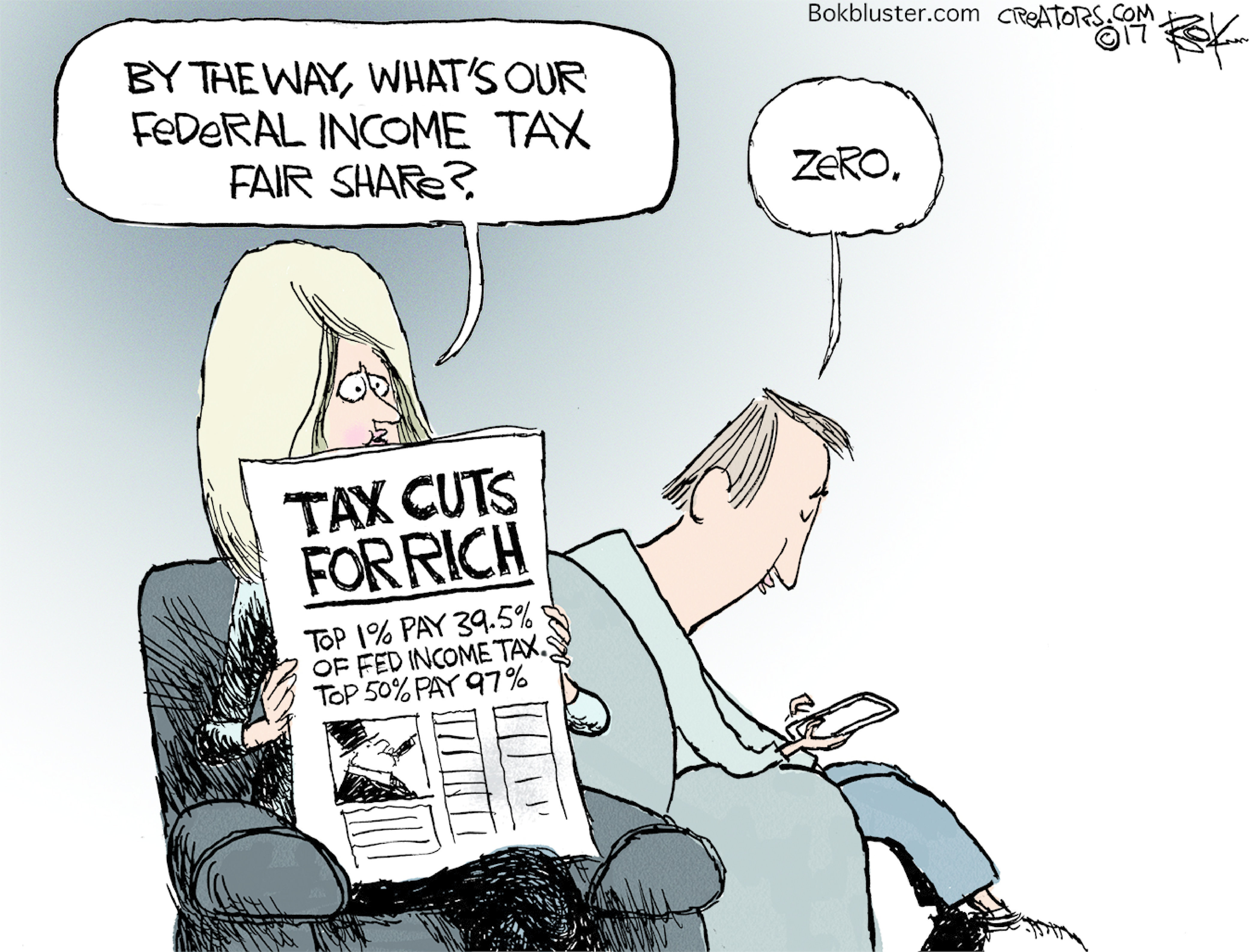

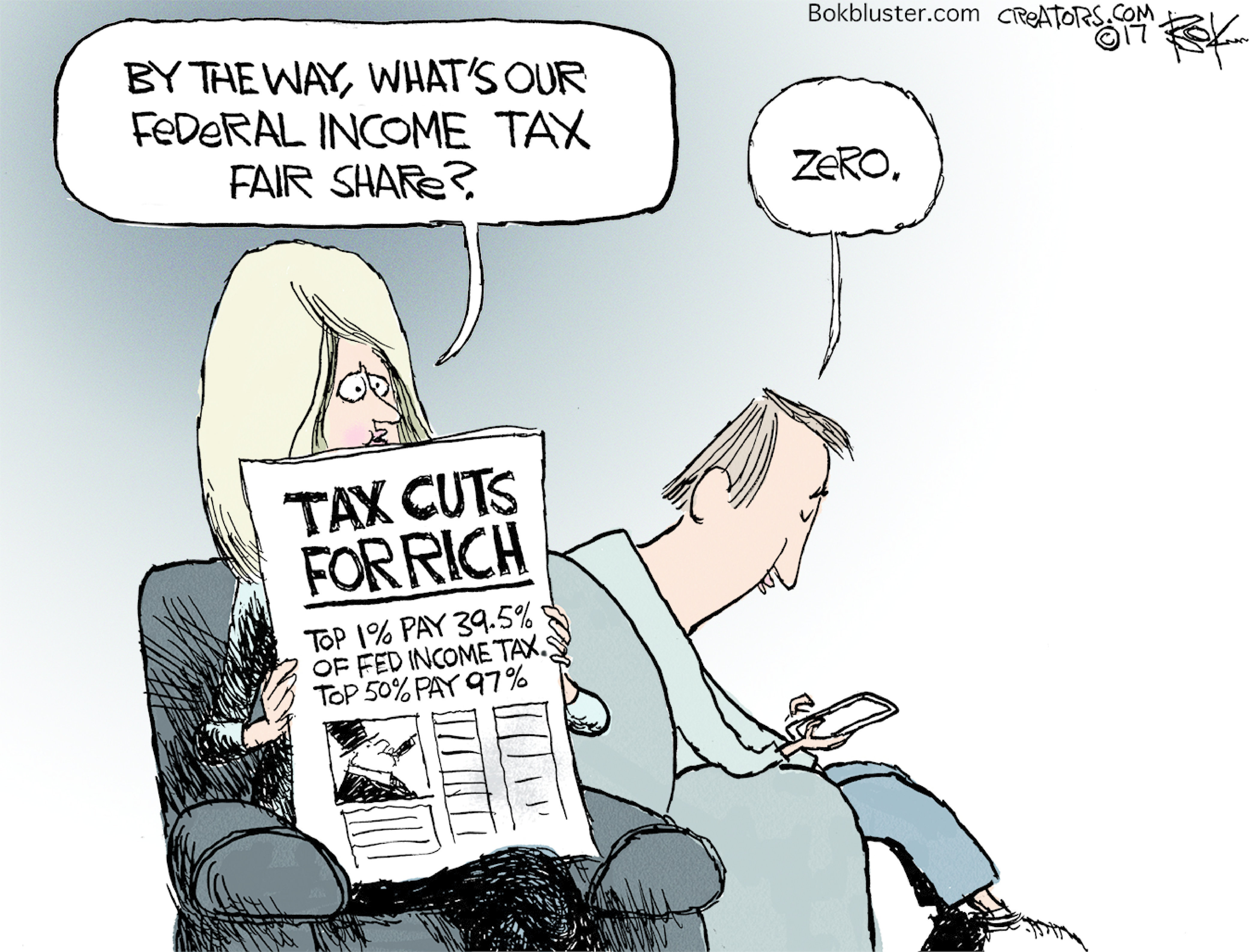

Dissecting The GOP Tax Cuts: A Hard Look At The Numbers

Table of Contents

Impact on Different Income Brackets

The GOP tax cuts significantly altered tax burdens across different income levels. While proponents argued for widespread benefits, the reality shows a more complex picture, with varying impacts on different segments of the population.

Tax Cuts for the Wealthy

The 2017 tax legislation resulted in substantial tax reductions for high-income earners. Critics argued these cuts disproportionately favored the wealthy, exacerbating income inequality.

- Significant Reduction in Top Marginal Rates: The top individual income tax rate was reduced, leading to a substantial percentage decrease in taxes for high-income individuals.

- Estate Tax Changes: Modifications to the estate tax significantly reduced its impact on wealthy families, allowing for greater intergenerational transfer of wealth.

- Capital Gains Tax Benefits: Favorable treatment of capital gains further benefitted high-net-worth individuals with substantial investment portfolios.

- Pass-Through Business Deductions: Changes to deductions for pass-through businesses, such as S corporations and partnerships, disproportionately benefited high-income individuals who own such businesses.

For example, the top 1% saw a 15% decrease in their effective tax rate, while the bottom 50% experienced a far smaller reduction. The elimination of the individual mandate, while seemingly unrelated, indirectly benefited higher earners by reducing their healthcare costs.

Tax Relief for the Middle Class

The GOP tax cuts claimed to provide significant tax relief for middle-class families. However, the benefits were often temporary and less substantial than initially advertised.

- Standard Deduction Increase: The increase in the standard deduction provided some tax savings for middle-income households, simplifying tax filing for many.

- Child Tax Credit Expansion (Temporary): While a temporary expansion of the child tax credit offered some relief, it wasn't substantial enough for many low and middle-income families and had a limited timeframe.

- Limited Impact on Overall Tax Burden: For many middle-class families, the overall tax reduction was modest and often overshadowed by other economic factors like inflation and healthcare costs.

For example, the standard deduction increase provided a 5% tax reduction for many middle-class families in the initial years, but this was largely offset by subsequent inflation and expiring tax credits.

Impact on Low-Income Earners

The impact on low-income earners was minimal, largely due to the low tax liability of many in this group prior to the cuts. While some provisions offered marginal benefits, the overall effects were relatively insignificant.

- Minimal Change in Tax Liability: Many low-income individuals already faced low or no tax liability before the tax cuts. Therefore, the changes had little practical effect on their financial situations.

- Expanded Child Tax Credit (Marginal Benefit): The expansion of the child tax credit provided some small relief for low-income families with children, but this was often insufficient to address their larger economic challenges.

- No significant impact on EITC: The Earned Income Tax Credit, a crucial support for low-income working families, saw only minor modifications.

In summary, the tax cuts brought minimal changes to the tax burden for many low-income families, offering only marginal benefits through existing programs.

Economic Consequences of the GOP Tax Cuts

The economic consequences of the GOP tax cuts remain a subject of considerable debate, with differing viewpoints on their impact on economic growth, the national debt, and business investment.

Impact on Economic Growth

The projected economic growth following the tax cuts did not fully materialize. While there was some short-term GDP growth, it fell short of initial projections, fueling debate about the effectiveness of supply-side economics.

- Short-Term GDP Growth: GDP growth increased slightly in the years immediately following the tax cuts, but this increase was modest.

- Job Creation: Job creation remained relatively stable but did not significantly outperform previous years, failing to meet expectations.

- Limited Long-Term Impact: Evidence suggests that the long-term impact of the tax cuts on sustained economic growth was limited.

For example, GDP growth increased by only 2.5% in the year following the tax cuts, falling far short of the projected 3-4% increase.

Effect on the National Debt

The tax cuts contributed significantly to an increase in the national debt. The reduction in tax revenue wasn't offset by sufficient economic growth, resulting in a larger budget deficit.

- Increased Budget Deficit: The budget deficit expanded significantly in the years after the tax cuts were implemented.

- Rising National Debt: The national debt increased by over 2 trillion dollars in the first three years following the tax cuts.

- Long-Term Fiscal Sustainability Concerns: The increased debt raises significant long-term concerns about the sustainability of the nation's fiscal position.

For instance, the national debt increased by $2.2 trillion within the first three years, contributing to growing concerns about long-term fiscal sustainability.

Impact on Business Investment

The corporate tax rate reduction, a central element of the tax cuts, was intended to stimulate business investment. However, evidence suggests a significant portion of these savings were used for purposes other than capital investments.

- Corporate Tax Rate Reduction: The corporate tax rate was significantly reduced, leading to increased corporate profits.

- Stock Buybacks over Investments: A considerable portion of corporate tax savings was allocated to stock buybacks rather than increased capital expenditures or research and development.

- Limited Evidence of Increased Investment: Data shows limited evidence of a significant increase in business investment following the tax cuts.

For example, while corporate tax rates fell from 35% to 21%, a large proportion of the resulting savings were directed towards stock buybacks, rather than boosting capital investment or R&D spending.

Conclusion

The GOP tax cuts of 2017 had a complex and multifaceted impact on the American economy. While proponents touted increased economic growth and widespread benefits, a detailed analysis reveals a more nuanced reality. The cuts disproportionately benefited higher-income earners, fueled a substantial increase in the national debt, and produced less economic growth than initially projected. Understanding the long-term consequences of this legislation requires ongoing investigation. To gain a deeper understanding of the effects of the GOP tax cuts, further research is essential. Continue your exploration to fully comprehend the implications of this landmark legislation and its enduring effects on the American tax system. To learn more about the detailed impacts of tax policy, explore further resources on the [link to relevant resource].

Featured Posts

-

The Ultimate Guide To Solo Travel Freedom And Exploration

May 20, 2025

The Ultimate Guide To Solo Travel Freedom And Exploration

May 20, 2025 -

Tampoy Apokalyptika Nea Stoixeia Gia Toys Fonoys

May 20, 2025

Tampoy Apokalyptika Nea Stoixeia Gia Toys Fonoys

May 20, 2025 -

Crisis En La Familia Schumacher Mick Schumacher Separacion Y Nueva Aplicacion De Citas

May 20, 2025

Crisis En La Familia Schumacher Mick Schumacher Separacion Y Nueva Aplicacion De Citas

May 20, 2025 -

Manaus Recebe Festival Da Cunha Shows Cultura E Vivencias Amazonicas Com Isabelle Nogueira

May 20, 2025

Manaus Recebe Festival Da Cunha Shows Cultura E Vivencias Amazonicas Com Isabelle Nogueira

May 20, 2025 -

Tampoy Mega Apokleistiko Proepiskopisi Toy Simerinoy Epeisodioy

May 20, 2025

Tampoy Mega Apokleistiko Proepiskopisi Toy Simerinoy Epeisodioy

May 20, 2025

Latest Posts

-

Big Bear Ai Bbai Stock Analyst Downgrade Sparks Investor Worry

May 20, 2025

Big Bear Ai Bbai Stock Analyst Downgrade Sparks Investor Worry

May 20, 2025 -

What Caused D Wave Quantum Qbts Stock To Fall On Monday

May 20, 2025

What Caused D Wave Quantum Qbts Stock To Fall On Monday

May 20, 2025 -

Big Bear Ai Holdings Inc Bbai Analyst Downgrade And Growth Concerns

May 20, 2025

Big Bear Ai Holdings Inc Bbai Analyst Downgrade And Growth Concerns

May 20, 2025 -

D Wave Quantum Qbts Stock Performance Analyzing Mondays Dip

May 20, 2025

D Wave Quantum Qbts Stock Performance Analyzing Mondays Dip

May 20, 2025 -

D Wave Quantum Qbts Stock Plunge Understanding Mondays Decline

May 20, 2025

D Wave Quantum Qbts Stock Plunge Understanding Mondays Decline

May 20, 2025