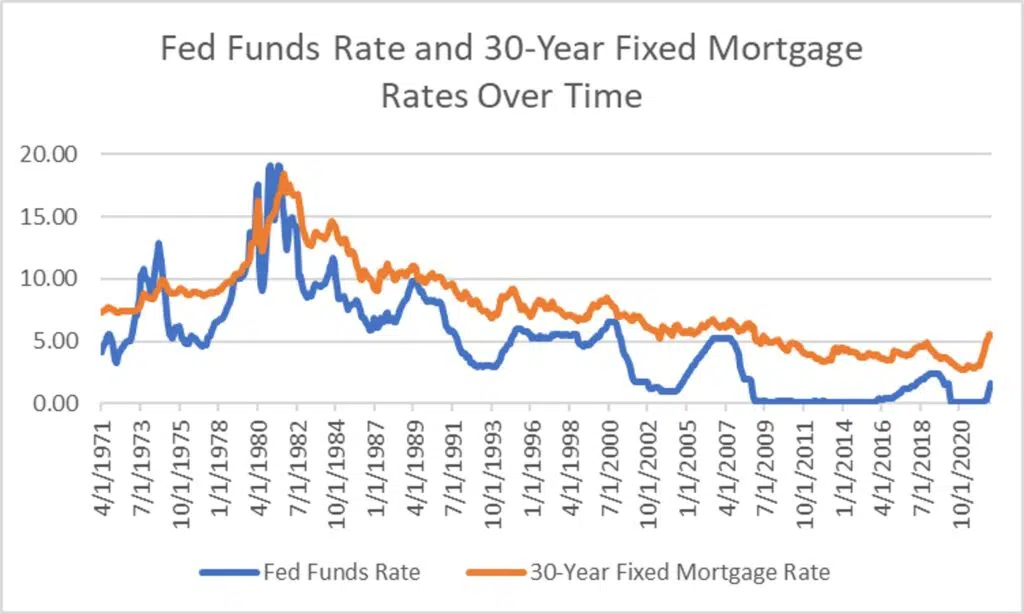

Soaring Housing Costs

The cost of housing in America has skyrocketed, creating a significant barrier to entry for many aspiring homeowners and renters. This housing crisis manifests in several ways, making the pursuit of the American Dream a challenging uphill battle for a large segment of the population.

The Housing Crisis in Major Cities

Major metropolitan areas are experiencing a severe housing shortage, driving up rental and purchase prices to exorbitant levels. Factors contributing to this crisis include limited housing supply, rapid gentrification, and a lack of affordable housing initiatives.

- Average rent increases in major cities: Rent in many major cities has increased by 20-30% in the last few years, making it increasingly difficult for individuals and families to afford a place to live.

- Examples of unaffordable housing markets: Cities like New York, San Francisco, and Los Angeles consistently rank among the most expensive places to live in the US, making homeownership an unattainable goal for many.

- Impact on commuting times and affordability: The high cost of housing in city centers often forces people to live further away, leading to longer commutes, increased transportation costs, and a further strain on already tight budgets.

The Suburban Sprawl and its Costs

While suburban living is often perceived as the epitome of the American Dream, the reality is that it comes with a significant financial burden. The allure of larger homes and yards often masks the hidden costs associated with this lifestyle.

- Comparison of urban vs. suburban living costs: While suburban homes may seem cheaper upfront than comparable city homes, the long-term costs, including property taxes, transportation, and utilities, can significantly outweigh the initial savings.

- Hidden costs of suburban living: Longer commutes translate to higher gas expenses, more wear and tear on vehicles, and lost productivity. Maintaining larger properties also adds to the financial burden.

- Impact on family budgets: The cumulative effect of these costs can significantly strain family budgets, leaving less money available for savings, education, or other essential needs.

Education Debt Burden

The cost of higher education has exploded in recent decades, leaving many graduates saddled with crippling student loan debt that impacts their financial stability for years, if not decades, to come. This debt burden significantly hinders their ability to achieve the American Dream.

The Rising Cost of Higher Education

Tuition fees at colleges and universities have far outpaced inflation, making higher education increasingly unaffordable for many.

- Average student loan debt: The average student loan debt in the US is staggering, placing a significant financial burden on recent graduates.

- Impact on career choices: The pressure to repay student loans often influences career choices, pushing graduates into higher-paying jobs they may not be passionate about.

- Long-term financial implications of student loan debt: Student loan debt can significantly delay major life milestones such as homeownership, starting a family, and retirement planning.

Limited Access to Affordable Education

Students from low-income backgrounds face significant challenges in accessing higher education due to limited financial aid and scholarship opportunities.

- Funding disparities in education: Funding for public education often varies significantly by state and district, leading to unequal access to quality education and resources.

- Impact on social mobility: The high cost of higher education further exacerbates existing inequalities, hindering social mobility for individuals from disadvantaged backgrounds.

- Alternative pathways to education: Exploring alternative pathways, such as vocational training programs or community colleges, can offer more affordable routes to career success but often lack the same prestige or earning potential as a four-year college degree.

Healthcare Expenses

The US healthcare system is notoriously expensive, creating another major obstacle to achieving the American Dream. The high cost of insurance and healthcare services significantly strains household budgets and can lead to devastating financial consequences.

The High Cost of Health Insurance

Obtaining affordable and adequate health insurance coverage remains a significant challenge for many Americans.

- High premiums, deductibles, and co-pays: The cost of health insurance premiums, deductibles, and co-pays is prohibitive for many families, leaving them vulnerable to financial ruin in the event of illness or injury.

- The impact of unexpected medical bills: Unexpected medical emergencies can lead to crippling medical debt, even for those with insurance, due to high out-of-pocket costs.

- Healthcare affordability for families: The high cost of healthcare significantly strains family budgets, often forcing families to choose between healthcare and other essential needs.

The Rising Costs of Healthcare Services

The cost of medical care, including doctor visits, hospital stays, and prescription drugs, continues to rise at an alarming rate.

- Comparison of healthcare costs with other developed nations: The US consistently ranks among the highest in healthcare costs among developed nations, despite not having the best health outcomes.

- The role of pharmaceutical companies: The high price of prescription drugs contributes significantly to the overall cost of healthcare.

- Strategies for managing healthcare costs: Strategies for managing healthcare costs include shopping around for better insurance plans, utilizing generic medications, and practicing preventative care to reduce the need for expensive treatments.

The Impact of Inflation and Stagnant Wages

The combined effect of rising inflation and stagnant wages creates a perfect storm, further squeezing household budgets and making it increasingly difficult for Americans to make ends meet.

Inflation's Squeeze on Household Budgets

Rising inflation erodes the purchasing power of wages, making everyday expenses like groceries, gas, and utilities increasingly unaffordable.

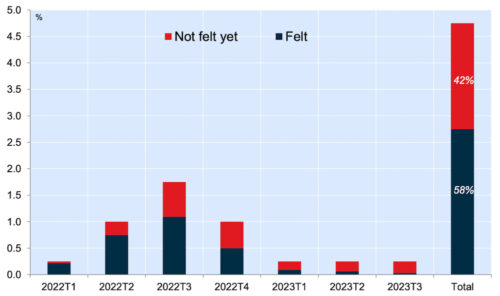

- Recent inflation rates: Recent years have seen significant increases in inflation rates, impacting the affordability of essential goods and services.

- Examples of increased costs: The cost of groceries, gasoline, and housing have all increased dramatically, leaving many Americans struggling to cover their basic needs.

- The impact on purchasing power: The increase in prices, coupled with stagnant wages, has significantly reduced the purchasing power of many Americans.

The Wage Stagnation Problem

For many Americans, wages have remained stagnant, failing to keep pace with inflation. This widening gap between income and the cost of living is a major contributor to the high cost of making it in America.

- Comparison of wage growth and inflation rates: Wage growth has not kept pace with inflation in recent years, resulting in a decline in real wages for many Americans.

- Income inequality: The gap between the wealthy and the poor continues to widen, further exacerbating the challenges faced by low- and middle-income families.

- The need for increased minimum wage: Many advocates argue that increasing the minimum wage is crucial to ensure a living wage for all workers.

Conclusion

The high cost of making it in America is a complex issue with far-reaching consequences. Soaring housing costs, crippling education debt, exorbitant healthcare expenses, and the combined pressure of inflation and stagnant wages are significantly hindering financial success for many. These challenges disproportionately impact lower-income families and communities, perpetuating cycles of poverty and inequality.

Understanding the High Cost of Making it in America is the first step towards addressing this critical issue. We need systemic change, innovative solutions, and a national conversation to create a more equitable and affordable future for all Americans. Let's work together to find solutions that will make the American Dream attainable for everyone.

Featured Posts

-

How To Get Capital Summertime Ball 2025 Tickets Your Complete Guide

Apr 29, 2025

How To Get Capital Summertime Ball 2025 Tickets Your Complete Guide

Apr 29, 2025 -

Mildred Snitzer Orchestra And Jeff Goldblum A Spring Concert At The London Palladium

Apr 29, 2025

Mildred Snitzer Orchestra And Jeff Goldblum A Spring Concert At The London Palladium

Apr 29, 2025 -

Report On Sons Care Of Willie Nelson Sparks Family Outburst

Apr 29, 2025

Report On Sons Care Of Willie Nelson Sparks Family Outburst

Apr 29, 2025 -

Murder Conviction After Fatal Teen Rock Throwing Incident

Apr 29, 2025

Murder Conviction After Fatal Teen Rock Throwing Incident

Apr 29, 2025 -

Was Jeff Goldblum Robbed Of An Oscar For His Role In The Fly

Apr 29, 2025

Was Jeff Goldblum Robbed Of An Oscar For His Role In The Fly

Apr 29, 2025

Latest Posts

-

Economists Forecast Bank Of Canada Interest Rate Reductions Following Tariff Related Job Losses

May 12, 2025

Economists Forecast Bank Of Canada Interest Rate Reductions Following Tariff Related Job Losses

May 12, 2025 -

White House Downplays Uk Trade Deal Impact On North American Automakers

May 12, 2025

White House Downplays Uk Trade Deal Impact On North American Automakers

May 12, 2025 -

Bank Of Canada Rate Cuts Economists Predict Renewed Cuts Amidst Tariff Job Losses

May 12, 2025

Bank Of Canada Rate Cuts Economists Predict Renewed Cuts Amidst Tariff Job Losses

May 12, 2025 -

The Bce Inc Dividend Cut What It Means For Your Investment Strategy

May 12, 2025

The Bce Inc Dividend Cut What It Means For Your Investment Strategy

May 12, 2025 -

Us Rejects Auto Industrys Uk Trade Deal Worries

May 12, 2025

Us Rejects Auto Industrys Uk Trade Deal Worries

May 12, 2025