Understanding The Friday Increase In D-Wave Quantum (QBTS) Stock Price

Table of Contents

News and Announcements Impacting QBTS Stock

Positive news and significant announcements often correlate directly with stock price increases. A company's stock price reflects investor confidence in its future performance, and positive developments naturally boost this confidence. Several potential events could have contributed to the recent rise in QBTS stock:

- New Partnerships: D-Wave Quantum might have announced a strategic partnership with a major technology company or research institution, opening doors to new markets and funding opportunities. This type of collaboration often signals a significant step towards commercialization and wider adoption of quantum computing technology.

- Contract Wins: Securing substantial contracts with government agencies or private sector clients would significantly impact the company's revenue projections and investor sentiment, leading to a positive stock price reaction. Large-scale contract wins demonstrate market demand for D-Wave's quantum computing solutions.

- Technological Advancements: Any breakthroughs in D-Wave's quantum computing technology, such as improvements in qubit performance or the development of new algorithms, could generate significant excitement and investor interest. Announcements about such advancements often translate into substantial stock price gains.

- Positive Research Publications: Publication of positive research findings showcasing the capabilities and potential applications of D-Wave's quantum computers in scientific journals or conferences could reinforce investor confidence in the technology and the company's future. Credible research validation is crucial in boosting the credibility of a company like D-Wave Quantum.

Market Sentiment and Investor Behavior

The overall market sentiment and prevailing investor behavior play a crucial role in influencing QBTS's stock performance. The stock market is a complex ecosystem where numerous intertwined factors impact individual stock prices.

- Broader Market Optimism/Pessimism: Positive sentiment in the broader stock market (a "bull market") can lead to increased investment in riskier assets, including QBTS stock. Conversely, negative sentiment (a "bear market") might result in investors selling off even promising stocks like QBTS.

- Short-Term Trading Activity: Short-term traders, focused on quick profits, can significantly influence a stock's daily price movements. Their actions can sometimes create volatility that isn't necessarily reflective of the company's underlying fundamentals.

- Investor Confidence in Quantum Computing: Positive news or advancements in the broader quantum computing field can boost investor confidence in the entire sector, creating a positive ripple effect for companies like D-Wave Quantum.

Speculation and Trading Activity

Speculation and increased trading volume are also factors that can contribute to short-term stock price surges.

- Rumors and Social Media Sentiment: Rumors, often spread through social media platforms, can influence trading behavior. Positive rumors, even if unsubstantiated, can create buying pressure and push the stock price upward.

- Short Squeezes: A short squeeze occurs when investors who bet against a stock (short sellers) are forced to buy it back to cover their positions, causing a rapid price increase. This can lead to dramatic short-term price fluctuations, independent of the company's actual performance.

- Institutional Investor Activity: Large institutional investors, such as hedge funds and mutual funds, can significantly impact a stock's price through their buying and selling activities. Their involvement often signals confidence in the company's long-term prospects. Increased institutional investment can drive significant price appreciation.

Analyzing the Long-Term Potential of D-Wave Quantum

While short-term fluctuations can be driven by speculation, the long-term potential of D-Wave Quantum and the quantum computing industry is crucial for understanding its investment value.

- Quantum Computing Market Growth: The quantum computing market is expected to experience significant growth in the coming years. This presents substantial opportunities for companies like D-Wave Quantum, provided they can effectively navigate the challenges and capitalize on emerging market demands.

- Future Valuation of QBTS: D-Wave's success in developing and commercializing its quantum computing technology will directly influence its future valuation. Positive developments will likely translate into higher stock prices, while challenges and setbacks could negatively impact its valuation.

- Challenges Facing D-Wave: The company faces challenges common to the quantum computing sector, including technological hurdles, competition, and the need to secure substantial funding. Overcoming these challenges is crucial for achieving its long-term objectives and maintaining positive investor sentiment.

Understanding and Investing in the Future of QBTS

Friday's increase in the QBTS stock price is likely a complex interplay of news, market sentiment, speculation, and the long-term potential of D-Wave Quantum and the quantum computing industry. It’s crucial to understand that multiple factors influence short-term stock price movements. While exciting breakthroughs might cause short-term surges, sustainable growth is dependent on the company's long-term success and the broader adoption of quantum computing technologies.

Before making any investment decisions related to D-Wave Quantum (QBTS) stock, conduct thorough research, understand the risks involved, and create a diversified investment strategy. Staying updated on the latest news and developments in the quantum computing sector is essential for navigating the volatility of the QBTS stock price and making informed decisions about investing in this promising yet unpredictable sector. For comprehensive QBTS stock analysis and a robust D-Wave Quantum investment strategy, be sure to conduct your own due diligence and stay informed on the latest QBTS stock fluctuations. Understanding QBTS stock analysis is crucial for successful investing in quantum computing.

Featured Posts

-

Rising Sea Levels Falling Credit Scores The Homebuyers Climate Risk

May 20, 2025

Rising Sea Levels Falling Credit Scores The Homebuyers Climate Risk

May 20, 2025 -

Cobolli Claims First Atp Title In Bucharest

May 20, 2025

Cobolli Claims First Atp Title In Bucharest

May 20, 2025 -

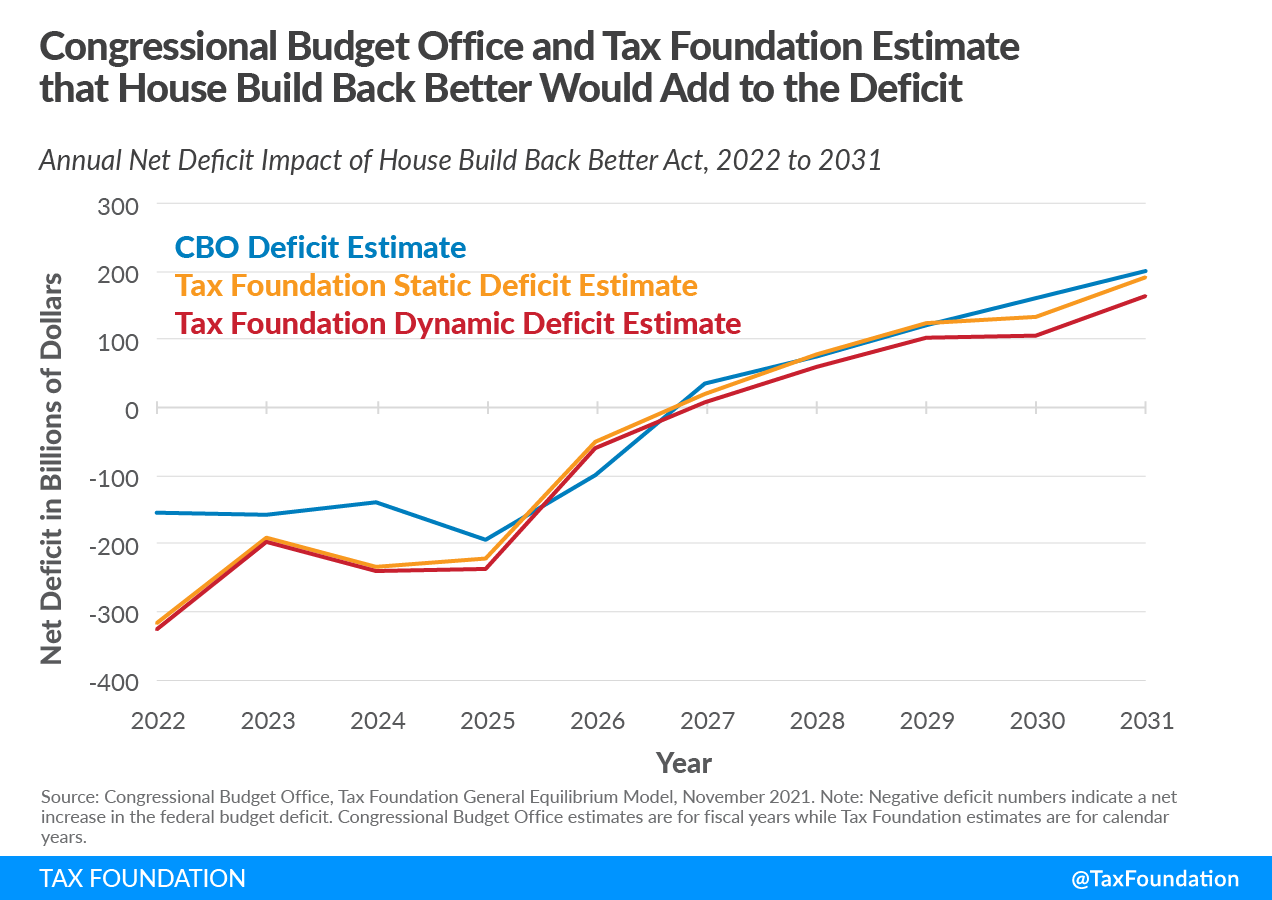

The Stark Math On The Gop Tax Plan Deficit Impact Analysis

May 20, 2025

The Stark Math On The Gop Tax Plan Deficit Impact Analysis

May 20, 2025 -

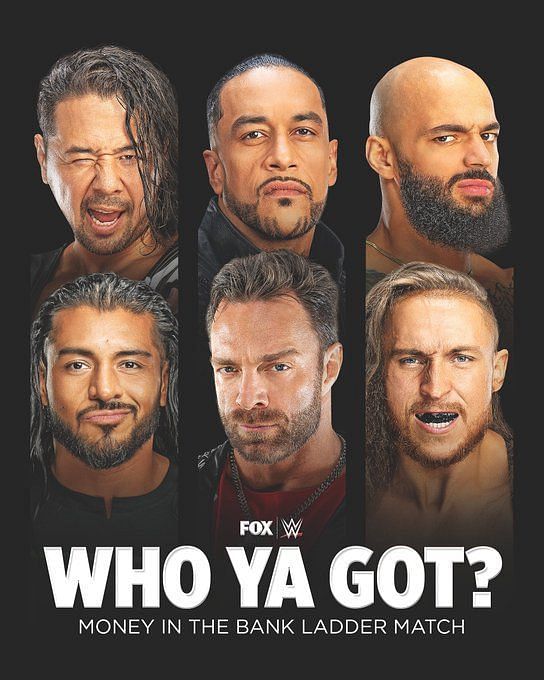

Roxanne Perez And Rhea Ripley Secure Money In The Bank Ladder Match Spots 2025

May 20, 2025

Roxanne Perez And Rhea Ripley Secure Money In The Bank Ladder Match Spots 2025

May 20, 2025 -

Philippine Typhon Missile Deployment A Costly Miscalculation

May 20, 2025

Philippine Typhon Missile Deployment A Costly Miscalculation

May 20, 2025

Latest Posts

-

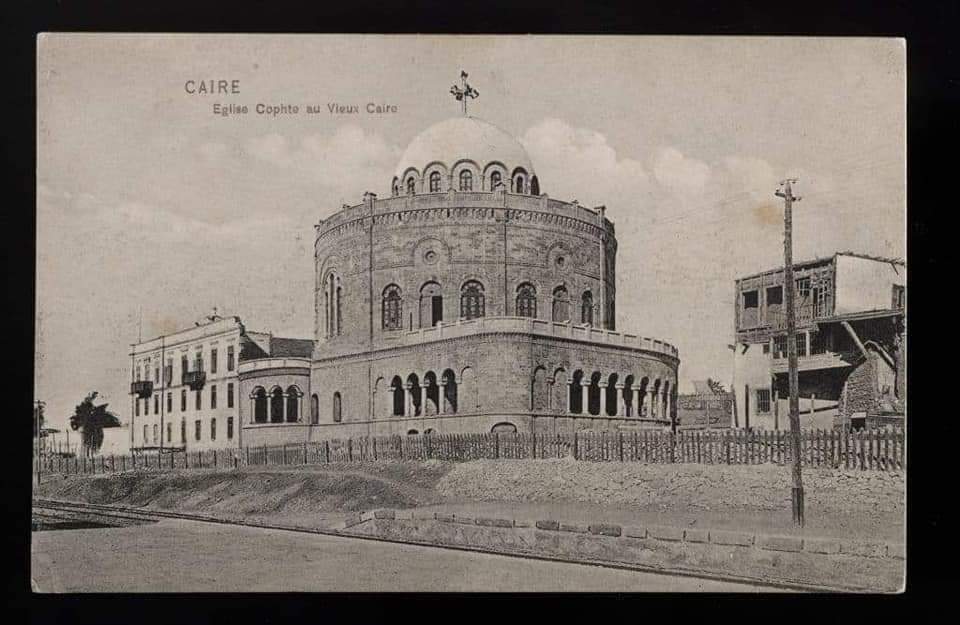

Liksi Megalis Tessarakostis Esperida Stin Patriarxiki Akadimia Kritis

May 20, 2025

Liksi Megalis Tessarakostis Esperida Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

Old North State Report Key Findings For May 9 2025

May 20, 2025

Old North State Report Key Findings For May 9 2025

May 20, 2025 -

Ekdilosi Megalis Tessarakostis Stin Patriarxiki Ekklisiastiki Akadimia Kritis

May 20, 2025

Ekdilosi Megalis Tessarakostis Stin Patriarxiki Ekklisiastiki Akadimia Kritis

May 20, 2025 -

I Megali Tessarakosti Esperida Stin Patriarxiki Akadimia Kritis

May 20, 2025

I Megali Tessarakosti Esperida Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

Symposio Megalis Tessarakostis Patriarxiki Akadimia Kritis

May 20, 2025

Symposio Megalis Tessarakostis Patriarxiki Akadimia Kritis

May 20, 2025