BofA On Stock Market Valuations: Why Investors Can Remain Calm

Table of Contents

BofA's Key Findings on Current Stock Market Valuations

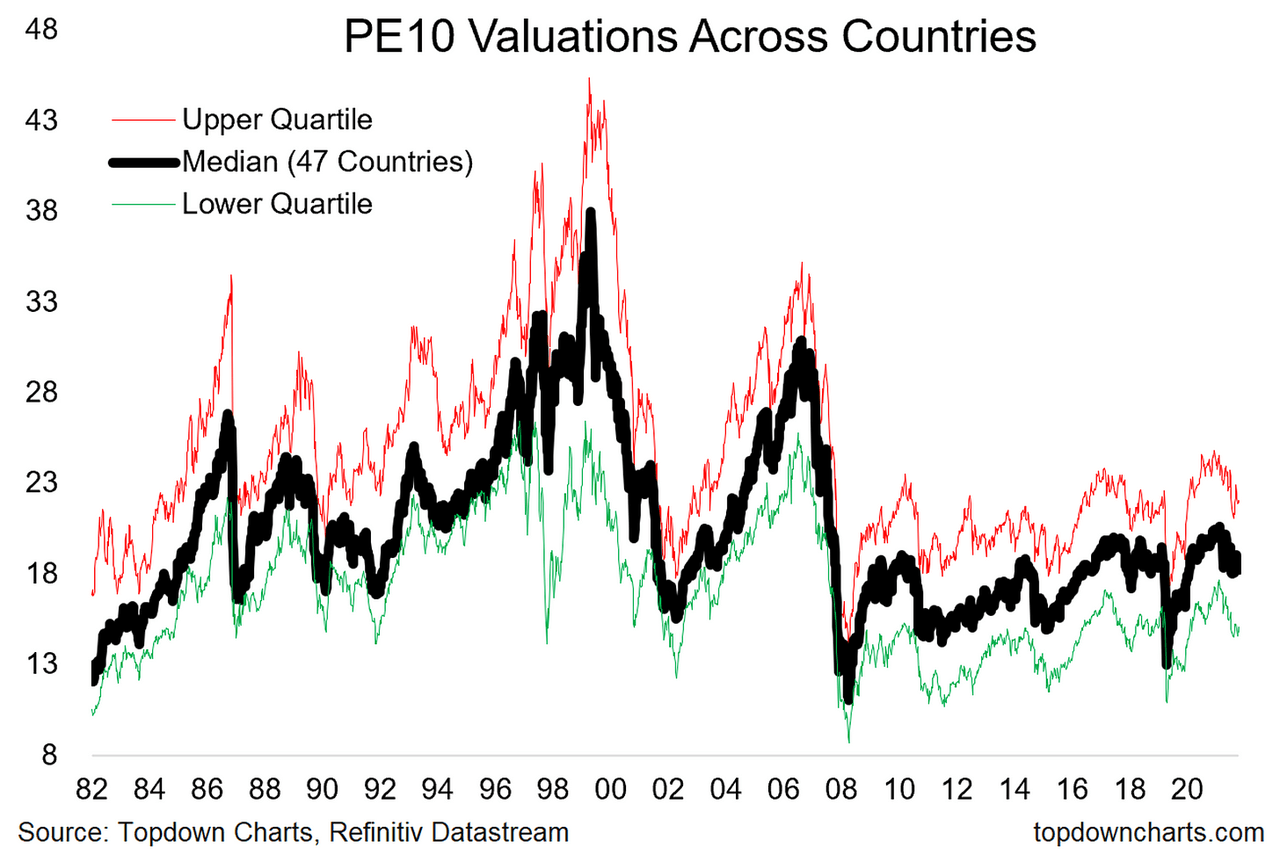

BofA's recent report concludes that current stock market valuations, while not exceptionally low, are not alarmingly high either. They suggest a relatively fair valuation, considering several key economic factors. Their analysis incorporates various metrics, prominently featuring price-to-earnings (P/E) ratios, including the cyclically adjusted price-to-earnings ratio (Shiller PE), to gauge market valuation against historical norms.

- Key Data Points:

- BofA found that the current S&P 500 P/E ratio is around 18, slightly above the historical average but below peak levels seen in previous market bubbles.

- The Shiller PE, which smooths out cyclical earnings fluctuations, indicates a valuation less extreme than during past market peaks.

- BofA’s analysis highlights specific sectors, such as technology and healthcare, which are showing relatively strong valuations but are supported by robust earnings growth.

Factors Contributing to BofA's Optimism

BofA's relatively calm outlook stems from several converging factors, which provide a counterbalance to the market anxieties.

Strong Corporate Earnings

Robust corporate profit growth is a key driver behind BofA's positive assessment.

- Evidence of Growth: Many companies across various sectors have reported exceeding earnings expectations. This indicates underlying strength in the economy and the ability of businesses to navigate challenges.

- Strong Sectors: Technology, healthcare, and certain consumer staples sectors are exhibiting particularly strong earnings, bolstering overall market performance.

- Impact on Valuations: Solid earnings justify, to some extent, the current valuation levels, supporting the argument against overvaluation.

Interest Rate Expectations and Their Impact

BofA's analysis incorporates expectations about future interest rate hikes by central banks.

- Rate Hike Outlook: While further rate increases are anticipated, BofA anticipates a slower pace compared to previous periods of tightening.

- Valuation Impact: Moderated rate hikes reduce the pressure on stock valuations, mitigating the risk of a sharp market correction driven by rising borrowing costs.

- Asset Class Impact: While equities might experience some pressure, BofA may suggest that fixed-income assets could become comparatively more attractive as interest rates rise.

Long-Term Growth Prospects

BofA’s positive outlook is grounded in a relatively optimistic view of the long-term economic landscape.

- Long-Term Economic Outlook: The analysis points to several long-term growth drivers, including technological innovation, demographic trends, and ongoing investments in infrastructure.

- Key Growth Drivers: BofA likely cites factors such as ongoing digital transformation across industries and global expansion opportunities for specific companies.

- Valuation Support: The projected growth supports the bank's argument that current valuations are sustainable, particularly considering the long-term perspective.

Addressing Potential Risks and Counterarguments

While BofA presents a relatively optimistic view, it's crucial to acknowledge potential risks.

- Inflationary Pressures: Persistent inflation remains a significant concern, potentially impacting corporate profitability and consumer spending. BofA may argue that inflation is likely to moderate over time.

- Geopolitical Uncertainty: Geopolitical instability poses another significant risk, potentially disrupting supply chains and impacting investor sentiment. BofA's counterargument might focus on the resilience of global markets.

- Recessionary Fears: The risk of a recession cannot be ignored. BofA's response may involve emphasizing the resilience of the corporate sector and the potential for a "soft landing."

- Limitations: BofA's analysis, like any market forecast, has limitations. External shocks or unforeseen economic shifts could alter the outlook.

Practical Investment Strategies Based on BofA's Analysis

Based on BofA's analysis, investors should consider a balanced approach.

- Diversification: Maintaining a diversified investment portfolio across various asset classes (equities, bonds, etc.) is crucial to mitigate risk.

- Long-Term Perspective: BofA's focus on long-term growth suggests that investors should maintain a long-term investment horizon, avoiding impulsive reactions to short-term market fluctuations.

- Professional Advice: Investors should always seek professional financial advice tailored to their specific circumstances and risk tolerance before making any investment decisions.

Conclusion

BofA's analysis of stock market valuations suggests that while valuations are not historically low, they are not excessively high either. The bank's relatively calm outlook is supported by strong corporate earnings, moderated expectations for interest rate hikes, and a positive outlook on long-term economic growth. While acknowledging inherent risks like inflation and geopolitical uncertainties, BofA's analysis provides a reasoned counterpoint to heightened market anxiety. Understand BofA's stock market valuations insights to make informed decisions, and remember to stay informed on BofA's perspective on market valuations to best manage your investment strategy. Learn more about BofA's analysis of stock market valuations to make informed investment decisions.

Featured Posts

-

Louisville Tragedy Prompts Shelter In Place Order Community Remembers

Apr 29, 2025

Louisville Tragedy Prompts Shelter In Place Order Community Remembers

Apr 29, 2025 -

Contempt Of Parliament Yukon Mine Managers Testimony Refusal Sparks Outrage

Apr 29, 2025

Contempt Of Parliament Yukon Mine Managers Testimony Refusal Sparks Outrage

Apr 29, 2025 -

Nfl International Series 2025 Green Bay Packers Potential For Two Away Games

Apr 29, 2025

Nfl International Series 2025 Green Bay Packers Potential For Two Away Games

Apr 29, 2025 -

Tariff Uncertainty Drives U S Businesses To Cut Costs

Apr 29, 2025

Tariff Uncertainty Drives U S Businesses To Cut Costs

Apr 29, 2025 -

Convicted Cardinal Claims Entitlement To Vote In Next Papal Election

Apr 29, 2025

Convicted Cardinal Claims Entitlement To Vote In Next Papal Election

Apr 29, 2025

Latest Posts

-

Stock Market Valuations Bof As Reassurance For Investors

May 12, 2025

Stock Market Valuations Bof As Reassurance For Investors

May 12, 2025 -

Analyzing Trumps Stance On Cheap Oil Implications For The Energy Sector

May 12, 2025

Analyzing Trumps Stance On Cheap Oil Implications For The Energy Sector

May 12, 2025 -

Trumps Embrace Of Cheap Oil Challenges And Consequences For The Energy Industry

May 12, 2025

Trumps Embrace Of Cheap Oil Challenges And Consequences For The Energy Industry

May 12, 2025 -

The Trump Presidency And Cheap Oil An Analysis Of Industry Impact

May 12, 2025

The Trump Presidency And Cheap Oil An Analysis Of Industry Impact

May 12, 2025 -

Trump Administrations Oil Policies Balancing Low Prices And Industry Support

May 12, 2025

Trump Administrations Oil Policies Balancing Low Prices And Industry Support

May 12, 2025