BofA Assures Investors: Why High Stock Market Valuations Are Manageable

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Cause for Alarm

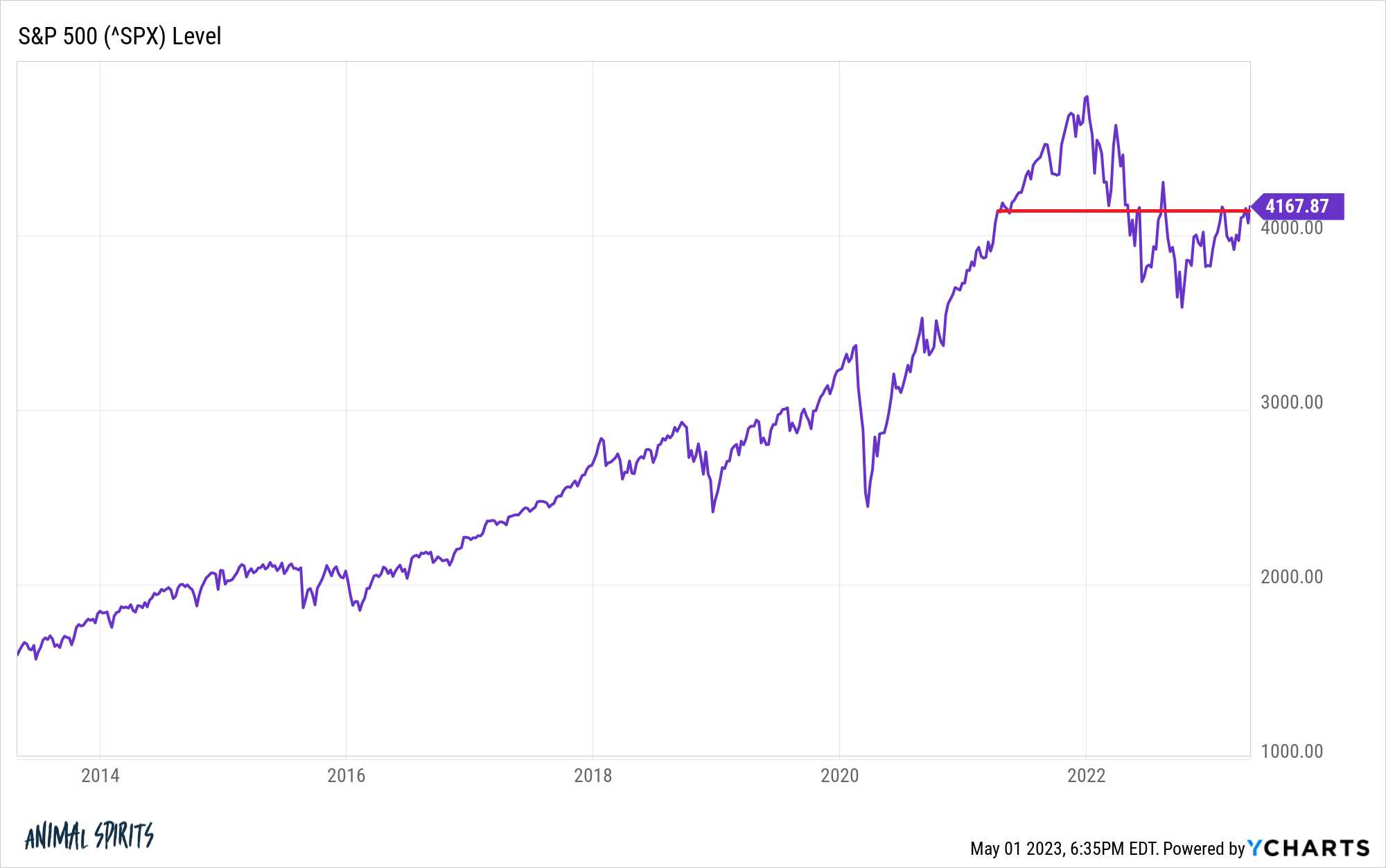

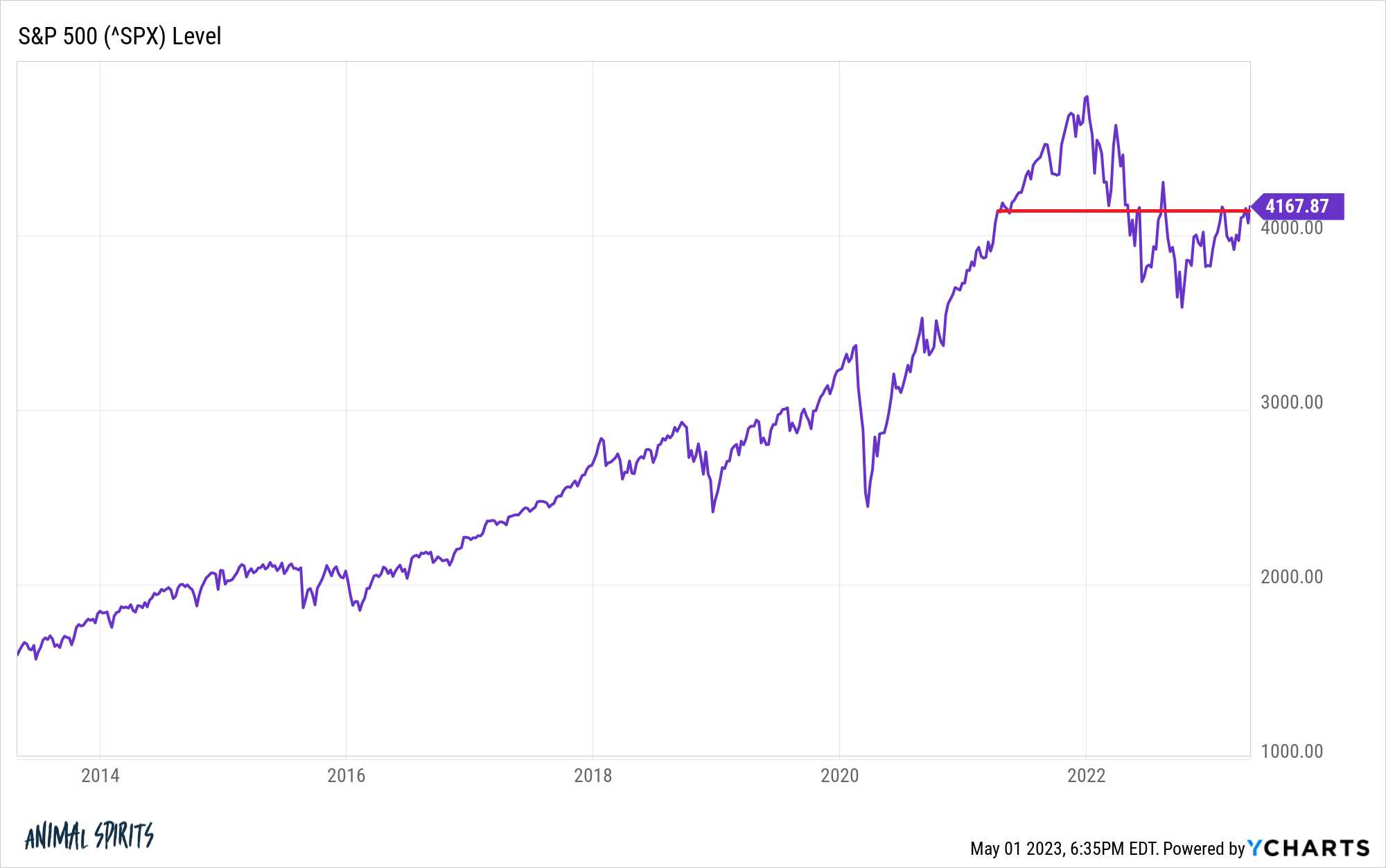

BofA's confidence stems from a multi-faceted analysis of the current market landscape. They aren't dismissing the high valuations outright; instead, they argue that several factors justify these levels and mitigate potential risks.

Strong Corporate Earnings Growth

BofA's projections indicate robust corporate earnings growth in the coming years. This anticipated growth, fueled by a combination of factors, provides a strong foundation for current stock prices. Their analysis points to:

- Increased Profit Margins: Many companies are experiencing improved profit margins due to efficient operations and strategic cost management.

- Resilient Revenue Growth: Despite economic uncertainties, several sectors show consistent revenue growth, driven by innovation and strong consumer demand.

- Data-Driven Projections: BofA's projections are not simply based on speculation; they leverage extensive data analysis and historical trends to support their claims. For example, their models suggest an X% increase in S&P 500 earnings over the next Y years. (Note: Replace X and Y with hypothetical but plausible data points).

These factors contribute to the argument that current stock prices, while high, are not necessarily overvalued when considered against the backdrop of projected earnings growth. Keywords used: corporate earnings, earnings growth, profit margins, revenue growth.

Low Interest Rates and Monetary Policy

The current low-interest-rate environment plays a crucial role in supporting BofA's perspective. Low interest rates make borrowing cheaper for companies, stimulating investment and growth. Furthermore:

- Quantitative Easing (QE): Previous rounds of QE injected liquidity into the market, further contributing to higher valuations. While QE may be tapering off, its lingering effects are still felt.

- Inflation Expectations: While inflation is a concern, BofA's analysis suggests that it remains manageable within the context of current monetary policy.

- Bond Yields: Low bond yields make equities a relatively more attractive investment option, further driving demand and contributing to high valuations. Keywords used: interest rates, monetary policy, quantitative easing, inflation, bond yields.

Technological Innovation and Sector-Specific Growth

Technological innovation is another key driver of high valuations in specific sectors. BofA highlights:

- Tech Stocks Leading the Way: The technology sector continues to show strong growth, with many companies leading the way in innovation and market disruption.

- Growth Stocks Outperforming: Companies with high growth potential, even with initially high valuations, often see sustained price appreciation if they deliver on their promises.

- Emerging Sectors: The rise of sectors like renewable energy and biotechnology creates new opportunities for growth and investment. Keywords used: tech stocks, growth stocks, innovation, disruptive technology, sector performance.

Mitigating Risks Associated with High Valuations

While BofA sees high valuations as manageable, they acknowledge the inherent risks. Mitigating these risks requires a thoughtful investment strategy:

Diversification Strategies

Diversification is key to reducing portfolio volatility. BofA recommends:

- Asset Class Diversification: Spread investments across different asset classes, including stocks, bonds, and real estate.

- Sector Diversification: Don't put all your eggs in one basket. Invest across various sectors to reduce exposure to sector-specific risks.

- Geographic Diversification: Consider international investments to further diversify your portfolio and reduce dependency on any single economy. Keywords used: portfolio diversification, asset allocation, risk management, hedging strategies.

Long-Term Investment Horizon

A long-term investment horizon is crucial to weathering short-term market fluctuations.

- Buy-and-Hold Strategy: This strategy involves buying quality assets and holding them for the long term, allowing time to recover from temporary dips.

- Ignoring Short-Term Noise: Focus on long-term growth potential rather than getting swayed by daily market fluctuations.

- Patience and Discipline: Sticking to your investment plan requires patience and discipline, especially during periods of market uncertainty. Keywords used: long-term investing, buy-and-hold strategy, patience, market cycles.

Careful Stock Selection

Thorough due diligence is essential when selecting individual stocks:

- Fundamental Analysis: Focus on a company's financial health, competitive advantage, and management team.

- Valuation Metrics: Use valuation metrics like P/E ratio and price-to-sales ratio to assess whether a stock is fairly valued.

- Growth Prospects: Invest in companies with strong growth potential and sustainable competitive advantages. Keywords used: fundamental analysis, stock picking, due diligence, valuation metrics, company fundamentals.

BofA's Investment Recommendations and Outlook

BofA's overall investment outlook is cautiously optimistic. They recommend a strategic asset allocation approach, favoring sectors with strong growth potential, while acknowledging the need for careful risk management. Specific recommendations may include (note: replace these with realistic examples from BofA's actual analysis):

- Increased exposure to technology and healthcare sectors.

- A balanced allocation to both growth and value stocks.

- Careful consideration of emerging market opportunities. Keywords used: investment recommendations, market outlook, sector allocation, strategic asset allocation.

Conclusion: Navigating High Stock Market Valuations with Confidence

BofA's analysis suggests that high stock market valuations are manageable due to factors like strong earnings growth, low interest rates, and sector-specific growth opportunities. By implementing effective risk mitigation strategies such as diversification, a long-term investment horizon, and careful stock selection, investors can navigate the current market environment with confidence. Don't let high stock market valuations deter you. Use BofA's insights to build a robust investment strategy that aligns with your goals. Conduct thorough research, consider BofA's analysis carefully, and develop a well-informed investment strategy to make the most of the current market conditions. Remember, understanding stock market valuations and employing a sound investment strategy is crucial for success.

Featured Posts

-

Garantia De Gol Evaluando El Desempeno De Alberto Ardila Olivares

Apr 29, 2025

Garantia De Gol Evaluando El Desempeno De Alberto Ardila Olivares

Apr 29, 2025 -

Jeff Goldblums Unexpected Revelation One Life Experience He Missed

Apr 29, 2025

Jeff Goldblums Unexpected Revelation One Life Experience He Missed

Apr 29, 2025 -

The High Cost Of Making It In America

Apr 29, 2025

The High Cost Of Making It In America

Apr 29, 2025 -

Humanitarian Crisis In Gaza Israel Urged To Lift Aid Restrictions

Apr 29, 2025

Humanitarian Crisis In Gaza Israel Urged To Lift Aid Restrictions

Apr 29, 2025 -

Clearwater Ferry Collision One Dead Multiple Injured

Apr 29, 2025

Clearwater Ferry Collision One Dead Multiple Injured

Apr 29, 2025

Latest Posts

-

Analyzing Trumps Stance On Cheap Oil Implications For The Energy Sector

May 12, 2025

Analyzing Trumps Stance On Cheap Oil Implications For The Energy Sector

May 12, 2025 -

Trumps Embrace Of Cheap Oil Challenges And Consequences For The Energy Industry

May 12, 2025

Trumps Embrace Of Cheap Oil Challenges And Consequences For The Energy Industry

May 12, 2025 -

The Trump Presidency And Cheap Oil An Analysis Of Industry Impact

May 12, 2025

The Trump Presidency And Cheap Oil An Analysis Of Industry Impact

May 12, 2025 -

Trump Administrations Oil Policies Balancing Low Prices And Industry Support

May 12, 2025

Trump Administrations Oil Policies Balancing Low Prices And Industry Support

May 12, 2025 -

Trumps Cheap Oil Policy Praise And Conflict With The Energy Sector

May 12, 2025

Trumps Cheap Oil Policy Praise And Conflict With The Energy Sector

May 12, 2025