Understanding The Net Asset Value (NAV) Of The Amundi MSCI World Catholic Principles UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

For ETF investors, the Net Asset Value (NAV) represents the net value of a single share in the fund. It's calculated by subtracting the ETF's total liabilities from its total assets, and then dividing that figure by the number of outstanding shares. The formula is simple:

(Total Assets - Total Liabilities) / Number of Outstanding Shares = NAV

The ETF provider, Amundi, calculates and publishes the NAV daily. This figure represents the theoretical price per share if you were to redeem your shares. It's important to note that the NAV can differ from the market price of the ETF. This difference can arise due to market supply and demand, trading volume, and other market forces.

Examples:

- Example 1: If an ETF has total assets of €10 million, total liabilities of €100,000, and 1 million outstanding shares, the NAV would be (€10,000,000 - €100,000) / 1,000,000 = €9.90 per share.

- Example 2: If the same ETF's assets increase to €12 million while liabilities remain the same, the NAV would rise to (€12,000,000 - €100,000) / 1,000,000 = €11.90 per share.

Factors Affecting the NAV of the Amundi MSCI World Catholic Principles UCITS ETF

Several factors influence the NAV of the Amundi MSCI World Catholic Principles UCITS ETF:

Underlying Asset Performance

The primary driver of NAV is the performance of the underlying assets. The ETF tracks the MSCI World Catholic Principles Index, which comprises companies meeting specific ethical and social criteria aligned with Catholic principles. Positive performance of these constituent companies will increase the ETF's NAV, while poor performance will reduce it. The index methodology ensures that only companies aligning with its principles are included.

Currency Fluctuations

As a global ETF, the Amundi MSCI World Catholic Principles UCITS ETF is exposed to currency fluctuations. Changes in exchange rates between the ETF's base currency (likely EUR) and the currencies of the companies it invests in can impact the NAV. A strengthening Euro, for example, could lower the NAV when measured in other currencies.

Expense Ratio

The ETF's expense ratio, a yearly fee charged to cover management and operational costs, indirectly affects the NAV. While not directly deducted from the NAV calculation on a daily basis, it impacts the overall growth of the assets over time, therefore affecting the future NAV.

Dividends and Distributions

Dividend payments from the underlying holdings are usually reinvested back into the ETF, contributing to an increase in the total assets and consequently the NAV. This reinvestment strategy maximizes returns but it's important to understand the impact of this compounding factor.

Corporate Actions

Corporate actions such as stock splits, mergers, or acquisitions of the companies within the index can affect the ETF's NAV. These events alter the number of shares or the value of the underlying holdings.

Using NAV to Make Informed Investment Decisions

Monitoring NAV changes is essential for tracking the Amundi MSCI World Catholic Principles UCITS ETF's performance over time. By comparing the NAV's movements to those of similar ethical ETFs, investors can gauge relative performance and identify top performers in the responsible investing space.

- Return on Investment (ROI): Changes in NAV help in calculating the ROI, offering a clear picture of the ETF's returns.

- Comparative Analysis: Use NAV data to compare the Amundi MSCI World Catholic Principles UCITS ETF to other ethically-focused ETFs with similar investment strategies.

- Holistic Approach: Remember that NAV is just one piece of the puzzle. Consider factors like the expense ratio, the fund's investment strategy, and your personal financial goals before making an investment decision. NAV alone isn't a sufficient indicator of future performance.

Mastering the Net Asset Value (NAV) of the Amundi MSCI World Catholic Principles UCITS ETF

Understanding the Net Asset Value (NAV) of the Amundi MSCI World Catholic Principles UCITS ETF is key to responsible investing. While NAV offers valuable insight into the ETF's performance, it's crucial to consider it alongside other factors, such as the expense ratio, the underlying index's composition, and the overall market conditions. Regularly monitoring the NAV, readily accessible on the Amundi website [insert link here], and conducting thorough research will allow you to make well-informed decisions. Remember, investing in ethical funds like the Amundi MSCI World Catholic Principles UCITS ETF is a long-term commitment. By mastering the use of NAV and other vital indicators, you can navigate the world of ethical investing with confidence.

Featured Posts

-

Joy Crookes Unveils New Single Carmen

May 24, 2025

Joy Crookes Unveils New Single Carmen

May 24, 2025 -

Unlocking Ai And Automation Potential Orchestration At Camunda Con 2025 Amsterdam

May 24, 2025

Unlocking Ai And Automation Potential Orchestration At Camunda Con 2025 Amsterdam

May 24, 2025 -

Understanding The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Understanding The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Massovye Svadebnye Torzhestva Na Kharkovschine 40 Par Skazali Da

May 24, 2025

Massovye Svadebnye Torzhestva Na Kharkovschine 40 Par Skazali Da

May 24, 2025 -

Aex Index Crashes More Than 4 Loss Lowest Point In 12 Months

May 24, 2025

Aex Index Crashes More Than 4 Loss Lowest Point In 12 Months

May 24, 2025

Latest Posts

-

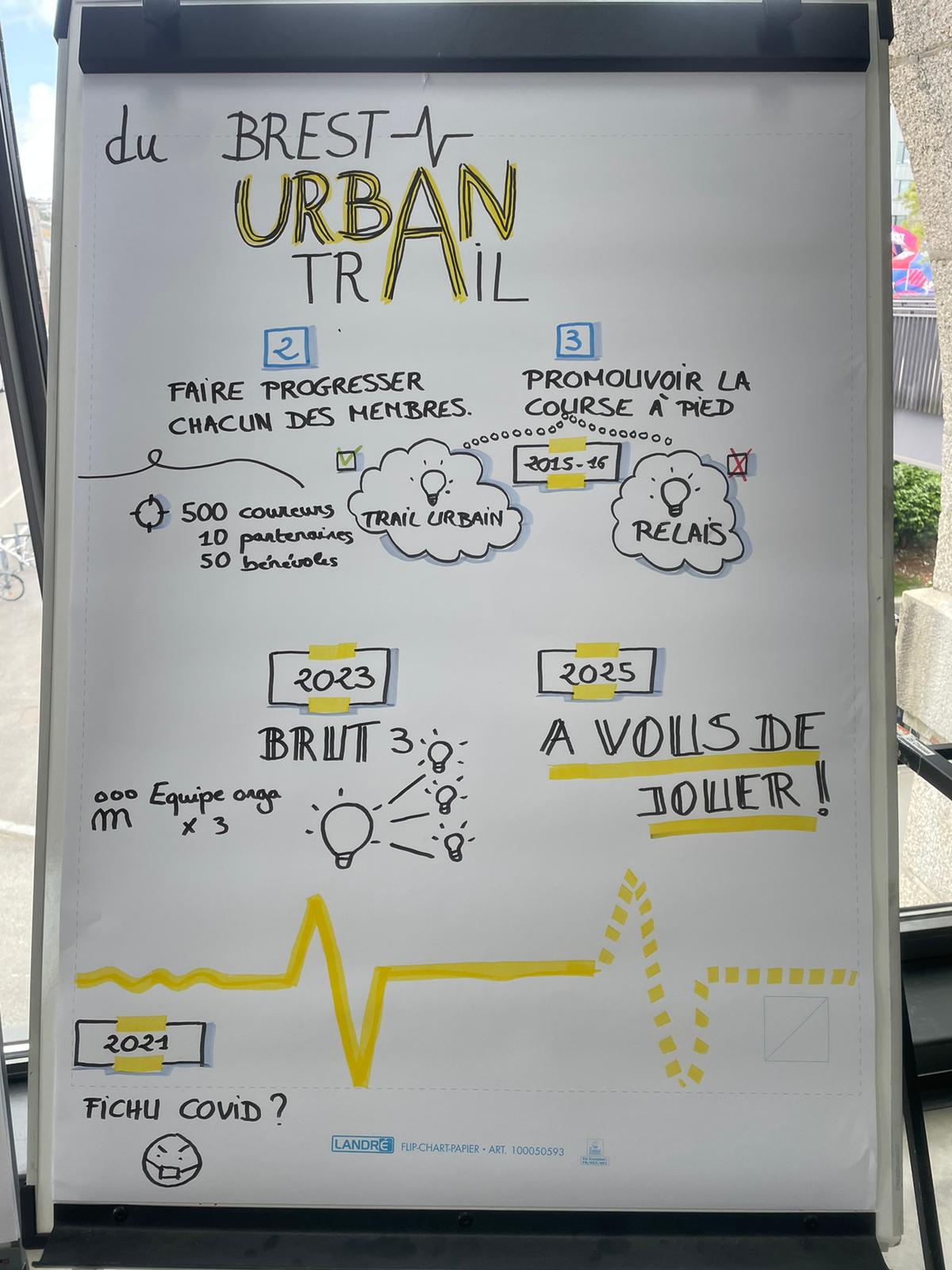

Brest Urban Trail L Importance Des Benevoles Artistes Et Partenaires

May 24, 2025

Brest Urban Trail L Importance Des Benevoles Artistes Et Partenaires

May 24, 2025 -

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 24, 2025

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 24, 2025 -

Les Personnes Cles Du Brest Urban Trail Benevoles Artistes And Partenaires

May 24, 2025

Les Personnes Cles Du Brest Urban Trail Benevoles Artistes And Partenaires

May 24, 2025 -

Brest Urban Trail Benevoles Artistes Et Partenaires Au Coeur De L Evenement

May 24, 2025

Brest Urban Trail Benevoles Artistes Et Partenaires Au Coeur De L Evenement

May 24, 2025 -

Brest Urban Trail Les Visages De La Course Benevoles Artistes Et Partenaires

May 24, 2025

Brest Urban Trail Les Visages De La Course Benevoles Artistes Et Partenaires

May 24, 2025