Thousands Owe HMRC: Unclaimed Savings And Refunds

Table of Contents

How to Check if You Have Unclaimed Savings with HMRC

Many people are unaware of unclaimed funds owed to them by HMRC. Let's explore several ways to check:

Using the HMRC Online Portal

The most efficient way to check for unclaimed savings and tax refunds is through the official HMRC online portal.

-

Step-by-step guide: Navigate to the HMRC website (www.gov.uk/government/organisations/hm-revenue-customs). Log in using your Government Gateway credentials. Use search terms like "check my tax refund," "unclaimed tax credits," or "find my HMRC refund" to locate the relevant sections.

-

Potential difficulties: You might encounter difficulties if you've forgotten your login details or if you're not registered for online services. If you face such issues, use the "forgotten password" feature or contact HMRC directly for assistance.

-

Required information: You'll need your National Insurance number, date of birth, and potentially other personal details for verification purposes.

-

- Bullet Points:

- Access the HMRC website via www.gov.uk/government/organisations/hm-revenue-customs.

- Use search terms such as "check my tax refund" or "unclaimed savings."

- Ensure you have your Government Gateway credentials ready.

- Gather your National Insurance number and date of birth.

Contacting HMRC Directly

If you prefer, you can contact HMRC directly via phone or post. However, be prepared for potential delays.

-

Contact details: HMRC's contact details are readily available on their website. Expect potentially lengthy wait times, particularly during peak periods.

-

Necessary documentation: Having your National Insurance number, full name, address, and any relevant tax information readily available will significantly speed up the process.

-

- Bullet Points:

- Collect all relevant documentation, including your National Insurance number and proof of address.

- Be prepared for lengthy wait times if contacting via phone.

- Keep a record of your communication with HMRC.

Using Third-Party Services (with caution)

Several commercial services claim to help you find and claim unclaimed money from HMRC. While some are legitimate, others are scams. Exercise extreme caution.

-

Pros and cons: Pros include potentially faster processing times; cons include fees and the risk of encountering fraudulent companies.

-

Choosing reputable companies: Thoroughly research any service provider before using their services. Check online reviews and verify their legitimacy.

-

Warning against scams: Never share sensitive personal information unless you're absolutely certain of the company's authenticity.

-

- Bullet Points:

- Ask potential service providers about their fees and success rates.

- Check online reviews and verify their legitimacy with the relevant authorities.

- Never share your banking details or National Insurance number unless you are certain of the company's legitimacy.

Common Reasons for Unclaimed HMRC Refunds

Several factors can lead to unclaimed HMRC refunds. Let's explore the most common:

Overpaid Tax

Overpaying tax is surprisingly common. This can happen due to errors in self-assessment tax returns or changes in circumstances.

-

Examples: Incorrectly claiming expenses, failing to account for changes in income, or errors in calculating tax liability.

-

- Bullet Points:

- Errors in self-assessment tax returns.

- Changes in circumstances (e.g., marriage, job loss).

- Incorrectly claiming tax reliefs or allowances.

Unclaimed Tax Credits

Many individuals are entitled to tax credits but fail to claim them or are unaware of their eligibility.

-

Types of tax credits: Child Tax Credit, Working Tax Credit.

-

Checking eligibility: Use the HMRC website to check if you're eligible for past tax credits.

-

- Bullet Points:

- Child Tax Credit

- Working Tax Credit

- Tax credits for disabled individuals

Unclaimed Savings Accounts

Forgotten or dormant savings accounts can hold significant unclaimed funds.

-

Situations: Forgotten accounts from previous employment, deceased relatives' accounts, or accounts opened years ago and subsequently overlooked.

-

Government resources: Utilize government resources to locate lost savings.

-

- Bullet Points:

- Search for forgotten accounts using online search engines.

- Check with banks and building societies you've held accounts with.

- Inquire about accounts held by deceased relatives.

The Process of Claiming Your Unclaimed HMRC Refund

Once you've identified unclaimed funds, follow these steps to claim them:

Gathering Necessary Documentation

Before submitting your claim, collect all required documents.

-

Essential documents: National Insurance number, bank details, and any supporting documentation relevant to your claim (e.g., payslips, tax returns).

-

HMRC guides: Refer to HMRC's online guides for detailed information on required documentation.

-

- Bullet Points:

- National Insurance number

- Bank account details

- Supporting documentation (payslips, tax returns, etc.)

Submitting Your Claim

Submitting your claim is typically done online through the HMRC portal.

-

Online claim process: The HMRC website provides a step-by-step guide for submitting your claim.

-

Processing times: Allow sufficient processing time, as specified by HMRC.

-

- Bullet Points:

- Complete the online claim form accurately.

- Ensure all required documentation is attached.

- Submit your claim and keep a copy for your records.

What to Do if Your Claim is Rejected

If your claim is rejected, understand your rights to appeal.

-

Appealing a rejected claim: HMRC provides information on how to appeal a rejected claim.

-

Further assistance: Contact HMRC for further assistance and clarification.

-

- Bullet Points:

- Review the rejection notice carefully.

- Gather additional evidence to support your claim.

- Follow HMRC's appeals procedure.

Don't Let Your Money Go Unclaimed – Check for Your HMRC Refund Today!

This article highlighted how thousands owe HMRC unclaimed savings and refunds. We explored how to check for unclaimed funds, common reasons for unclaimed money, and the claiming process. Don't delay! Check for your unclaimed HMRC money, HMRC tax refund check, or find your HMRC refund today. Visit the HMRC website (www.gov.uk/government/organisations/hm-revenue-customs) or contact them directly to find out if you're owed a refund. Don't let your hard-earned money go unclaimed!

Featured Posts

-

Nyt Mini Crossword Answers For April 2 2024

May 20, 2025

Nyt Mini Crossword Answers For April 2 2024

May 20, 2025 -

Ecowas Charts Economic Future At Niger Strategic Retreat

May 20, 2025

Ecowas Charts Economic Future At Niger Strategic Retreat

May 20, 2025 -

Ferraris Warning Prioritizing Hamilton Could Alienate Leclerc

May 20, 2025

Ferraris Warning Prioritizing Hamilton Could Alienate Leclerc

May 20, 2025 -

Eurovision 2025 Finalists A Ranking From Hypnotic To Atrocious

May 20, 2025

Eurovision 2025 Finalists A Ranking From Hypnotic To Atrocious

May 20, 2025 -

Robert Pattinson And Accents How They Define His Roles Including Mickey 17

May 20, 2025

Robert Pattinson And Accents How They Define His Roles Including Mickey 17

May 20, 2025

Latest Posts

-

Femicide Defining The Crime And Investigating The Reasons Behind Its Growth

May 20, 2025

Femicide Defining The Crime And Investigating The Reasons Behind Its Growth

May 20, 2025 -

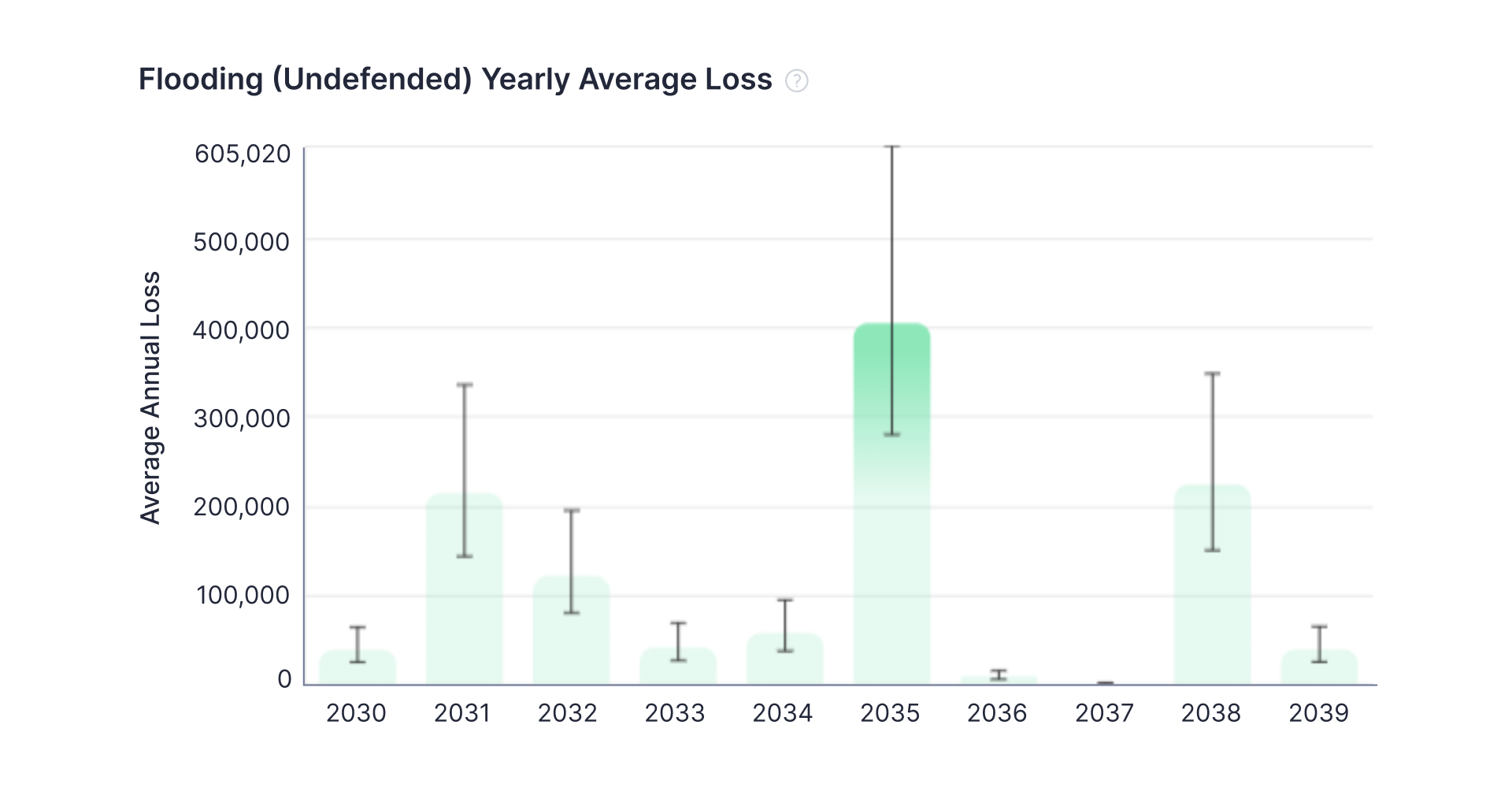

Assessing Climate Risk Before Applying For A Home Loan

May 20, 2025

Assessing Climate Risk Before Applying For A Home Loan

May 20, 2025 -

Femicide A Deep Dive Into The Causes And The Recent Surge In Cases

May 20, 2025

Femicide A Deep Dive Into The Causes And The Recent Surge In Cases

May 20, 2025 -

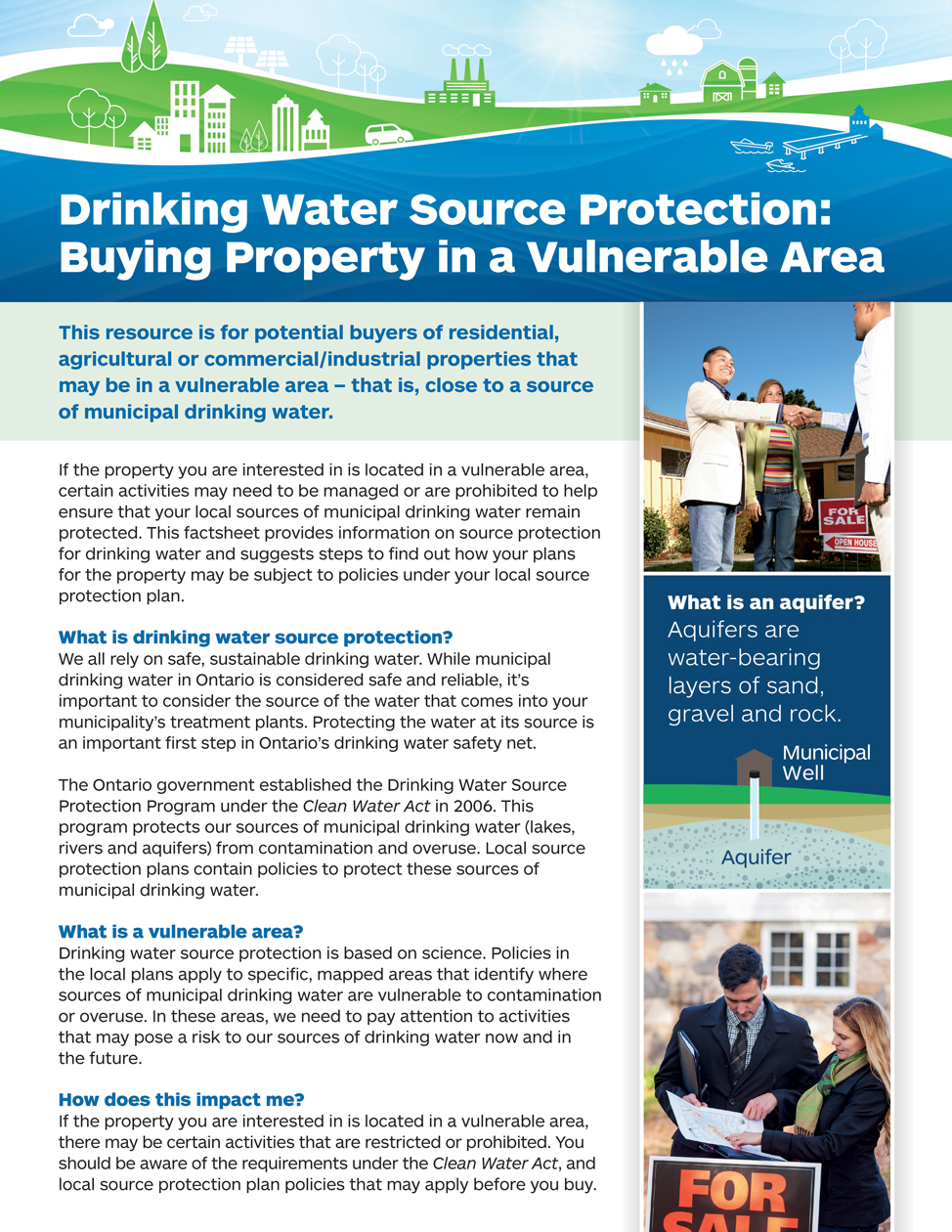

Buying A Home In A Climate Vulnerable Area Credit Implications

May 20, 2025

Buying A Home In A Climate Vulnerable Area Credit Implications

May 20, 2025 -

The Rise Of Femicide Exploring The Factors Contributing To Increased Incidents

May 20, 2025

The Rise Of Femicide Exploring The Factors Contributing To Increased Incidents

May 20, 2025